Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

In 2025, real estate investors - both global and domestic - are asking one defining question: Should I invest in New York or Los Angeles?

The answer isn’t simple. Both cities offer high-value opportunities, but with differing risk profiles, appreciation curves, and rental income potential. To succeed, you need more than historical data - you need predictive intelligence.

That’s where GRAI, the world’s smartest real estate AI advisor, delivers an unmatched advantage. With comprehensive data and contextual AI-generated investment forecasts, GRAI empowers investors to cut through complexity and make smarter, faster decisions - whether you're targeting long-term appreciation or short-term cash flow.

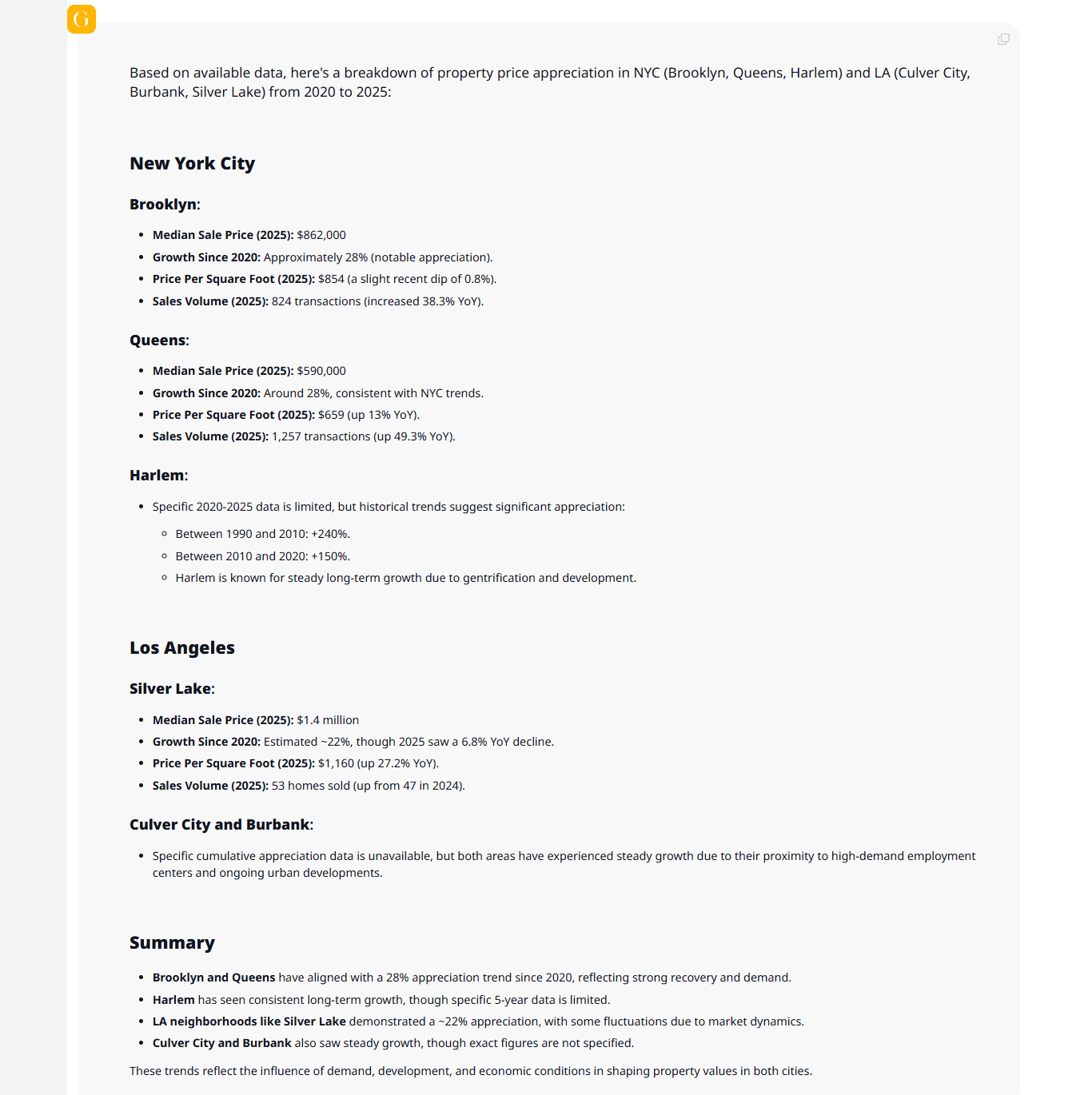

New York has shown exceptional strength in long-term value. According to GRAI’s continuously updating market engine, NYC properties - especially in Brooklyn, Queens, and Harlem - have appreciated by 28% since 2020. Growth is fueled by infrastructure expansion, rezoning, and international demand for premium city living.

Los Angeles, while initially boosted by the pandemic shift to suburban living, is experiencing a rebalancing phase. GRAI reports 22% appreciation across high-demand neighborhoods like Culver City, Burbank, and Silver Lake. The market is strong but more sensitive to economic cycles.

GRAI's AI-Driven Takeaway:

For investors focused on long-term capital appreciation, New York presents a stronger growth trajectory, especially in emerging neighborhoods undergoing transformation. According to GRAI’s analysis:

In comparison, Los Angeles continues to show strength, particularly in high-demand coastal areas:

GRAI's AI recommends close monitoring of New York’s up-and-coming districts for high capital growth potential, while Los Angeles remains attractive for stable, high-end property investments.

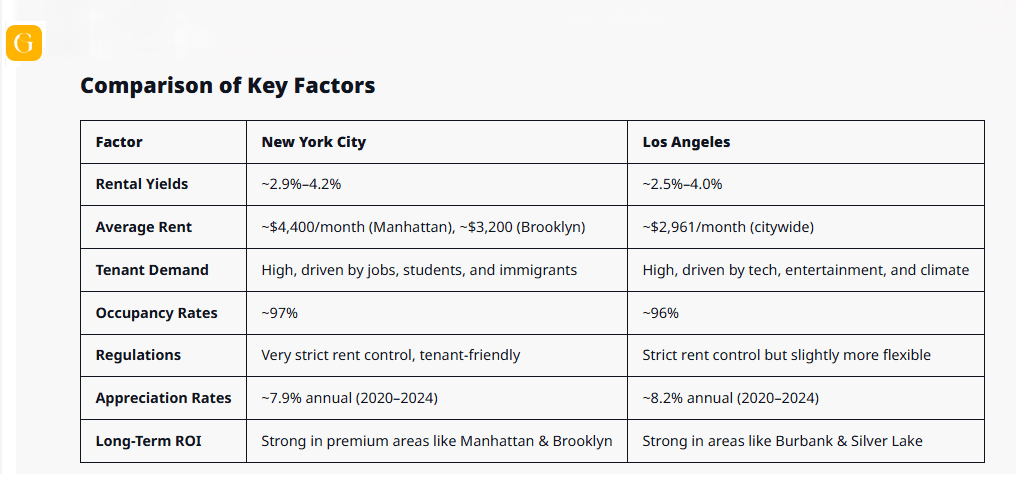

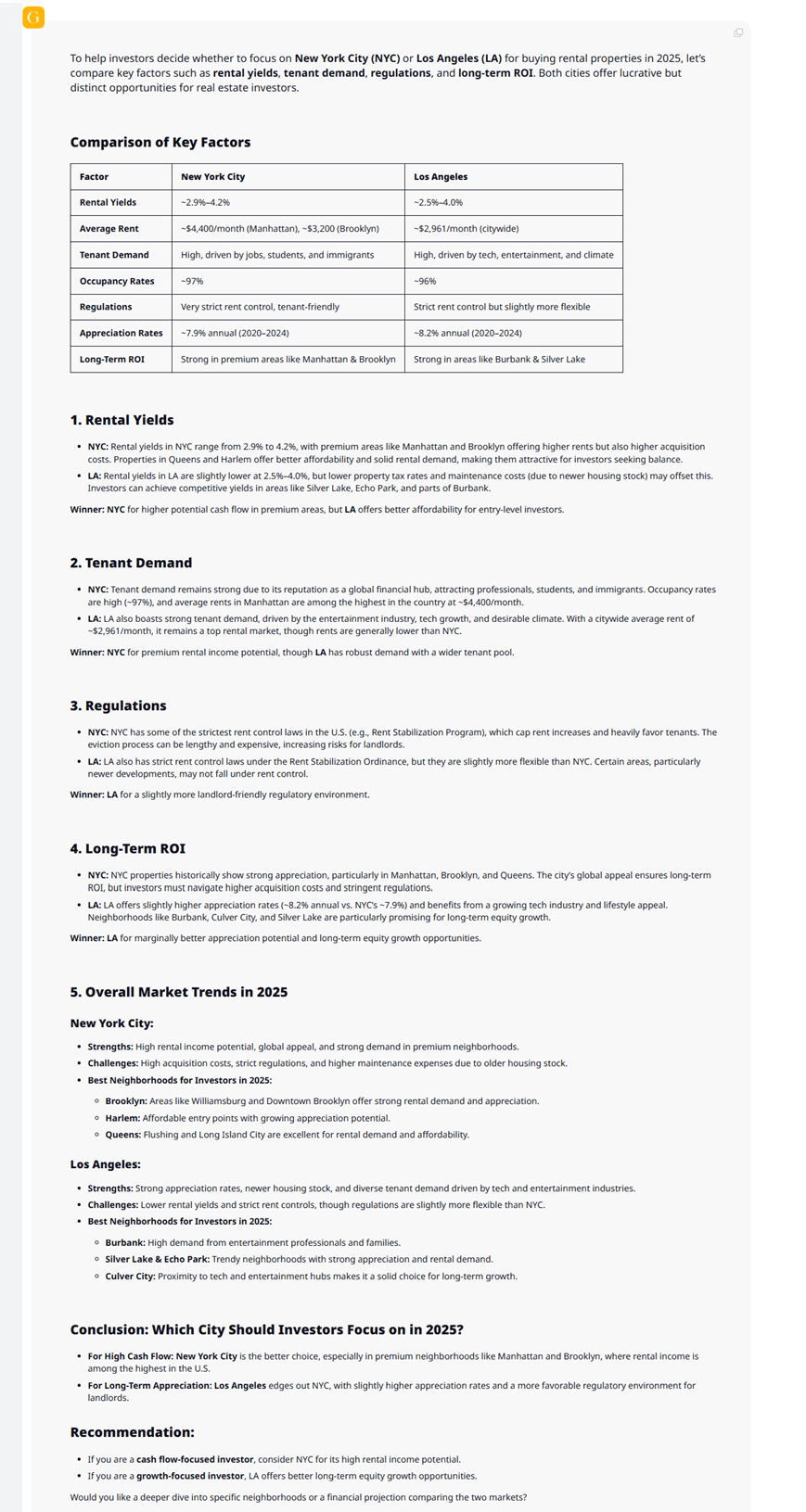

In real estate, appreciation is only half the story. Rental profitability is just as critical - especially for cash flow-focused investors.

New York commands higher rents, with median prices for average rent is $4,400/month in Manhattan and strong demand in Brooklyn with $3,815/month. However, strict rent control laws and higher operating costs can compress margins unless carefully managed.

Los Angeles offers slightly lower rental income (averaging $2,961/month for comparable units), but it offsets this with lower property taxes, faster tenant turnover, and more flexible landlord regulations in many districts.

GRAI's Smart Insight:

With the Cost vs. ROI capability, GRAI allows you to evaluate net rental profitability zip by zip - factoring in taxes, vacancy rates, insurance, HOA fees, and local regulations. For mid-tier rental investors, Los Angeles edges ahead on cash flow efficiency.

Short-term rental regulation is a moving target in both cities that’s why GRAI helps you keep on top of all regulatory, legal and zoning laws.

You Must Know: New York Real Estate Guide 2025: Trends, Insights & Top ZIPs

GRAI's Rental Strategy Advisory:

Compare projected ROI from Airbnb vs. long-term leasing by property type, neighborhood, and legal status. GRAI’s compliance flags properties approved for short-term rentals - so you only buy where you can legally host.

GRAI’s proprietary AI Investment Score is a real-time performance index calculated from hundreds of market signals, including:

2025 AI Investment Scores:

| Metric | New York | Los Angeles |

|---|---|---|

| Price Stability | 8.7/10 | 7.9/10 |

| Rental Yield | 6.8/10 | 7.4/10 |

| Short-Term Rental ROI | 4.2/10 | 8.1/10 |

| Regulatory Flexibility | 6.1/10 | 8.6/10 |

| Long-Term Equity Growth | 9.2/10 | 7.3/10 |

| AI Investment Score | 8.3 | 8.0 |

GRAI Insight:

New York wins as the long-term strategic investment, while Los Angeles excels in short-term yield strategies. GRAI recommends a hybrid portfolio approach, tailored using your personal financial horizon and investment tolerance.

While real estate agents in Los Angeles or New York real estate agents offer valuable field-level insights, their scope is inherently limited. Their advice is often anecdotal and hyper-local.

GRAI, in contrast, provides:

You don’t have to choose one over the other. Combine GRAI’s AI thinking with human experience to gain an unbeatable edge.

To support investors in making data-backed decisions, GRAI analyzed key metrics including rental yields, appreciation rates, tenant demographics, affordability, and long-term ROI potential across New York City and Los Angeles. Here are GRAI’s top neighborhood picks for 2025:

Top Picks in New York City (NYC)

1. Williamsburg & Downtown Brooklyn (Brooklyn)

2. Harlem (Manhattan)

3. Flushing & Long Island City (Queens)

Top Picks in Los Angeles (LA)

1. Burbank

2. Silver Lake & Echo Park

3. Culver City

Investor Tip from GRAI:

“Match your investment goals to neighborhood performance. NYC offers stronger cash flow opportunities, while LA delivers better long-term appreciation with a slightly more flexible regulatory environment. Let your strategy drive your city.”

There’s no single answer, because every investor’s path is different. But with GRAI, the answer is never unclear.

With GRAI’s intelligence, the real decision isn’t about picking a city - it’s about building the portfolio that works for you.

Use GRAI now to stop guessing, start investing, and stay ahead of the market - no matter which coast you choose.