Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Berlin’s real estate market is entering 2025 at a pivotal moment. After years of turbulence between 2022 and 2024, Germany’s capital has stabilized and is once again drawing the attention of global investors.

Unlike many German cities that are still grappling with corrections, Berlin is showing signs of resilience:

Existing property prices have stopped falling and are forecast to rise modestly.

New construction projects command record premiums, especially energy-efficient builds.

Rents continue to climb, with demand far outpacing supply.

What sets Berlin apart in 2025 is the widening gap between districts. Prime areas like Mitte demand over €11,000 per square meter for new builds, while outer-ring neighborhoods deliver yields not seen since the early 2010s. This creates an arbitrage opportunity for investors who know where to look -and this is where GRAI, the world’s smartest real estate AI advisor, changes the game.

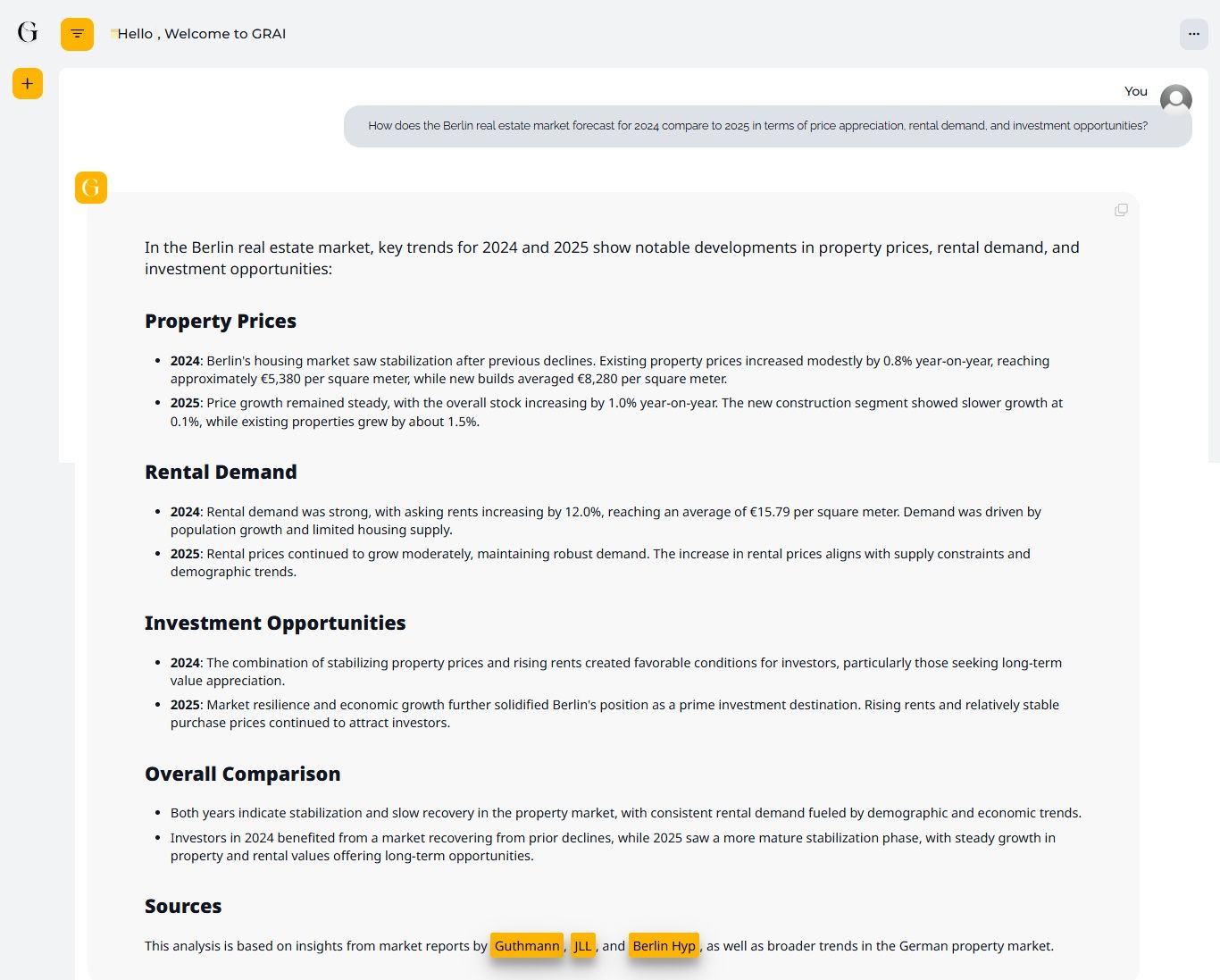

Berlin’s real estate market between 2024 and 2025 reflected a period of stabilization with moderate growth, signaling a balanced yet attractive environment for long-term investors. GRAI’s analysis of property prices, rental demand, and investment opportunities highlights key trends shaping this European capital.

Property Prices

2024: The market showed early signs of recovery after previous declines. Existing property prices grew modestly by 0.8% year-on-year, reaching approximately €5,380 per square meter, while newly built homes averaged €8,280 per square meter.

2025: Growth steadied further. The overall stock increased by about 1.0% year-on-year, driven mainly by existing properties, which rose 1.5%, while new construction lagged with only 0.1% growth.

Rental Demand

2024: Demand was strong, with average asking rents rising by 13%, reaching €20.91 per square meter. This was fueled by population growth and limited housing supply.

2025: Rental demand remained robust, with prices continuing to increase moderately. Demographic pressure and supply constraints supported a consistent upward trajectory in rental yields.

Investment Opportunities

2024: Stabilizing property values combined with rapidly rising rents created favorable conditions for investors seeking long-term value appreciation.

2025: Resilience in the market, coupled with Germany’s economic strength, reinforced Berlin’s role as a prime investment destination. Rising rents, alongside relatively stable purchase prices, made Berlin particularly attractive for both institutional and private investors.

Overall Comparison

2024 marked the rebound phase, as Berlin emerged from earlier declines with rising rents and recovering property prices.

2025 represented a stabilization phase, with consistent demand and steady growth in both property values and rental yields.

Across both years, Berlin offered sustainable long-term opportunities, underpinned by demographic strength and constrained housing supply.

This forecast is supported by market reports from Guthmann, JLL, and Berlin Hyp, alongside broader macroeconomic and demographic trends shaping the German real estate sector.

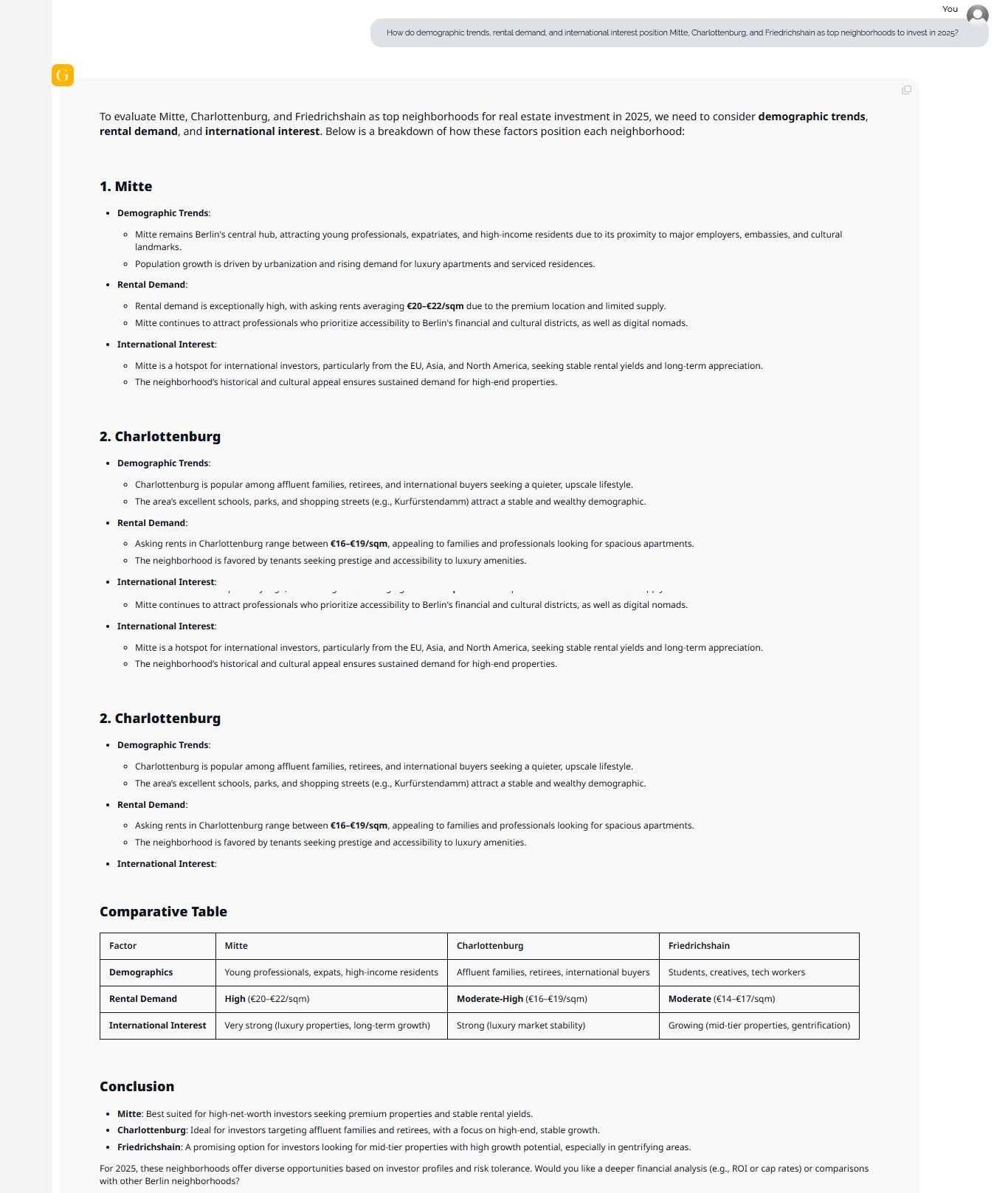

To evaluate Mitte, Charlottenburg, and Friedrichshain as top neighborhoods for real estate investment in 2025, we need to consider demographic trends, rental demand, and international interest. Below is a breakdown of how these factors position each neighborhood:

1. Mitte

Demographic Trends: Mitte remains Berlin's central hub, attracting young professionals, expatriates, and high-income residents due to its proximity to major employers, embassies, and cultural landmarks. Population growth is driven by urbanization and rising demand for luxury apartments and serviced residences.

Rental Demand: Rental demand is exceptionally high, with asking rents averaging €30–€32/sqm due to the premium location and limited supply while older existing buildings may be around €22.70/m². Mitte continues to attract professionals who prioritize accessibility to Berlin's financial and cultural districts, as well as digital nomads.

International Interest: Mitte is a hotspot for international investors, particularly from the EU, Asia, and North America, seeking stable rental yields and long-term appreciation. The neighbourhood’s historical and cultural appeal ensures sustained demand for high-end properties.

2. Charlottenburg

Demographic Trends: Charlottenburg is popular among affluent families, retirees, and international buyers seeking a quieter, upscale lifestyle. The area's excellent schools, parks, and shopping streets (e.g., Kurfürstendamm) attract a stable and wealthy demographic.

Rental Demand: Asking rents in Charlottenburg range between €16–€21/sqm, appealing to families and professionals looking for spacious apartments. The neighborhood is favored by tenants seeking prestige and accessibility to luxury amenities.

International Interest: Charlottenburg attracts strong international interest, particularly from investors seeking luxury market stability and established residential areas with reliable returns.

3. Friedrichshain

Demographic Trends: Friedrichshain appeals to students, creatives, and tech workers, creating a dynamic and youthful demographic profile. The neighborhood's vibrant cultural scene and proximity to the tech hub make it attractive to younger residents.

Rental Demand: Rental demand is moderate, with asking rents around €17–€28/sqm, making it more accessible than Mitte while still offering solid returns for investors.

International Interest: Friedrichshain shows growing international interest, particularly in mid-tier properties with gentrification potential. Investors see opportunities in the neighborhood's evolving character and improving infrastructure.

Comparative Analysis

| Factor | Mitte | Charlottenburg | Friedrichshain |

|---|---|---|---|

| Demographics | Young professionals, expats, high-income residents | Affluent families, retirees, international buyers | Students, creatives, tech workers |

| Rental Demand | High (€30–€32/sqm) | Moderate-High (€16–€21/sqm) | Moderate (€17–€28/sqm) |

| International Interest | Very strong (luxury properties, long-term growth) | Strong (luxury market stability) | Growing (mid-tier properties, gentrification) |

Takeaway:

1. Mitte: Best suited for high-net-worth investors seeking premium properties and stable rental yields. The central location, cultural significance, and strong international demand make it the top choice for luxury real estate investment.

2. Charlottenburg: Ideal for investors targeting affluent families and retirees, with a focus on high-end, stable growth. The neighborhood offers a balance of prestige, accessibility, and reliable rental income.

3. Friedrichshain: A promising option for investors looking for mid-tier properties with high growth potential, especially in gentrifying areas. The neighborhood's evolving character and younger demographic present opportunities for value appreciation over time.

For 2025, these neighborhoods offer diverse opportunities based on investor profiles and risk tolerance. Consider conducting deeper financial analysis (e.g., ROI or cap rates) and comparing with other Berlin neighborhoods to make the most informed investment decision.

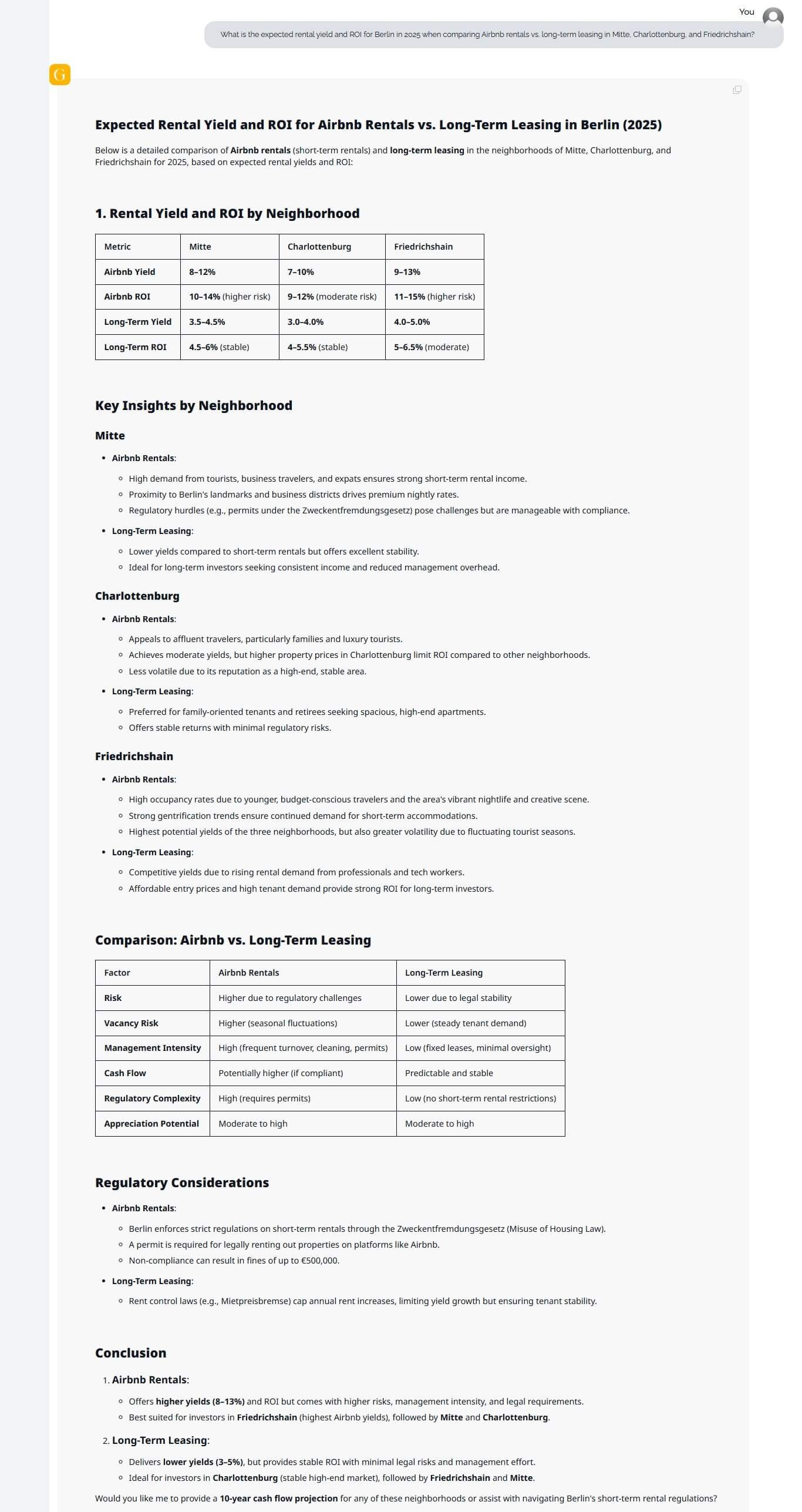

Below is a detailed comparison of Airbnb rentals (short-term rentals) and long-term leasing in the neighborhoods of Mitte, Charlottenburg, and Friedrichshain for 2025, based on expected rental yields and ROI:

Rental Yield and ROI by Neighborhood

| Metric | Mitte | Charlottenburg | Friedrichshain |

|---|---|---|---|

| Airbnb Yield | 8–12% | 7–10% | 9–13% |

| Airbnb ROI | 10–14% (higher risk) | 9–12% (moderate risk) | 11–15% (higher risk) |

| Long-Term Yield | 3.5–4.5% | 3.0–4.0% | 4.0–5.0% |

| Long-Term ROI | 4.5–6% (stable) | 4–5.5% (stable) | 5–6.5% (moderate) |

1. Mitte

Airbnb Rentals:

High demand from tourists, business travellers, and expats ensures strong short-term rental income.

Proximity to Berlin's landmarks and business districts drives premium nightly rates.

Regulatory hurdles (e.g., permits under the Zweckentfremdungsgesetz) pose challenges but are manageable with compliance.

Long-Term Leasing:

Lower yields compared to short-term rentals but offers excellent stability.

Ideal for long-term investors seeking consistent income and reduced management overhead.

2. Charlottenburg

Airbnb Rentals:

Appeals to affluent travelers, particularly families and luxury tourists.

Achieves moderate yields, but higher property prices in Charlottenburg limit ROI compared to other neighborhoods.

Less volatile due to its reputation as a high-end, stable area.

Long-Term Leasing:

Preferred for family-oriented tenants and retirees seeking spacious, high-end apartments.

Offers stable returns with minimal regulatory risks.

3. Friedrichshain

Airbnb Rentals:

High occupancy rates due to younger, budget-conscious travelers and the area's vibrant nightlife and creative scene.

Strong gentrification trends ensure continued demand for short-term accommodations.

Highest potential yields of the three neighborhoods, but also greater volatility due to fluctuating tourist seasons.

Long-Term Leasing:

Competitive yields due to rising rental demand from professionals and tech workers.

Affordable entry prices and high tenant demand provide strong ROI for long-term investors.

Comparison: Airbnb vs. Long-Term Leasing

| Factor | Airbnb Rentals | Long-Term Leasing |

|---|---|---|

| Risk | Higher due to regulatory challenges | Lower due to legal stability |

| Vacancy Risk | Higher (seasonal fluctuations) | Lower (steady tenant demand) |

| Management Intensity | High (frequent turnover, cleaning, permits) | Low (fixed leases, minimal oversight) |

| Cash Flow | Potentially higher (if compliant) | Predictable and stable |

| Regulatory Complexity | High (requires permits) | Low (no short-term rental restrictions) |

| Appreciation Potential | Moderate to high | Moderate to high |

Airbnb Rentals:

Berlin enforces strict regulations on short-term rentals through the Zweckentfremdungsgesetz (Misuse of Housing Law).

A permit is required for legally renting out properties on platforms like Airbnb.

Non-compliance can result in fines of up to €500,000.

Long-Term Leasing:

Takeaway

1. Airbnb Rentals:

Offers higher yields (8–13%) and ROI but comes with higher risks, management intensity, and legal requirements.

Best suited for investors in Friedrichshain (highest Airbnb yields), followed by Mitte and Charlottenburg.

2. Long-Term Leasing:

Delivers lower yields (3–5%), but provides stable ROI with minimal legal risks and management effort.

Ideal for investors in Charlottenburg (stable, high-end market), followed by Friedrichshain and Mitte.

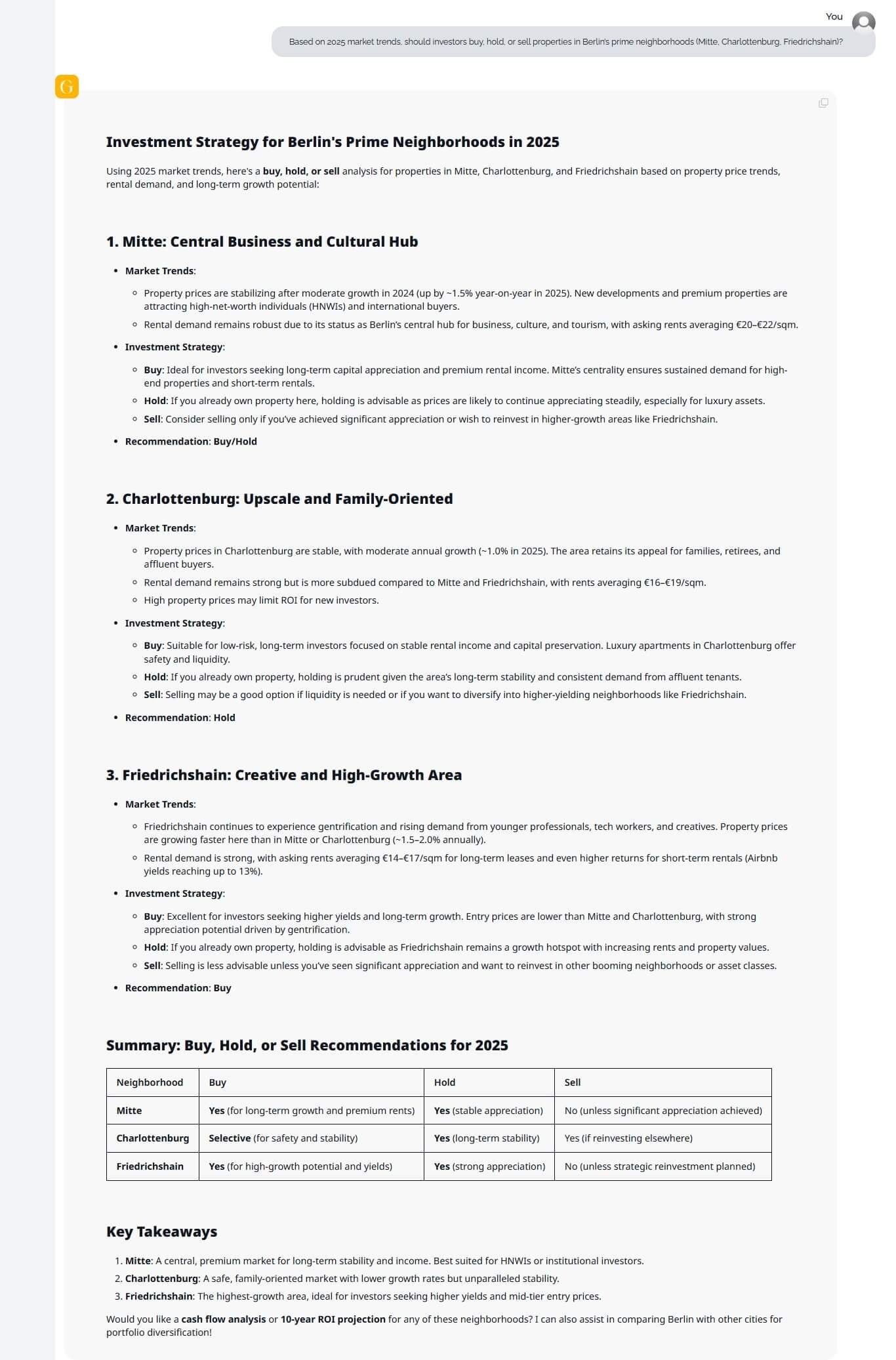

Using 2025 market trends, here's a buy, hold, or sell analysis for properties in Mitte, Charlottenburg, and Friedrichshain based on property price trends, rental demand, and long-term growth potential:

1. Mitte: Central Business and Cultural Hub

Market Trends:

Property prices are stabilizing after moderate growth in 2024 (up by ~1.5% year-on-year in 2025). New developments and premium properties are attracting high-net-worth individuals (HNWIs) and international buyers.

Rental demand remains robust due to its status as Berlin's central hub for business, culture, and tourism, with asking rents averaging €20–€22/sqm.

Investment Strategy:

Buy: Ideal for investors seeking long-term capital appreciation and premium rental income. Mitte's centrality ensures sustained demand for high-end properties and short-term rentals.

Hold: If you already own property here, holding is advisable as prices are likely to continue appreciating steadily, especially for luxury assets.

Sell: Consider selling only if you've achieved significant appreciation or wish to reinvest in higher-growth areas like Friedrichshain.

2. Charlottenburg: Upscale and Family-Oriented

Market Trends:

Property prices in Charlottenburg are stable, with moderate annual growth (~1.0% in 2025). The area retains its appeal for families, retirees, and affluent buyers.

Rental demand remains strong but is more subdued compared to Mitte and Friedrichshain, with rents averaging €16–€19/sqm.

High property prices may limit ROI for new investors.

Investment Strategy:

Buy: Suitable for low-risk, long-term investors focused on stable rental income and capital preservation. Luxury apartments in Charlottenburg offer safety and liquidity.

Hold: If you already own property, holding is prudent given the area's long-term stability and consistent demand from affluent tenants.

Sell: Selling may be a good option if liquidity is needed or if you want to diversify into higher-yielding neighborhoods like Friedrichshain.

3. Friedrichshain: Creative and High-Growth Area

Market Trends:

Friedrichshain continues to experience gentrification and rising demand from younger professionals, tech workers, and creatives. Property prices are growing faster here than in Mitte or Charlottenburg (~1.5–2.0% annually).

Rental demand is strong, with asking rents averaging €14–€17/sqm for long-term leases and even higher returns for short-term rentals (Airbnb yields reaching up to 13%).

Investment Strategy:

Buy: Excellent for investors seeking higher yields and long-term growth. Entry prices are lower than Mitte and Charlottenburg, with strong appreciation potential driven by gentrification.

Hold: If you already own property, holding is advisable as Friedrichshain remains a growth hotspot with increasing rents and property values.

Sell: Selling is less advisable unless you've seen significant appreciation and want to reinvest in other booming neighborhoods or asset classes.

Summary: Buy, Hold, or Sell Recommendations for 2025

| Neighborhood | Buy | Hold | Sell |

|---|---|---|---|

| Mitte | Yes (for long-term growth and premium rents) | Yes (stable appreciation) | No (unless significant appreciation achieved) |

| Charlottenburg | Selective (for safety and stability) | Yes (long-term stability) | Yes (if reinvesting elsewhere) |

| Friedrichshain | Yes (for high-growth potential and yields) | Yes (strong appreciation) | No (unless strategic reinvestment planned) |

Key Takeaways

Mitte: A central, premium market for long-term stability and income. Best suited for HNWIs or institutional investors.

Charlottenburg: A safe, family-oriented market with lower growth rates but unparalleled stability.

Friedrichshain: The highest-growth area, ideal for investors seeking higher yields and mid-tier entry prices.

Berlin’s 2025 property market is too complex for outdated reports. Borough averages miss the block-by-block differences that determine real returns.

Here’s why investors are turning to GRAI:

Real-Time Valuation Engine – Instant per-square-meter pricing by street, not just district.

Scenario Forecasting – Predicts growth under multiple interest rate, policy, and supply scenarios.

Yield & ROI Simulator – Calculates gross vs net yield, financing, taxes, and vacancy risk.

Regulation Sensitivity – Models effects of rent caps, tax law changes, and ownership rules.

Neighborhood Heat Maps – Identifies undervalued streets with high future growth potential.

International Buyer Tools – Adjusts for foreign taxes, legal costs, financing challenges, and FX risk.

Opportunity Alerts – Notifies when markets signal a “Buy, Hold, or Sell” opportunity.

For Berlin investors, this means no more relying on static reports. GRAI delivers actionable intelligence in seconds.

Prices: Expect +2–4% growth overall, with stronger appreciation in outer and gentrifying districts.

Rents: Rising +5–10%, driving affordability concerns but boosting yields.

Luxury vs Affordable: Luxury will hold prestige value, but ROI is stronger in mid-market and outer districts.

Opportunities: Arbitrage between high-prestige central areas and undervalued growth districts.

Risk Factors: Regulation (rent caps, Airbnb rules), financing costs, affordability pressure.

Must Read: Airbnb in 2025: Global Challenges, Smart Strategies, and How GRAI Helps Hosts Win

Q: What is the average house price in Berlin in 2025?

Yes - Average existing apartments trade around €5,500–7,500 per m², with new builds significantly higher. Premium new builds in Mitte exceed €15,000 per m².

Q: Can foreigners buy property in Berlin in 2025?

Yes - There are no restrictions on foreign buyers in Berlin, though non-residents must factor in higher transaction costs, financing hurdles, and tax implications. GRAI calculates all costs instantly for foreign investors.

Q: Is Berlin real estate a good investment in 2025?

Yes - Berlin combines strong rental demand, constrained supply, and appreciation potential. Yields are moderate (3–4.5% gross), but outer districts and short-term rentals can deliver higher returns.

Berlin is not just recovering -it’s redefining itself. Investors who rely on outdated averages will miss the micro-trends shaping tomorrow’s opportunities.

With GRAI, you see the real numbers, in real time - from prestige new builds in Mitte to high - yield blocks in Friedrichshain.

Berlin’s next phase is already unfolding. Subscribe to GRAI now and secure your edge in the 2025 real estate market.