Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

International investors are no longer debating whether Europe belongs in a diversified real estate portfolio. That question is settled. What now separates outperformers from the rest is city-level precision under regulatory pressure, capital constraints, and demographic shifts.

In 2026, one comparison dominates investor search intent, institutional memos, and private capital discussions alike: Berlin vs. Amsterdam.

Both cities anchor the international real estate market. Both attract global capital. Yet they operate under fundamentally different economic mechanics, regulatory philosophies, and risk-return profiles.

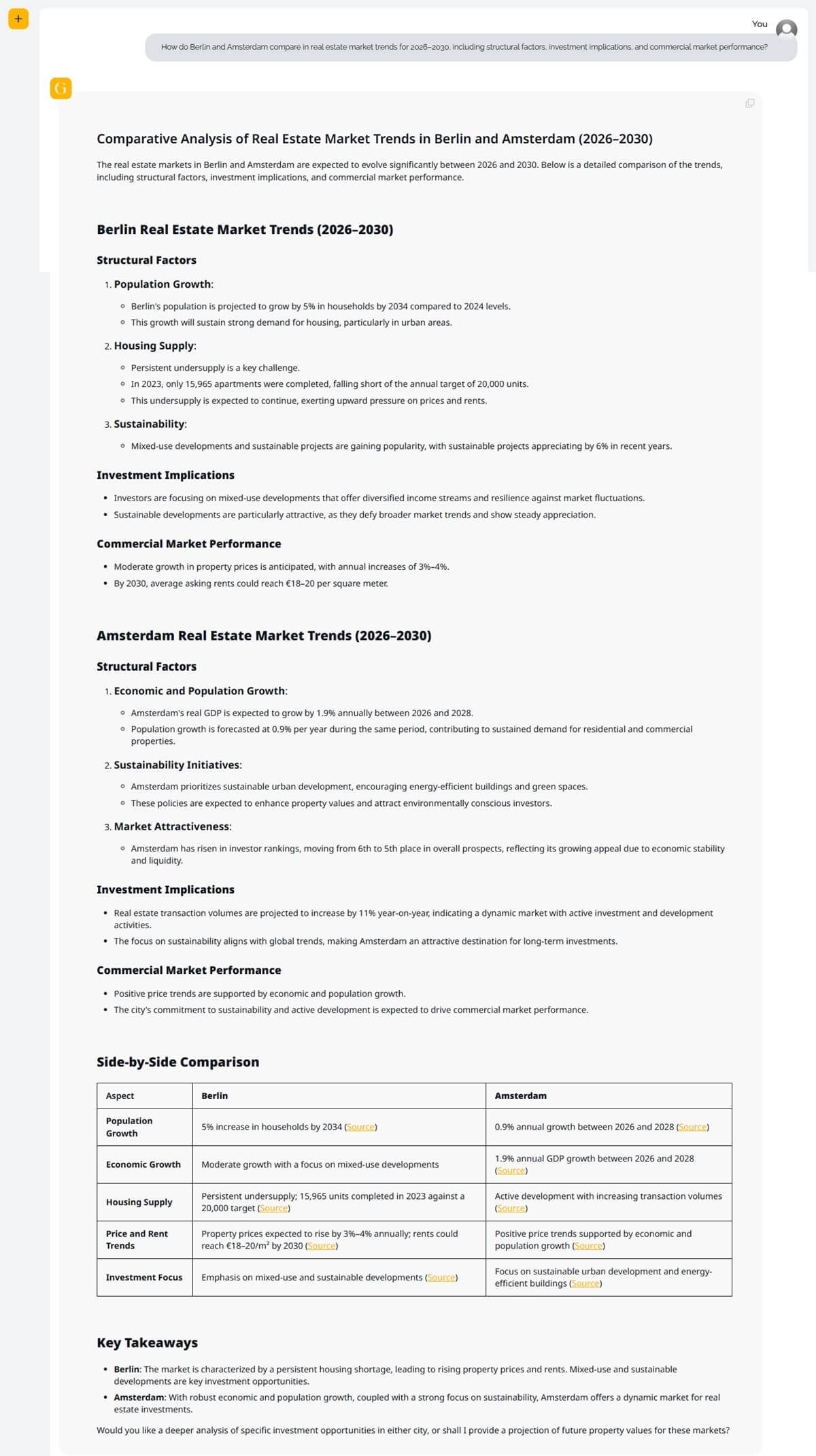

Using forward-looking data, GRAI compared the evolution of Berlin and Amsterdam’s real estate markets from 2026 to 2030, examining structural factors, investment implications, and commercial market performance. While both cities remain attractive long-term markets, their drivers differ materially-Berlin’s narrative is shaped by persistent supply constraints, while Amsterdam’s momentum is powered by sustainability, capital inflows, and urban competitiveness.

Structural Factors :

1. Population Growth

Berlin’s population is expected to rise steadily, with households projected to grow ~5% by 2034. This household formation trend underpins sustained housing demand, particularly across central districts and urban regeneration corridors.

2. Housing Supply

Pressure on supply remains a defining feature. Only ~15,965 units were completed in 2023, against housing targets of ~20,000 units, reinforcing a structural undersupply. This gap is projected to continue through 2030, keeping property prices and rents on an upward trajectory.

3. Sustainability & Mixed-Use Development

Developments that combine residential, retail, and flexible commercial uses are gaining traction alongside sustainability-focused projects, which have appreciated ~6% in recent years as ESG-aligned real assets attract institutional capital.

Investment Implications :

Investors are increasingly favoring mixed-use, ESG-oriented developments for their resilience and diversified income streams. With Berlin’s supply constraints unlikely to ease meaningfully before 2030, these segments are well-positioned for continued appreciation and defensive performance.

Commercial Market Performance :

Commercial property values are expected to grow 3-4% annually, supported by stable tenant demand and constrained office availability. Average asking rents may reach €18-€20/m² by 2030, reinforcing Berlin’s role as a core Western European office and innovation hub.

Structural Factors :

1. Economic & Population Growth

Amsterdam’s macro-outlook is more growth-driven, with real GDP projected to expand ~1.9% annually between 2026 and 2028, while population increases ~0.9% per year, sustaining residential and commercial absorption.

2. Sustainability as Core Policy

Amsterdam is aggressively integrating sustainability into planning-prioritizing energy-efficient buildings, dense mixed-use districts, and public greenspace. These policies enhance both capital values and investor sentiment, particularly among global ESG funds.

3. Market Attractiveness & Capital Flows

Amsterdam has climbed in global investor rankings, moving from 6th to 5th, reflecting stronger pricing resilience and institutional liquidity. Transaction volumes are projected to increase ~11% YoY, underscoring continued depth in the investment market.

Investment Implications :

Amsterdam aligns well with international demand for sustainable, low-volatility assets. The city’s regulatory emphasis on green building performance, paired with consistent transaction activity, positions it as a preferred destination for long-term investors.

Commercial Market Performance :

Commercial real estate performance is buoyed by synchronized economic and demographic drivers. Sustainability-linked building upgrades and tenant preferences are expected to support rental growth and capital appreciation through 2030.

| Aspect | Berlin | Amsterdam |

|---|---|---|

| Population Growth | +5% in households by 2034 | +0.9% annually (2026-2028) |

| Economic Momentum | Moderate; driven by mixed-use | Stronger; GDP +1.9%/yr (2026-2028) |

| Housing Supply | Structurally undersupplied | Active development pipeline |

| Price & Rent Trends | Prices +3-4%/yr; rents €18-20/m² by 2030 | Positive; supported by capital & population |

| Investment Focus | Mixed-use & sustainable development | ESG-driven assets & green buildings |

| Market Drivers | Demographics + supply constraints | Sustainability + global investor demand |

Berlin:

The thesis is supply-driven. Persistent undersupply and rising household formation support price and rent appreciation. Mixed-use and sustainable developments are the city’s most attractive investment themes.

Amsterdam:

The thesis is growth- and capital-driven. Strong GDP performance, sustainability policy alignment, and increased transaction liquidity make Amsterdam particularly compelling for ESG-focused real-estate capital.

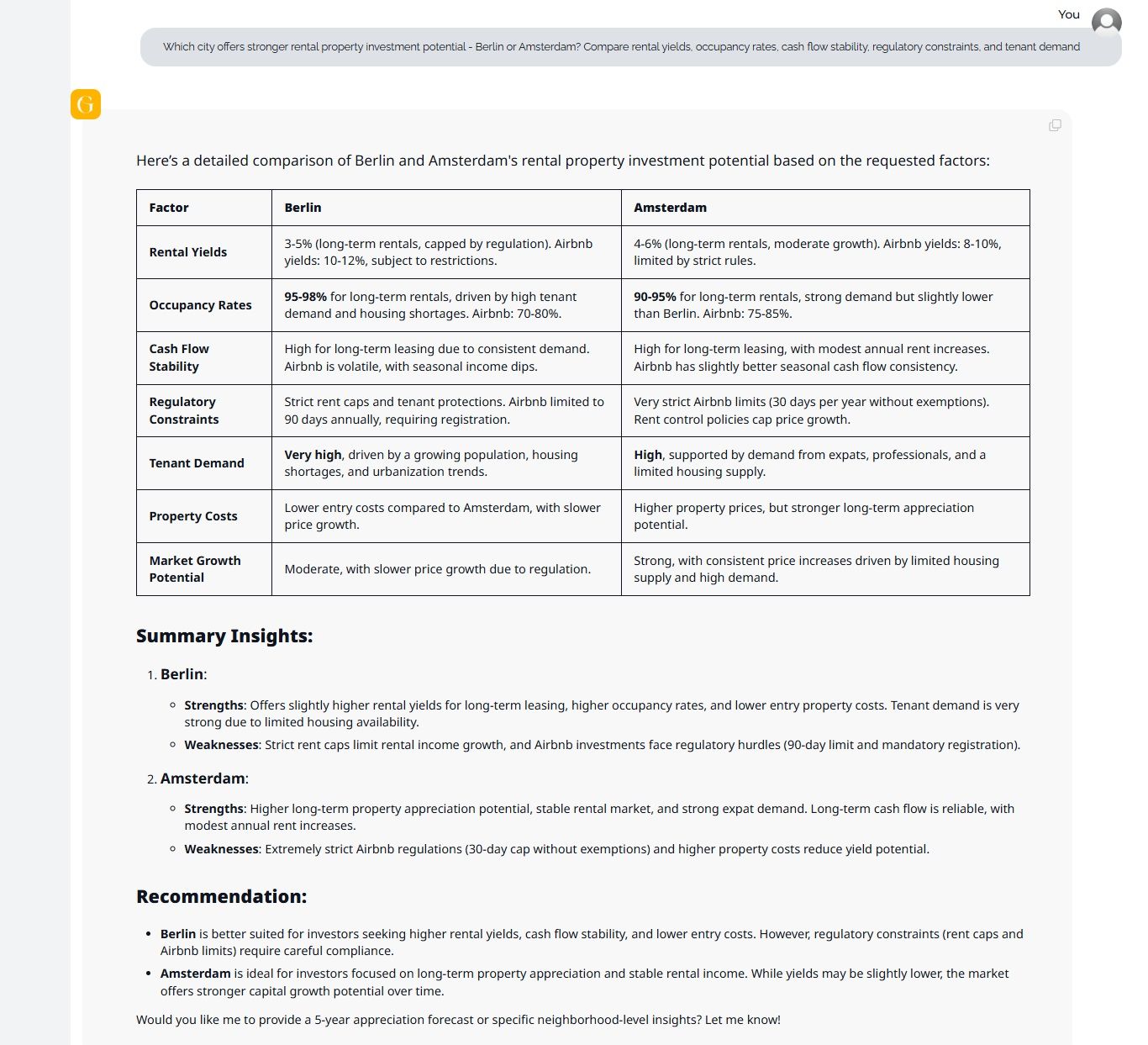

GRAI compared Berlin and Amsterdam across the most relevant rental investment variables-yields, occupancy, cash-flow stability, regulations, tenant demand, and growth potential. Both cities remain compelling, but the profiles differ sharply depending on whether investors prioritize yield, appreciation, regulatory certainty, or cash-flow resilience.

| Factor | Berlin | Amsterdam |

|---|---|---|

| Rental Yields | 3-5% for long-term rentals (capped). Airbnb 10-12%, subject to tight restrictions. | 4-6% long-term yields with higher appreciation potential. Airbnb 8-10%, tightly regulated. |

| Occupancy Rates | 95-98% long-term due to structural shortages. Airbnb 70-80%. | 90-95% long-term; strong but slightly lower than Berlin. Airbnb 75-85%. |

| Cash-Flow Stability | High for long-term leasing; Airbnb volatile with seasonal swings. | High for long-term leasing; Airbnb moderately seasonal with tighter stability. |

| Regulatory Constraints | Strict rent caps + tenant protections; Airbnb capped at 90 days/year with registration. | Very strict Airbnb 30-day cap, no exemptions; rental controls push appreciation into long-term assets. |

| Tenant Demand | Very High - driven by population growth, urbanization, tech workforce + supply shortages. | High - driven by expats, corporate demand, and limited housing. |

| Property Costs | Lower entry costs; slower price appreciation. | Higher entry costs; stronger long-term capital appreciation. |

| Market Growth Potential | Moderate, with slower price growth due to rent caps and regulation. | Strong, supported by constrained supply and consistent demand. |

Strengths

Constraints

Strengths

Constraints

Berlin is better suited for yield-focused investors seeking cash-flow stability, tenant stickiness, and lower entry valuations, provided they can navigate tenant protections and rental caps.

Amsterdam benefits investors prioritizing capital appreciation and long-term rent growth, driven by ESG-aligned development, demographic fundamentals, and global investor interest.

In short:

Berlin = Yield + Stability

Amsterdam = Appreciation + Institutional Demand

Discover which city matches your investment strategy with GRAI’s real-time intelligence: https://internationalreal.estate/chat

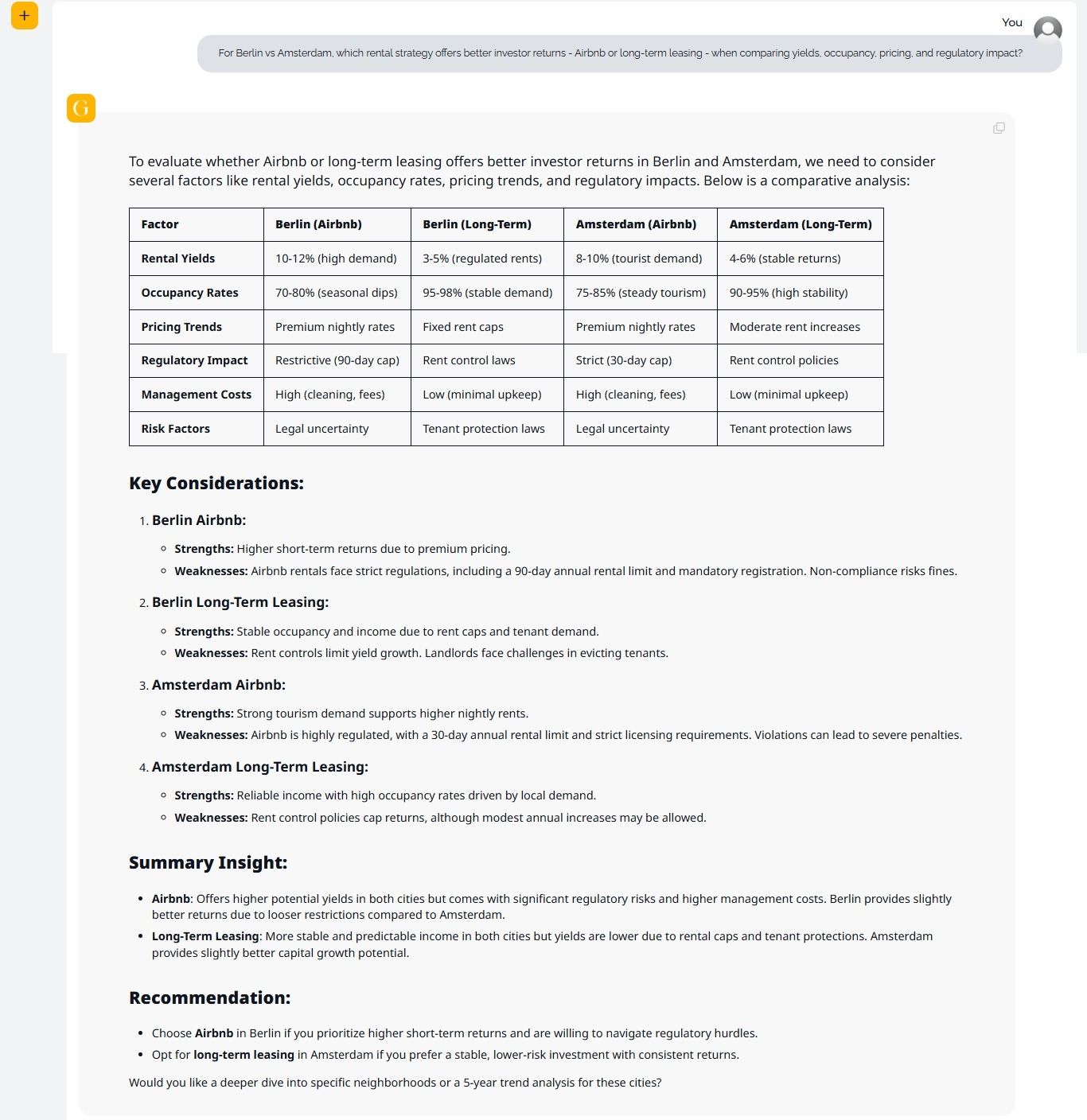

To determine whether short-term (Airbnb) rentals or long-term leasing offers stronger investor performance in Berlin and Amsterdam, GRAI evaluated yields, occupancy levels, pricing, regulatory conditions, operating costs, and risk factors across both markets.

| Factor | Berlin (Airbnb) | Berlin (Long-Term) | Amsterdam (Airbnb) | Amsterdam (Long-Term) |

|---|---|---|---|---|

| Rental Yields | 10-12% (high nightly premiums) | 3-5% (regulated rates) | 8-10% (tourist-driven) | 4-6% (stable returns) |

| Occupancy Rates | 70-80% (seasonal) | 95-98% (near-full utilization) | 75-85% (steady tourism) | 90-95% (high stability) |

| Pricing Trends | Premium nightly rates | Fixed rent caps | Premium nightly rates | Moderate rent increases |

| Regulatory Impact | Restrictive (90-day annual limit + registration) | Rent control laws | Very strict (30-day annual cap + licensing) | Rent controls with modest uplift potential |

| Management Costs | High (cleaning, frequent turnover, fees) | Low (minimal upkeep) | High (cleaning, fees, licensing) | Low (minimal upkeep) |

| Primary Risk Factors | Legal + regulatory uncertainty | Tenant protection constraints | Legal + compliance penalties | Tenant protections + slower escalation |

1. Berlin - Airbnb

Strengths

Weaknesses

2. Berlin - Long-Term Leasing

Strengths

Weaknesses

3. Amsterdam - Airbnb

Strengths

Weaknesses

4. Amsterdam - Long-Term Leasing

Strengths

Weaknesses

Airbnb delivers higher gross yield potential in both cities but introduces regulatory volatility, higher management complexity, and compliance risk - particularly pronounced in Amsterdam.

Long-term leasing offers superior stability and predictable occupancy in both markets, though returns are modest due to rent caps and tenant protection regimes.

Choose Airbnb in Berlin if the objective is short-term yield maximization and investors can actively navigate compliance requirements. Premium pricing + weaker enforcement makes Berlin more favorable than Amsterdam for short-term strategies.

Opt for long-term leasing in Amsterdam when prioritizing lower regulatory risk, stable corporate tenant demand, and long-term capital appreciation, despite moderated yields.

Price momentum probability

Rental sustainability under regulation

Policy friction and compliance risk

Economic resilience

Liquidity and exit probability

Strengths:

Deep rental demand

Lower acquisition thresholds

Long-term demographic tailwinds

Constraints:

Regulatory unpredictability

Yield sensitivity to policy changes

Strengths:

Capital stability

Global liquidity

Strong exit dynamics

Constraints:

High entry costs

Selective rental viability

Strategic Reality: Berlin rewards analytical strategy. Amsterdam rewards disciplined capital.

Generic real estate platforms provide listings. GRAI provides decision intelligence.

GRAI enables investors to:

Analyze real estate markets in real time

Review legal documents automatically across jurisdictions

Forecast economic and regulatory shifts at city and district levels

Model valuation and rental income dynamically

Interpret sentiment across policy, capital flows, and investor behavior

This is not market data. It is market reasoning.

Berlin and Amsterdam are not competitors - they are expressions of different investment philosophies.

Berlin offers opportunity through structural demand and rewards patient, strategy-driven capital

Amsterdam delivers resilience through scarcity and global liquidity, favoring disciplined buyers

Success in 2026 does not come from choosing the louder market. It comes from choosing the right strategy - and validating it with intelligence that updates in real time.

Let GRAI run the investment model and score Berlin vs Amsterdam for your strategy. Talk with GRAI: https://internationalreal.estate/chat

That is what GRAI delivers.

Q1. Is Berlin still a good real estate investment in 2026?

Yes, Berlin remains attractive for long-term investors due to persistent housing undersupply, strong rental demand, and demographic growth. Returns are increasingly strategy-driven, as rent regulation and policy shifts reward precision over speculation.

Q2. Is Amsterdam overpriced or structurally strong for investors?

Amsterdam is not structurally overpriced; it is scarcity priced. Limited supply, global liquidity, and strict planning controls support long-term capital stability, particularly for compliant, energy-efficient assets in prime locations.

Q3. Which city is better for rental income: Berlin or Amsterdam?

Berlin offers deeper rental demand but higher regulatory sensitivity. Amsterdam offers stable rental income in select segments with strict compliance requirements. The better city depends on regulatory tolerance and holding horizon.

Q4. Are short-term rentals viable in Berlin or Amsterdam in 2026?

Short-term rentals are heavily regulated in both cities. They are viable only under narrow compliance conditions. Long-term rentals offer greater regulatory durability for most international investors.

Q5. How do foreign investors compare Berlin vs. Amsterdam?

Berlin attracts strategy-focused investors seeking long-term rental exposure. Amsterdam appeals to capital-preservation buyers prioritizing liquidity and exit certainty. The optimal choice depends on risk appetite and regulatory capacity.