Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The Los Angeles real estate market is evolving fast. From multi-million-dollar estates in Beverly Hills to rapidly appreciating homes in South LA, investors must navigate a complex ecosystem of price trends, rental yields, and shifting zoning policies. Traditional approaches no longer cut it.

What separates successful investors in 2025? Instant access to data-driven insights, hyperlocal market predictions, and real-time analysis - all made possible by GRAI, the world's smartest AI-powered real estate advisor.

Whether you're eyeing luxury mansions or starter homes, GRAI empowers you with real-time property valuations, growth projections, rental forecasts, and legal checks, all in one platform.

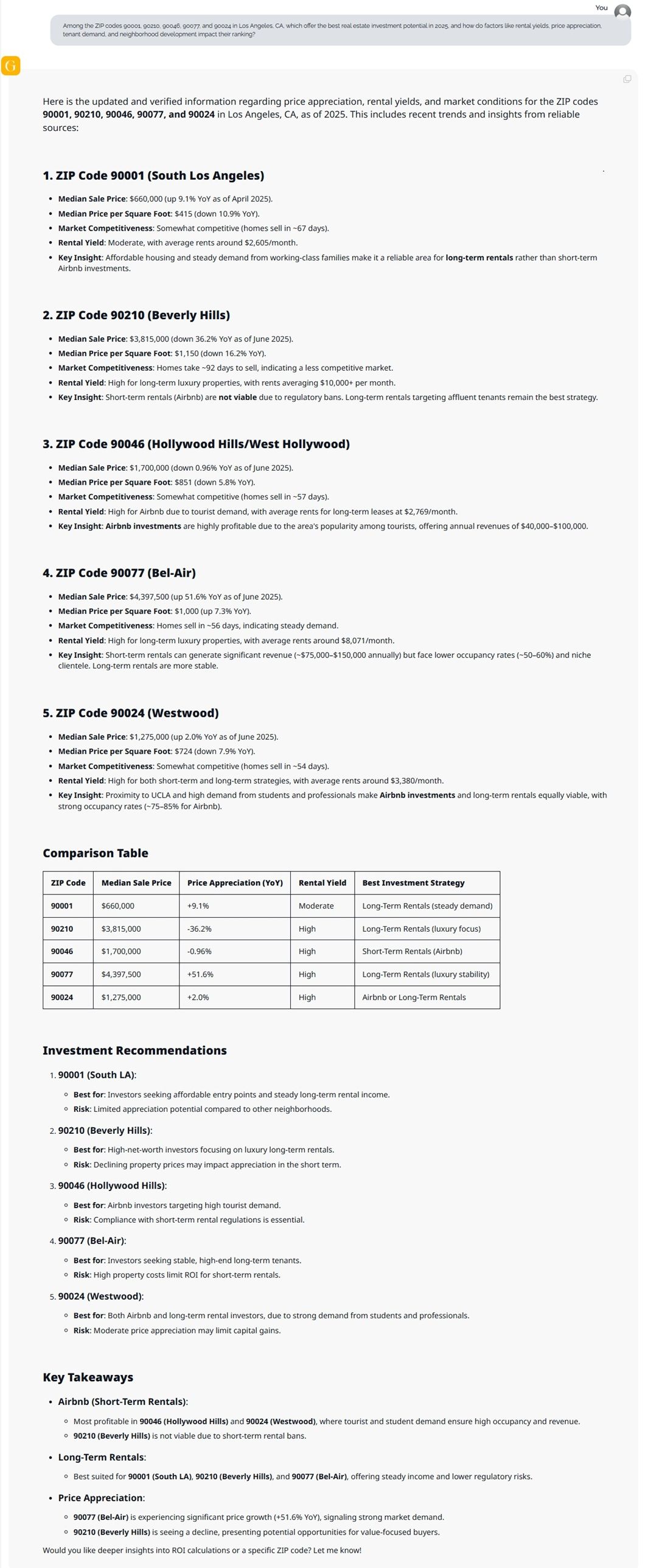

GRAI’s market intelligence identifies the most promising Los Angeles ZIP codes for real estate investment in 2025 by analyzing price appreciation, rental yields, tenant demand, and regulatory factors. Below is a detailed breakdown of each area.

1. 90001 (South Los Angeles)

Median Sale Price: $660,000 (+9.1% YoY, April 2025)

Median Price per Sq. Ft.: $415 (+10.9% YoY)

Market Competitiveness: Moderate – homes sell in ~67 days.

Rental Yield: Moderate; average rents ~$2,605/month.

Key Insight: Affordable housing and steady working-class demand make this ideal for long-term rentals over Airbnb.

2. 90210 (Beverly Hills)

Median Sale Price: $3,815,000 (-36.2% YoY, June 2025)

Median Price per Sq. Ft.: $1,156 (-16.2% YoY)

Market Competitiveness: Low – homes sell in ~92 days.

Rental Yield: High; luxury rents ~$10,000+/month.

Key Insight: Airbnb not viable due to short-term rental bans. Best suited for long-term luxury rentals.

3. 90046 (Hollywood Hills / West Hollywood)

Median Sale Price: $1,700,000 (-0.96% YoY, June 2025)

Median Price per Sq. Ft.: $851 (-5.8% YoY)

Market Competitiveness: Moderate – homes sell in ~57 days.

Rental Yield: High for Airbnb; long-term rents ~$2,769/month.

Key Insight: Airbnb properties here perform exceptionally due to strong tourist appeal, generating $40,000–$100,000 annually.

4. 90077 (Bel-Air)

Median Sale Price: $4,397,500 (+51.6% YoY, June 2025)

Median Price per Sq. Ft.: $1,000 (+7.3% YoY)

Market Competitiveness: Steady – homes sell in ~56 days.

Rental Yield: High for long-term luxury rentals; ~$8,071/month.

Key Insight: Short-term rentals can yield $75,000–$150,000 annually but face lower occupancy (50–60%). Best for long-term stability.

5. 90024 (Westwood)

Median Sale Price: $1,275,000 (+2.0% YoY, June 2025)

Median Price per Sq. Ft.: $724 (-7.9% YoY)

Market Competitiveness: High – homes sell in ~54 days.

Rental Yield: High for both strategies; long-term rents ~$3,380/month.

Key Insight: Proximity to UCLA and strong demand from students/professionals make both Airbnb and long-term rentals viable.

Comparison Table

| ZIP Code | Median Sale Price | Price Appreciation (YoY) | Rental Yield | Best Investment Strategy |

|---|---|---|---|---|

| 90001 | $660,000 | +9.1% | Moderate | Long-Term Rentals |

| 90210 | $3,815,000 | -36.2% | High | Long-Term Rentals |

| 90046 | $1,700,000 | -0.96% | High | Short-Term Rentals (Airbnb) |

| 90077 | $4,397,500 | +51.6% | High | Long-Term Rentals |

| 90024 | $1,275,000 | +2.0% | High | Airbnb / Long-Term Rentals |

Investment Recommendations

90001 (South LA): Affordable entry and consistent long-term income.

90210 (Beverly Hills): Best for high-net-worth buyers seeking luxury rental stability.

90046 (Hollywood Hills): Ideal for Airbnb targeting tourist demand.

90077 (Bel-Air): Suited for luxury long-term tenants.

90024 (Westwood): Balanced Airbnb and long-term potential due to student/professional demand.

Key Takeaways

Airbnb: Most profitable in 90046 (Hollywood Hills) and 90024 (Westwood). Not viable in 90210 due to bans.

Long-Term Rentals: Best suited for 90001, 90210, and 90077.

Price Appreciation: Highest in 90077 (+51.6% YoY); largest drop in 90210 (-36.2% YoY).

GRAI Verdict

For 2025, Airbnb investors should prioritize 90046 and 90024 for high occupancy and strong returns, while long-term investors will find the best stability and income potential in 90001, 90210, and 90077.

The standout high-growth market is 90077 (Bel-Air), combining luxury stability with exceptional appreciation. In contrast, 90210 offers prestige and steady rental yields but faces declining property values, making it more suitable for long-term wealth preservation than short-term gains.

| Segment | ZIP Codes | Price Range | Target Audience | Strategy |

|---|---|---|---|---|

| Ultra-Luxury | 90210, 90077, 90049 | $3M – $50M+ | Celebrities, global elites | Prestige holding, long-term gains |

| Mid-Market | 90046, 90024, 90064 | $25K – $61M | Professionals, dual-income families | Balanced income & growth |

| Entry-Level Growth | 90001, 90019, 90037 | $4.6K – $3.8M | First-time buyers, flippers | Fix-and-flip, high appreciation play |

GRAI helps match your budget and strategy with the right ZIP code based on thousands of real-time data points.

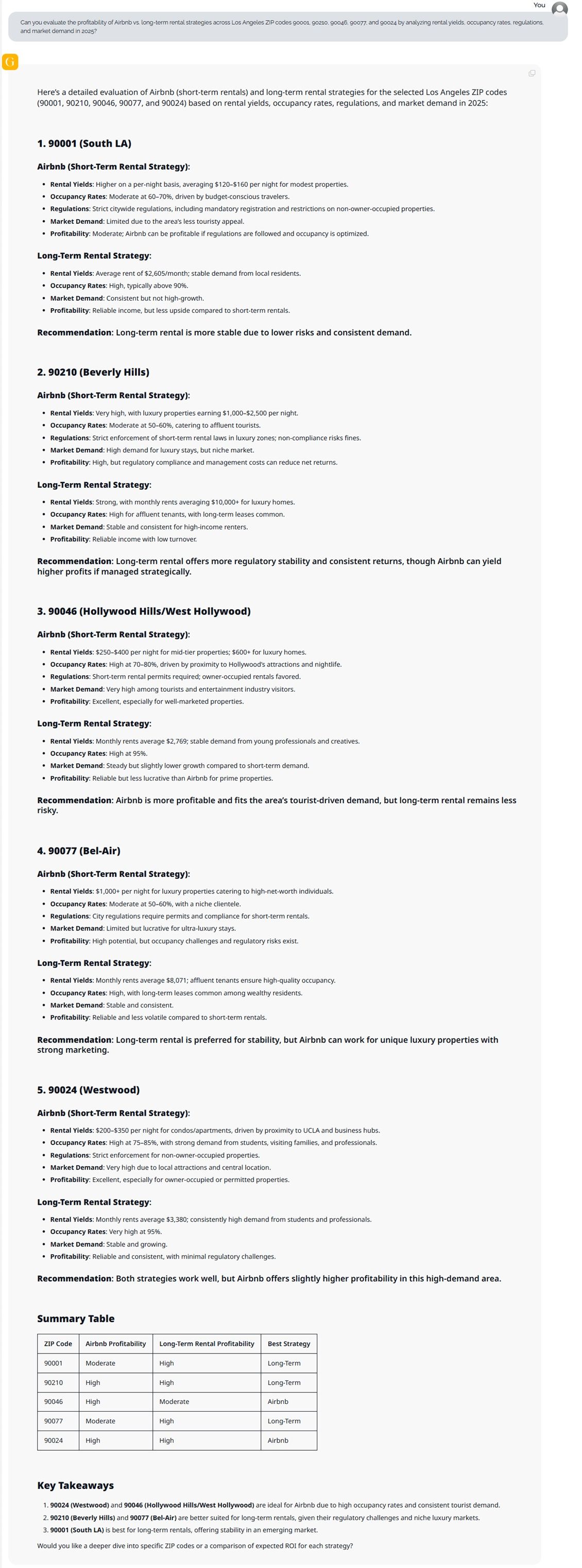

GRAI conducted a comprehensive analysis comparing Airbnb (short-term rentals) and long-term rental strategies across five key Los Angeles ZIP codes - 90001, 90210, 90046, 90077, and 90024 - factoring in rental yields, occupancy rates, local regulations, and market demand to determine which approach delivers stronger profitability in 2025.

1. 90001 (South LA)

Airbnb Profitability:

• Rental Yields: High per night ($80–$170), but dependent on budget-conscious travellers.

• Occupancy Rates: Moderate (60–70%).

• Regulations: Strict city rules and limits on non-owner-occupied short-term rentals.

• Demand: Limited tourist appeal.

• Recommendation: Moderate profitability. Best suited for compliant, highly optimized Airbnb operations.

Long-Term Rental Strategy:

• Rental Yields: $2,605/month average, supported by consistent local demand.

• Occupancy Rates: High (90%+).

• Recommendation: Preferred strategy for 90001 due to stable yields and lower regulatory risk.

2. 90210 (Beverly Hills)

Airbnb Profitability:

• Rental Yields: Very high – $1,000–$10,000 per night for luxury stays.

• Occupancy Rates: Moderate (50–60%).

• Regulations: Heavy restrictions in luxury zones with penalties for non-compliance.

• Recommendation: High yield potential, but regulatory friction makes Airbnb more complex.

Long-Term Rental Strategy:

• Rental Yields: Strong, with typical monthly rents exceeding $10,000.

• Occupancy Rates: High, with stable high-income demand.

• Recommendation: Long-term rentals offer safer, more stable returns in this market.

3. 90046 (Hollywood Hills / West Hollywood)

Airbnb Profitability:

• Rental Yields: $250–$400 per night for mid-tier homes, $600+ for luxury.

• Occupancy Rates: High (70–80%) driven by tourism and nightlife.

• Regulations: Owner-occupied rentals preferred; moderate restrictions.

• Recommendation: Airbnb is more profitable, fitting the area's short-term tourist demand.

Long-Term Rental Strategy:

• Rental Yields: ~$2,769/month - $8000/month.

• Occupancy Rates: High, though demand is slightly lower than Airbnb.

• Recommendation: Long-term is stable, but Airbnb wins on yield if compliant.

4. 90077 (Bel-Air)

Airbnb Profitability:

• Rental Yields: $1,000+/night for luxury estates.

• Occupancy Rates: Moderate (50–60%).

• Regulations: Requires permits and compliance.

• Recommendation: High-profit potential for ultra-luxury Airbnb properties but niche.

Long-Term Rental Strategy:

• Rental Yields: ~$8,071/month.

• Occupancy Rates: High with long-term leases common.

• Recommendation: Long-term is safer and more reliable in this affluent market.

5. 90024 (Westwood)

Airbnb Profitability:

• Rental Yields: $250–$350/night for condos/apartments.

• Occupancy Rates: High (75–85%), driven by students, professionals, and tourists.

• Regulations: Strict on non-owner-occupied units.

• Recommendation: Airbnb edges ahead in profitability in this high-demand, well-located area.

Long-Term Rental Strategy:

• Rental Yields: $3,380/month average.

• Occupancy Rates: Moderate (66%).

• Recommendation: Strong for long-term cash flow with minimal risks.

Summary Table

| ZIP Code | Airbnb Profitability | Long-Term Profitability | Best Strategy |

|---|---|---|---|

| 90001 | Moderate | High | Long-Term |

| 90210 | High | High | Long-Term |

| 90046 | High | Moderate | Airbnb |

| 90077 | Moderate | High | Long-Term |

| 90024 | High | High | Airbnb |

Key Takeaways – GRAI’s Strategic Insights

90024 (Westwood) and 90046 (Hollywood Hills) are ideal for Airbnb thanks to tourism, student traffic, and high occupancy rates.

90210 (Beverly Hills) and 90077 (Bel-Air) are better suited for long-term rentals, given high regulatory pressure and stable luxury demand.

90001 (South LA) is a rising long-term rental zone, ideal for investors seeking steady income in affordable markets.

GRAI Advantage: GRAI’s AI tracks rental yield trends, booking data, lease durations, and city regulations, giving you an edge in pricing and strategy.

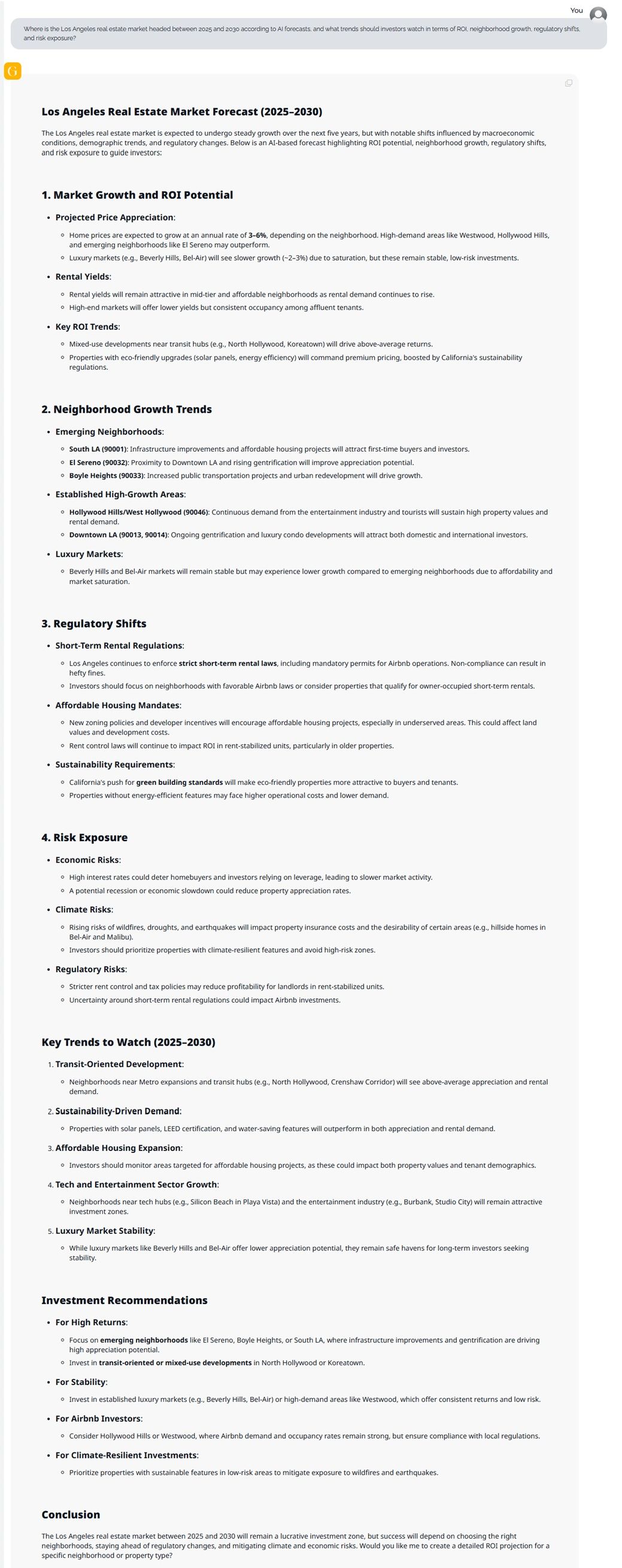

According to GRAI’s real estate intelligence engine, the Los Angeles real estate market is forecast to see steady growth between 2025 and 2030, with key shifts driven by infrastructure, demographics, regulation, and sustainability mandates.

Below is a detailed, AI-powered outlook to guide strategic investment decisions over the next five years.

1. Market Growth and ROI Potential

Price Appreciation:

• Home values expected to grow at 3–6% annually, depending on ZIP code.

• High-demand areas like Westwood, Hollywood Hills, and El Sereno may outperform due to location, development, or gentrification.

• Luxury zones like Beverly Hills and Bel-Air will see slower appreciation (~2–3%) due to market saturation but remain low-risk.

Rental Yields:

• Mid-tier and affordable neighborhoods will remain attractive for rental investors.

• High-end zones will offer lower yields but stable, affluent tenants.

High-ROI Trends:

•Transit-adjacent zones (e.g., North Hollywood, Koreatown) will deliver premium returns.

•Sustainability upgrades (solar, energy-efficient systems) will command higher resale and rental value.

2. Neighborhood Growth Trends

Emerging High-ROI Zones:

• 90001 (South LA): Affordable housing initiatives and infrastructure improvements will attract first-time buyers.

• 90032 (El Sereno): Gentrification and proximity to Downtown will drive price appreciation.

• 90033 (Boyle Heights): Transit access and redevelopment will spur long-term growth.

Established High-Growth Areas:

• 90046 (Hollywood Hills): Continued demand from tourists and creatives keeps yields strong.

• 90013 / 90014 (Downtown LA): Ongoing gentrification and condo development appeal to both local and global investors.

Luxury Markets (Stability-Focused):

• 90210 (Beverly Hills) and 90077 (Bel-Air) will see slower growth but offer long-term capital protection.

3. Regulatory Shifts

Short-Term Rental Laws:

• Los Angeles is expected to continue enforcing strict Airbnb rules, requiring permits and owner-occupancy compliance.

• Investors should prioritize Airbnb-friendly zones or pivot to long-term rentals.

Affordable Housing Mandates:

New laws and incentives will shape the investment landscape, particularly in rent-stabilized or underserved areas.

Green Building Requirements:

• California’s sustainability push will favor properties with eco-certifications, such as solar panels, LEED standards, and energy-saving systems.

• Older or inefficient buildings may face demand and pricing disadvantages.

4. Risk Exposure

Economic Risks:

• High interest rates and a potential economic slowdown may dampen price appreciation and leverage-driven purchasing.

Climate Risks:

• Areas prone to wildfires, droughts, and earthquakes—e.g., Bel-Air and Malibu - could face higher insurance costs and demand volatility.

• Investors should seek climate-resilient, low-risk zones with sustainability features.

Regulatory Risks:

• Tighter rent control and evolving Airbnb rules may reduce profitability in certain neighborhoods.

5. Key Trends to Watch (2025–2030)

1. Transit-Oriented Development:

Areas near Metro expansions (e.g., Crenshaw Corridor, North Hollywood) will outperform due to improved connectivity and renter appeal.

2. Sustainability-Driven Demand:

Eco-friendly buildings will become more valuable as buyers and renters seek lower utility costs and greener living.

3. Affordable Housing Expansion:

Zones targeted for affordable housing will see appreciation and strong rental demand due to population growth.

4. Tech & Entertainment Sector Growth:

Proximity to hubs like Silicon Beach (Playa Vista) and Studio City will attract young professionals and developers.

5. Luxury Market Stability:

Even with slower appreciation, markets like Beverly Hills and Bel-Air remain safe harbors for long-term capital.

Investment Recommendations

For High Returns:

• Invest in El Sereno, Boyle Heights, and South LA, where gentrification and development create high appreciation potential.

• Prioritize transit-oriented zones and mixed-use communities.

For Stability:

• Target luxury areas like Beverly Hills or Westwood with strong occupancy and consistent returns.

For Airbnb Investors:

• Focus on Hollywood Hills or Westwood, where occupancy remains strong and regulations are manageable.

For Climate-Resilient Investments:

• Choose properties with green features in low-risk regions to mitigate climate exposure.

The Winning Formula:

From 2025 to 2030, the Los Angeles real estate market will remain a high-opportunity zone, but outcomes will depend heavily on:

Selecting the right neighborhoods

Navigating regulatory pressures

Prioritizing sustainability

Mitigating climate and economic risks

Must Read: GRAI Tops 2025’s Best Real Estate AI Platforms

GRAI is more than a real estate tool. It is an AI engine built for property intelligence, offering:

Real-Time Property Valuation: Instant pricing using market data, comps, and visuals

Automated Legal Document Review: Upload images of, permits, and titles for AI-based red flag analysis

Predictive Economic Forecasting: Hyper-localized growth models using interest rates, policy, migration

Rental ROI Modeling: Get short-term vs. long-term profitability guidance

Environmental Impact & Build Feasibility: Assess flood/fire risks, soil stability, and green compliance

Whether you’re a developer, landlord, or investor, GRAI replaces months of due diligence with superior and instant insights.

1. What are the hottest ZIP codes to invest in Los Angeles in 2025?

90210, 90077, 90046, 90001, and 90024 are top picks for luxury, short-term rentals, value growth, and rental income.

2. Is South LA a good investment in real estate?

GRAI forecasts a 16–27% price increase in 90001 real estate by 2030 - thanks to significant infrastructure developments transforming the area.

3.What is the rental yield in Hollywood Hills?

Hollywood Hills (90046) offers an Airbnb yield of up to 10% with high tourist demand and year-round bookings.

4.Can AI really predict real estate trends accurately?

GRAI combines macroeconomic forecasting, real-time data, and sentiment analysis for highly accurate trend predictions.

5.What is the current real estate market trend in Los Angeles, CA?

Los Angeles is seeing stability in luxury ZIPs and high growth in emerging areas like South LA, with evolving rental and commercial demand.

GRAI is your edge in the competitive Los Angeles real estate market. Whether you're investing $500K or $5M, GRAI delivers the market intelligence, risk analysis, and valuation speed you need to stay ahead.

Subscribe now at https://internationalreal.estate/chat and access the most powerful AI property advisor built for serious investors.