Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The San Francisco real estate market is entering a new phase.

The median home price now stands at $1.5 million, up 4.3% year-over-year, while median apartment rent climbed to $3,094/month-$3,510/month, an 11.5% increase from 2025. In this environment, every block matters. Prices can differ by 25-40% within a single ZIP, and appreciation potential shifts weekly.

This is exactly where GRAI, the world’s first AI-powered real estate advisor, transforms uncertainty into strategy-analyzing sentiment, permits, economic data, and climate risk in real time.

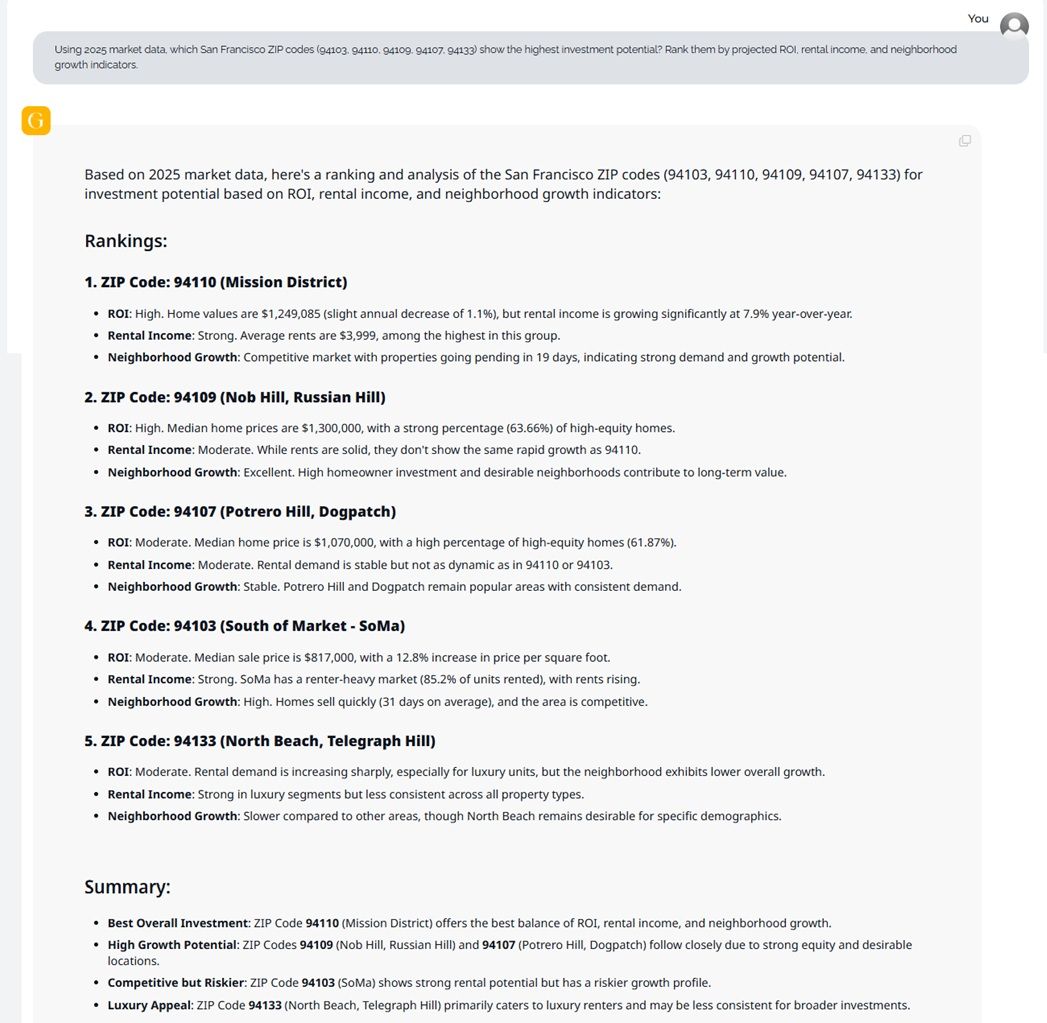

Based on GRAI’s 2025 market data and investment analysis, these five San Francisco ZIP codes stand out for their ROI performance, rental income growth, and neighborhood development potential.

1. ZIP Code: 94110 (Mission District)

ROI: High. Median home values are around $1,249,085, showing a slight dip of 1.1%, but rental income is rising strongly at 7.9% year-over-year.

Rental Income: Robust, with average rents reaching $3,999, among the highest in this group

Neighborhood Growth: Highly competitive, with homes going pending in just 19 days, signaling powerful buyer activity and appreciation potential.

🔹 GRAI Insight: Mission District represents the best overall investment opportunity due to its balance of ROI, income growth, and rapid absorption rate.

2. ZIP Code: 94109 (Nob Hill, Russian Hill)

ROI: High. Median home prices hover around $1.3 million, with 58% of homes being high-equity properties.

Rental Income: Moderate but consistent; rents are strong, though growth lags slightly behind Mission District.

Neighborhood Growth: Excellent. Prestigious addresses and high homeowner concentration ensure stable, long-term capital appreciation.

🔹 GRAI Insight: Offers strong equity retention and luxury appeal - ideal for investors prioritizing steady, premium-value growth.

3. ZIP Code: 94107 (Potrero Hill, Dogpatch)

ROI: Moderate, with a median home price of $1.07 million and 61.87% equity share.

Rental Income: Solid, though not as dynamic as 94110 or 94103.

Neighborhood Growth: Consistent, with Potrero Hill and Dogpatch retaining popularity among professionals and long-term tenants.

🔹 GRAI Insight: Reliable performer with low vacancy risk and strong rental consistency -suitable for investors seeking stable, mid-risk returns.

4. ZIP Code: 94103 (SoMa - South of Market)

ROI: Moderate. Median sale price sits at $817,000, up 12.8% year-on-year, signaling renewed demand. $898000 and 12.4

Rental Income: Growing steadily, supported by 85.2% renter occupancy.

Neighborhood Growth: High - homes sell in roughly 31 days, driven by tech-sector proximity and investor confidence.

🔹 GRAI Insight: Strong short-term appreciation and rental momentum - ideal for investors targeting urban regeneration opportunities.

5. ZIP Code: 94133 (North Beach, Telegraph Hill)

ROI: Moderate, though trending upward in the luxury segment.

Rental Income: Steady growth, particularly in premium units, though broader demand is slower compared to other ZIPs.

Neighborhood Growth: Niche-oriented, with North Beach remaining attractive to cultural and lifestyle-driven demographics.

🔹 GRAI Insight: Suited for investors focused on heritage or boutique residential assets rather than aggressive yield plays.

Summary (GRAI Investment Ranking)

| Ranking | ZIP Code | Key Strength | GRAI Verdict |

|---|---|---|---|

| 1 | 94110 (Mission District) | Strongest ROI, fastest rent growth, and rapid sales cycle | Best Overall Investment |

| 2 | 94109 (Nob Hill, Russian Hill) | High equity and long-term capital security | High Growth Potential |

| 3 | 94107 (Potrero Hill, Dogpatch) | Steady rental income, stable occupancy | Reliable Mid-Risk Option |

| 4 | 94103 (SoMa) | Price appreciation and high rental activity | Competitive Urban Play |

| 5 | 94133 (North Beach, Telegraph Hill) | Luxury niche, limited volume growth | Luxury Appeal, Lower Liquidity |

GRAI Summary Insight

In 2025, Mission District (94110) emerges as the top-performing ZIP code, driven by fast-rising rental yields and investor competition. Nob Hill (94109) and Potrero Hill (94107) follow as secure, long-term value zones, while SoMa (94103) offers high upside for dynamic investors. North Beach (94133) remains a premium but selective play within the luxury market segment.

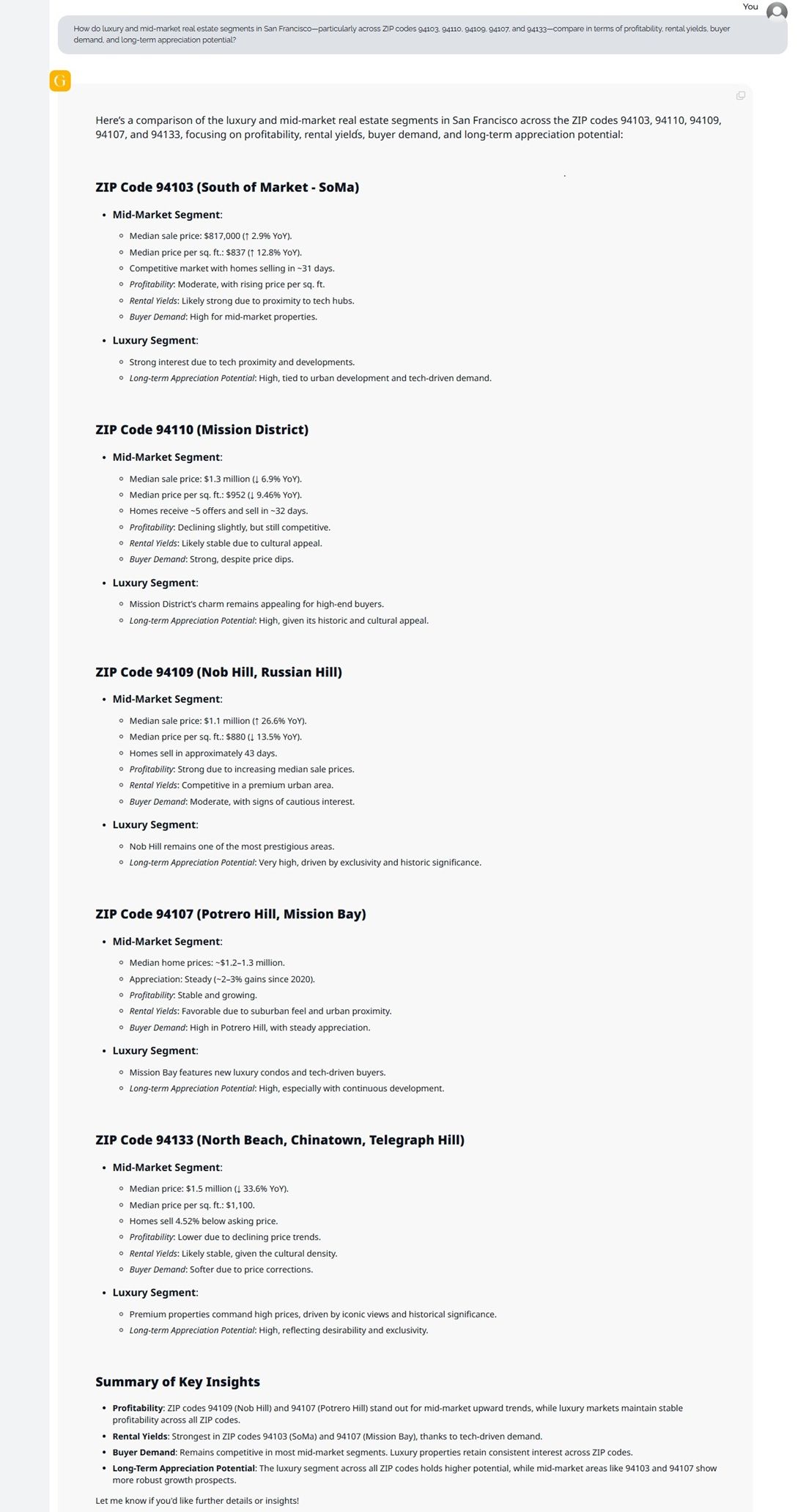

GRAI’s comparative analysis of San Francisco’s luxury and mid-market real estate across ZIP codes 94103 (SoMa), 94110 (Mission District), 94109 (Nob Hill, Russian Hill), 94107 (Potrero Hill, Mission Bay), and 94133 (North Beach, Telegraph Hill) highlights distinct investment trajectories for 2025.

Each market segment presents unique profitability patterns, rental yield potential, and long-term appreciation drivers.

Mid-Market Segment:

Median sale price: $817,000 (↑ 2.9% YoY)

Median price per sq. ft.: $837 (↑ 12.18% YoY)

Profitability: Moderate, with rising price per sq. ft.

Rental Yields: Strong, benefiting from proximity to tech hubs.

Buyer Demand: High, especially for mid-market condos and starter units.

Luxury Segment:

Trend: Attracts tech professionals and investors seeking urban convenience.

Long-Term Appreciation: High, supported by SoMa’s ongoing redevelopment and tech-driven economic base.

Mid-Market Segment:

Median sale price: $1.3 million (↓ 6.9% YoY)

Median price per sq. ft.: $952 (↓ 4.66% YoY)

Profitability: Slightly declining but remains competitive due to rapid absorption (≈32 days).

Rental Yields: Stable, supported by cultural vibrancy and steady demand.

Buyer Demand: Strong; price dips have attracted new investors.

Luxury Segment:

Trend: Continues to draw high-end buyers seeking character and exclusivity.

Long-Term Appreciation: Strong, anchored in the district’s cultural heritage and lifestyle appeal.

Mid-Market Segment:

Median sale price: $1.1 million (↑ 6.6% YoY)

Median price per sq. ft.: $880 (↑ 1.35% YoY)

Profitability: Robust, with steady price appreciation and ~43-day turnover.

Rental Yields: Competitive; premium rents reflect high demand and limited inventory.

Buyer Demand: Moderate but reliable, particularly among established professionals.

Luxury Segment:

Trend: Remains one of the city’s most prestigious enclaves.

Long-Term Appreciation: Exceptionally high, sustained by exclusivity and architectural legacy.

Mid-Market Segment:

Median home price: $1.2-1.3 million.

Appreciation: Steady (↑ 2-3% annually since 2020).

Profitability: Stable, supported by sustained buyer interest and new residential inventory.

Rental Yields: Attractive due to proximity to employment hubs and newer developments.

Buyer Demand: Rising among young professionals seeking accessibility and modern design.

Luxury Segment:

Trend: Growth in luxury condos and waterfront developments in Mission Bay.

Long-Term Appreciation: High, fueled by continuous urban expansion and tech-sector demand.

Mid-Market Segment:

Median price: $1.5 million (↑ 3.6% YoY)

Median price per sq. ft.: $1,100

Profitability: Stable, though price corrections have tempered short-term returns.

Rental Yields: Steady, supported by cultural and tourism-driven demand.

Buyer Demand: Selective, appealing primarily to lifestyle-oriented investors.

Luxury Segment:

Trend: Premium properties command high prices due to waterfront and historic views.

Long-Term Appreciation: Elevated, underpinned by exclusivity and architectural significance.

Summary of Key Insights from GRAI

ZIP codes 94109 (Nob Hill) and 94107 (Potrero Hill) outperform in the mid-market category, showing the strongest price momentum. The luxury segment remains resilient across all ZIPs, particularly in 94109 and 94133.

Highest in 94103 (SoMa) and 94107 (Mission Bay), supported by tech employment and newer housing stock.

Consistent across mid-market areas like SoMa and Mission District, while luxury demand continues to thrive in Nob Hill and Telegraph Hill.

The luxury market demonstrates stronger appreciation potential overall, but mid-market segments in SoMa and Potrero Hill are showing steady, technology-driven upward trends.

GRAI Summary:

In 2025, San Francisco presents two profitable paths - the luxury segment, offering exclusivity and enduring appreciation in high-status ZIP codes like 94109 and 94133, and the mid-market segment, driving steady ROI through high occupancy and urban growth in 94103 and 94107. The Mission District (94110) bridges both worlds, balancing cultural appeal with investment stability.

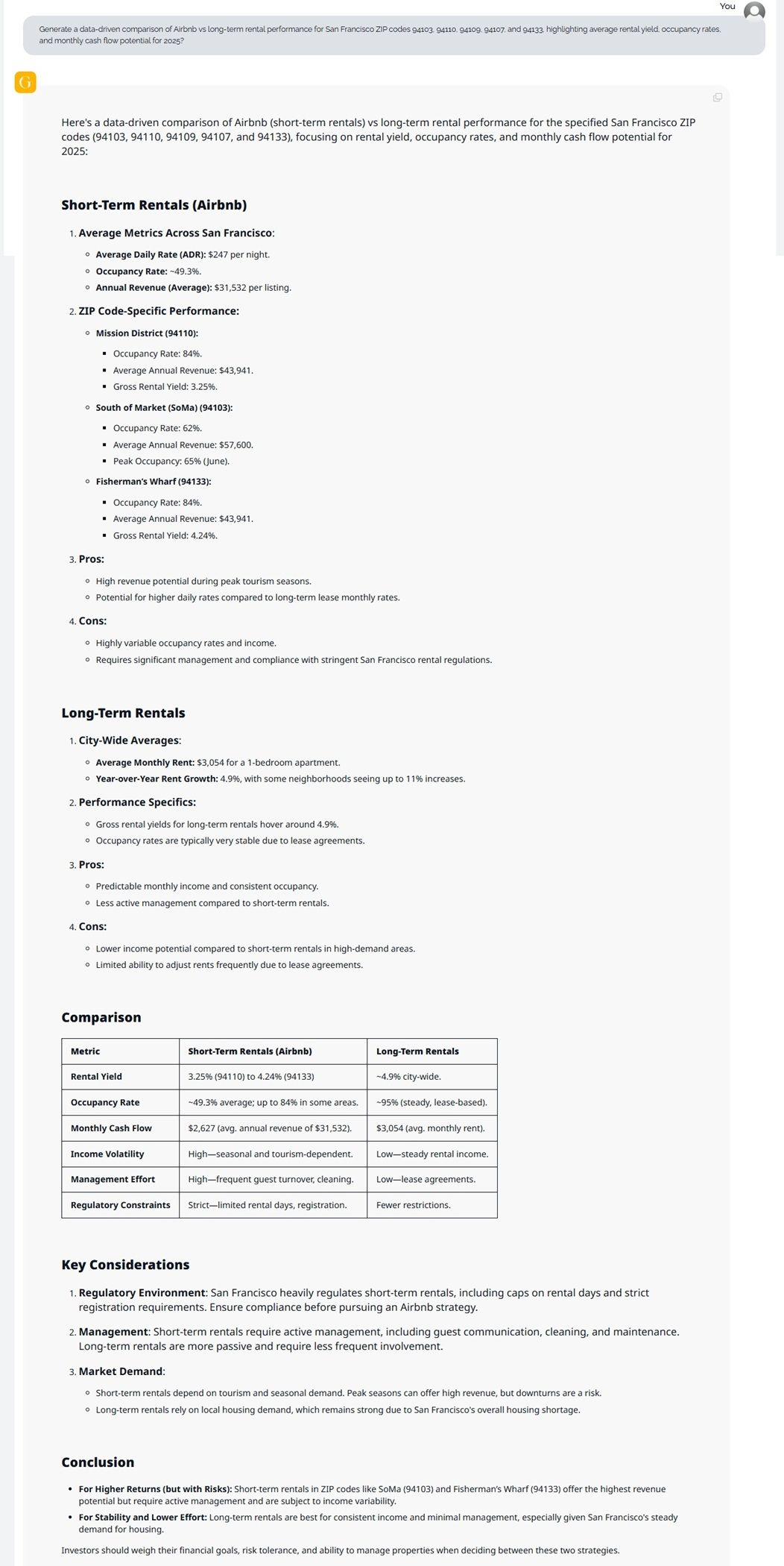

According to GRAI’s 2025 data model, San Francisco’s rental market continues to split between two powerful but distinct strategies - short-term (Airbnb-style) and long-term leases. Both can be profitable, but the balance between yield, occupancy, and management intensity defines where real cash flow wins.

1. Short-Term Rentals (Airbnb) - High Yield, High Volatility

GRAI’s forecast shows that average daily rates (ADR) across San Francisco hover around $247 per night, with an average occupancy of 49.3% and an annual revenue potential near $31,500 per listing.

Hotspots like SoMa (94103) and Fisherman’s Wharf (94133) outperform city averages, with yields ranging from 3.25% to 4.24% and peak occupancy reaching up to 84% during tourism surges.

Pros:

Exceptional revenue potential in peak seasons.

Flexible pricing aligned with real-time demand.

Cons:

Income volatility due to tourism cycles.

High management effort and tight city regulations limiting rental days.

In short, Airbnb rentals win on cash flow, but the model demands hands-on management and regulatory awareness.

2. Long-Term Rentals - Stability Over Speed

On the long-term side, GRAI’s data places average monthly rent at $3,054 for a one-bedroom unit, with year-over-year growth of 4.9% and yields around 4.9% city-wide. Neighborhoods such as the Mission District (94110) and SoMa remain consistent performers with stable lease demand and minimal vacancy.

Pros:

Predictable monthly income and steady occupancy (~95%).

Less turnover and reduced management costs.

Cons:

Lower flexibility in adjusting rents.

Modest returns compared to peak Airbnb periods.

For investors focused on security and reduced operational friction, long-term rentals remain San Francisco’s most sustainable strategy.

3. GRAI’s Comparative Insight

| Metric | Short-Term (Airbnb) | Long-Term Rentals |

|---|---|---|

| Rental Yield | 3.25%–4.24% | ~4.9% city-wide |

| Occupancy Rate | ~49% avg. (up to 84%) | ~95% lease-based |

| Monthly Cash Flow | $2,627 (avg.) | $3,054 (avg.) |

| Income Volatility | High | Low |

| Management Effort | Intensive | Minimal |

| Regulatory Constraints | Strict | Fewer |

4. GRAI’s Verdict

For higher returns but greater risk, GRAI identifies Airbnb-friendly zones like SoMa (94103) and Fisherman’s Wharf (94133) as top performers, driven by tourism and short-term demand cycles.

For stability and passive growth, Mission District (94110) and 94107 lead due to reliable tenant demand and predictable yield curves.

Ultimately, GRAI recommends investors align their strategy with their risk tolerance and time commitment - short-term rentals for aggressive, hands-on investors seeking high cash flow; long-term rentals for those valuing stability, low turnover, and steady ROI.

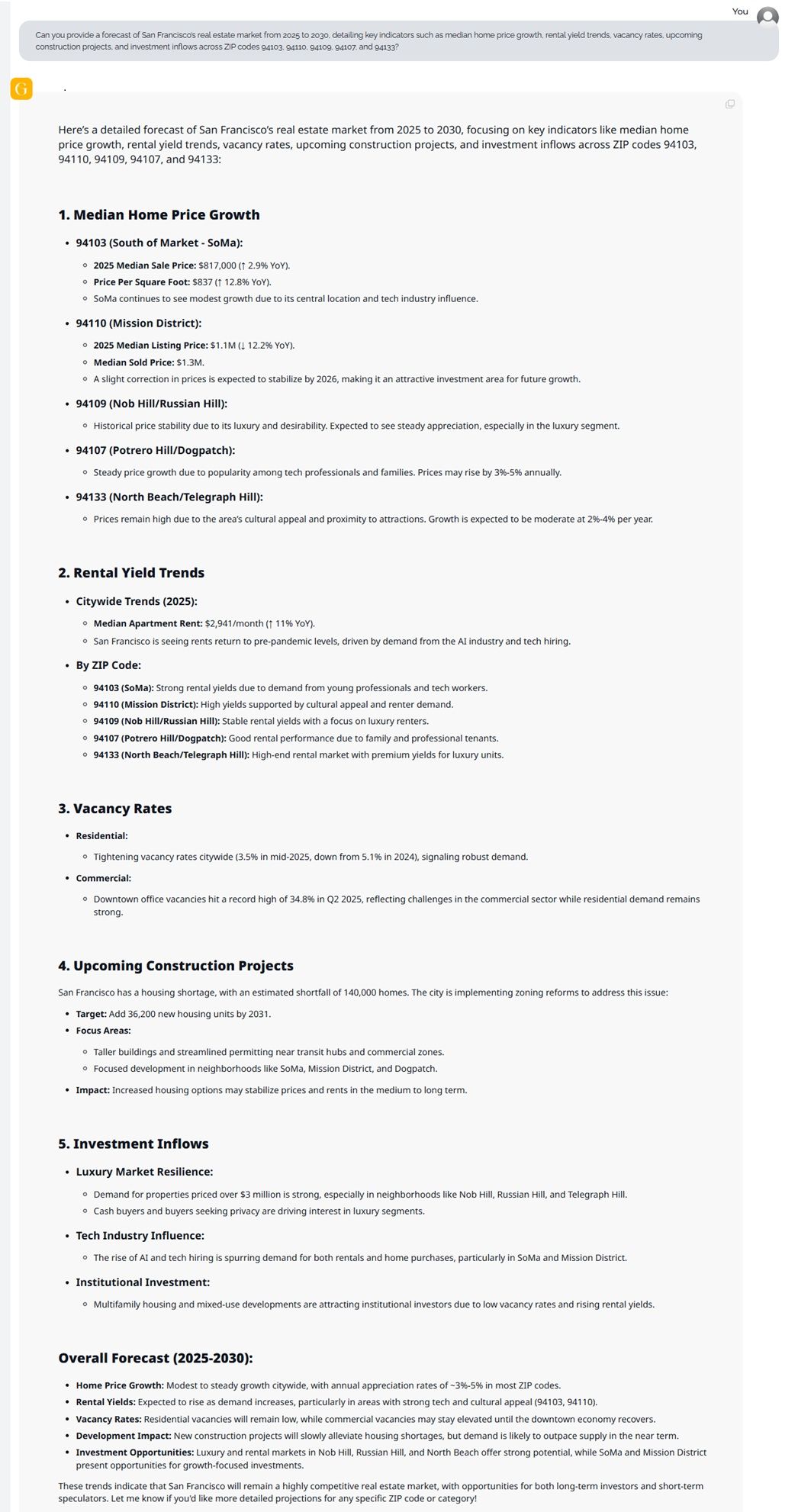

GRAI’s advanced data models provide a detailed outlook for San Francisco’s real estate market from 2025 to 2030, mapping critical investment metrics across ZIP codes 94103 (SoMa), 94110 (Mission District), 94109 (Nob Hill/Russian Hill), 94107 (Potrero Hill/Dogpatch), and 94133 (North Beach/Telegraph Hill).

From price growth to rental yields, vacancy rates, and construction trends - here’s how each neighborhood is shaping the city’s next investment wave.

1. Median Home Price Growth

2025 median sale price is projected at $817,000 (+2.9% YoY), with price per square foot averaging $837 (+12.8% YoY). SoMa remains attractive due to its tech proximity and modern developments.

Median listing price expected to reach $1.1M (+12.2% YoY), stabilizing by 2026 as the market corrects slightly from 2024 highs. Ideal for mid- to long-term capital appreciation.

Luxury submarket with historical price resilience. GRAI projects steady appreciation of 3-5% annually, driven by scarcity and high-end buyer activity.

Consistent growth expected due to family-friendly demand and professional tenants. Annual appreciation forecast: 3–5%.

Prices to hold firm due to cultural appeal and tourism adjacency. Growth expected at 2-4% annually.

2. Rental Yield Trends

Citywide (2025):

Median apartment rent: $2,941/month (+11% YoY). Demand rebound is powered by tech hiring and AI-sector workforce growth.

By ZIP Code:

94103 (SoMa): Strong yields fueled by young professionals and tech workers.

94110 (Mission District): Consistent rental demand from long-term tenants and cultural draw.

94109 (Nob Hill / Russian Hill): Stable luxury yields, attractive to institutional investors.

94107 (Potrero Hill / Dogpatch): Balanced yields due to family and professional tenant mix.

94133 (North Beach / Telegraph Hill): Premium yields in luxury rental segment.

3. Vacancy Rates

Expected to tighten to 3.5% by mid-2025 (from 5.1% in 2024), signaling solid rental absorption and limited supply.

Office vacancies remain high (~34.8% in Q2 2025) as the commercial sector continues to recalibrate post-pandemic, but residential demand remains robust.

4. Upcoming Construction Projects

San Francisco’s ongoing housing shortfall (≈140,000 units) is driving an aggressive construction response.

Target: Add 36,200 new housing units by 2031.

5. Investment Inflows

Properties priced above $3 million show strong demand, especially in Nob Hill, Russian Hill, and Telegraph Hill, driven by affluent buyers seeking privacy and exclusivity.

The rise of AI and tech hiring continues to stimulate rental and ownership demand, particularly in SoMa and Mission District, reinforcing both rental and resale potential.

Increased focus on multifamily and mixed-use developments, particularly in urban-core ZIPs with low vacancy rates and consistent rent growth.

Overall Forecast (2025–2030)

Home Price Growth: Moderate to steady gains, averaging 3–5% annually across most ZIPs.

Rental Yields: Expected to rise as demand recovers, particularly in tech-influenced zones like 94103 and 94110.

Vacancy Rates: Residential supply will remain tight, keeping rents elevated.

New Construction: Pipeline projects will ease shortages gradually but not fully offset demand pressure.

Investment Outlook:

High potential: Luxury and prime ZIPs such as Nob Hill, Russian Hill, and North Beach.

Growth zones: SoMa and Mission District, ideal for investors balancing capital growth and rental yield.

GRAI’s models predict that San Francisco will remain a competitive, high-demand real estate market through 2030 - supported by the AI industry’s expansion, resilient luxury buyers, and ongoing institutional investment.

GRAI’s Predictive Economic Model continuously updates these projections using macro indicators (Fed rates, job growth, zoning permits), giving investors live forward visibility that no static report can match.

In the most data-dense property market on earth, timing and precision decide outcomes. GRAI gives investors both-instantly.

1. Instant AI Valuation - Upload a property image or address to receive real-time, data-backed valuation and comparable sales.

2. Predictive Analytics - Detect ZIP-level inflection points before appreciation begins.

3. Sentiment Analysis - Measure developer and social buzz from thousands of data streams to spot emerging hotspots.

4. Portfolio Advisory - Simulate multi-asset allocations and forecast returns under multiple macro scenarios.

5. Lease & Yield Optimization - Compare Airbnb vs. long-term returns with precise cash-flow modeling.

6. Environmental Assessments - Evaluate flood, soil, and climate risks automatically for risk-adjusted investment clarity.

While traditional research relies on lagging indicators, GRAI thinks in real time-turning every insight into a strategic edge.

San Francisco rewards preparation, not hesitation. With homes receiving four offers on average and “hot” listings selling 17% above asking within 12 days, the margin for timing errors is razor-thin.

GRAI ensures you never guess:

Know the true value before bidding.

See appreciation trends before they appear in listings.

Manage rental yield scientifically, not emotionally.

Stress-test your portfolio against future market cycles.

The next five years will define who profits from San Francisco’s comeback.

Make every decision with data, speed, and confidence-powered by GRAI.

Start your AI-driven property journey today: https://internationalreal.estate/chat

1. What are the top investment ZIP codes in San Francisco for 2025?

94103 (SoMa), 94107 (Potrero Hill), 94109 (Russian Hill), 94110 (Mission District), and 94133 (North Beach) lead 2025 for growth and yield potential.

2. Is San Francisco’s real estate market recovering in 2025?

Yes. Median prices are up ~3.8% YoY with strong rental rebounds. Limited supply and AI-sector wealth are fueling renewed appreciation.

3. Where is rental demand strongest?

SoMa, Potrero Hill, and Mission District show highest absorption, while North Beach performs best for short-term rentals.

4. How can AI help identify investment hotspots?

GRAI’s predictive analytics analyze permits, social sentiment, and economic data to highlight emerging micro-markets before they trend publicly.

5. Why use GRAI for San Francisco investments?

Because timing is everything. GRAI delivers instant valuations, forecasts, sentiment tracking, and risk analysis-giving you institutional-grade insight in minutes.