Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Buying your first home in Austin, USA requires navigating a complex landscape of neighborhood options, assistance programs, hidden costs, legal procedures, market trends and financial calculations. Without expert guidance, many buyers struggle to make informed decisions that align with both their budget and lifestyle needs. Meet GRAI, the world’s smartest real estate AI advisor that recently helped a first-time home buyer in the US seamlessly navigate their way to purchasing their dream home.

"I needed to understand everything from affordable housing programs to mortgage calculations to neighborhood comparisons," Alex recalls. "Finding accurate, personalized information seemed impossible until I discovered GRAI."

For just $4.99, GRAI provided Alex with comprehensive guidance across every aspect of the home buying process in Austin.

GRAI offered insights into Austin's housing market dynamics:

Housing Affordability: Analysis showing median home prices across different areas and how they compared to Alex's budget

Market Conditions: Information about Austin's competitive market and strategies for successful offers

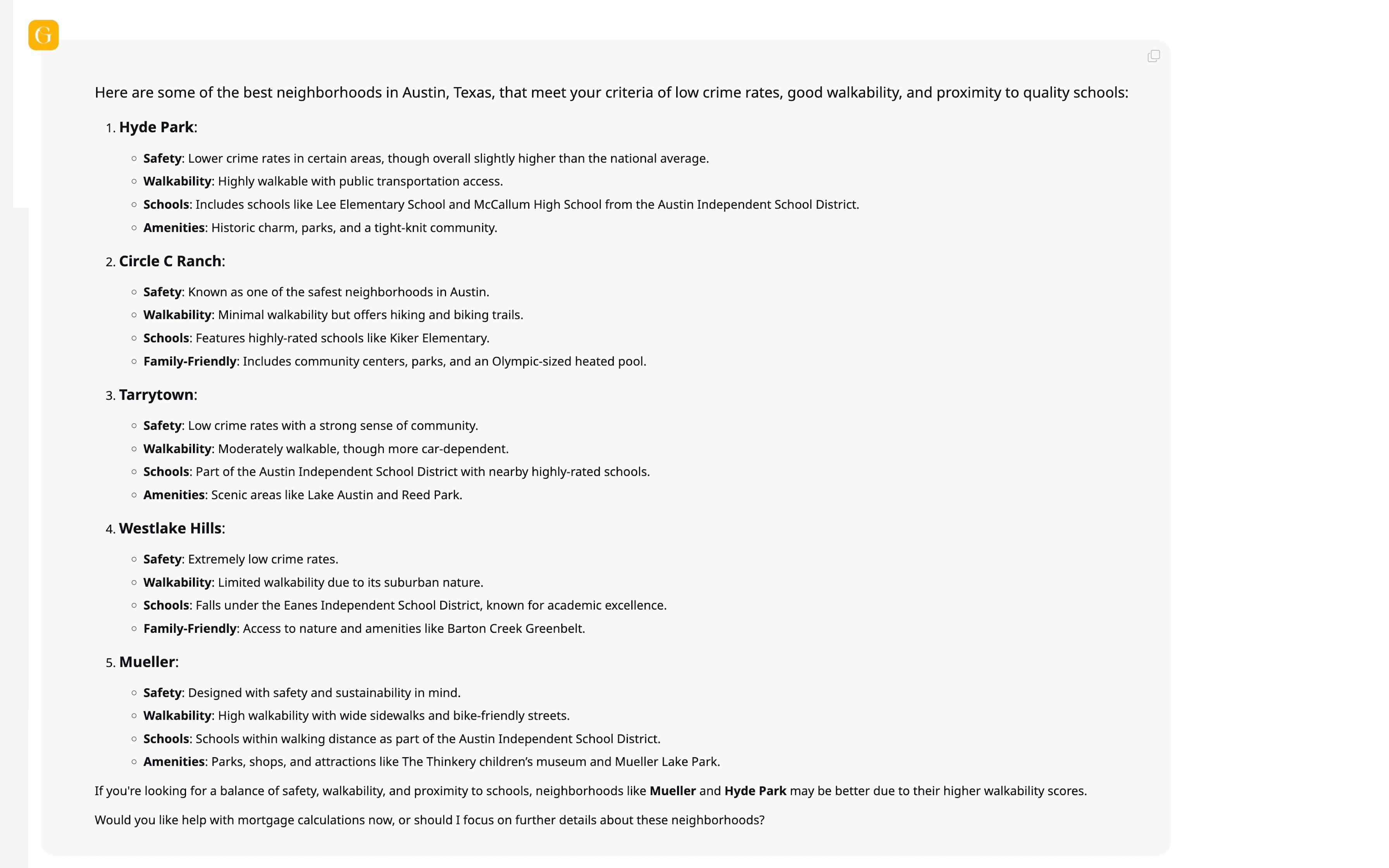

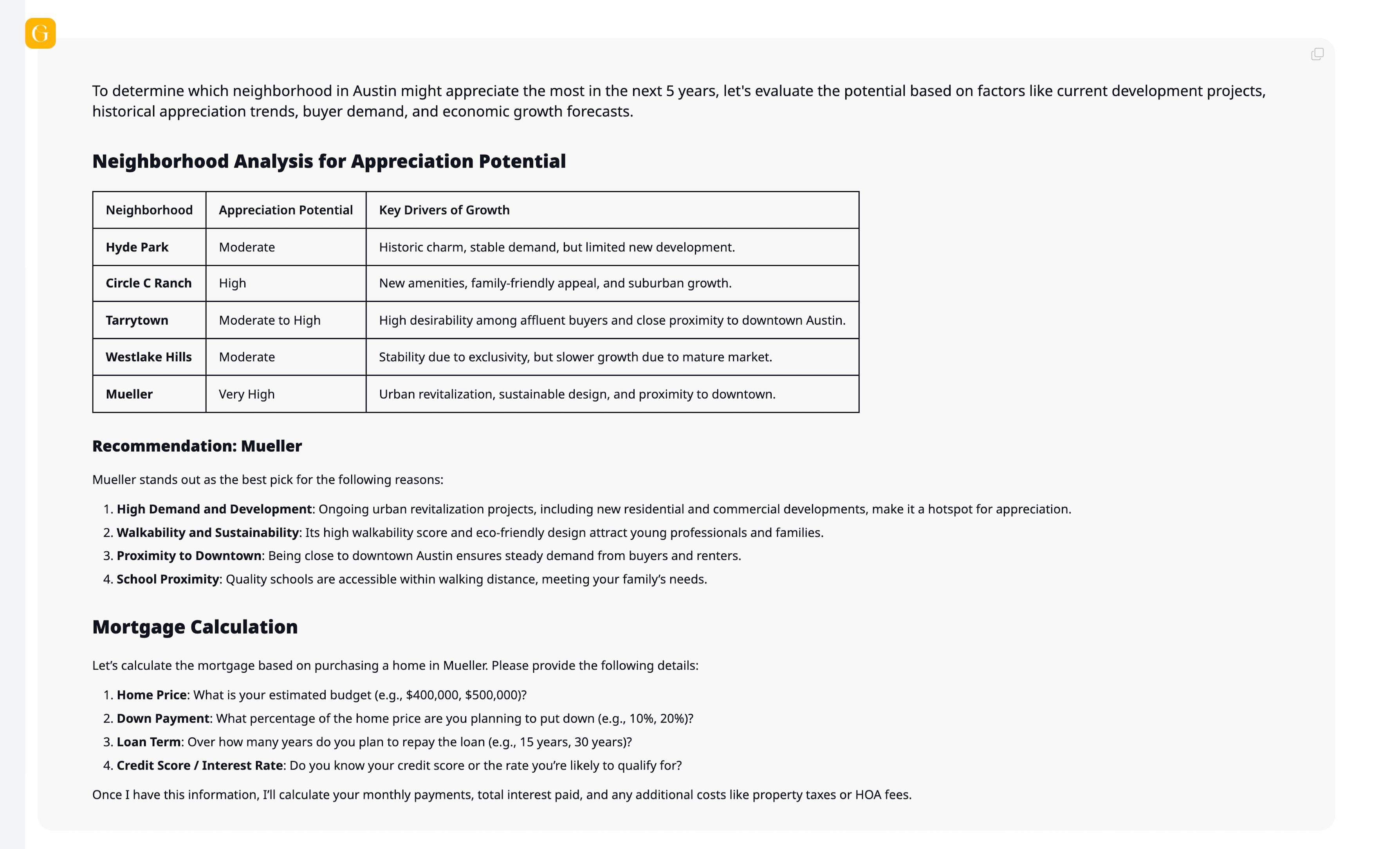

Neighborhood Comparisons: Details about schools, safety, walkability, amenities, and community features in different parts of Austin

Property Types: Guidance on choosing between single-family homes, condos, and townhouses based on lifestyle preferences

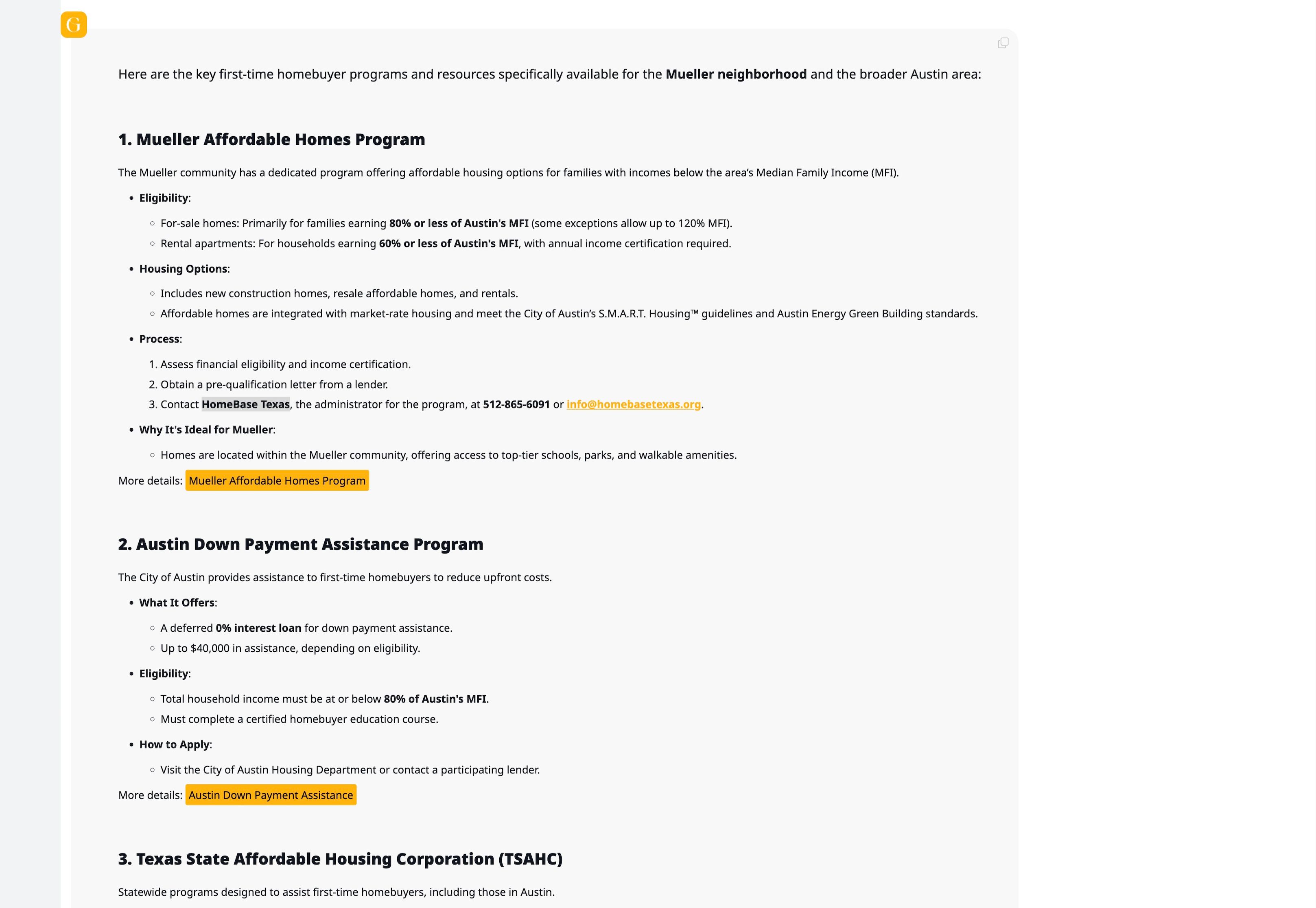

GRAI provided clear information about assistance programs available in Texas:

Down Payment Assistance: Details on Texas programs offering between $5,000-$15,000 for qualifying buyers

Texas State Affordable Housing Corporation (TSAHC): Eligibility requirements for home loans with down payment grants

Mortgage Credit Certificate (MCC): Explanation of how this program offers up to $2,000 annually in tax credits

Austin's Housing Down Payment Assistance Program: Information on local assistance options and application processes

GRAI helped Alex understand complex financial aspects:

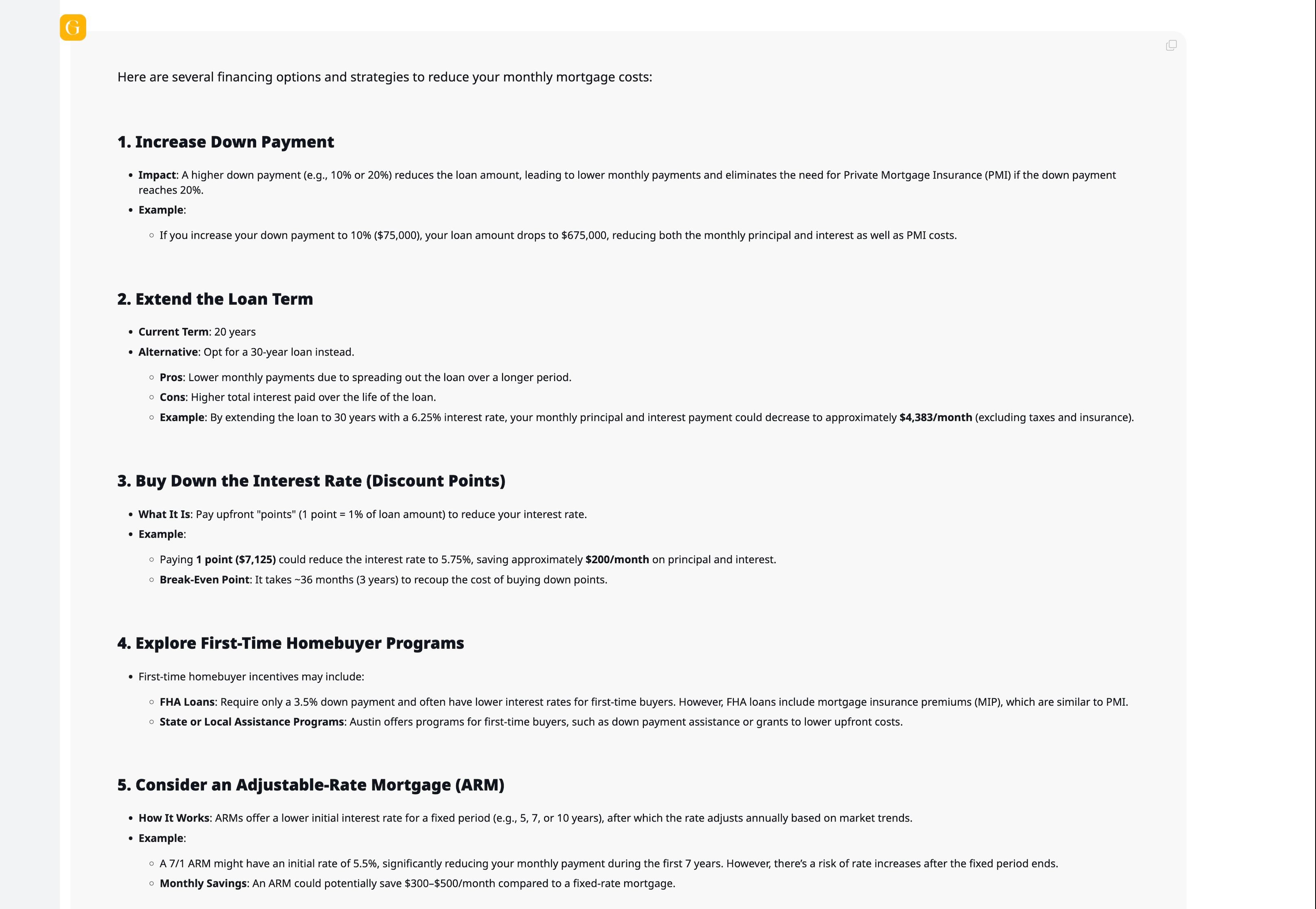

Mortgage Calculations: Personalized estimates based on credit score, down payment, and loan type

Closing Cost Estimates: Detailed breakdown of fees and potential assistance options

Financial Assistance Eligibility: Clear guidance on income limits for various programs

Long-term Financial Impact: Analysis of different loan types and their effect on monthly payments

| Home Buying Challenges | How GRAI Helped |

|---|---|

| Understanding preferable neighborhoods | Personalized analysis of areas matching budget and preferences |

| Navigating assistance programs | Clear eligibility guidance for various Texas programs |

| Making informed financial decisions | Detailed mortgage calculations and closing cost estimates. Even offered negotiation strategies based on the latest market conditions. |

| Combining multiple resources | Strategies for utilizing complementary assistance programs |

Alex successfully closed on their ideal home within just 6 weeks of subscribing to GRAI, saving significant time and money compared to conventional methods.

"GRAI was like having a personal real estate advisor, financial planner, and local expert all in one," Alex says. "It helped me understand every aspect of buying a home in Austin."

Unlike general-purpose AI assistants, GRAI provides:

Location-specific market insights updated with current conditions

Detailed information on the location and local assistance programs

Personalized financial calculations based on your unique situation

Comprehensive guidance across the entire home buying process

1) What Austin neighborhoods fit my budget and lifestyle?

GRAI analyzes your financial situation and preferences to recommend suitable areas, considering factors like commute times, amenities, and future growth potential.

2) What assistance programs am I eligible for in Texas?

GRAI provides personalized eligibility assessments for programs like the Texas First-Time Homebuyer Program, Mortgage Credit Certificates, and local down payment assistance.

3) How much house can I actually afford in Austin?

GRAI calculates your purchasing power based on income, debt-to-income ratio, credit score, and available down payment, providing realistic estimates for Austin's market.

Join the growing community of smart home buyers who have discovered the GRAI advantage. For just $4.99, less than a breakfast taco, you can access the world’s smartest real estate AI advisor that's changing how people buy their first homes.

Start Your Smart Home Buying Journey Today →

GRAI provides comprehensive guidance across neighborhoods, financing, and assistance programs

The platform offers personalized recommendations based on your unique situation and preferences

For just $4.99, buyers gain access to expertise covering every aspect of the home buying process

GRAI users make more informed decisions by understanding all available options and resources

The platform simplifies complex information into clear, actionable guidance