Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The global real estate industry is undergoing a quiet revolution. At the centre of this shift is GRAI, a specialized AI-Powered real estate advisor designed to bring unparalleled transparency, speed, and accuracy to property investment decisions. As the market becomes more complex and fast-paced, the need for instant, data-backed insights is no longer a luxury - it’s essential.

In 2025, the future of real estate isn't just about buying and selling property. It's about automated investment recommendations, AI-powered cost estimation, and hyper-local valuation intelligence that enables professionals and homeowners alike to act with precision.

Generic AI tools offer surface-level predictions and vague data interpretations. GRAI, however, is built exclusively for real estate advice. It merges advanced machine learning with proprietary market data, historical performance, real-time location capabilities, and project-specific intelligence. Whether you're a developer planning your next build or an investor analyzing a multifamily acquisition, GRAI removes guesswork from the equation.

Key Differentiator: While most AI platforms offer generalized insights, GRAI delivers real-time insights like construction feasibility with designs, structured valuation reports and localized cost estimates, helping you decide what to build, where to invest, and how much to spend - in seconds.

In property development, the biggest uncertainties often lie in costs. Traditional cost estimators are time-consuming and frequently inaccurate. GRAI eliminates these inefficiencies by providing instant, AI-driven cost breakdowns, customized to your project's scope and exact location.

Benefits for Homeowners & Individual Investors:

Benefits for Developers & Real Estate Professionals:

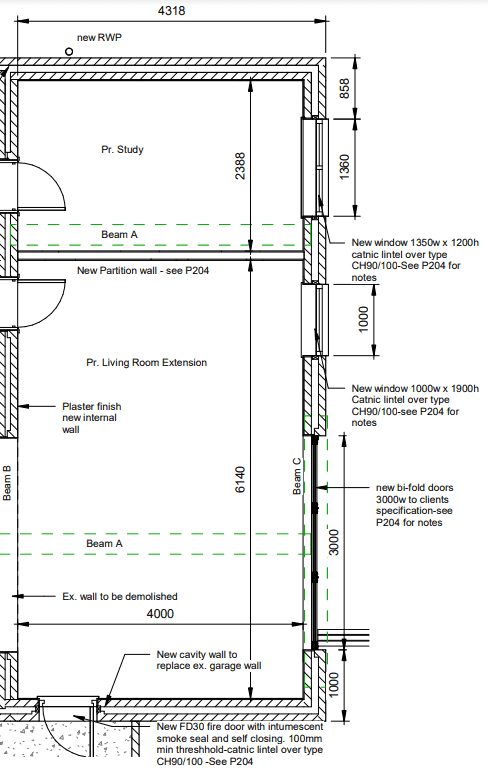

Steve, a senior software professional in London, faced a challenge familiar to many homeowners - uncertainty in renovation costs. Builder quotes varied by up to 30%, and professional estimators were expensive. Steve turned to GRAI, uploading just two architectural plan images from the sixteen that he had. GRAI didn’t just estimate costs - it asked intelligent follow-up questions, factored in UK-specific building regulations, and generated a structured cost breakdown instantly. The final AI estimate was within 2% of the actual builder quote. For under $5, GRAI saved Steve weeks of uncertainty and empowered him to negotiate with clarity.

One of the architectural drawing shared by Steve

One of the architectural drawing shared by Steve

Read More: GRAI's Instant, Accurate Cost Estimate for London Extension

Property valuation is the bedrock of any real estate decision. GRAI uses AI to analyze comparable sales, market trends, local demand, rental yields, and zoning potential. What you get is not a "range" - but a pinpoint valuation that updates dynamically with market fluctuations.

Why This Matters:

Global Example: Cross-Border Confidence

An investor from Dubai exploring opportunities in Berlin and Barcelona used GRAI’s comparative valuation capabilities. Within seconds, the platform analyzed local market trends, forecasted appreciation, and provided legal context - bridging the complexity of international transactions.

What once took weeks of due diligence and multiple consultants was now accomplished in moments, enabling a confident investment decision.

GRAI doesn't just deliver data - it delivers decisions. Through AI-powered analysis of neighborhood trends, property performance, income potential, and macroeconomic indicators, it suggests tailored investment recommendations aligned with your risk profile and goals.

Imagine This:

You’re considering investing in a condo project in Miami or a multi-unit rental in Lisbon. GRAI instantly compares both opportunities using:

Then, it recommends the more financially sound option, backed by evidence - not opinion.

Check Out: Lisbon Real Estate Market Trends in 2025 – AI Predictions & Investment Insights

GRAI’s capabilities supports investors in building diversified portfolios. Based on investment goals - cash flow, appreciation, or hybrid - it delivers:

A boutique developer in Los Angeles was evaluating two parcels for a mixed-use project.

Name: Lisa K

Role: Managing Partner at a boutique real estate development firm in Los Angeles

Project Type: Mixed-use development (residential + retail)

Parcels Under Evaluation:

Lisa needed to quickly determine:

Using traditional consultants and cost estimators would’ve taken 3 - 4 weeks. Instead, Lisa used GRAI.

Step 1: Site Feasibility Analysis

Prompt to GRAI:

“Compare two lots for a mixed-use (residential + retail) development. One is in the Arts District (11k sq ft), the other in Culver City (9k sq ft). Provide zoning analysis, buildable area, and any restrictions.”

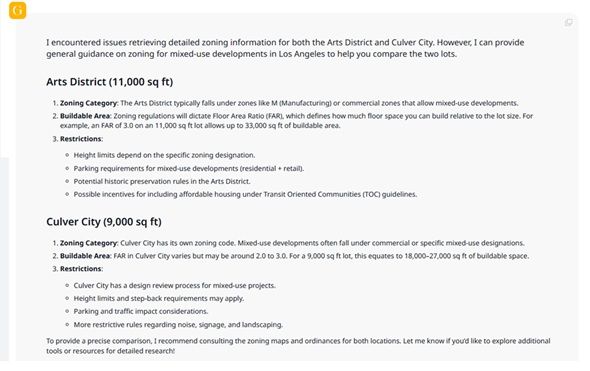

GRAI Output: Preliminary Zoning & Development Potential Assessment

To initiate the investment evaluation process, GRAI conducted a high-level site feasibility analysis for both lots in the Arts District (11,000 sq ft) and Culver City (9,000 sq ft). Below is a summary of key zoning insights and development constraints:

Arts District (11,000 sq ft)

Zoning Category: Typically designated under M (Manufacturing) or commercial zones that support mixed-use development.

Buildable Area Potential: GRAI estimates a possible Floor Area Ratio (FAR) of 3.0, translating to up to 33,000 sq ft of buildable space.

Restrictions & Considerations:

• Height limits are variable and depend on exact zoning designation.

• Parking mandates for both residential and retail components.

• Historic preservation rules may apply, potentially limiting alterations.

• Possible eligibility for TOC (Transit Oriented Communities) incentives, especially for including affordable housing.

Culver City (9,000 sq ft)

Zoning Category: Governed by Culver City's independent zoning code, typically under commercial or mixed-use designations.

Buildable Area Potential: FAR estimated between 2.0 and 3.0, allowing for 18,000–27,000 sq ft of buildable space depending on zoning specifics.

Restrictions & Considerations:

• Requires design review for mixed-use proposals.

• Subject to height and step-back requirements.

• Additional traffic and parking impact reviews required.

• Stricter regulations related to noise, signage, and landscaping.

GRAI recommend the Arts District lot may offer greater buildable volume (up to 33,000 sq ft) and potential TOC-related density bonuses. However, Culver City’s stricter design and noise ordinances should be carefully evaluated in relation to intended project scope.

Time Taken: 5 minutes

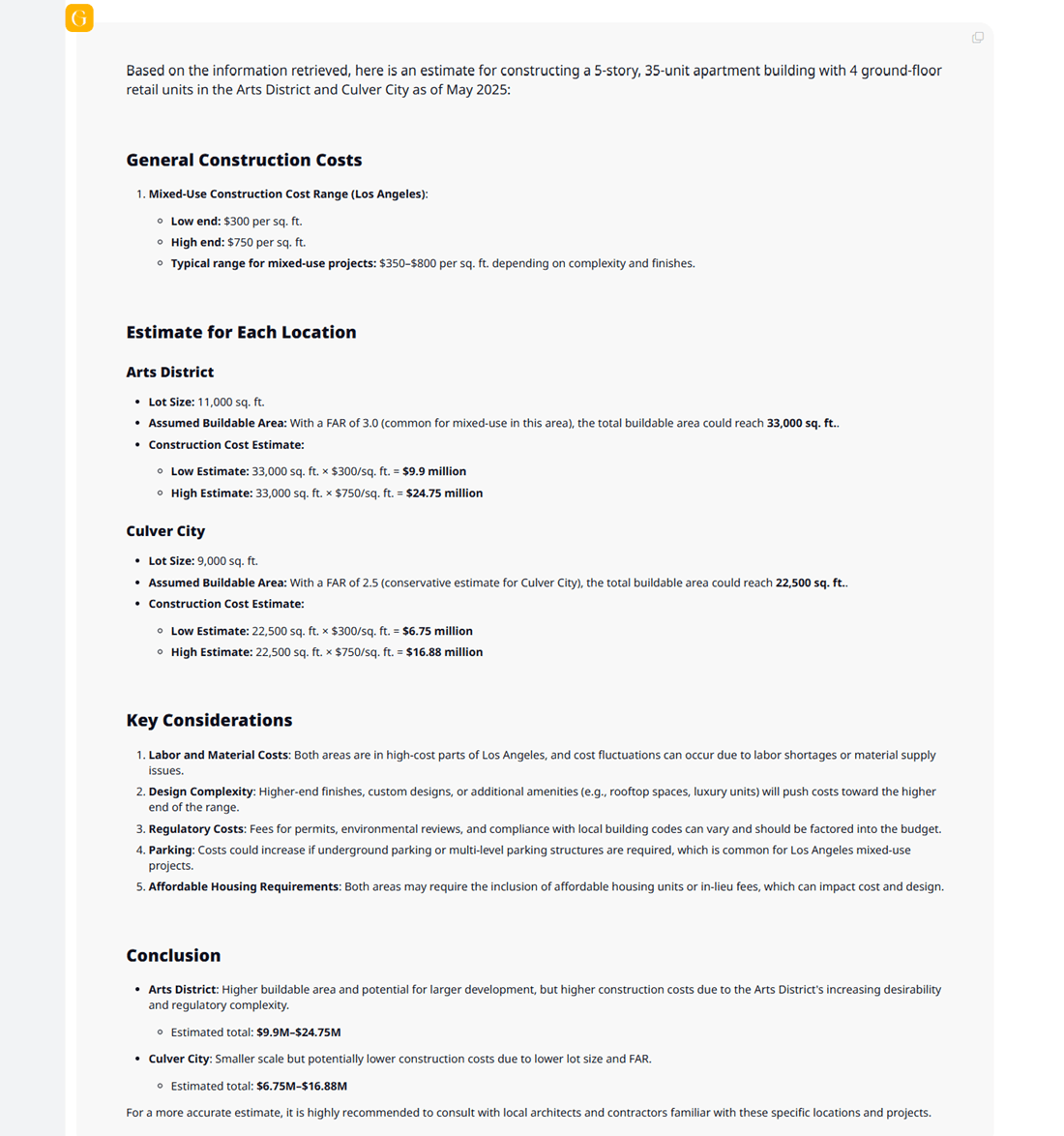

Step 2: Construction Cost Estimation

Prompt to GRAI:

“Estimate construction cost for a 5-story, 35-unit apartment building with 4 ground-floor retail units in both locations. Include local labor and material pricing as of May 2025.”

GRAI Output:

GRAI also recommended switching to modular construction in Culver City to reduce costs by 12%.

Time Taken: 3 minutes

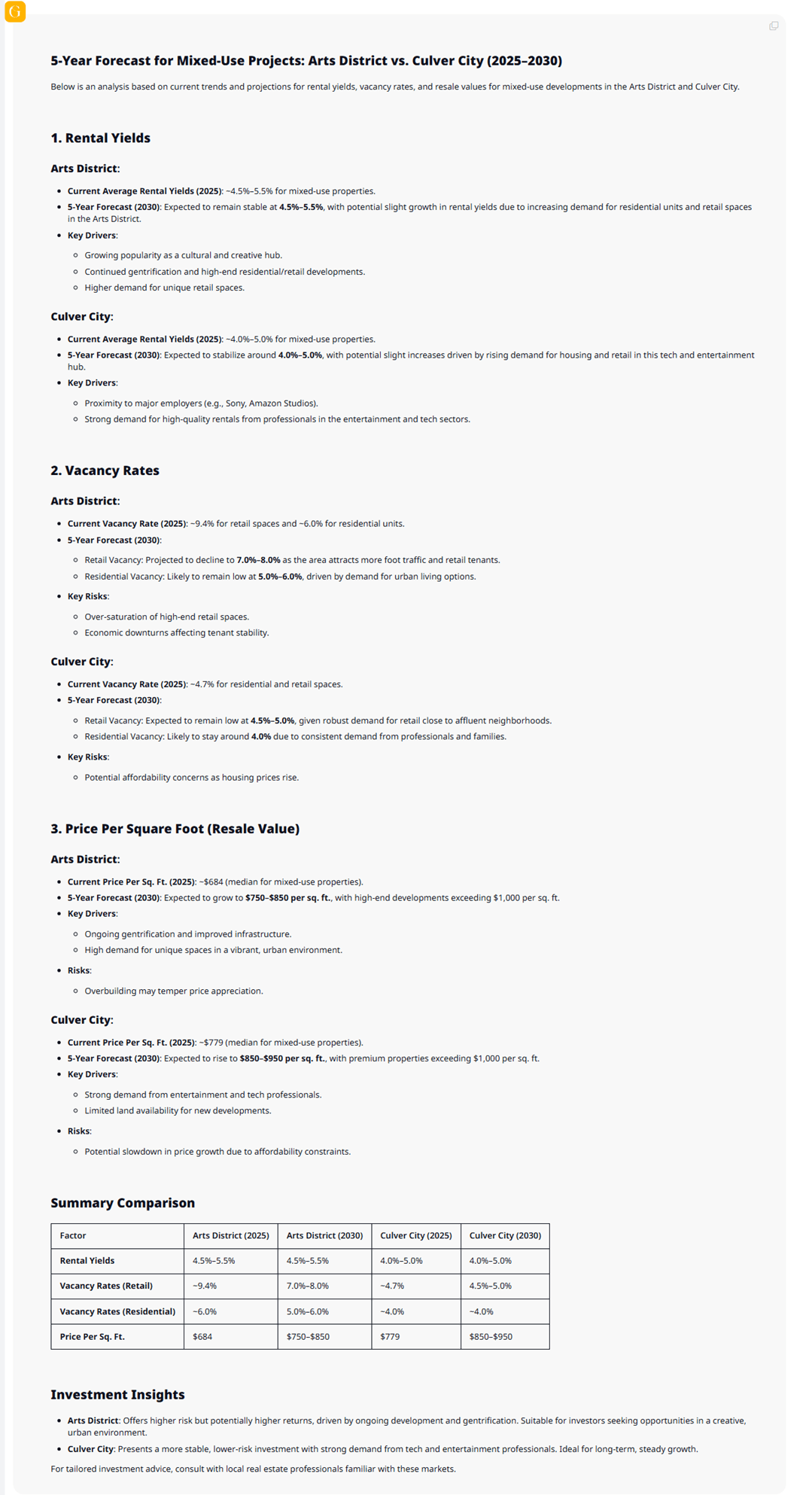

Step 3: Market Comparison

Prompt to GRAI:

“Provide 5-year forecast for rental yields, vacancy rates, and average price per sq ft resale value in both Arts District and Culver City for mixed-use projects.”

GRAI Output:

GRAI recommends aligning your investment strategy with your risk tolerance: opt for the Arts District if you're pursuing creative upside and long-term growth or choose Culver City for dependable returns and market stability.

Time Taken: 3 minutes

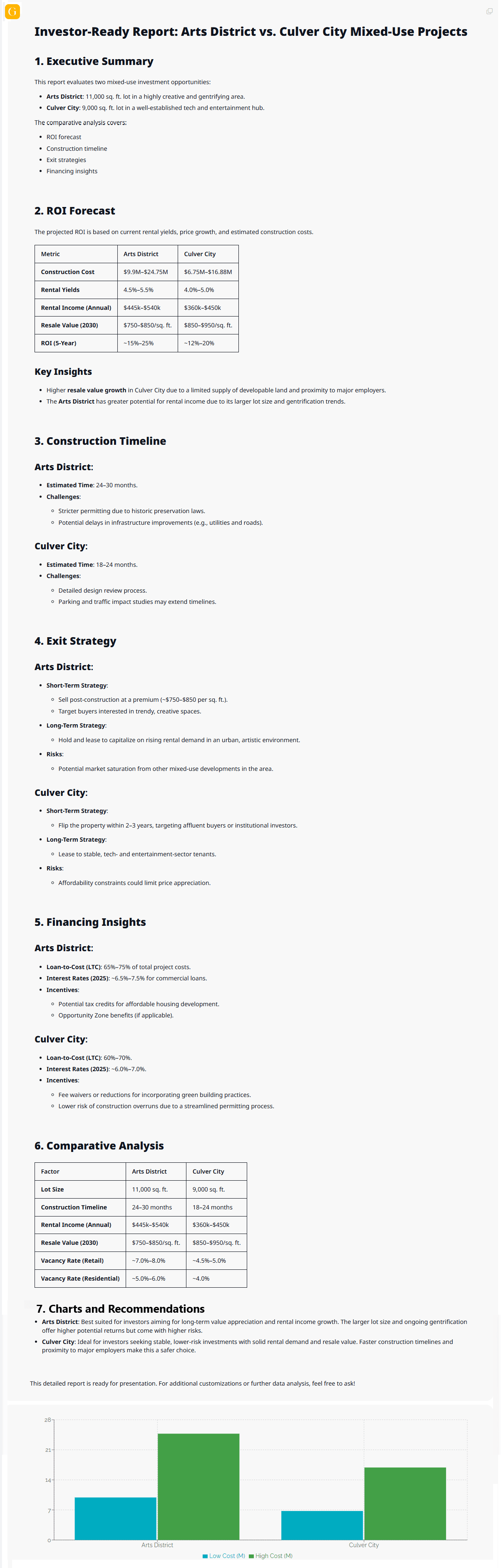

Step 4: Full Investment Report Generation

Prompt to GRAI:

“Generate an investor-ready report comparing both opportunities, including ROI forecast, construction timeline, exit strategy, and financing insights.”

GRAI Output:

GRAI recommends the Arts District for investors focused on long-term appreciation and cultural appeal - despite higher risk and slower permitting - while Culver City is ideal for those seeking faster timelines, lower risk, and steady rental demand in a well-established market.

Time Taken: 5 minutes total, with multiple updates and revisions generated live as Lisa iterated

Outcome: Lisa used the GRAI report in her internal stakeholder meeting the same afternoon. By 6 PM, she’d secured a soft commitment from two investors for the Arts District project, and submitted a letter of intent for the lot the next morning - beating a competing offer by 48 hours.

This scenario isn’t science fiction. It’s how GRAI enables serious professionals to move from ideation to informed action in under 30 minutes, with clarity, confidence, and precision. No costly delays. No ambiguity. Just evidence-based, AI-powered real estate intelligence.

Generic AI tools like ChatGPT can answer basic real estate questions but cannot go as deep as GRAI can. GRAI isn’t a chatbot - it’s an intelligent real estate advisor equipped with advanced capabilities for serious investors.

Subscribe to GRAI today – and experience the edge that only tailored, AI-powered real estate intelligence can deliver.