Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Bangalore, India's Silicon Valley, has a real estate ecosystem inextricably linked to its thriving IT sector. The recent wave of layoffs across major tech companies has sent ripples through the city's residential property landscape, creating both challenges and opportunities for stakeholders. This comprehensive guide examines the profound impact of IT job losses on Bangalore's housing market and how you can navigate these uncertain times with GRAI, the world's smartest real estate AI advisor.

The Bangalore real estate market has demonstrated remarkable resilience historically, but the recent IT sector downsizing has introduced caution among buyers and investors.

According to the 2024 Bangalore Real Estate Market Report, there's a noticeable increase in inventory levels, particularly in tech-centric localities.

Key insights include:

Property Prices are forecasted to increase by 6.5% in 2025 and 6.0% in 2026, following a 4% increase in 2024.

Unsold inventory has decreased, with a 21% year-on-year drop by the end of H1 2024.

While the market hasn't crashed, these indicators point to an important transitional phase that requires strategic navigation.

Get real-time Bangalore market insights from GRAI →

The IT sector isn't just an industry in Bangalore—it's the city's economic foundation, directly impacting:

Property demand: Tech professionals constitute over 65% of premium housing buyers

Price stability: IT salaries have historically driven price appreciation

Rental market: Tech hub areas like Koramangala, HSR Layout, and Bellandur show higher rental yields

Investment Opportunities: IT-driven demand boosts ROI, while developers focus on smart homes for tech-savvy buyers.

With major employers like Wipro, Infosys, and TCS announcing workforce reductions, this correlation has created a tangible market shift that requires expert analysis to navigate successfully.

This critical question requires nuanced analysis. The current slowdown is influenced by several intersecting factors:

Global economic uncertainty affecting IT services demand

AI-driven automation transforming workforce requirements

Mass layoffs in established firms reshaping employment patterns

Remote/hybrid work models changing housing preferences

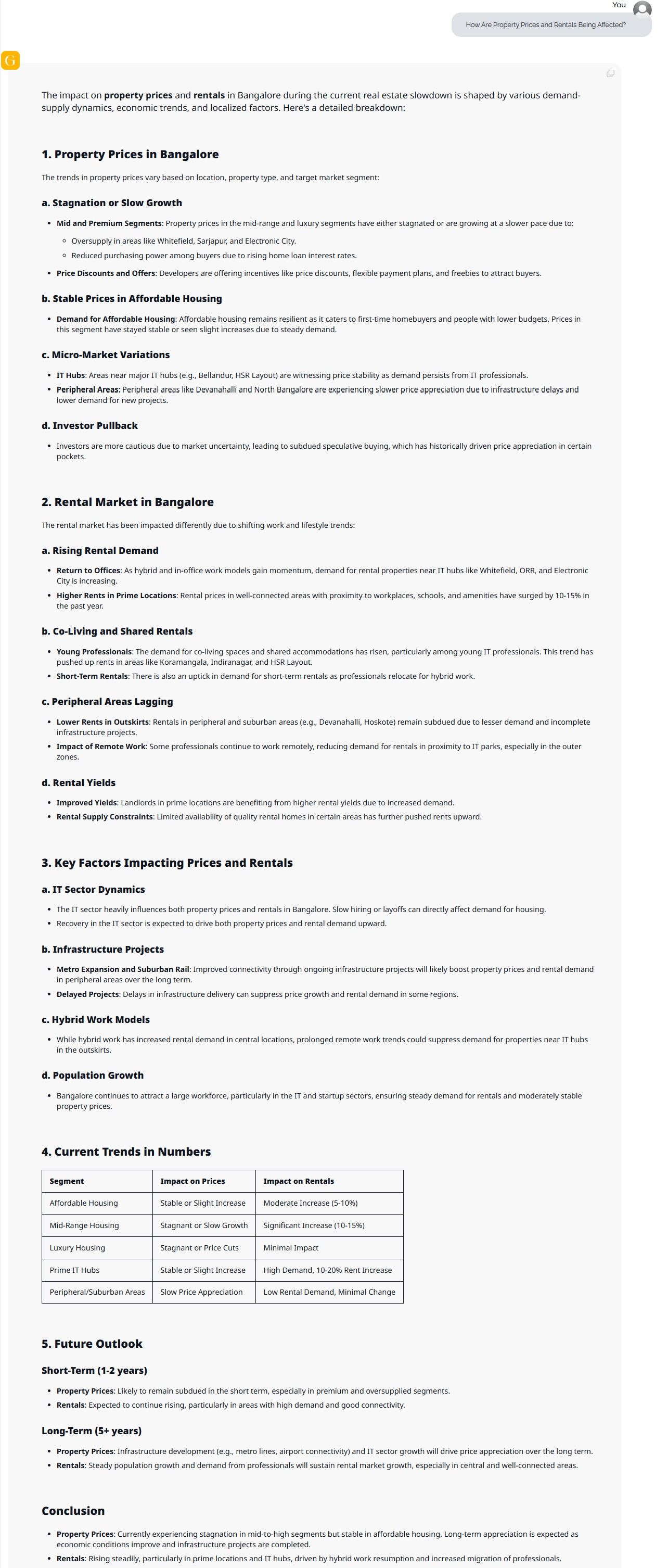

Property Price Trends:

The impact varies significantly by micro-market and property segment:

Luxury segment: Prices are stagnant and might see a cut to increase sales.

Mid-segment: Prices are stagnant and are likely to witness slow growth.

Affordable segment: Price is stable and might slightly increase

Prime IT Hubs: Price is stable and might slightly increase

Also Read: Get property-specific valuation insights from GRAI →

Rental Market Dynamics:

a. Rising Rental Demand

Return to Offices: As hybrid and in-office work models gain momentum, demand for rental properties near IT hubs like Whitefield, ORR, and Electronic City is increasing.

Higher Rents in Prime Locations: Rental prices in well-connected areas with proximity to workplaces, schools, and amenities have surged by 10-15% in the past year.

b. Co-Living and Shared Rentals

Young Professionals : The demand for co-living spaces and shared accommodations has risen, particularly among young IT professionals. This trend has pushed up rents in areas like Koramangala, Indiranagar, and HSR Layout.

Short-Term Rentals : There is also an uptick in demand for short-term rentals as professionals relocate for hybrid work.

Check out Video:

Despite the challenges, several positive counter-trends are creating opportunities:

• Affordable housing demand remains robust with steady absorption rates

• Government infrastructure initiatives (metro expansion, peripheral ring road) enhancing connectivity

• NRI investments increasing by both rental income and long-term appreciation year by year due to favorable exchange rates

• Alternative employment sectors (healthcare, education, aerospace) offsetting IT job losses

These factors contribute to market resilience and provide strategic entry points for informed investors.

The impact varies dramatically by location, with areas heavily dependent on tech professionals showing greater vulnerability:

Whitefield: Stagnant property prices and slower sales in mid-to-premium segments

Electronic City: Rental demand has dropped slightly except for in well-connected areas with proximity to workplaces, schools, amenities.

Outer Ring Road (Sarjapur-Devanahalli stretch): High unsold inventory, slow price growth, and stagnant mid-to-premium property sales.

In contrast, these areas showing resilience due to better infrastructure, connectivity, and balanced development:

North Bangalore (Hebbal, Yelahanka): Proximity to the airport and strong infrastructure are driving demand in these areas, especially for premium housing.

South Bangalore (JP Nagar, Jayanagar): These areas remain popular for their established social infrastructure and connectivity.

East Bangalore (MG Road, Indiranagar): High-end and luxury segments in these areas are less affected by the slowdown due to demand from affluent buyers and NRIs.

Understanding these micro-market dynamics is essential for targeted investment strategies.

This represents both a challenge and opportunity depending on your profile:

For End-Users:

Negotiation leverage has increased sales in several areas and segments.

Developer incentives now include payment flexibility, free upgrades, and maintenance waivers

Quality options in previously unaffordable locations have become accessible

Mortgage rates remain competitive despite market uncertainties

For Investors:

Entry prices in emerging corridors offer significant appreciation potential

Rental yield expectations should be recalibrated for the medium term

Portfolio diversification across micro-markets reduces risk exposure

The key is approaching transactions with comprehensive market intelligence rather than emotional reactions.

GRAI utilizes advanced AI capabilities to deliver critical advantages beyond what traditional advisors can offer:

Hyperlocal property valuation incorporating IT sector employment data

Predictive market analysis using proprietary forecasting models

Investment scenario modeling with risk-adjusted return calculations

These capabilities enable decisions backed by data rather than speculation during uncertain market conditions.

Start your AI-powered real estate journey with GRAI →

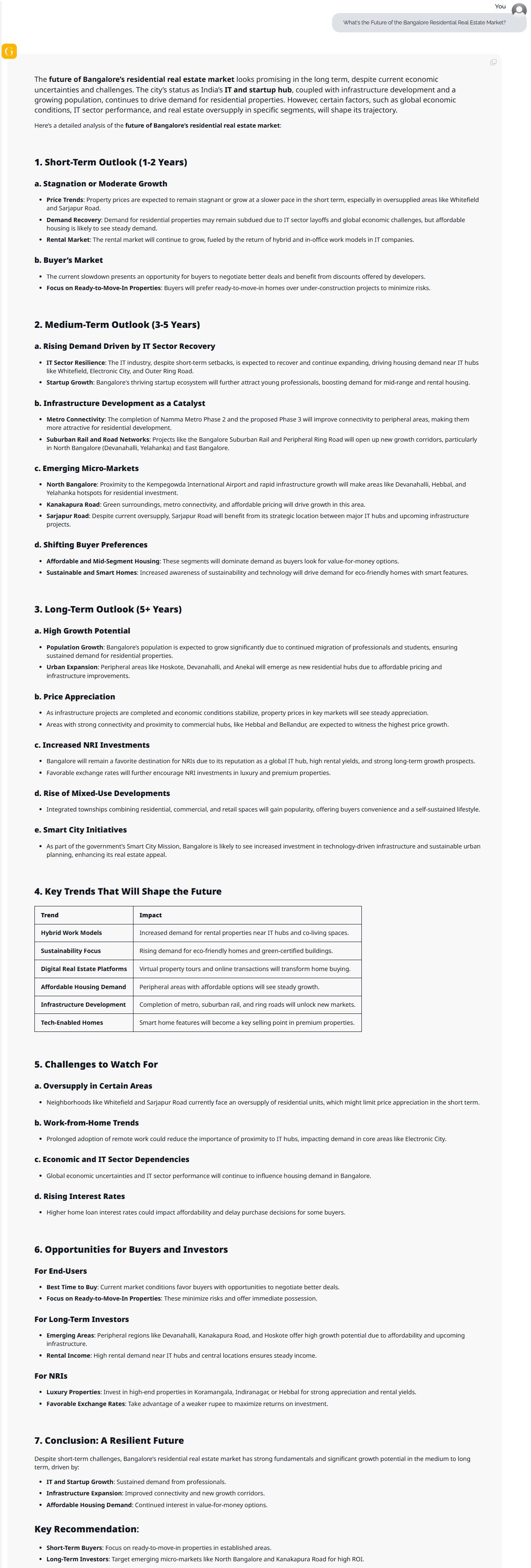

The future of Bangalore's residential real estate market presents a nuanced and promising landscape, characterized by both challenges and significant growth potential. Let's break down the outlook across different time horizons:

Short-Term Outlook (1-2 Years):

Price Trends: Expected to remain stagnant or grow at a slower pace

Market Dynamics:

• Subdued demand due to IT sector layoffs

• Buyer's market with negotiation opportunities

• Increased focus on ready-to-move-in properties

• Affordable housing segment maintaining steady demand

Medium-Term Outlook (3-5 Years):

Key Growth Drivers:

• IT Sector Recovery: Expected rebound driving housing demand near tech hubs

• Startup Ecosystem: Continuing to attract young professionals

Long-Term Outlook (5+ Years):

Promising Indicators:

• Population Growth: Continued professional and student migration

• Urban Expansion: Peripheral areas like Hoskote and Anekal emerging as new residential hubs

• Price Appreciation: Expected in well-connected areas

• NRI Investments: Increased interest due to global IT hub reputation

Key Trends Shaping the Market:

Hybrid Work Models: Driving demand for flexible living spaces

Sustainability Focus: Rising interest in eco-friendly and smart homes

Digital Real Estate Platforms: Transforming property transactions

Affordable Housing: Continued strong demand in peripheral areas

Challenges to Consider:

Potential oversupply in specific areas

Global economic uncertainties

Evolving work-from-home trends

Fluctuating interest rates

Strategic Recommendations:

For End-Users:

• Focus on ready-to-move-in properties

• Negotiate better deals in current market conditions

For Long-Term Investors:

• Target emerging micro-markets

• Consider areas with strong infrastructure potential

For NRIs:

• Explore luxury properties in prime locations

• Leverage favorable exchange rates

The key is strategic investment, careful market analysis, and a forward-looking approach that considers both immediate market conditions and future potential.

The impact of IT sector layoffs on Bangalore's residential market creates a complex landscape where risks and opportunities coexist. While traditional market analysis falls short, AI-driven insights provide the competitive edge needed to navigate these conditions successfully.

Subscribe to GRAI today and transform your Bangalore real estate search into strategic advantage.