Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Introduction: Real Estate Meets Policy Shock

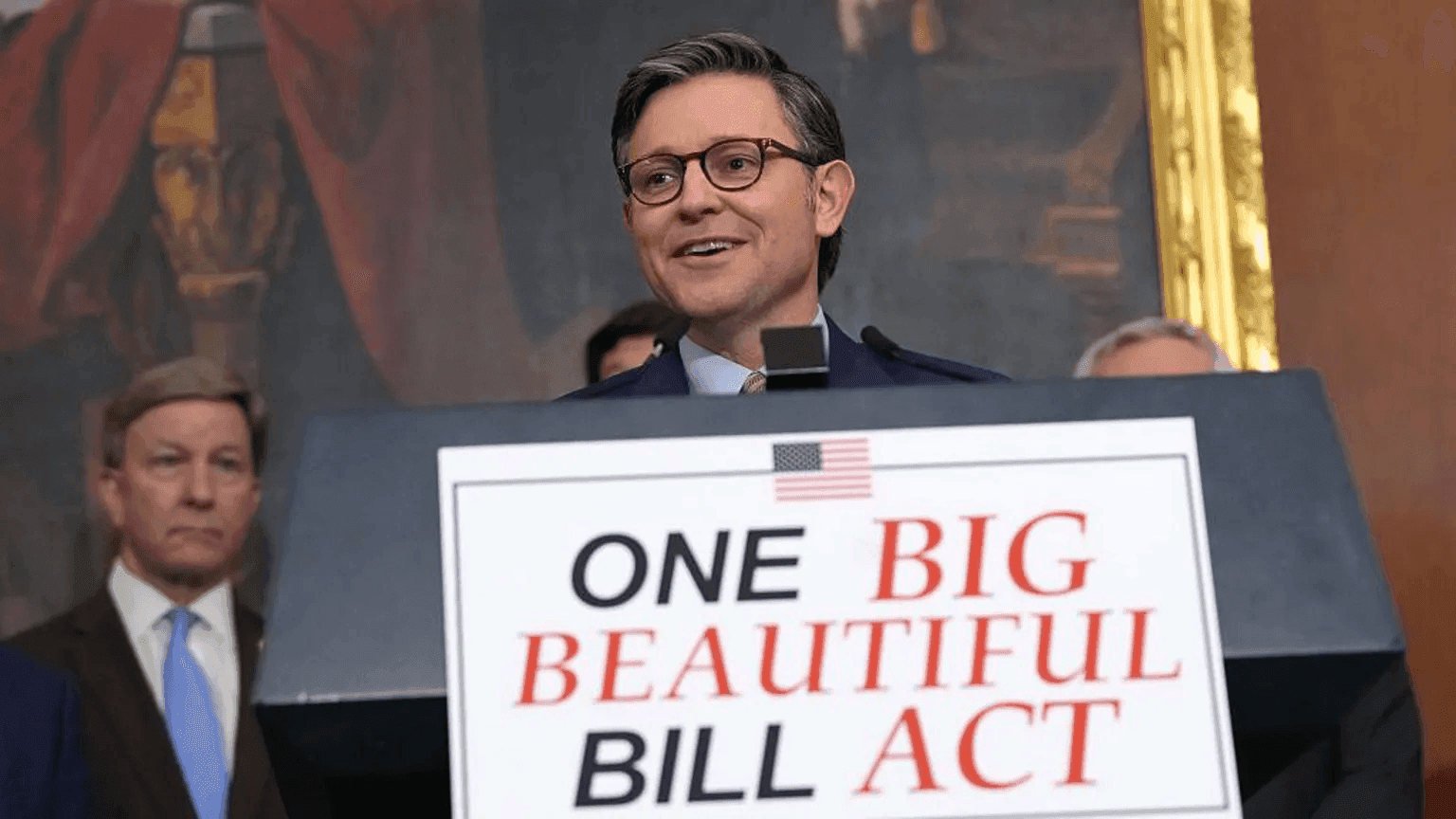

The U.S. Senate just passed what former President Donald Trump dubbed his "Big Beautiful Bill" - a sweeping legislative package with massive implications for taxation, housing affordability, and long-term investment trends.

While media headlines focus on tax cuts and political controversy, real estate investors - both domestic and international - should be reading between the lines. This bill isn’t just political theater. It’s a policy shift that could radically impact ROI, risk appetite, and market positioning.

In this article, we break down the bill's direct and indirect implications for real estate investing - and how GRAI, the world’s smartest real estate AI advisor, can help you adapt your strategy with precision.

The cap on the State and Local Tax (SALT) deduction has been lifted from $10,000 to $40,000, benefiting homeowners in states like California, New York, New Jersey, and Illinois.

Implications:

Renewed buyer interest in high-end homes in these states

Stronger pricing power for sellers in high-tax metros

Short-term appreciation in luxury ZIP codes

GRAI Prompts You Can Use:

"Simulate buyer demand changes in Manhattan post $40K SALT deduction."

"Compare ROI for $2M home in NY vs FL with updated SALT benefit."

The bill makes tip income and overtime pay tax-free, increasing take-home pay for millions. There’s also talk of mortgage interest deductions on auto loans and broader family tax relief.

Implications:

Increased mortgage eligibility for middle-income earners

Boost in first-time homebuyer activity

Greater rental absorption in working-class metros

GRAI Prompts You Can Use:

"Model rental yield changes in Houston based on projected wage growth."

"Forecast mortgage approval trends by city after Big Beautiful Bill."

CBO estimates peg the bill’s 10-year cost at $2.4 to $3.3 trillion. That could spur inflationary pressure, higher interest rates, and global investor skepticism about U.S. fiscal health.

Implications:

Cost of borrowing may rise in late 2025–2026

Cap rate expansion could compress property values

Foreign capital may pivot toward emerging markets or REITs

GRAI Prompts You Can Use:

"Predict 5-year cap rate shifts in Sunbelt cities under high-deficit scenario."

"Model foreign investment inflows in the U.S. CRE under dollar weakening trend."

Must Read: GRAI Turned a $1B CRE Memo into 180 Sec - Here’s Why It Matters

Markets that combine high taxes with strong economic fundamentals - like NYC, SF Bay Area, and parts of New Jersey - are poised to rebound. Meanwhile, investors should watch overinflated Sunbelt metros for interest rate sensitivity.

Winners:

Manhattan

Westside LA

Jersey City

Caution Zones:

Phoenix

Tampa

Austin (watch debt cost vs yield)

GRAI Prompts You Can Use:

"Compare IRR for duplex investment in Tampa vs Brooklyn with updated tax policy."

"Run sensitivity matrix on 200bps mortgage rate shift for Sunbelt SFR portfolio."

Also Read: How U.S. High-Income Investors Use Real Estate Tax Strategies to Build Wealth Faster

For serious investors, this is not a time to chase headlines. It’s a time to rebalance portfolios:

Reduce exposure to rate-sensitive flip markets

Add assets in now-advantaged high-tax metros

Run scenarios across both U.S. and global holdings

GRAI Portfolio Intelligence Can Help You:

Simulate multi-market strategies under macro and tax policy changes

Forecast rent growth, buyer behavior, and cap rate trends

Compare international real estate exposure for currency + tax arbitrage

Trump’s Big Beautiful Bill may be politically divisive, but for investors, it’s a strategic trigger.

Whether you're a domestic investor repositioning your multifamily play, or an overseas buyer looking to capture U.S. arbitrage, GRAI helps you model, adapt, and stay ahead.

Ready to invest smarter?

Start your free trial now: https://internationalreal.estate/chat