Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Jakarta’s real estate market in 2025 is no longer just a national story - it’s becoming Southeast Asia’s most dynamic property opportunity. With the market projected to hit USD 66.74 billion this year, growing at a 5.44% CAGR, the city’s property sector is fueled by robust fundamentals and a surge in smart, AI-driven investment strategies.

Economic stability underpins this growth. Indonesia’s GDP expanded by around 5.0% in 2024 and is forecast to maintain 5.1% growth in 2025, while foreign direct investment jumped 20% last year. Strategic infrastructure projects like the East-West MRT line and the Cimanggis-Cibitung toll road are reshaping accessibility, raising the value of both established neighborhoods and emerging corridors.

This convergence of economic strength, infrastructure rollout, and cutting-edge AI market analysis makes 2025 a pivotal year for investors. And GRAI, the world’s smartest real estate AI advisor, is the only platform that transforms Jakarta’s complexity into real-time, actionable strategies.

Jakarta’s property market in 2024 displayed cautious optimism, with sector-specific differences in momentum. Developers in the residential sector limited new project launches, focusing on ready-to-occupy units, which pushed occupancy rates to a five-year high of 65.4%. Looking into 2025, residential demand is projected to stabilize, especially in upper-middle market segments in areas such as Tangerang, Bekasi, and South Jakarta. However, the pipeline of new supply will remain tight, supporting price stabilization and healthier absorption rates.

The office sector maintained stable performance, with CBD occupancy holding at around 70% and Grade A rents marking their first significant increase since 2015 (+0.7%). Demand from multinational companies underpinned this recovery. Moving into 2025, premium-grade spaces are expected to retain strong demand, supported by infrastructure projects such as mass transit expansions, which will make office hubs even more attractive.

In the retail sector, resilience was evident in 2024 as occupied retail space reached nearly 3.75 million sqm, with an occupancy rate of 77.9%. Strong consumer activity and the entry of new tenants in F&B, fashion, and specialty segments sustained growth. For 2025, this trend is expected to continue, with the retail market benefiting from both domestic consumption and growing international interest.

The industrial sector was Jakarta’s standout performer in 2024. A wave of relocations by Chinese manufacturers, responding to U.S. tariffs, pushed industrial rents 15-25% higher-the strongest growth in two decades. The momentum is expected to continue in 2025, as expansion in manufacturing and automotive-related industries strengthens Jakarta’s industrial backbone and supports long-term demand.

Infrastructure and fiscal policies will remain pivotal in shaping Jakarta’s market trajectory. The completion of the Cimanggis-Cibitung toll road in 2024 improved regional connectivity, while 2025 will bring further uplift from the Jakarta Mass Rapid Transit West–East line, boosting property values along key corridors. On the fiscal side, the government’s initiatives-such as lowering corporate tax rates and launching the $28 billion New Nutritious Meals program-are designed to fuel broader economic growth, indirectly bolstering property performance across sectors.

Also Read: 2025 Rent vs Buy: Must-Know Tips for Modern Home Seekers

Jakarta’s 2024 performance was defined by resilience and cautious recovery, while 2025 is projected to deliver greater stability and moderate growth. Residential prices are likely to stabilize, office and retail demand will strengthen further, and industrial will continue its robust upward trajectory. Strategic infrastructure expansion and supportive fiscal policies will provide the foundation for sustained momentum, making Jakarta a market to watch in 2025.

GRAI’s Predictions

GRAI processes millions of data points - from transaction histories and infrastructure schedules to sentiment analysis of government and developer announcements - to reveal micro-market profit patterns invisible to standard reports.

Example: GRAI projects that waterfront apartments in PIK-2 could appreciate 15-20% over the next three years, based on completion timelines and historical growth patterns from comparable Asian mega-developments.

Risk Mitigation: Beyond returns, GRAI assesses flood risk, soil stability, and climate projections, ensuring investors avoid hidden hazards - an increasingly critical factor in Jakarta’s evolving environmental landscape.

Jakarta’s property market in 2025 is expected to see strong momentum across several prime investment territories, with Sudirman, Kuningan, Menteng, Pantai Indah Kapuk (PIK), and emerging corridors such as Bekasi, Tangerang, and Depok standing out as the key hotspots. These areas combine strategic location advantages, infrastructure upgrades, and evolving lifestyle trends that make them highly attractive for investors.

1. Strategic Locations and Connectivity

Sudirman & Kuningan (CBD Areas): Central to Jakarta’s business and diplomatic activities, these districts host multinational companies, embassies, and financial institutions. Connectivity upgrades through the Jakarta MRT (North-South Line) and LRT expansions enhance accessibility, while proximity to luxury hotels, high-end retail, and entertainment hubs ensures sustained demand for both commercial and residential real estate.

Menteng: A prestigious and historically significant neighborhood, Menteng remains the preferred choice for high-net-worth individuals. Its exclusivity, central positioning, and premium amenities make it one of Jakarta’s most stable residential markets.

Pantai Indah Kapuk (PIK): Transformed into a modern lifestyle and tourism hub, PIK benefits from waterfront developments, eco-friendly projects, and excellent connectivity via the Outer Ring Road and Soekarno-Hatta International Airport. Its integrated mixed-use projects are drawing affluent buyers, tourists, and expats.

Emerging Corridors (Bekasi, Tangerang, Depok): Offering greater affordability compared to the core CBD, these corridors are rapidly gaining traction. Projects like the Jakarta-Bandung high-speed rail and the Cimanggis-Cibitung toll road are boosting connectivity and fueling both residential and industrial growth.

2. Infrastructure Development

Ongoing and upcoming projects are reshaping Jakarta’s property dynamics:

East-West MRT Line improving cross-city accessibility.

LRT Jabodebek (Jakarta-Bogor-Depok-Bekasi) enhancing connectivity for suburban areas, increasing attractiveness for both housing and industrial investments.

Toll road expansions linking peripheral zones with the city center, driving land appreciation in previously overlooked areas.

3. Diversified Real Estate Markets

Residential: High demand for luxury condos and apartments in Sudirman, Kuningan, and Menteng; waterfront and eco-friendly homes in PIK.

Commercial: Grade A office spaces in Sudirman and Kuningan are benefiting from the return of multinational corporations, while PIK’s retail spaces are thriving on lifestyle and tourism-driven demand.

Industrial: Emerging corridors like Bekasi and Tangerang are becoming major logistics and e-commerce hubs, fueled by relocations of manufacturing operations.

4. Favorable Government Policies

Indonesia’s pro-investment reforms are reinforcing market confidence:

Omnibus Law simplifying foreign ownership rules.

Corporate tax cuts expected to reduce rates to 20% in 2025, attracting global businesses.

Visa reforms offering long-term residency options for digital nomads, expats, and retirees, boosting housing demand in lifestyle hubs like PIK.

5. Economic Recovery and Growth

Jakarta’s GDP is projected to expand steadily in 2025, driven by:

Strong domestic consumption fueling retail and residential absorption.

Growing foreign capital targeting mixed-use developments and industrial parks.

Rising status as a regional hub for green energy and technology investments.

6. Lifestyle and Urban Trends

Luxury living: Menteng, Sudirman, and Kuningan appeal to affluent buyers seeking exclusive enclaves, cultural attractions, and high-end dining.

Tourism and lifestyle hubs: PIK’s beachfront developments, eco-friendly designs, and vibrant retail strips attract both locals and international visitors.

Smart cities: Emerging areas like BSD City and Cikarang are integrating eco-friendly housing with smart urban planning.

7. Capital Appreciation and Rental Yields

Prime neighborhoods such as Sudirman, Kuningan, and Menteng deliver high rental yields of 5-7%, driven by premium demand and limited supply.

PIK and emerging corridors show strong growth potential as infrastructure upgrades lift accessibility and long-term property values.

8. Rising Demand from Millennials and Expats

Millennials are fueling demand for compact apartments in Sudirman and Kuningan, valuing proximity to offices and entertainment.

Expats increasingly prefer PIK and Menteng due to international schools, lifestyle amenities, and connectivity to business hubs.

Sudirman, Kuningan, Menteng, PIK, and emerging corridors like Bekasi, Tangerang, and Depok are set to dominate Jakarta’s property market in 2025. Backed by infrastructure upgrades, favorable policies, economic growth, and shifting lifestyle trends, these territories present diverse opportunities-from stable luxury investments in Menteng to high-growth prospects in PIK and industrial-driven appreciation in Bekasi and Tangerang. For investors, these areas represent Jakarta’s most strategic bets for long-term gains.

AI-driven analysis of rental yield and ROI is transforming how investors approach Jakarta’s real estate market. By leveraging real-time data, predictive models, and localized insights, AI platforms like GRAI equips investors with accurate, actionable strategies on whether to buy, hold, or sell properties in 2025.

How AI-Driven Analysis Helps Investors

1. Precise Rental Yield Assessment

Evaluates yields using historical rental income, occupancy trends, and comparable property data.

Identifies high-performing areas, e.g., luxury apartments in Sudirman, where yields average 5-7%, versus suburban properties at 3-5%.

2. Accurate ROI Calculations

Incorporates acquisition costs, financing, taxes, and projected appreciation.

Calculates Net ROI and payback periods, highlighting assets with strong long-term potential, such as Pantai Indah Kapuk (PIK) with its robust waterfront developments.

3. Predictive Market Trends

Forecasts growth using macroeconomic indicators, supply-demand dynamics, and government incentives.

AI predicts a 5-10% price increase in Menteng due to limited supply and sustained demand from HNWIs.

4. Risk & Scenario Analysis

Models ROI under changing conditions like rising interest rates or increased costs.

Recommends safer, cash-flow-positive assets when risk levels increase.

5. Localized Insights

6. Real-Time Adjustments

🟢 Buy

Pantai Indah Kapuk (PIK): Premium yields and long-term ROI from lifestyle and tourism-driven demand.

Emerging Suburbs (Bekasi, Tangerang, BSD City): Affordable entry prices, strong growth potential, boosted by high-speed rail and toll road projects.

Sudirman & Kuningan: Attractive for Grade A offices and luxury apartments, with stable 5-7% yields.

Investor Profile: Long-term investors seeking capital appreciation and strong rental returns.

🔴 Hold

Menteng: Moderate appreciation expected; exclusivity ensures stable demand.

CBD Areas (Sudirman, SCBD): Consistent rental income from expatriates and multinationals.

Investor Profile: Those preferring steady returns and lower-risk investments.

🟡 Sell

Overbuilt Areas: Older stock in East Jakarta with high vacancy rates.

Non-strategic Locations: Assets lacking infrastructure growth.

Investor Profile: Investors aiming to reallocate capital toward higher-performing submarkets.

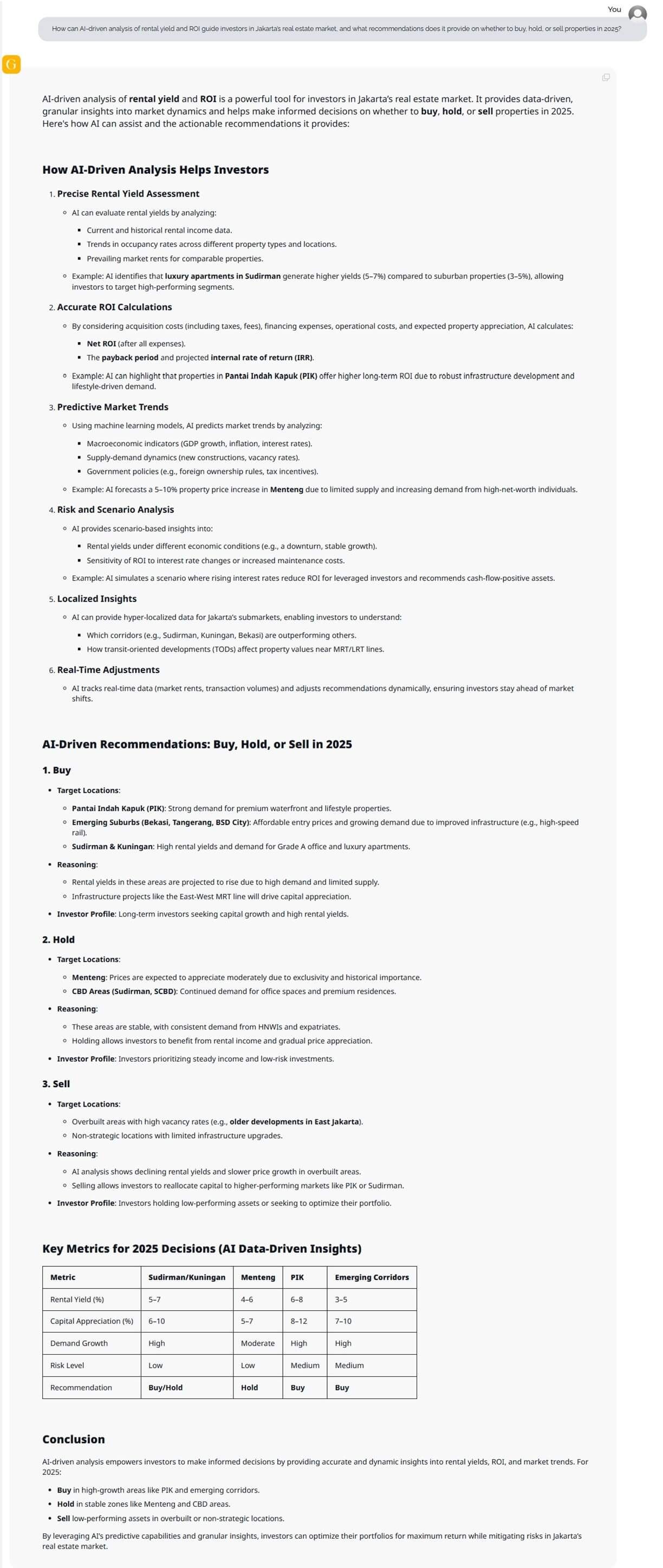

| Metric | Sudirman/Kuningan | Menteng | PIK | Emerging Corridors |

|---|---|---|---|---|

| Rental Yield (%) | 5-7 | 4-6 | 6-8 | 3-5 |

| Capital Appreciation (%) | 6-10 | 5-7 | 8-12 | 7-10 |

| Demand Growth | High | Moderate | High | High |

| Risk Level | Low | Low | Medium | Medium |

| Recommendation | Buy/Hold | Hold | Buy | Buy |

GRAI insights position Jakarta’s 2025 real estate market as a mix of stable, high-yield premium zones and fast-growing suburban corridors.

Buy in high-growth areas like PIK and emerging corridors.

Hold in stable districts such as Menteng and CBD hubs.

Sell low-performing assets in overbuilt or stagnant areas.

By leveraging GRAI real estate AI advisor’s analysis, investors can optimize rental yields, minimize risks, and capture sustainable ROI in Jakarta’s evolving property market.

1. What is the forecast for Jakarta real estate market in 2025?

The Jakarta real estate market is expected to grow by 5-7% in 2025, supported by strong GDP growth, new infrastructure projects such as the East-West MRT, and increasing foreign direct investment. Smaller residential units are driving demand, while waterfront projects like PIK-2 show the strongest long-term appreciation potential.

2. What are the best neighborhoods to invest in Jakarta in 2025?

The top neighborhoods for property investment include:

Sudirman – CBD apartments with yields above 10%.

Kuningan – Diplomatic and commercial hub with high-value mixed-use projects.

Menteng – Exclusive heritage district offering long-term capital stability.

Pantai Indah Kapuk & PIK-2 - Jakarta’s new waterfront city with strong appreciation prospects.

Affordable growth corridors like South Tangerang also present early-stage opportunities.

3. What is the average property price per square meter in Jakarta 2025?

In 2025, small residential units average around IDR 25 million per square meter. Luxury detached homes in premium areas cost significantly more, while outer Jakarta apartments can start as low as USD 30,000-36,000 making them attractive for entry-level investors.

4. What are rental yields in Jakarta in 2025?

Rental yields remain strong:

Central Jakarta (Sudirman, CBD): One-bedroom units can achieve 11%+ annual yields through corporate leasing.

West Jakarta: Affordable units deliver about 5.75% yields with steady demand.

PIK-2: Serviced apartments are expected to perform well in the short-term rental market once full infrastructure and leisure amenities launch.

5. Can foreigners buy property in Jakarta?

Yes, foreigners can buy property in Jakarta under specific regulations. Typically, they can purchase apartments or strata-title units above certain price thresholds, but land ownership remains restricted. Using GRAI’s legal document analysis feature, investors can navigate these requirements with confidence.

6. Is it better to buy or rent property in Jakarta in 2025?

Buying is generally the better option in 2025, given the 5-7% expected appreciation, attractive rental yields, and upcoming infrastructure projects boosting long-term value. Renting makes sense for short-term stays, but ownership offers capital growth and stable income for investors who want to secure a foothold in Southeast Asia’s fastest-growing market.

Jakarta’s real estate market in 2025 is a calculated growth story. With forecasted 5-7% price appreciation, expanding infrastructure, and micro-markets like PIK-2 and Sudirman outperforming, the opportunities are clear - but so are the risks for uninformed investors.

GRAI’s combination of real-time market intelligence, predictive analytics, and personalized recommendations ensures you act before the market reacts. Whether you’re seeking yield, appreciation, or diversification, GRAI transforms uncertainty into strategic certainty.

In a city where information delays cost millions, the investors who win are those who see the future before it’s priced in.

Subscribe to GRAI today and get instant access to property intelligence for Jakarta and beyond