Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The Lisbon real estate market continues its impressive trajectory in 2025, cementing its status as one of Europe's most dynamic property investment destinations. International investors, digital nomads, and tech professionals increasingly view Portugal's capital as an ideal balance of affordability, quality of life, and investment potential compared to other Western European capitals. The city's unique blend of historic charm, Mediterranean climate, and emerging status as a tech and innovation hub creates a compelling case for both residential buyers and investment-focused purchasers.

However, navigating Lisbon's rapidly evolving real estate landscape requires precision and market intelligence beyond traditional research methods. This is where GRAI - the world's most advanced AI real estate advisor - transforms the investment experience through predictive analytics and real-time insights.

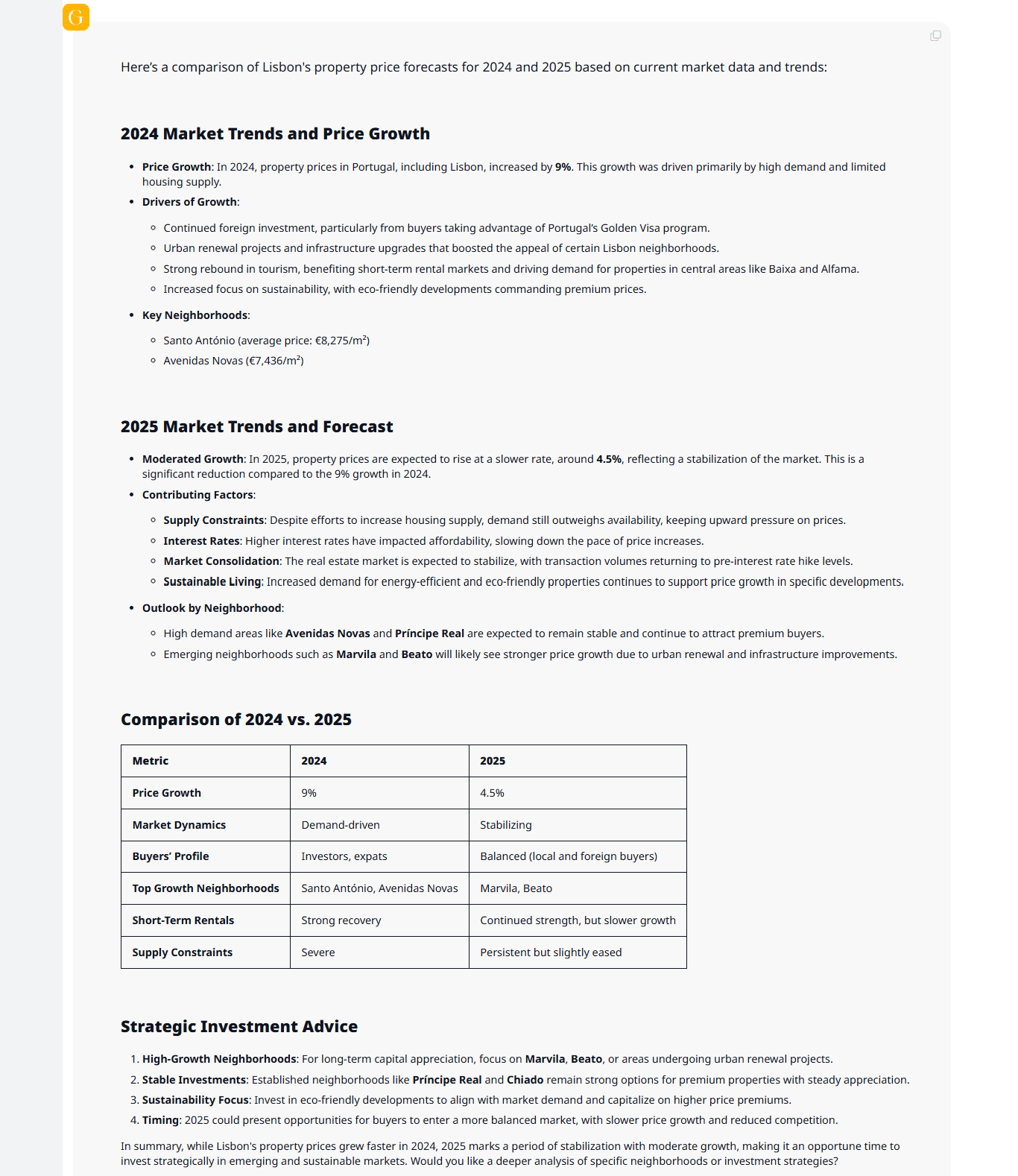

Lisbon's real estate market is undergoing a notable transition, with property price growth expected to moderate from 9% in 2024 to approximately 4.5% in 2025. This shift represents a strategic opportunity for investors seeking to enter a more balanced market.

2024 Market Performance

Property values in Lisbon saw significant appreciation in 2024, driven by:

Premium neighborhoods like Santo António (€8,275/m²) and Avenidas Novas (€7,436/m²) led market growth.

2025 Market Outlook

The market is expected to stabilize in 2025, with more moderate but sustainable growth. Key factors influencing this outlook include:

Neighborhood Investment Potential

The market is becoming more nuanced, with different neighborhoods showing varied growth potential:

Strategic Investment Approach

As the market transitions in 2025, investors should consider:

1. Focusing on emerging neighborhoods like Marvila and Beato for long-term appreciation

2. Established areas like Príncipe Real and Chiado for stable returns

3. Prioritizing eco-friendly properties that align with increasing market demand

4. Taking advantage of the timing opportunity presented by a more balanced market with reduced competition

This moderation in growth creates an opportune window for strategic investment, particularly in emerging neighborhoods and sustainable developments that align with evolving market preferences.

GRAI's analysis identifies several key market drivers influencing Lisbon real estate values:

What differentiates GRAI's forecasting capabilities is its Sentiment Analysis, which processes thousands of policy announcements, news articles, and social media conversations to detect early market signals. As Lisbon authorities implement zoning changes and short-term rental restrictions in historic districts, GRAI has identified emerging opportunities in specific suburban developments before mainstream market recognition.

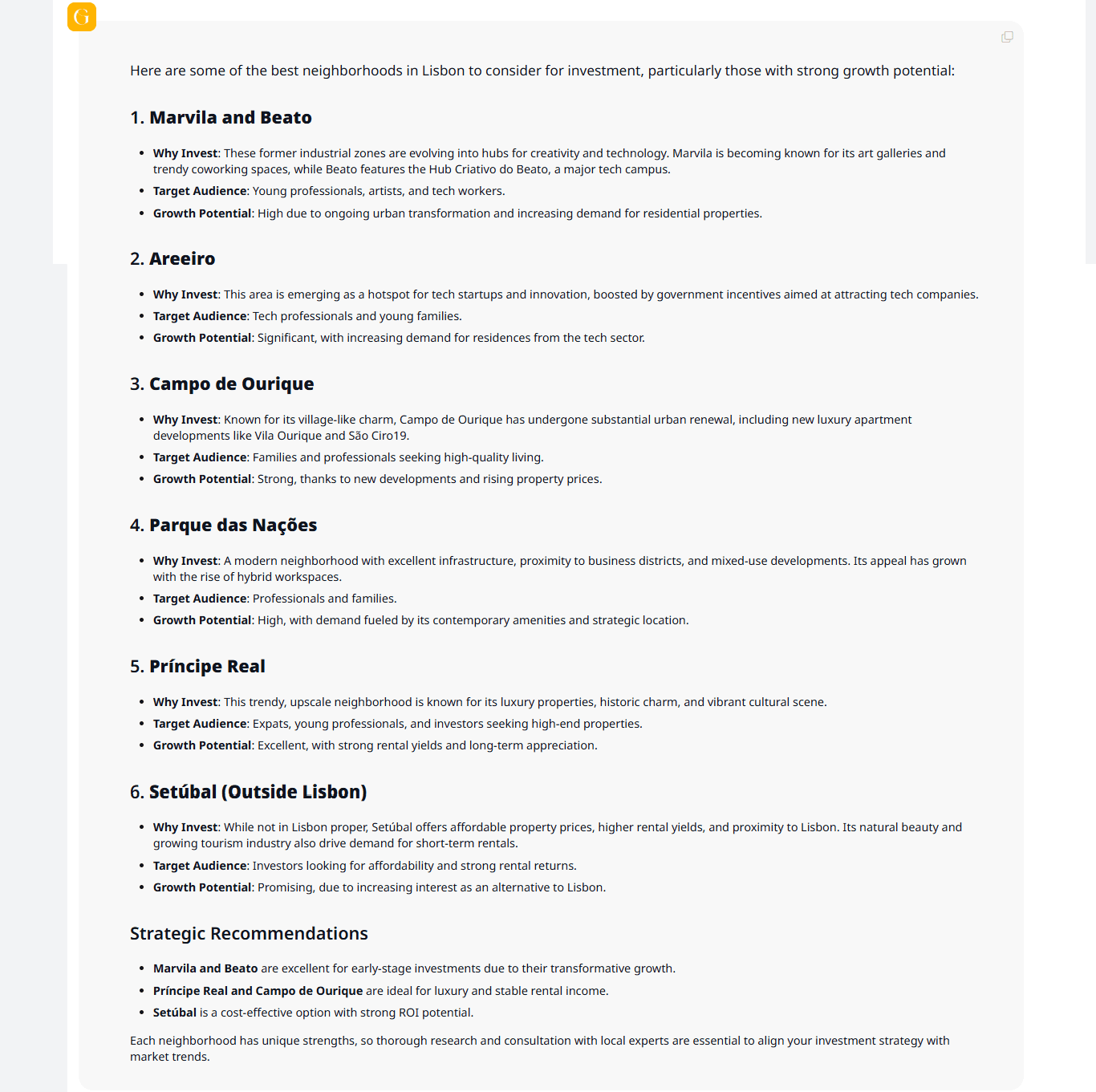

GRAI's global insights feature combines hyperlocal analysis, economic indicators, and cultural trends to identify Lisbon's most promising investment neighborhoods for 2025:

1. Marvila and Beato

Why Invest: These former industrial zones are evolving into hubs for creativity and technology. Marvila is becoming known for its art galleries and trendy coworking spaces, while Beato features the Hub Criativo do Beato, a major tech campus.

Target Audience: Young professionals, artists, and tech workers.

Growth Potential: High due to ongoing urban transformation and increasing demand for residential properties.

2. Areeiro

Why Invest: This area is emerging as a hotspot for tech startups and innovation, boosted by government incentives aimed at attracting tech companies.

Target Audience: Tech professionals and young families.

Growth Potential: Significant, with increasing demand for residences from the tech sector.

3. Campo de Ourique

Why Invest: Known for its village-like charm, Campo de Ourique has undergone substantial urban renewal, including new luxury apartment developments like Vila Ourique and São Ciro19.

Target Audience: Families and professionals seeking high-quality living.

Growth Potential: Strong, thanks to new developments and rising property prices.

4. Parque das Nações

Why Invest: A modern neighborhood with excellent infrastructure, proximity to business districts, and mixed-use developments. Its appeal has grown with the rise of hybrid workspaces.

Target Audience: Professionals and families.

Growth Potential: High, with demand fueled by its contemporary amenities and strategic location.

5. Príncipe Real

Why Invest: This trendy, upscale neighborhood is known for its luxury properties, historic charm, and vibrant cultural scene.

Target Audience: Expats, young professionals, and investors seeking high-end properties.

Growth Potential: Excellent, with strong rental yields and long-term appreciation.

6. Setúbal (Outside Lisbon)

Why Invest: While not in Lisbon proper, Setúbal offers affordable property prices, higher rental yields, and proximity to Lisbon. Its natural beauty and growing tourism industry also drive demand for short-term rentals.

Target Audience: Investors looking for affordability and strong rental returns.

Growth Potential: Promising, due to increasing interest as an alternative to Lisbon.

Strategic Recommendations

Marvila and Beato are excellent for early-stage investments due to their transformative growth.

Príncipe Real and Campo de Ourique are ideal for luxury and stable rental income.

Setúbal is a cost-effective option with strong ROI potential.

Using GRAI's Instant Land Image Analysis capabilities investors can upload photos of target properties to receive immediate insights on construction feasibility, zoning restrictions, and value-enhancing renovation opportunities - critical advantages when evaluating properties in heritage-protected areas or emerging neighborhoods.

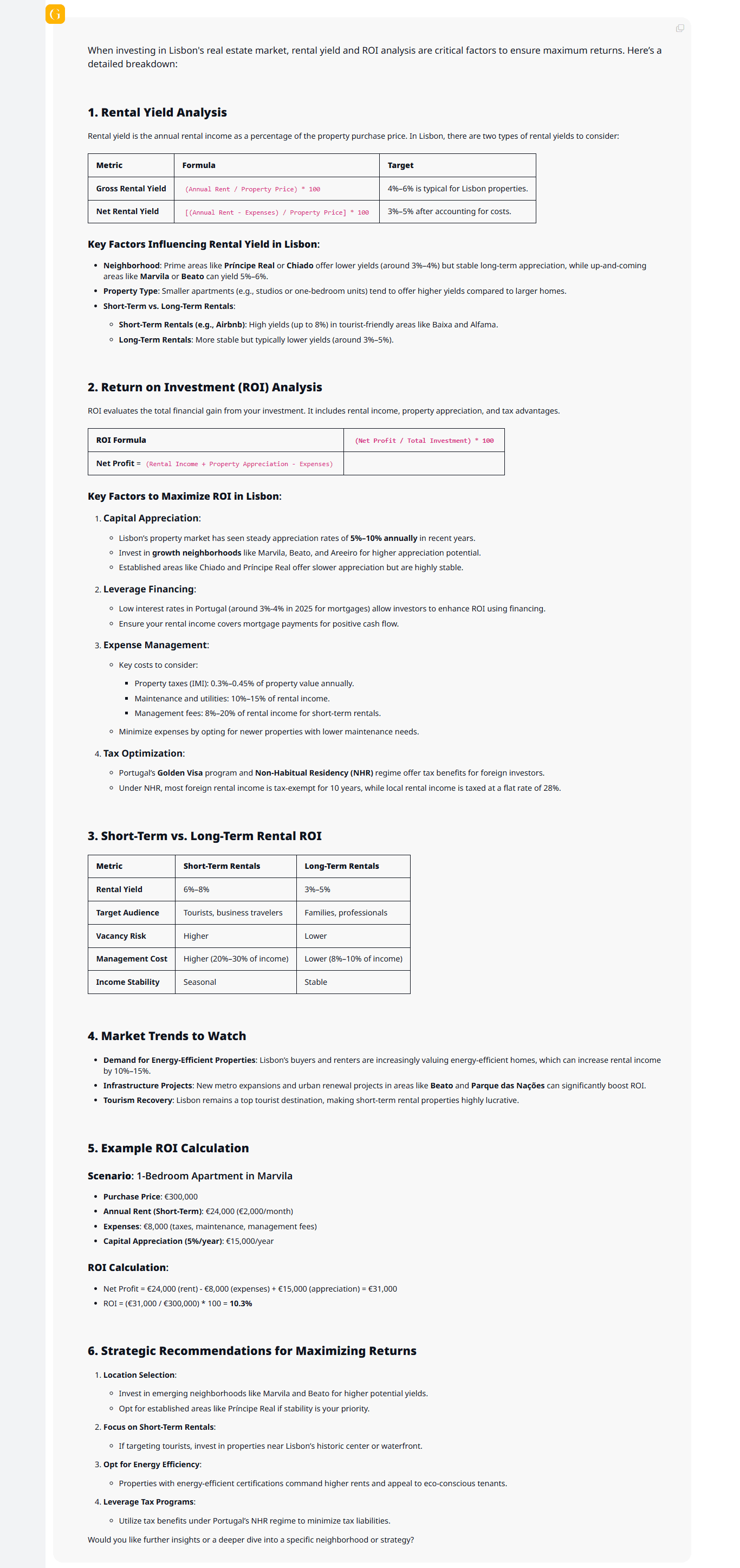

When investing in Lisbon's real estate market, rental yield and ROI analysis are critical factors to ensure maximum returns. GRAI's Advanced Portfolio Management Advisory offers comprehensive insights that go beyond basic calculations:

1. Rental Yield Analysis

Rental yield represents the annual rental income as a percentage of property purchase price. In Lisbon, GRAI identifies two essential metrics:

| Metric | Formula | Target |

|---|---|---|

| Gross Rental Yield | (Annual Rent / Property Price) × 100 | 4%–6% is typical for Lisbon properties |

| Net Rental Yield | [(Annual Rent - Expenses) / Property Price] × 100 | 3%–5% after accounting for costs |

Key Factors Influencing Rental Yield in Lisbon:

Neighborhood: Prime areas like Príncipe Real or Chiado offer lower yields (around 3%-4%) but stable long-term appreciation, while up-and-coming areas like Marvila or Beato can yield 5%-6%.

Property Type: Smaller apartments (studios or one-bedroom units) tend to offer higher yields compared to larger homes.

Short-Term vs. Long-Term Rentals:

• Short-Term Rentals (Airbnb): High yields (up to 8%) in tourist-heavy areas like Baixa and Alfama.

• Long-Term Rentals: More stable but typically lower yields (around 3%-5%).

2. Return on Investment (ROI) Analysis

ROI evaluates the total financial gain from your investment, including rental income, property appreciation, and tax advantages.

Key Factors to Maximize ROI in Lisbon:

Capital Appreciation:

• Lisbon's property market has seen steady appreciation rates of 5%-10% annually in recent years.

• GRAI recommends investing in growth neighborhoods like Marvila, Beato, and Areeiro for higher appreciation potential.

• Established areas like Chiado and Príncipe Real offer slower appreciation but are highly stable.

Leverage Financing:

• Low interest rates in Portugal (around 3%-4% in 2025 for mortgages) allow investors to enhance ROI using financing.

• GRAI analysis shows that ensuring rental income covers mortgage payments is essential for positive cash flow.

Expense Management:

Key costs to consider:

• Property Taxes (IMI): 0.3%-0.45% of property value annually

• Maintenance and Utilities: 10%-15% of rental income

• Management Fees: 8%-20% of rental income for short-term rentals

GRAI recommends minimizing expenses by opting for newer properties with lower maintenance needs.

Tax Optimization:

• Portugal's Golden Visa program and Non-Habitual Residency (NHR) regime offer tax benefits for foreign investors.

• Under NHR, most foreign rental income is tax-exempt for 10 years, while local rental income is taxed at a flat rate of 28%.

3. Short-Term vs. Long-Term Rental Comparison

GRAI's market analysis provides a clear comparison between rental strategies:

| Metric | Short-Term Rentals | Long-Term Rentals |

|---|---|---|

| Rental Yield | 6% - 8% | 3% - 5% |

| Target Audience | Tourists, business travellers | Families, professionals |

| Vacancy Risk | Higher | Lower |

| Management Cost | Higher (20% - 30% of income) | Lower (8% - 10% of income) |

| Income Stability | Seasonal | Stable |

4. Market Trends to Watch

GRAI's predictive algorithms highlight several trends impacting rental returns:

Demand for Energy-Efficient Properties: Lisbon's buyers and renters are increasingly valuing energy-efficient homes, which can increase rental income by 10%-15%.

Infrastructure Projects: New metro expansions and urban renewal projects in areas like Beato and Parque das Nações can significantly boost ROI.

Tourism Recovery: Lisbon remains a top tourist destination, making short-term rental properties highly lucrative.

5. ROI Calculation Example

GRAI provides a practical example to illustrate potential returns:

Scenario: 1-Bedroom Apartment in Marvila

Purchase Price: €300,000

Annual Rent (Short-Term): €24,000 (€2,000/month)

Expenses: €8,000 (taxes, maintenance, management fees)

Capital Appreciation (5%/year): €15,000/year

ROI Calculation:

Net Profit = €24,000 (rent) - €8,000 (expenses) + €15,000 (appreciation) = €31,000

ROI = (€31,000 / €300,000) × 100 = 10.3%

6. Strategic Recommendations for Maximizing Returns

Based on comprehensive data analysis, GRAI recommends the following strategies:

1. Location Selection:

2. Focus on Short-Term Rentals:

3. Opt for Energy Efficiency:

4. Leverage Tax Advantages:

GRAI's capabilities allows investors to simulate various rental scenarios tailored to specific property characteristics and investment horizons, ensuring optimized returns in Lisbon's dynamic market.

GRAI's market intelligence reveals a strategic shift occurring in Lisbon's rental landscape. While short-term accommodations dominated investor strategies in previous years, regulatory changes and the growing population of remote professionals seeking medium-term stays (3-12 months) are creating new optimization opportunities.

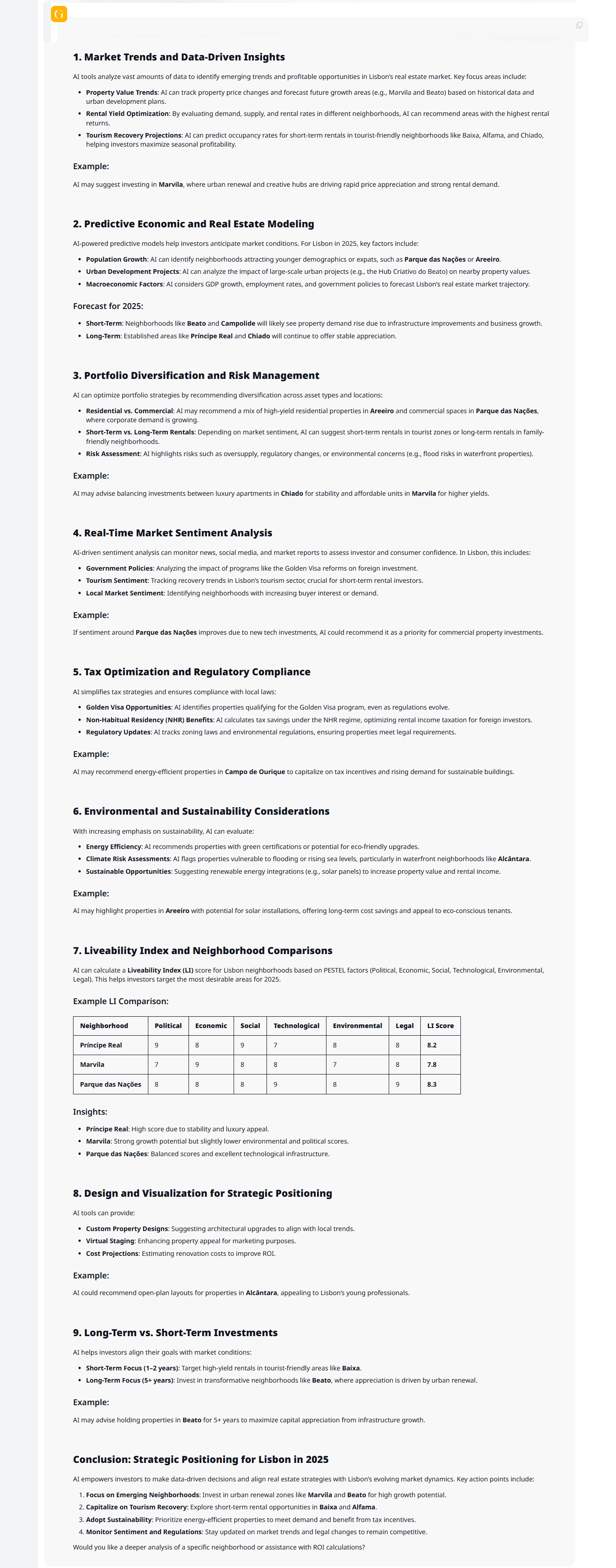

GRAI's AI-driven investment insights are designed to help investors strategically position themselves in Lisbon's real estate market for 2025. By leveraging advanced data analytics, predictive modeling, and real-time trend monitoring, GRAI highlights the following key strategies:

1. Market Trends and Data-Driven Insights

GRAI identifies emerging trends and profitable opportunities by analyzing vast datasets, with focus areas including:

Example:

Investment in Marvila, where creative hubs are accelerating price appreciation and rental demand.

2. Predictive Economic and Real Estate Modeling

GRAI anticipates market conditions using predictive models focused on:

Population Growth: Tracking young demographics and expats in areas like Parque das Nações and Areeiro.

Urban Development Projects: Evaluating the impact of large-scale urbanization on property values.

Macroeconomic Indicators: Considering GDP growth, employment, and government policies.

Forecast for 2025:

3. Portfolio Diversification and Risk Management

GRAI optimizes investment portfolios through:

Asset Type Mix: Balancing residential in Areeiro with commercial in Parque das Nações.

Rental Strategy: Choosing between short-term tourist rentals or long-term family rentals.

Risk Assessment: Highlighting risks like regulatory changes or environmental vulnerabilities.

Example:

Balanced investment between Chiado (stability) and Marvila (high yields).

4. Real-Time Market Sentiment Analysis

GRAI tracks sentiment through:

Government Policy Changes: Monitoring Golden Visa program reforms.

Tourism Sentiment: Following visitor trends in key tourist districts.

Local Demand Trends: Detecting neighborhood popularity shifts.

Example:

Prioritizing commercial investments in Parque das Nações based on improving sentiment.

5. Tax Optimization and Regulatory Compliance

GRAI simplifies tax planning and compliance by:

Golden Visa Eligibility: Identifying qualifying properties.

Non-Habitual Residency (NHR) Savings: Calculating tax benefits.

Regulatory Updates: Ensuring properties meet evolving legal standards.

Example:

Recommending energy-efficient properties in Campo de Ourique for tax incentives.

6. Environmental and Sustainability Considerations

With growing demand for sustainable assets, GRAI evaluates:

Example:

Highlighting solar-ready properties in Areeiro for long-term savings and tenant appeal.

7. Liveability Index and Neighborhood Comparisons

GRAI's Liveability Index (LI) evaluates Lisbon neighborhoods based on key factors:

| Neighborhood | Political | Economic | Social | Technological | Environmental | Legal | LI Score |

|---|---|---|---|---|---|---|---|

| Principe Real | 9 | 8 | 9 | 7 | 8 | 8 | 8.2 |

| Marvila | 7 | 9 | 8 | 8 | 7 | 8 | 7.8 |

| Parque das Nações | 8 | 8 | 9 | 8 | 9 | 8 | 8.3 |

Insights:

Principe Real: Stability and luxury appeal.

Marvila: Strong potential driven by urban renewal.

Parque das Nações: Balanced services and excellent tech infrastructure.

8. Design and Visualization for Strategic Positioning

GRAI recommends:

Example:

Open plan designs in Alcântara targeting young professionals.

9. Long-Term vs. Short-Term Investments

GRAI tailors investment strategies:

Short-Term (1–2 years): Focus on tourist-friendly areas like Baixa.

Long-Term (5+ years): Target transformative neighborhoods like Beato.

Example:

Holding assets in Beato to capitalize on infrastructure-driven appreciation.

To succeed in Lisbon’s evolving market, GRAI recommends:

1. Focus on Emerging Neighborhoods: Invest early in Marvila and Beato.

2. Capitalize on Tourism Recovery: Leverage short-term rentals in Baixa and Alfama.

3. Adopt Sustainability: Prioritize eco-efficient, tax-incentivized properties.

4. Monitor Sentiment and Regulations: Stay agile to maximize competitive advantage.

Unlike basic property listing platforms or general market reports, GRAI delivers comprehensive, actionable intelligence specifically engineered for real estate investment success. Whether you're exploring your first Lisbon property purchase or expanding an established portfolio, GRAI transforms information overload into strategic clarity.

As Lisbon's real estate landscape continues evolving in 2025, the competitive advantage belongs to investors with superior market intelligence, faster decision-making capabilities, and precise risk assessment tools. GRAI's advanced AI platform delivers this critical edge through data-driven insights that anticipate market movements before they become widely recognized.

For international investors navigating unfamiliar territory or local buyers seeking optimal value, GRAI eliminates guesswork from the equation. Its comprehensive analysis spans from macro-economic trends affecting Portugal's housing market to building-specific insights that impact individual property values.

By subscribing to GRAI today, you gain immediate access to the most sophisticated real estate intelligence platform available for the Lisbon and global market. Whether you're seeking your perfect pied-à-terre in Campo de Ourique, identifying high-yield rental properties in emerging neighborhoods, or building a diversified portfolio across the city, GRAI empowers you with the insights to execute with confidence in any market condition.

Because in Lisbon's competitive real estate environment, the difference between exceptional returns and missed opportunities often comes down to one factor: superior information.