Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The global real estate market in 2025 is at a turning point. For decades, London has been the gold standard for safe, long-term property investment. Its prestige, regulatory stability, and consistent appreciation have made it a cornerstone of international portfolios.

But in recent years, Dubai has emerged as a formidable competitor, delivering exceptional capital growth, high rental yields, and a tax-friendly investment ecosystem. For investors in 2025, the debate is no longer “London or Dubai?”- it’s “how do I make the smarter move in a fast-changing market?”

Traditional research methods fall short, as they rely on static reports and outdated data. Enter GRAI, the world’s most advanced AI-powered real estate advisor, offering instant, real-time insights - from five-year appreciation forecasts and rental demand modeling to AI Investment Scores - so investors can make confident decisions before others spot the opportunity.

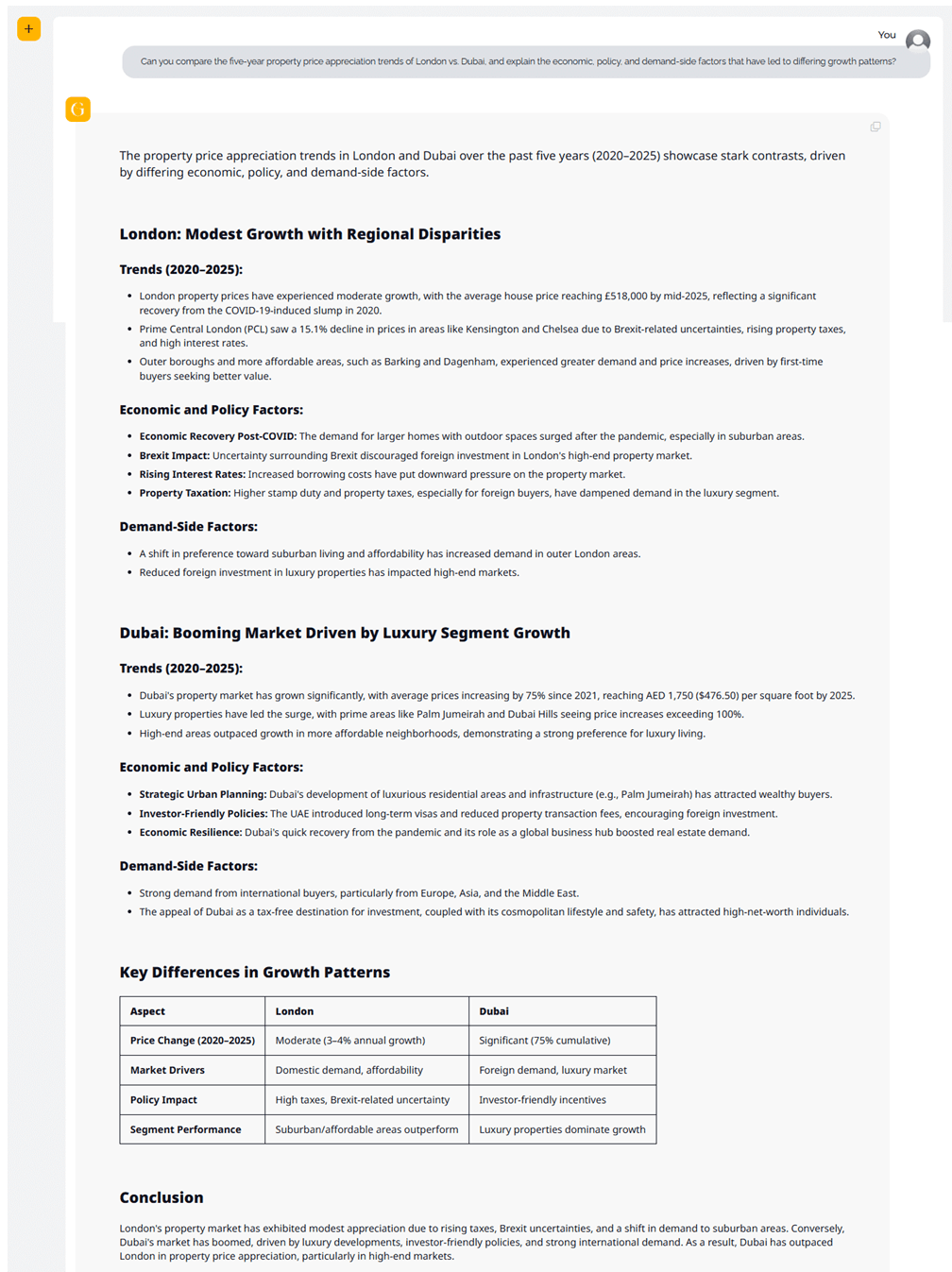

GRAI analyzed the property price appreciation trends in London and Dubai from 2020 to 2025, revealing contrasting growth trajectories shaped by economic, policy, and demand-side factors.

Price Growth: London property prices saw moderate annual growth of 3-4%, with the average house price reaching £518,000 by mid-2025 after recovering from the 2020 COVID-induced slump.

Prime Central London (PCL): High-end areas like Kensington and Chelsea faced a 15.1% price drop, affected by Brexit-related uncertainties, rising taxes, and higher interest rates.

Outer Boroughs: Affordable areas, including Barking and Dagenham, outperformed due to strong demand from first-time buyers seeking better value.

Economic & Policy Drivers:

Demand-Side Dynamics:

Price Growth: Dubai’s property market experienced significant growth of 75% cumulatively since 2021, with average prices reaching AED 1,750 ($476.50) per sq. ft. by 2025.

Luxury Segments: Prime districts like Palm Jumeirah and Dubai Hills led the surge, with price hikes exceeding 100%.

Broader Market: High-end neighborhoods also saw strong performance, supported by demand for luxury living.

Economic & Policy Drivers:

Ambitious urban planning and luxury-focused development attracted global investors.

Investor-friendly policies, including long-term visas and reduced transaction fees, encouraged foreign ownership.

Dubai’s fast-paced economic recovery and global business prominence bolstered real estate momentum.

Demand-Side Dynamics:

Key Comparative Insights

| Aspect | London | Dubai |

|---|---|---|

| Price Change | Moderate (3–4% annual growth) | Significant (75% cumulative) |

| Market Drivers | Domestic demand, affordability | Foreign demand, luxury market |

| Policy Impact | High taxes, Brexit uncertainty | Investor-friendly incentives |

| Top Segments | Suburban/affordable areas | Luxury properties dominate |

GRAI’s Takeaway

London’s growth remained steady yet uneven, with affordable suburban areas outperforming due to tax pressures, Brexit uncertainties, and a shift in buyer preferences. In contrast, Dubai emerged as a top performer, driven by its luxury segment, investor incentives, and surging international demand-cementing its status as a leading global investment destination for 2025.

GRAI’s AI-powered property valuation gives investors precise entry points and projected growth, eliminating guesswork and ensuring maximum capital appreciation.

Related: Dubai Golden Visa Program: Complete Guide to Cost, Benefits & Application Process 2025

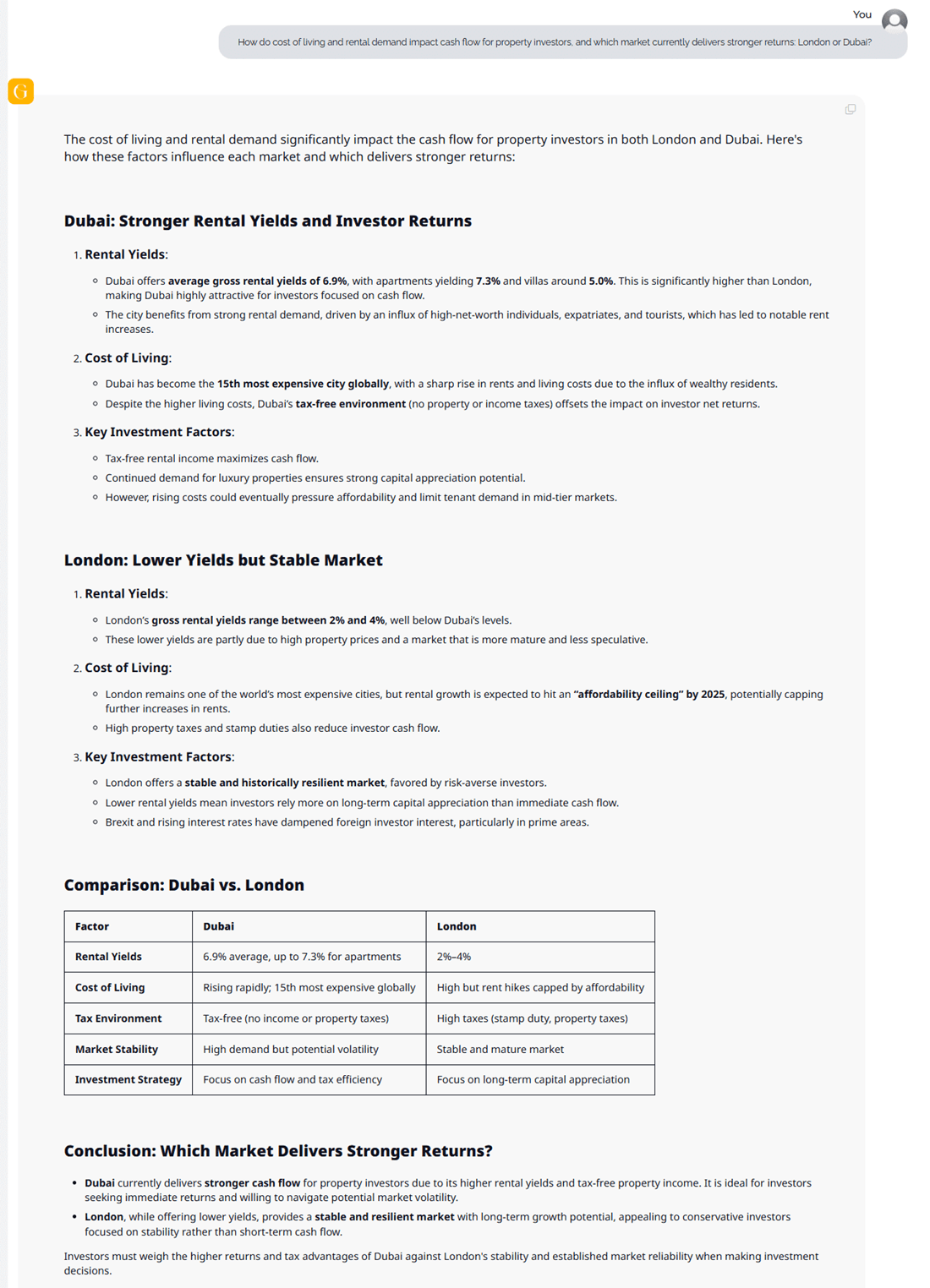

GRAI analyzed the impact of cost of living and rental demand on investor cash flow in London and Dubai, revealing stark differences in returns, tax efficiency, and long-term stability.

Dubai - Stronger Rental Yields and Higher Net Returns

Dubai offers average gross rental yields of 6.9%, with apartments yielding 7.3% and villas around 5.0% - substantially higher than London. Strong rental demand is fueled by an influx of high-net-worth individuals, expatriates, and tourists, resulting in sustained yield growth.

Dubai ranks as the 15th most expensive city globally, with rising rents and living costs due to its growing population of affluent residents. However, its tax-free structure (no property or income taxes) offsets high living costs, preserving investor net returns.

Key Investment Factors:

Tax-free rental income maximizes cash flow.

Ongoing luxury demand underpins capital appreciation.

Rising costs could eventually pressure affordability and demand in mid-tier markets.

London - Lower Yields but a Resilient Market

London’s gross rental yields range between 2% and 4%, significantly below Dubai’s. High property prices and a more mature, less speculative market limit immediate cash-flow gain.

London remains one of the world’s most expensive cities, though rent increases are expected to meet an “affordability ceiling” by 2025, potentially capping further growth. High property taxes and stamp duties further erode investor returns.

Key Investment Factors:

London offers a stable, historically resilient market, appealing to risk-averse investors.

Lower yields push investors to rely more on long-term capital appreciation than short-term cash flow.

Brexit-related uncertainty and rising interest rates have weakened foreign investor appetite, especially in prime districts.

Also Read: How GRAI Delivered Instant, Accurate Cost Estimations for a Home Extension in London, UK

Dubai vs. London – Cash Flow Comparison

| Factor | Dubai | London |

|---|---|---|

| Rental Yields | 6.9% average, up to 7.3% for apartments | 2–4% |

| Cost of Living | Rising; 15th most expensive globally | High but capped by affordability |

| Tax Environment | Tax-free (no property/income taxes) | High taxes (stamp duty, property taxes) |

| Market Stability | High demand, potential volatility | Stable and mature |

| Investment Strategy | Cash flow & tax efficiency focus | Long-term capital appreciation |

GRAI’s Verdict - Which Market Wins on Cash Flow?

Dubai currently provides superior investor cash flow, thanks to higher yields and tax-free income, making it attractive for those prioritizing returns and navigating market volatility.

London, while offering lower yields, remains a stable, resilient market with strong long-term appreciation potential - appealing to conservative investors focused on security over short-term returns.

GRAI’s sentiment analysis predicts shifts in rental preferences by scanning millions of data points - traveller patterns, social trends, and regulations.

London: Short-term rentals can outperform long-term rents by 20-40% in peak seasons, but strict regulations limit flexibility. Properties rented for over 90 days annually often require planning permission and council approval. Long-term leases offer steadier returns and regulatory security.

Dubai: Short-term rentals thrive, supported by year-round tourism, minimal regulations, and tax-free income. Properties near attractions and business hubs routinely outperform long-term lets by 50–100%, making Dubai highly attractive for Airbnb investors.

Investment Accessibility and Market Entry

London: Entry costs are high. Investors face stamp duty land tax (3-12%), survey and legal fees (2–3%), and annual property-related charges. Prime areas require significant upfront capital, and foreign buyers may face additional surcharges.

Dubai: Lower barriers to entry. Investors enjoy no property or capital gains tax, flexible payment plans, and freehold ownership for foreigners in many areas. Streamlined documentation and pro-investor policies make Dubai one of the easiest global markets to enter.

GRAI can even help with reviewing documents like property brochure, contracts and other such documents to help investors quickly navigate due diligence, ensuring compliance and eliminating delays.

Economic Outlook and Currency Considerations

London: A mature, low-volatility market anchored by a diversified economy - finance, tech, and education. However, GBP volatility affects returns for international buyers. Pound weakness has historically attracted foreign capital but necessitates exchange-rate hedging.

Dubai: A fast-growing, diversified economy. The UAE dirham’s peg to the US dollar ensures currency stability, reducing exposure to exchange-rate risk and simplifying international investment planning.

GRAI integrates macroeconomic signals and currency dynamics into its AI Investment Score, giving investors a complete risk-adjusted picture.

Must Read: UK Loses 16,500 Millionaires: What Real Estate Investors Need

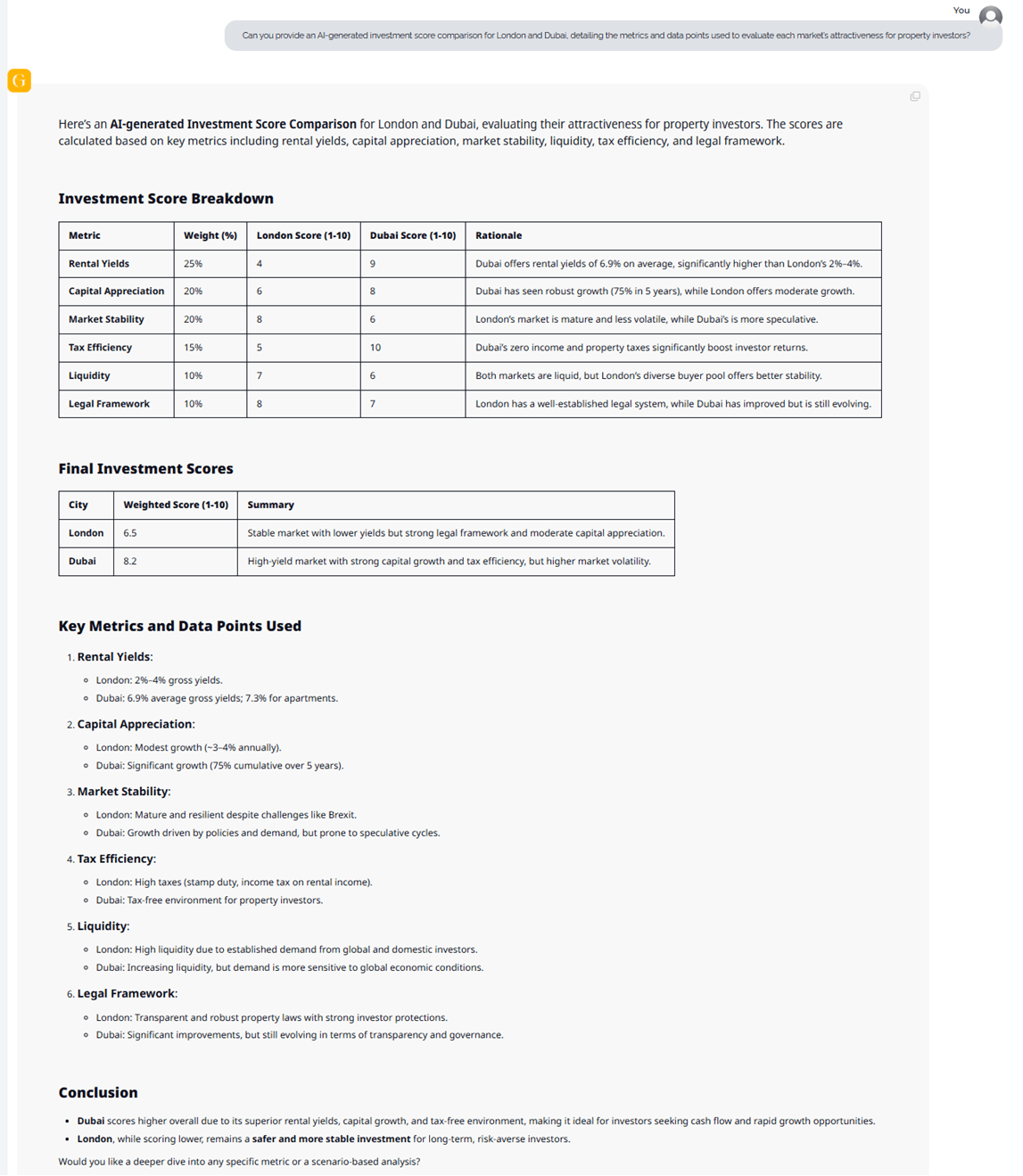

GRAI’s AI-generated Investment Score evaluates London and Dubai’s investment attractiveness using six weighted metrics: rental yields, capital appreciation, market stability, tax efficiency, liquidity, and legal framework. Each city’s score reflects how these factors align with investor goals in 2025.

Investment Score Breakdown

| Metric | Weight (%) | London Score (1–10) | Dubai Score (1–10) | Rationale |

|---|---|---|---|---|

| Rental Yields | 25% | 4 | 9 | Dubai’s average gross rental yield of 6.9% far outpaces London’s 2–4%, making it highly cash-flow attractive. |

| Capital Appreciation | 20% | 6 | 8 | Dubai’s 75% cumulative growth over five years outperforms London’s moderate 3–4% annual rise. |

| Market Stability | 20% | 6 | 6 | London’s mature, less volatile market contrasts Dubai’s faster but more speculative cycles. |

| Tax Efficiency | 15% | 5 | 10 | Dubai’s zero property and income taxes significantly enhance investor net returns. |

| Liquidity | 10% | 7 | 6 | Both markets are highly liquid, but London offers a more stable buyer pool. |

| Legal Framework | 10% | 8 | 7 | London benefits from a transparent and robust legal system, while Dubai’s framework continues to evolve. |

London: 6.5 - A stable, lower-yield market with strong legal infrastructure and moderate growth, appealing to long-term, risk-averse investors.

Dubai: 8.2 - A high-yield, high-growth market offering superior cash flow and tax efficiency but with higher exposure to market volatility.

Key Data Points Driving GRAI’s Verdict

Rental Yields: London’s 2–4% vs. Dubai’s 6.9% average, with apartments yielding up to 7.3%.

Capital Appreciation: London’s steady 3-4% annual growth vs. Dubai’s 75% surge since 2021.

Market Stability: London’s resilient, low-volatility market contrasts Dubai’s opportunity-rich but cyclical performance.

Tax Efficiency: London faces high stamp duties and income taxes, whereas Dubai’s tax-free structure boosts investor ROI.

Liquidity: Both cities are highly liquid, though London maintains steadier demand from global buyers.

Legal Framework: London’s well-established legal system provides greater transparency and investor protection, while Dubai continues improving governance.

GRAI’s Overall Take

Dubai secures the lead with a higher AI Investment Score, driven by exceptional yields, strong capital growth, and unmatched tax efficiency, making it ideal for investors prioritizing cash flow and growth.

London, while trailing in returns, remains the safer, more predictable option for long-term, risk-conscious investors seeking market stability.

By running “what-if” portfolio scenarios, GRAI enables investors to match their strategies to city-specific opportunities.

London: Focus on boroughs benefiting from the Elizabeth Line (Crossrail) ripple effect, major regeneration projects in areas like Battersea, King’s Cross, and Stratford, and long-term housing supply constraints that continue to drive capital growth beyond 2025.

Dubai: Established communities like Marina and Downtown remain safe bets, while emerging developments like Dubai Creek Harbour offer potential upside for early movers

Beyond comparative insights, GRAI empowers investors with:

Real-time global market data and sentiment analysis

Advanced portfolio simulations for multi-city diversification

Environmental impact assessments to safeguard assets

Custom property visualizations for pre-construction planning

From price modeling to cultural contextualization, GRAI’s instant, real-time intelligence turns complex data into actionable investment strategies.

Dubai offers higher yields and faster growth, while London remains a haven for stable, long-term appreciation.

Dubai - no property or capital gains tax, plus easier entry for foreign investors.

London: Kensington, Battersea, King’s Cross. Dubai: Downtown, Marina, Mohammed Bin Rashid City.

Choose London for stability, long-term security, and prestige.

Choose Dubai for higher returns, tax efficiency, and rapid growth.

In 2025, the most successful investors won’t rely on outdated reports - they’ll use GRAI to predict, compare, and act with confidence.