Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Choosing between London and Paris is no longer a simple question of preference - it is a high-stakes financial decision shaping long-term returns for investors, private equity firms, family offices, and global landlords. Both cities remain among the most liquid and stable real estate markets in the world, but the divergence between them is widening.

London is entering a renewed growth cycle after years of recalibration. Paris maintains stability but faces structural constraints, regulatory tightening, and slower upward mobility.

To cut through noise and competing data sources, investors increasingly rely on GRAI, the world’s most advanced AI real estate advisor. GRAI analyzes real-time market signals, economic momentum, regulatory direction, rental demand, environmental risks, and investor sentiment across thousands of channels. This level of insight is no longer optional - it defines competitive advantage.

This consolidated guide merges the strongest ideas, missing elements, and distinctive points from both attached articles, building a single authoritative comparison for investors.

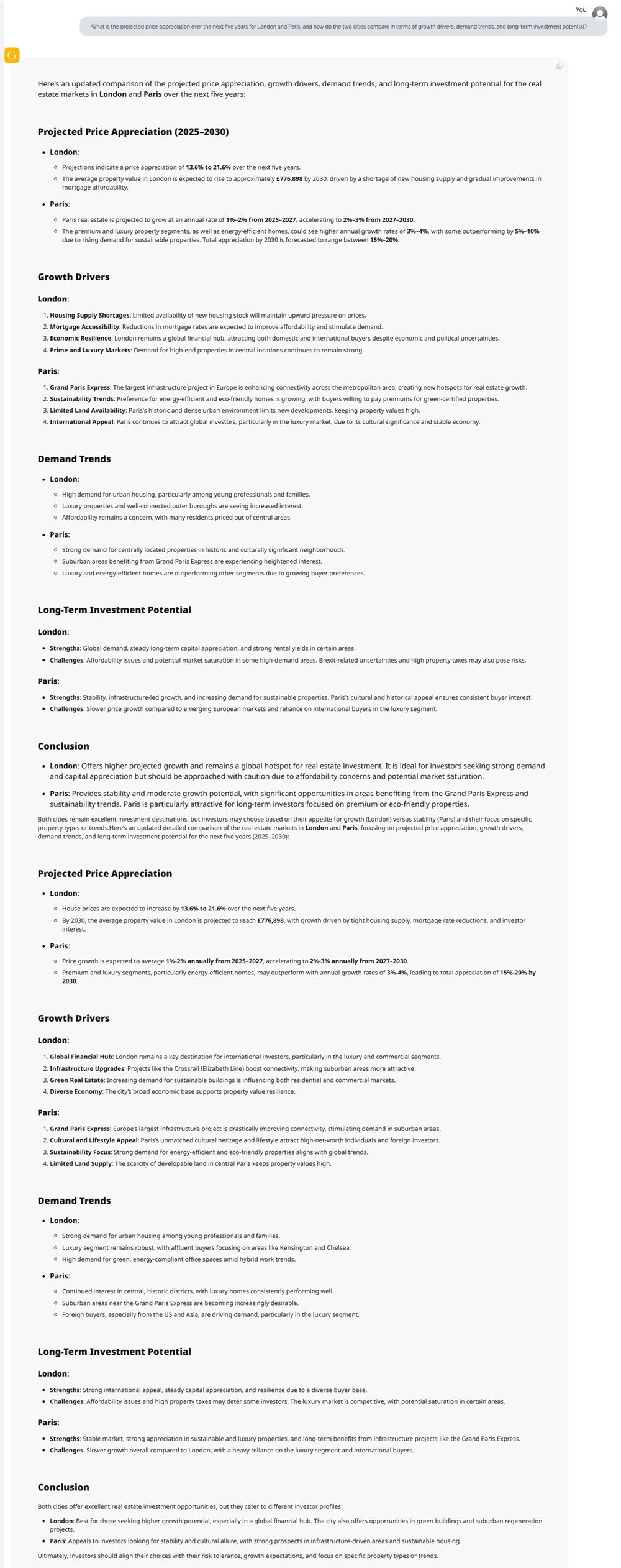

GRAI’s multi-layered analysis of London and Paris highlights two fundamentally strong but structurally different growth trajectories for European real estate investors. Both cities remain blue-chip global markets, yet their drivers, appreciation curves, and long-term investment resilience diverge sharply over the next five years.

London

London continues to show one of the strongest medium-term outlooks in Europe.

Projected Growth: 13+% to 21+% appreciation over the next five years.

Average Price Outlook: Expected to reach £776,898 by 2030, powered by tight supply and improving mortgage affordability.

Market Dynamics: Limited new housing stock and easing interest rates will maintain upward price pressure, especially in high-demand central and commuter-belt zones.

Paris

Paris shows a more moderate but highly stable appreciation path-one strengthened by infrastructure megaprojects and sustainability-led demand.

Projected Growth: 1%-2% annually from 2025–2027, increasing to 2%-3% annually from 2027-2030.

Premium Segment Outlook: Energy-efficient and luxury properties may outperform with 3%-4% annual growth, with total appreciation potentially reaching 15%-20% by 2030.

Underlying Trend: Constrained land supply and strong heritage zoning keep core values resilient.

London

1. Housing Supply Shortages: Limited availability of new homes continues to push prices upward.

2. Mortgage Accessibility: Improving affordability from gradual rate reductions fuels buyer demand.

3. Economic Resilience: Strong business, tech, and financial sectors attract diversified global buyers.

4. Luxury & Prime Markets: Kensington, Chelsea, and central London remain magnets for premium buyers.

Paris

1. Grand Paris Express: Europe’s largest infrastructure project is reshaping connectivity and creating new investment corridors.

2. Sustainability Trends: Strong demand for eco-friendly, energy-efficient homes - increasingly commanding price premiums.

3. Limited Land Availability: Strict development regulations protect property values in historic districts.

4. International Appeal: Cultural significance and lifestyle continue to attract high-net-worth international buyers.

London

Robust demand from young professionals and families seeking urban locations.

Upscale buyers increasingly focus on prime boroughs with strong international appeal.

High interest in green-certified properties and hybrid-work-friendly spaces.

Paris

Consistently strong demand for centrally located homes with historic cachet.

Suburban zones along the Grand Paris Express lines gaining desirability.

Luxury and energy-efficient properties outperforming other segments due to shifting buyer preferences.

London

Strengths:

Global financial center attracting international capital.

Strong rental yields in select areas.

High resilience and long-term appreciation potential.

Challenges:

Affordability constraints and localized market saturation.

High property taxes may deter some investors.

Paris

Strengths:

Highly stable market backed by infrastructure expansion and premium demand.

Strong appreciation prospects in luxury and sustainable property segments.

Long-term upside in emerging zones influenced by the Grand Paris Express.

Challenges:

Slower growth profile than London.

Heavy dependence on luxury and international buyers for top-end performance.

Take Away

London and Paris both remain elite global real estate destinations-but they appeal to fundamentally different investor profiles:

London offers higher appreciation potential, strong international liquidity, and robust rental performance. It is best suited for investors seeking growth, diversification, and financial-hub stability.

Paris delivers moderate but highly stable long-term growth, underpinned by cultural heritage, infrastructure megaprojects, and rising demand for sustainable living.

Ultimately, the choice depends on risk tolerance and investment priorities:

London for higher-growth momentum; Paris for stability, culture, and sustainability-driven appreciation.

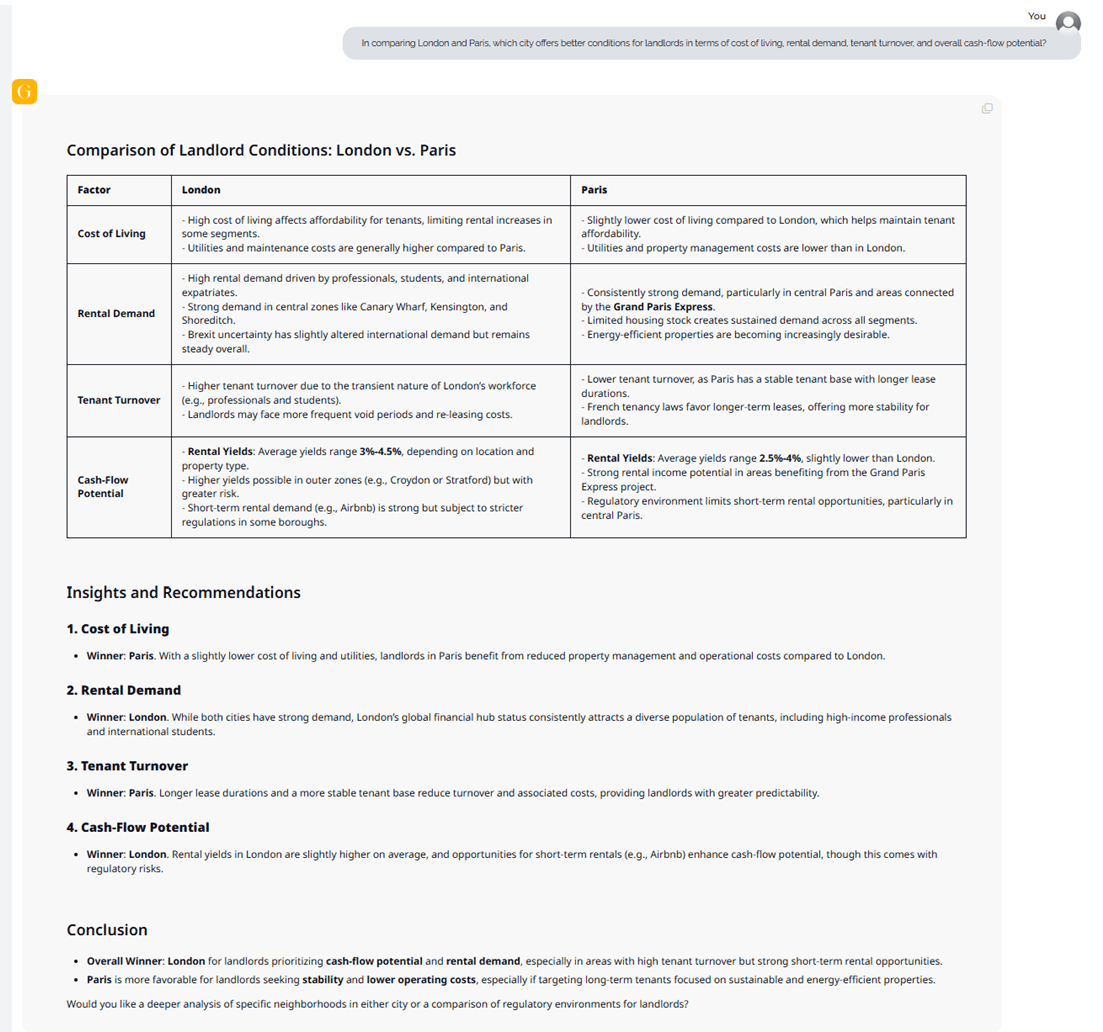

GRAI’s deep-dive comparison of landlord conditions in London and Paris reveals two very different operating environments shaped by cost structures, rental demand, tenant turnover, and cash-flow potential. While both cities remain global investment magnets, their profitability profiles diverge significantly depending on investor goals.

Operational efficiency strongly influences net returns, and here Paris has a clear edge.

Paris

Slightly lower cost of living compared to London helps maintain tenant affordability.

Utilities and property management expenses are generally lower.

Lower operating costs translate into more efficient landlord margins, especially for long-term rentals.

London

A higher cost of living limits rental increases in many segments.

Maintenance and management costs tend to be higher relative to Paris.

Affordability pressures can reduce the pace at which rents can grow.

Winner: Paris

For landlords who prioritize operational efficiency, Paris offers better cost structures and lower overheads.

Despite affordability challenges, London continues to outperform Paris in demand velocity and tenant composition.

London

Exceptionally strong rental demand driven by:

• Professionals

• Students

• International expatriates

High demand in prime centers like Canary Wharf, Kensington, Shoreditch.

Brexit has introduced slight uncertainty, but overall demand remains resilient.

Paris

Demand remains strong in:

• Historic districts

• Central arrondissements

• Locations connected by the Grand Paris Express

Limited housing stock keeps Paris competitive, especially for long-term renters.

Surge in demand for energy-efficient homes.

Winner: London

London’s global financial hub status keeps tenant demand consistently high, feeding a deep and diversified rental base.

Turnover directly affects landlord costs-from vacancy periods to re-leasing logistics.

Paris

Generally lower tenant turnover due to stronger tenant protection laws and longer lease durations.

This stability reduces:

• Vacancy risk

• Re-leasing expenses

• Operational unpredictability

London

Faces higher turnover, driven by:

• A mobile workforce

• International students

• Shorter lease terms

More frequent re-listing and renewal cycles increase overhead.

Winner: Paris

Paris offers landlords a calmer, more predictable rental environment.

GRAI’s yield comparison shows both cities are competitive, but London edges ahead.

London

Rental yields typically, 3%-4.5%, depending on location and asset class.

Suburban zones such as Croydon or Stratford may deliver higher yields with higher risk.

Short-term rentals (Airbnb) show strong income potential but face stricter borough-level regulations.

Paris

Rental yields average 2.5%-4%, slightly lower than London.

Properties near Grand Paris Express corridors show strong upward yield potential.

Short-term rental opportunities exist but are heavily capped in many central districts.

Winner: London

London provides stronger yield upside and better short-term rental margins - though regulations must be navigated carefully.

Best for Cash Flow & Rental Demand: London

Landlords targeting yield performance and consistent tenant inflows will find London more rewarding, especially in high-demand hubs and selected suburban markets.

Best for Operational Efficiency & Lower Costs: Paris

Paris favors investors prioritizing lower operating costs, longer lease durations, and tenant stability. Sustainable and energy-efficient housing segments offer especially attractive long-term prospects.

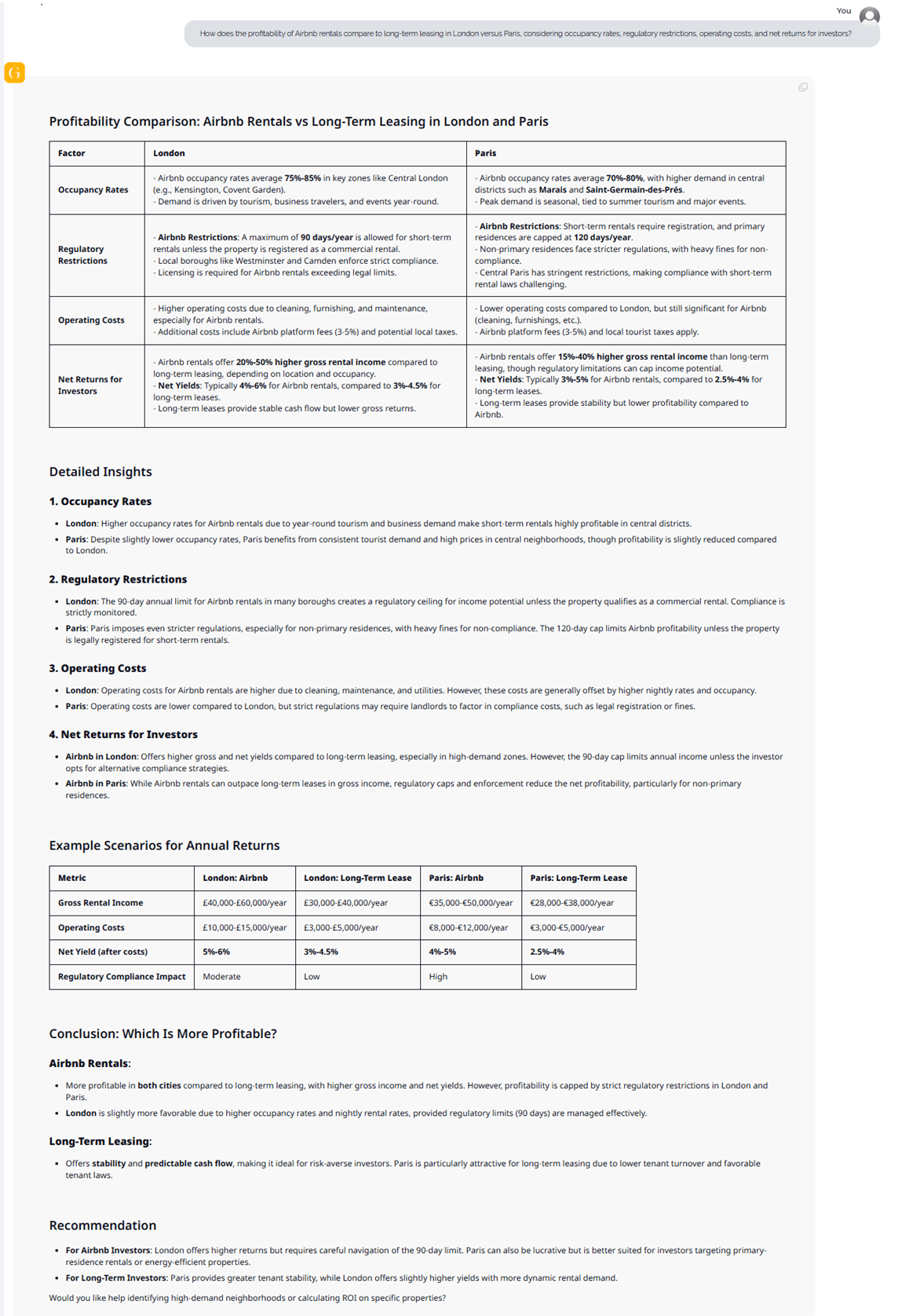

When comparing short-term (Airbnb) rentals and long-term leasing across London and Paris, investors must carefully evaluate occupancy patterns, regulatory barriers, operating costs, and net returns. GRAI’s detailed analysis highlights clear differences between the two global cities-revealing which strategy performs best depending on investor goals.

1. Occupancy Rates

London

Airbnb occupancy rates are strong at 75%-85% in high-demand zones (Kensington, Covent Garden).

Year-round business and leisure tourism sustain demand.

Paris

Occupancy averages 70%-80%, highest in central districts like Marais and Saint-Germain-des-Prés.

Demand is more seasonal, especially in summer and cultural peak periods.

Verdict: London benefits from more stable, year-round occupancy, making short-term rentals consistently profitable

2. Regulatory Restrictions

London

90-day annual cap for Airbnb rentals unless the property is registered as a commercial asset.

Local councils like Westminster enforce strict penalties for non-compliance.

Licensing is mandatory for Airbnb rentals exceeding legal limits.

Paris

Paris enforces Europe’s strictest Airbnb rules :

• Primary residences capped at 120 nights/year.

• Non-primary homes require full commercial registration.

Heavy fines and close enforcement reduce profit potential for unregistered hosts.

Verdict: Paris is significantly more restrictive, requiring legal navigation that may reduce Airbnb profitability.

3. Operating Costs

London

High operating costs due to cleaning, utilities, guest turnover, furnishing, and repairs.

Additional Airbnb platform fees + compliance expenses.

Paris

Operating costs slightly lower than London, though still significant.

Costs rise for luxury-grade fittings and professional cleaning.

Verdict: Paris offers marginally lower operating costs, but regulatory costs can outweigh savings.

4. Net Returns for Investors

London

Airbnb yields deliver 20%-50% higher gross rental income than long-term leases.

Gross returns:

• Airbnb: Typically 4%-6%

• Long-term leases: 3%-4.5%

Long-term leases offer lower income but greater stability.

Paris

Airbnb returns offer 15%–40% higher gross income than long-term leasing but are heavily capped by regulation.

Gross returns:

• Airbnb: 3%-5%

• Long-term leases: 2.5%-4%

Verdict: London Airbnb investors generally outperform Paris due to fewer restrictions and stronger occupancy.

1. Occupancy Dynamics

London: Year-round business travel and tourism boost occupancy for Airbnb hosts.

Paris: Solid demand, but seasonality reduces overall consistency vs. London.

2. Regulatory Barriers

London: 90-day rule affects income ceiling unless commercial licensing is pursued.

Paris: Tougher enforcement, penalties, and zoning laws significantly limit Airbnb earnings.

3. Operational Burden

Short-Term Rentals: High management effort in both cities due to cleaning and guest turnover.

Long-Term Leases: Far lower involvement, stable tenants, predictable maintenance.

4. Net Yield Reality

London Airbnb: Highest yield potential when rules are managed correctly.

Paris Airbnb: High gross income but reduced net due to regulatory caps.

Long-Term Leasing (Both): Lowest risk and most stable flow, but lower yearly returns.

| Metric | London: Airbnb | London: Long-Term Lease | Paris: Airbnb | Paris: Long-Term Lease |

|---|---|---|---|---|

| Gross Rental Income | £40,000–£60,000/yr | £30,000–£40,000/yr | €35,000–€50,000/yr | €28,000–€38,000/yr |

| Operating Costs | £10,000–£15,000/yr | £3,000–£5,000/yr | €8,000–€12,000/yr | €3,000–€5,000/yr |

| Net Yield (after costs) | 5%–6% | 3%–4.5% | 4%–5% | 2.5%–4% |

| Regulatory Impact | Moderate | Low | High | Low |

London:

More profitable vs. long-term leasing.

Higher occupancy, higher nightly rates, lower seasonality.

Regulatory limit (90-day rule) is the key challenge-but still manageable with correct structuring.

Paris:

Can yield strong income only for primary residences.

Strict rules and enforcement significantly cap income for non-primary homes.

Best for stability:

Lower risk, predictable yields, minimal management.

Particularly attractive in Paris, where tenant laws favor long-term stability.

Choose London Airbnb, particularly in high-demand zones-provided compliance with the 90-day rule is planned.

Choose Paris Long-Term Leasing, ideal for investors prioritizing predictable income and low turnover.

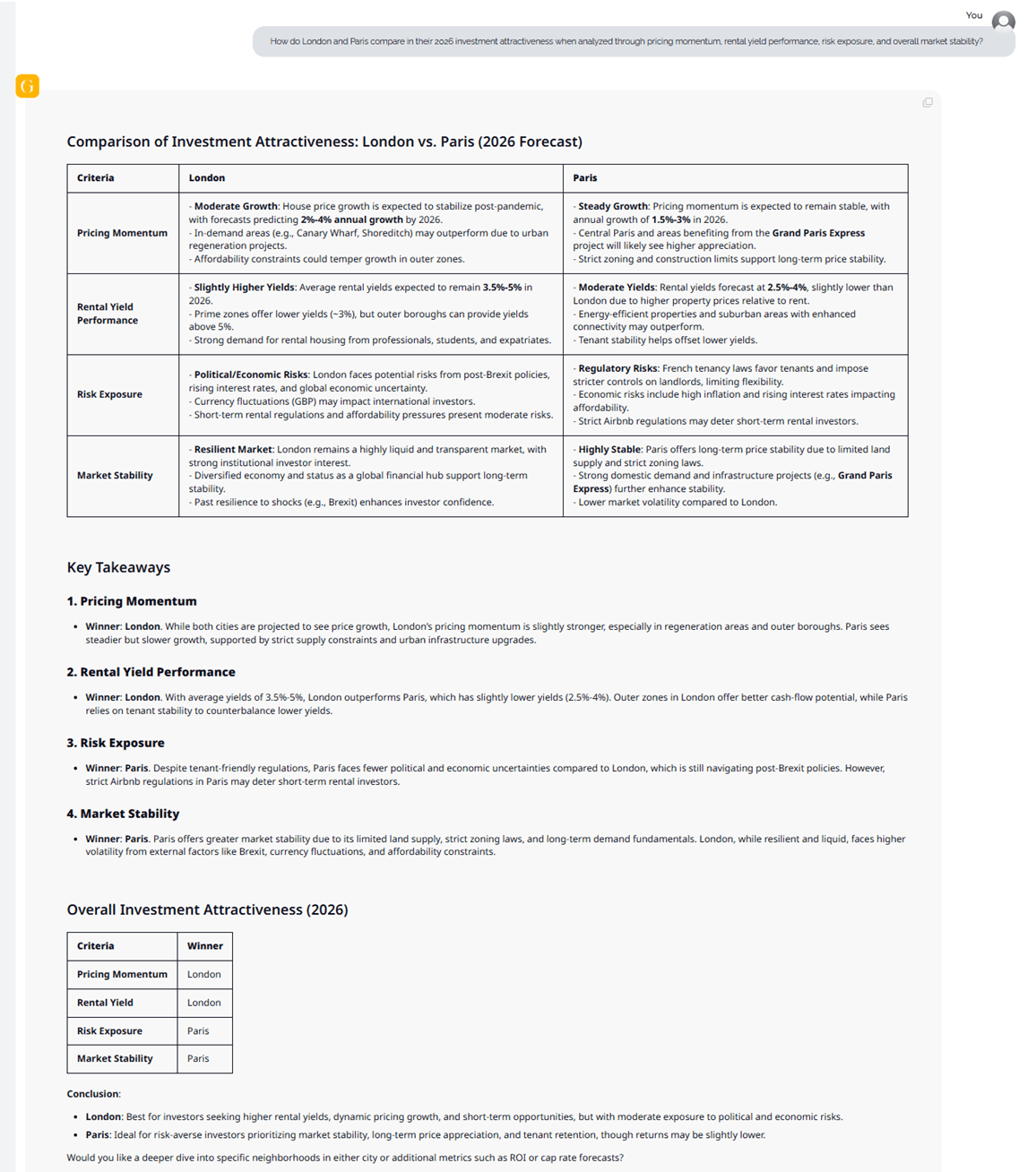

London and Paris remain two of Europe’s most influential real estate markets - but their investment profiles diverge sharply when analyzed through pricing momentum, rental yields, risk exposure, and long-term stability. GRAI’s 2026 evaluation reveals how the two cities stack up across the major performance indicators that matter most to investors.

London

London is projected to experience moderate but rising pricing momentum, with property values stabilizing post-pandemic and expected to grow 2%-4% annually by 2026. Regeneration areas such as Canary Wharf and Shoreditch may outperform due to infrastructure upgrades and continued urban revitalization. However, affordability pressures could constrain growth in some outer zones.

Paris

Paris demonstrates steady and more consistent pricing momentum, with 1%-3% annual growth supported by demand in central boroughs and continued benefits from the Grand Paris Express. Strong zoning and persistent supply limitations help maintain price stability, with infrastructure megaprojects further strengthening long-term appreciation potential.

Pricing Momentum Winner: London

While growth rates are similar, London’s regeneration zones and post-recovery upswing provide stronger upside potential.

London

Average rental yields are expected to remain between 3.5%–5%, with prime areas offering slightly lower yields but high demand from professionals and expatriates. Outer boroughs continue to present attractive cash-flow opportunities. Housing pressure, immigration, and strong tenant demand contribute to consistent leasing performance.

Paris

Paris yields remain more conservative at 2.5%–4%, driven by long-term tenant retention and strict rental regulations. Energy-efficient homes and suburban areas with improved connectivity may edge higher yields, but citywide returns remain lower than London’s.

Rental Yield Performance Winner: London

Higher yields and a more dynamic rental market give London an advantage, despite stricter affordability barriers.

London

London’s risk profile remains elevated due to lingering uncertainty from post-Brexit policies, regulatory shifts, inflation, and currency volatility. Despite its global investor appeal and strong institutional confidence, near-term risks persist across affordability and rental reforms.

Paris

Paris faces significantly lower risk exposure, thanks to its stable tenant laws, limited housing supply, and long-standing demand fundamentals. French tenancy laws ensure lower turnover and predictable occupancy, though strict rules on short-term rentals may hinder some investor strategies.

Risk Exposure Winner: Paris

Paris provides stronger defensive characteristics for risk-averse investors seeking long-term predictability.

London

London continues to position itself as one of the world’s most transparent and liquid real estate markets. Its resilient financial sector and global capital flows reinforce stability, though market volatility can increase during periods of political or economic uncertainty.

Paris

Paris displays exceptionally high market stability, driven by strict zoning laws, low housing turnover, and tightly controlled supply. Additionally, major infrastructure investments such as the Grand Paris Express expand commuter demand, reinforcing long-term resilience. With lower volatility than London, Paris offers greater certainty for stability-oriented investors.

Market Stability Winner: Paris

1. Pricing Momentum

Winner: London

Stronger recovery cycles and regeneration-led upside outperform Paris’s slower but steadier growth.

2. Rental Yield Performance

Winner: London

London’s yields outpace Paris across most boroughs, making it more income-driven investor friendly.

3. Risk Exposure

Winner: Paris

Lower volatility, resilient demand, and tenant protections reduce investment risk.

4. Market Stability

Winner: Paris

Stable pricing, strict supply constraints, and long-term fundamentals make Paris the more predictable market.

| Criteria | Winner |

|---|---|

| Pricing Momentum | London |

| Rental Yield | London |

| Risk Exposure | Paris |

| Market Stability | Paris |

London:

Best suited for investors seeking higher rental yields, stronger short-term pricing momentum, and strategic upside from regeneration districts. Ideal for those willing to tolerate moderate political and economic fluctuations in exchange for higher growth potential.

Paris:

Ideal for risk-averse investors prioritizing stability, long-term tenant retention, predictable appreciation, and lower market volatility. While yields may be lower, Paris offers stronger resilience and certainty-especially for long-term, wealth-preservation focused portfolios.

Before making your investment decision, analyze both cities inside GRAI. Compare districts, forecast appreciation, evaluate rental demand, and generate a real-time AI Investment Score instantly.

In global real estate, precision separates winners from the rest-and GRAI is the only platform that delivers it.