Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Mumbai, India’s financial powerhouse, is entering a transformative phase in its property market. From South Mumbai’s ultra-luxury apartments to Bandra’s high-demand lifestyle hubs, Juhu’s beachfront villas, and Worli’s skyline-defining towers, the city continues to attract global investors seeking high returns and portfolio diversification.

Backed by India’s robust GDP growth and major infrastructure projects like the Mumbai Coastal Road, Metro expansions, and Sea Link upgrades, Mumbai real estate remains one of the most resilient markets globally. According to industry reports, luxury housing sales grew 11% in H1 2025, and Bandra West saw a 192% increase in transaction value-signals of a market that’s heating up faster than ever.

But this growth comes with complexity: environmental risks, policy shifts, and fluctuating rental yields make navigating Mumbai’s property landscape a challenge even for seasoned investors. Enter GRAI, the world’s smartest AI-driven real estate advisor, designed to transform speculation into data-backed strategy. With predictive analytics, climate risk assessments, automated legal review, and instant property valuation, GRAI empowers buyers and investors to make smarter decisions in seconds.

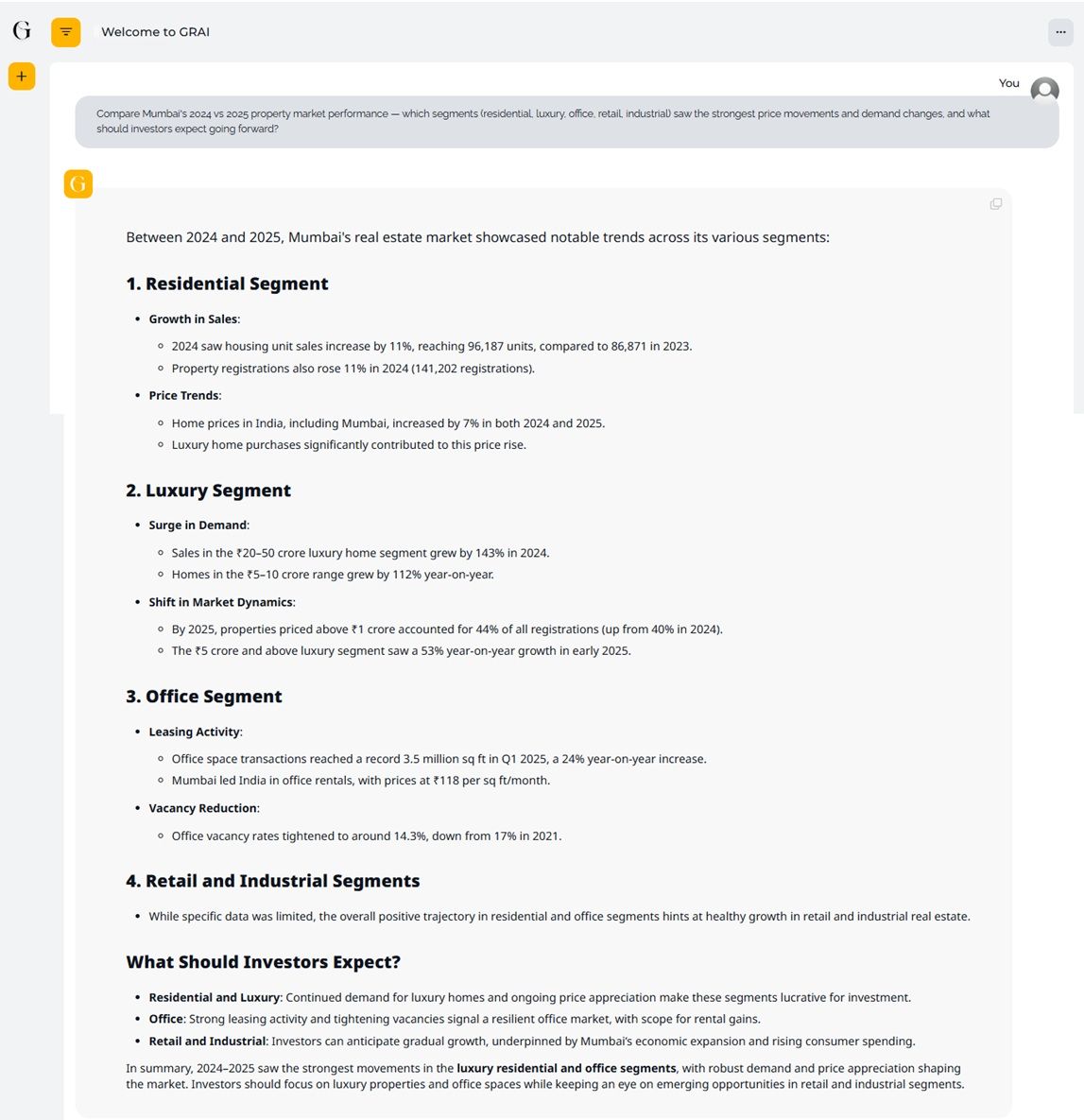

Between 2024 and 2025, Mumbai’s real estate market demonstrated strong performance across multiple segments, with luxury housing and office spaces emerging as the clear frontrunners in both demand and price appreciation.

1. Residential Segment

Sales Growth: Housing sales in 2024 rose by 11%, reaching 96,187 units versus 86,871 units in 2023. Property registrations also climbed, with 141,202 registrations recorded in 2024.

Price Trends: Home prices across Mumbai increased by 7% in 2024 and are forecast to rise by another 7% in 2025. Luxury home purchases were a significant driver of this price surge.

2. Luxury Segment

Demand Surge: The INR 20–50 crore luxury segment witnessed 143% sales growth in 2024, while homes in the INR 5–10 crore bracket expanded by 112% year-on-year.

Market Dynamics Shift:

By early 2025, properties priced above INR 1 crore accounted for 44% of registrations, up from 40% in 2024.

The INR 5 crore+ ultra-luxury segment saw a 53% year-on-year sales increase in Q1 2025, underlining investor confidence in premium housing.

3. Office Segment

Leasing Activity: Office leasing hit a record 3.5 million sq. ft. in Q1 2025, a 24% increase year-on-year, reflecting robust corporate expansion.

Rental Growth: Rents in Mumbai’s prime office districts reached INR 118 per sq. ft./month, supported by sustained occupier demand.

Vacancy Decline: Office vacancy rates fell to 14.3%, down from 17% in 2021, underscoring tightening supply in premium business districts.

4. Retail and Industrial Segments

While retail and industrial data were less detailed, the overall market trajectory signals gradual but steady growth in these categories, buoyed by rising consumer spending and ongoing economic expansion.

What Should Investors Expect?

Residential & Luxury: Continued strong momentum in luxury housing and steady price growth make these prime investment opportunities.

Office: Resilient office leasing and falling vacancy rates highlight Mumbai’s office market as a strong candidate for rental income gains.

Retail & Industrial: While growth is slower, these segments present long-term opportunities, particularly as consumption strengthens and supply chain investments expand.

AI-Powered Market Outlook

GRAI’s AI-driven analysis highlights that 2024–2025 will be defined by luxury residential and office segments, both delivering strong returns on investment.

Investors should prioritize luxury homes and premium office spaces, while maintaining selective exposure to retail and industrial properties for balanced portfolio growth.

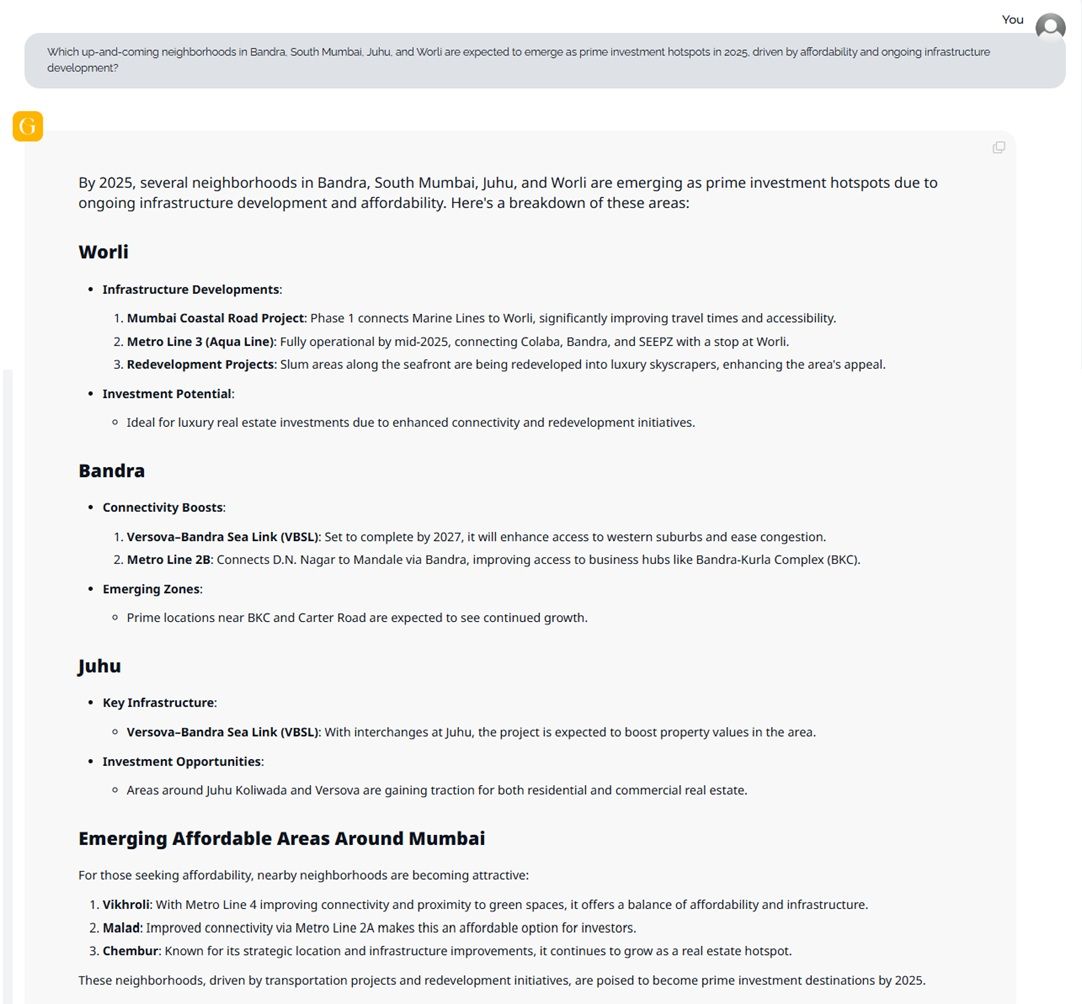

By 2025, several prime and emerging neighborhoods in Mumbai are expected to offer strong real estate investment opportunities, supported by large-scale infrastructure projects and rising affordability. Key hotspots include Worli, Bandra, Juhu, and South Mumbai, along with emerging affordable areas around the city.

Worli

Infrastructure Drivers:

Mumbai Coastal Road Project (Phase 1): Connecting Marine Lines to Worli, this development will significantly cut travel times and improve accessibility.

Metro Line 3 (Aqua Line): Scheduled for full operation by mid-2025, with slight delay linking Colaba, Bandra, Worli, and SEEPZ.

Redevelopment Projects: Slum rehabilitation along the seafront is being transformed into luxury skyscrapers, enhancing Worli’s appeal as a luxury hub.

Investment Potential:

Bandra

Connectivity Boosts:

Versova–Bandra Sea Link (VBSL): Expected by 2027, easing congestion and improving access to western suburbs.

Metro Line 2B: Linking D.N. Nagar to Mandale via Bandra, improving access to commercial hubs like Bandra-Kurla Complex (BKC).

Emerging Zones:

Juhu

Infrastructure Support:

Investment Opportunities:

Emerging Affordable Areas Around Mumbai

For buyers and investors seeking affordability without compromising on connectivity, several peripheral neighborhoods are rising in prominence:

Vikhroli: With Metro Line 4 improving connectivity and proximity to green spaces, it balances affordability with quality of life.

Malad: Improved accessibility via Metro Line 2A makes this one of Mumbai’s most attractive affordable markets.

Chembur: With strategic location and transport upgrades, Chembur continues to grow as a mixed-use residential and commercial hotspot.

Why These Neighborhoods Stand Out

Prime Hubs (Worli, Bandra, Juhu): Offer luxury appreciation potential backed by mega-projects like the Mumbai Coastal Road, VBSL, and Metro connectivity.

Affordable Corridors (Vikhroli, Malad, Chembur): Provide entry-level opportunities for investors seeking value, with the upside of long-term infrastructure-led growth.

GRAI’s AI-driven outlook highlights that by 2025, Mumbai’s neighborhoods will experience distinct growth trajectories-luxury hubs like Worli and Bandra will see strong appreciation, while emerging affordable zones like Vikhroli and Malad will deliver steady, value-driven opportunities.

Mumbai’s property market is hyper-local, and micro-market knowledge can make or break ROI. GRAI’s AI-Powered Property Valuation delivers location-specific pricing and appreciation forecasts.

| Neighborhood | Highlights | AI Insights |

|---|---|---|

| South Mumbai | Heritage luxury, ultra-premium apartments, and limited land availability. | Prices expected to appreciate 10–12% in 2025, making it a defensive, high-growth investment. |

| Bandra | Celebrity enclave, upscale nightlife, and commercial potential. | A 192% surge in sales for 2025 highlights booming demand, with rental yields adjusting to 3–5%. |

| Juhu | Iconic beachfront properties and film industry connections. | Short-term rental yields of 2–4% annually through Airbnb-ready assets. |

| Worli | Luxury towers and strategic location near Coastal Road and Sea Link. | AI forecasts 20–30% price growth post-infrastructure completion. |

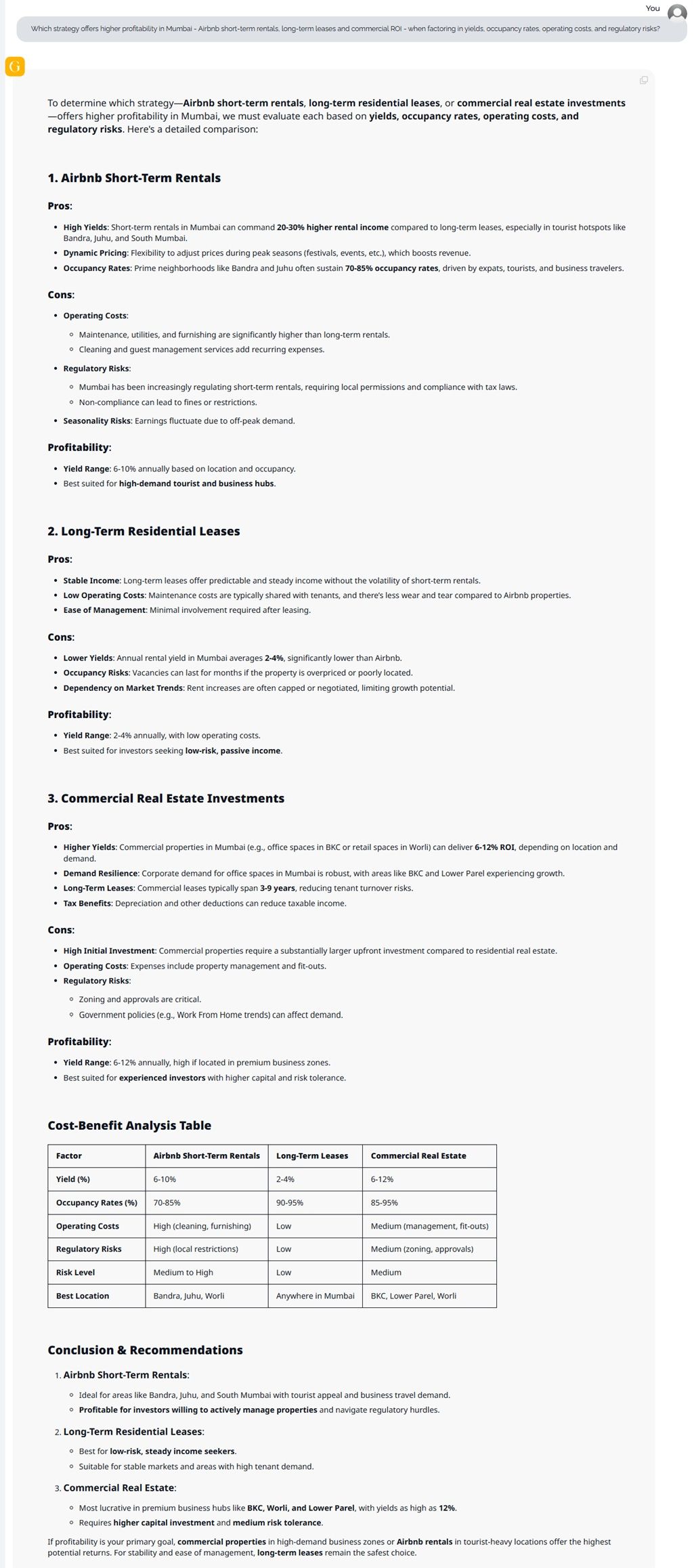

Mumbai’s rental investment landscape in 2025 offers diverse opportunities, ranging from Airbnb short-term rentals in tourist hubs to long-term leases in established neighborhoods, and commercial real estate investments in high-demand business districts. GRAI’s AI-driven evaluation compares these strategies based on yields, occupancy, costs, and risks to help investors determine the most profitable path.

1. Airbnb Short-Term Rentals

Pros:

Deliver 20-30% higher rental income compared to traditional leases in hotspots like Bandra, Juhu, and South Mumbai.

Flexibility through dynamic pricing during festivals and peak seasons boosts earnings.

Strong demand with 70-85% occupancy rates, driven by tourists, business travellers, and expats.

Cons:

High operating costs from cleaning, utilities, and guest services.

Increasing regulatory scrutiny in Mumbai, requiring permits and tax compliance.

Seasonal fluctuations impacting revenue stability.

Profitability:

Yield range is in the range of 6–10% annually, with strong returns in high-demand hubs.

Best suited for active investors targeting tourist and business markets.

2. Long-Term Residential Leases

Pros:

Provide stable, predictable income with minimal management effort.

Low operating costs as many expenses are shared with tenants.

Cons:

Lower yields of 2–4% annually, significantly below Airbnb returns.

Vacancy risk if properties are overpriced or poorly located.

Limited rental growth due to capped or negotiated rates.

Profitability:

3. Commercial Real Estate Investments

Pros:

Higher yields, with 6 –12% ROI achievable in prime districts like BKC, Worli, and Lower Parel.

Long-term tenant stability through 3-9 years leases.

Tax benefits through depreciation and deductions.

Cons:

Requires substantially higher upfront investment compared to residential properties.

Operating and fit-out costs can be significant.

Subject to zoning approvals and policy risks (e.g., work-from-home trends).

Profitability:

Yield range is 6–12% depending on location and tenant profile.

Best suited for experienced investors with larger capital and medium risk appetite.

| Factor | Airbnb Rentals | Long-Term Leases | Commercial Real Estate |

|---|---|---|---|

| Yield (%) | 6–10% | 2–4% | 6–12% |

| Occupancy Rates (%) | 70–85% | 90–95% | 85–95% |

| Operating Costs | High | Low | Medium |

| Regulatory Risks | High | Low | Medium |

| Risk Level | Medium–High | Low | Medium |

| Best Locations | Bandra, Juhu, Worli | Across Mumbai | BKC, Worli, Lower Parel |

Strategic Takeaways for 2025

Airbnb Short-Term Rentals: Most profitable in tourist-heavy areas like Bandra and Juhu, but require active management and regulatory compliance.

Long-Term Leases: Safest route for passive income seekers, delivering steady returns with minimal effort.

Commercial Real Estate: Offers the highest ROI potential in business hubs but demands high capital and tolerance for policy-related risks.

GRAI’s AI-driven analysis suggests a balanced strategy: investors prioritizing maximum profitability should target Airbnb in tourist hubs or commercial assets in premium districts, while those seeking stability and ease should favor long-term residential leases.

Mumbai’s geographical location and regulatory environment make risk assessment crucial:

Climate Risks:

Coastal flooding and monsoon strain affect property accessibility.

GRAI’s Environmental Impact Assessments evaluate sea-level rise projections and flood risk for every micro-market.

Properties in elevated or newly developed zones with advanced drainage infrastructure command a price premium.

Political and Regulatory Factors:

Changes in FDI policies, redevelopment laws, and property taxation can significantly impact liquidity.

Mumbai’s supportive stance for urban redevelopment and infrastructure expansion continues to attract foreign capital, but ongoing monitoring is essential.

GRAI’s Global Insights capabilities tracks government updates, giving users an informed and unbiased insight into ramifications of such changes.

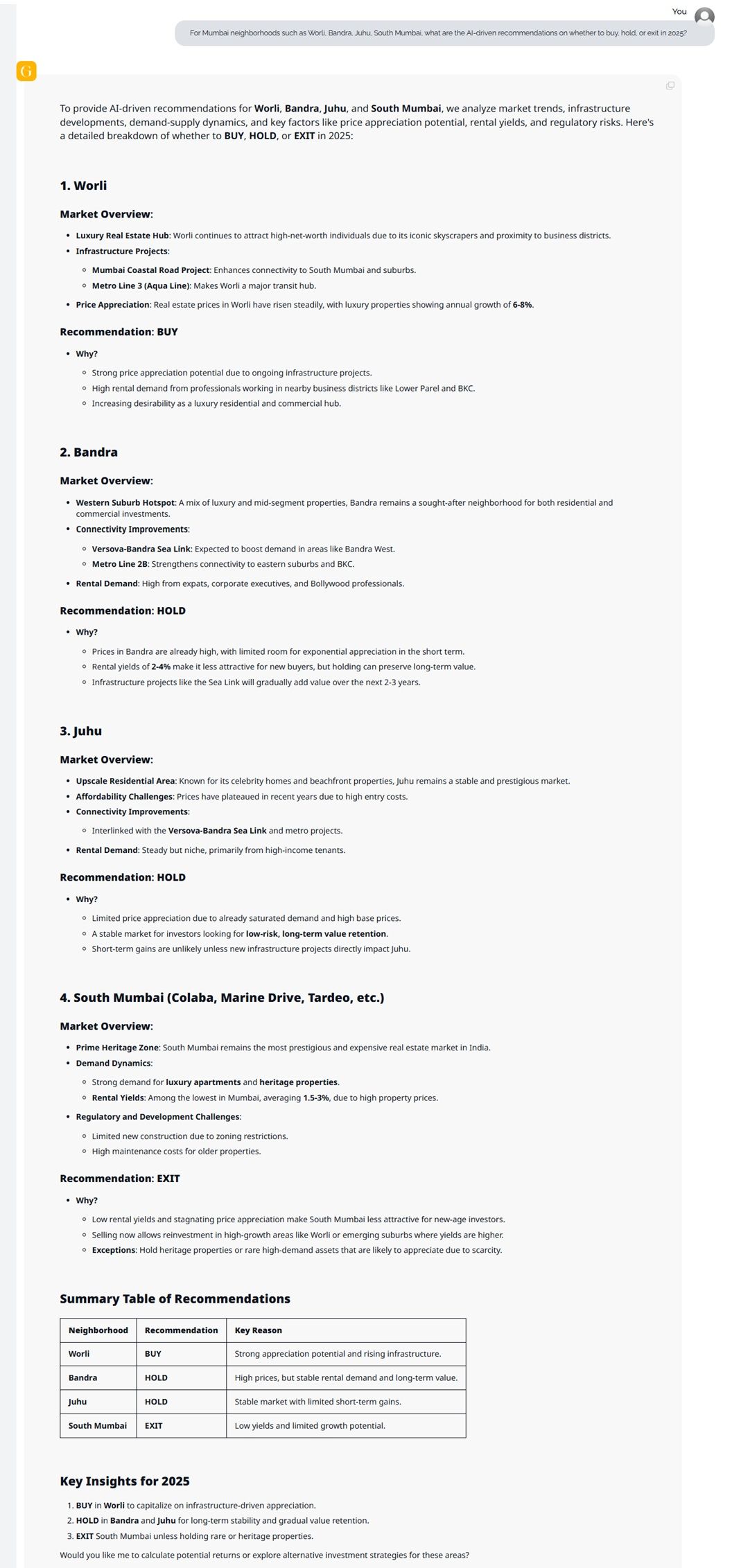

To help investors navigate Mumbai’s complex real estate market in 2025, GRAI analyzed market trends, infrastructure upgrades, demand-supply dynamics, rental yields, and regulatory risks across key neighborhoods - Worli, Bandra, Juhu, and South Mumbai.

Based on GRAI’s evaluation, here are the investment actions to consider:

1. Worli – BUY

Market Overview

A prime hub for luxury residential and commercial real estate, Worli continues to attract high-net-worth individuals due to its skyline and proximity to Lower Parel and BKC.

Major infrastructure projects - Mumbai Coastal Road and Metro Line 3 (Aqua Line) - are transforming Worli into a key transit hub.

Luxury properties are witnessing 6-8% annual price appreciation, with steady demand from professionals and global investors.

Why BUY?

Strong appreciation potential fueled by infrastructure upgrades.

Rising demand from corporate professionals working in nearby districts.

Increasing desirability as both a residential and commercial hub.

2. Bandra – HOLD

Market Overview

Known as the western suburb hotspot, Bandra blends luxury homes with mid-segment residential and commercial investments.

Infrastructure upgrades like the Versova-Bandra Sea Link and Metro Line 2B are boosting connectivity to the suburbs and BKC.

Strong rental demand from expats, executives, and Bollywood professionals.

Why HOLD?

Property prices are already high, leaving limited room for short-term growth.

Rental yields of 2–4% are relatively low for new buyers.

Holding preserves long-term value as infrastructure projects gradually enhance the area over the next 2–3 years.

3. Juhu – HOLD

Market Overview

A prestigious upscale residential zone, Juhu is famous for celebrity homes and beachfront properties.

Prices have plateaued in recent years due to high entry costs and affordability challenges.

Connectivity is improving via the Versova-Bandra Sea Link and metro projects.

Rental demand is steady but limited to niche, high-income tenants.

Why HOLD?

Price appreciation potential is capped due to market saturation and high base pricing.

Best suited for investors seeking low-risk, long-term value stability.

Short-term gains unlikely unless new infrastructure directly impacts the locality.

4. South Mumbai (Colaba, Marine Drive, Tardeo, etc.) - EXIT

Market Overview

Mumbai’s heritage and prime luxury zone, South Mumbai continues to attract ultra-high-net-worth buyers for its heritage apartments and iconic locations.

However, rental yields average only 1.5-3%, among the lowest in the city, due to extremely high property prices.

Development is limited by zoning restrictions, while maintenance costs remain high.

Why EXIT?

Limited growth potential and stagnating appreciation make it unattractive for new-age investors.

Selling now allows reinvestment in high-growth areas like Worli or emerging suburbs.

Exception: Retain rare heritage or unique high-demand properties that may appreciate due to scarcity.

| Neighborhood | Recommendation | Key Reason |

|---|---|---|

| Worli | BUY | Strong appreciation potential and infrastructure-driven growth |

| Bandra | HOLD | High entry prices but strong long-term value retention |

| Juhu | HOLD | Stable market with limited short-term upside |

| South Mumbai | EXIT | Low yields, high costs, and limited appreciation |

Key Insights for 2025

BUY in Worli to capture appreciation from upcoming infrastructure projects.

HOLD in Bandra and Juhu for long-term stability and gradual value retention.

EXIT South Mumbai unless holding rare heritage properties with unique appreciation potential.

Traditional advisors rely on manual research and subjective opinions, while GRAI delivers real-time intelligence by processing millions of data points:

Instant Valuation: Upload a property listing to get market-accurate pricing, ROI estimates, and benchmark analysis.

Predictive Analytics: Model future appreciation based on infrastructure projects and economic cycles.

Risk Intelligence: Evaluate flood risks, legal compliance, and political stability before investing.

Portfolio Simulations: Run “what-if” scenarios to optimize diversification and exit strategies.

GRAI isn’t just an assistant-it’s a strategic partner designed to help investors dominate one of the world’s most competitive real estate markets.

Mumbai real estate is on a growth trajectory, but not every investment will yield outsized returns. The key to building wealth in this market lies in:

Data-Driven Decisions: Investors with actionable insights will outpace speculative buyers.

Infrastructure Awareness: Projects like the Mumbai Coastal Road and Metro expansion will reshape property values in specific pockets.

Global Perspective: Investors should consider political stability, foreign policy changes, and international capital flows.

By leveraging GRAI’s intelligence, investors gain a decisive advantage-from instantly valuing properties to predicting shifts before they occur.

Subscribe to GRAI for real-time insights, investment forecasting, and portfolio optimization that transforms speculation into certainty.

Q1: What is the average house price in Mumbai in 2025?

In 2025, Mumbai’s average house price ranges between INR 35,000-INR 65,000 per sq. ft, depending on location. Premium zones like South Mumbai and Worli cross INR 1 lakh per sq. ft due to scarcity and luxury demand.

Q2: Is Mumbai real estate overpriced in 2025?

While prices are high, they reflect limited land availability and massive infrastructure investments. AI-driven insights show strong appreciation potential in key markets like Worli and Bandra, making properties strategic long-term investments.

Q3: Can foreigners buy property in Mumbai?

Yes, foreigners can buy residential property in India under certain conditions. However, commercial property rules and tax implications vary. GRAI instantly simplifies due diligence for foreign buyers as you can upload or ask GRAI specific questions as per your situations.

Q4: Which areas of Mumbai are best for investment in 2025?

South Mumbai, Bandra, Juhu, and Worli lead investment opportunities, driven by high rental yields, lifestyle appeal, and infrastructure upgrades.

Q5: Is it better to invest in Mumbai’s luxury or commercial real estate?

Luxury properties deliver capital appreciation, while Grade A commercial spaces in BKC and Worli offer 7%+ annual yields. GRAI’s Portfolio Simulation helps balance both.