Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The New York real estate market continues to undergo a dynamic transformation in 2025, offering both challenges and opportunities across Manhattan, Brooklyn, and the Bronx. As the market evolves, traditional property search methods are rapidly being replaced by AI-powered solutions delivering real-time insights and predictive analytics - with GRAI, the world’s premier real estate AI Advisor, leading the way.

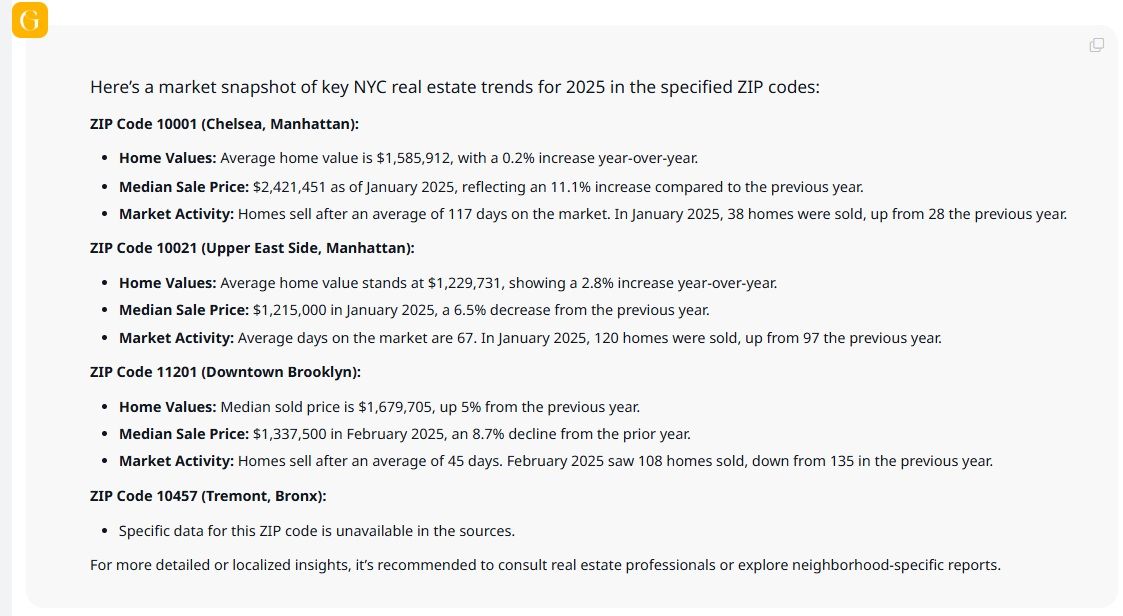

For prospective buyers, investors, and real estate professionals navigating this complex landscape, understanding neighborhood - specific trends has never been more crucial - particularly in high -demand ZIP codes like 10001 (Chelsea), 10021 (Upper East Side), 11201 (Brooklyn Heights), and 10457 (Bronx).

1. Neighborhood-Specific Listing Price Variations

While Manhattan's luxury market shows remarkable resilience, outer borough growth continues to outpace expectations:

| ZIP Code | Neighborhood | YOY Price Change | Avg. Price/Sq. Ft. |

|---|---|---|---|

| 10001 | Chelsea | -0.67% | $1,842 |

| 10021 | Upper East Side | +13.3% | $1,326 |

| 11201 | Brooklyn Heights | -13.5% | $1,566 |

| 10457 | Bronx | -2.5% | $300 |

2. The 2-Bedroom Condo Renaissance

The most significant market development of 2025 is the surging demand for 2-bedroom condos across prime neighborhoods. This trend is driven by:

Two-bedroom condos represent the sweet spot in today's market. They offer the flexibility modern New Yorkers demand while providing investors with the strongest appreciation potential through 2027.

3. Emerging Tech Corridor Impact

The expansion of tech companies along Manhattan's west side continues to transform Chelsea (10001), creating ripple effects throughout neighboring areas. This tech corridor has become a prime driver of residential demand, with proximity to these employment centers commanding premium prices.

4. Sustainability Premiums

Properties with green certifications and energy-efficient features now command 8 - 12% price premiums across all four ZIP codes, with Brooklyn Heights (11201) leading this environmentally conscious trend.

1. Chelsea, Manhattan (10001): Creative and Luxury Hub

Market Dynamics:

Chelsea continues to be a centre for high-end living, tech innovation, and cultural appeal, bolstered by the ongoing Hudson Yards development.

2-Bedroom Condo Market:

Average price: $2.5M - $3.2M

Key Features Driving Value:

Investment Outlook:

Projected appreciation of 4.5 - 5.2% annually through 2027, especially for properties near the High Line and Hudson Yards.

2. Upper East Side, Manhattan (10021): Timeless Luxury

Market Dynamics:

A classic Manhattan neighborhood, now attracting a younger demographic thanks to value offerings and upgraded transport like the Q subway line.

2-Bedroom Condo Market:

Average price: $1.8M - $2.4M

Key Features Driving Value:

Investment Outlook:

Steady appreciation forecasted at 3.8 – 4.5% annually, with lower market volatility compared to trendier neighborhoods.

3. Downtown Brooklyn (11201): Vibrant and Growing

Market Dynamics:

Downtown Brooklyn, including Brooklyn Heights, DUMBO, and Boerum Hill, offers a balanced blend of historic charm, waterfront amenities, and modern high-rises.

2-Bedroom Condo Market:

Average price: $1.2M - $1.7M

Key Features Driving Value:

Investment Outlook:

One of NYC’s strongest growth corridors, with projected appreciation of 5.3 - 6.1% annually through 2027.

4. Tremont, Bronx (10457): Affordable Growth Frontier

Market Dynamics:

Tremont and East Tremont in the Central Bronx are experiencing rising demand due to affordability, new developments, and improved infrastructure.

2-Bedroom Condo Market:

Average price: $400K - $600K

Key Features Driving Value:

Investment Outlook:

Highest projected growth among all featured ZIP codes 7.0 - 8.2% annually, though with higher market volatility.

When searching for your ideal home, GRAI simplifies neighborhood comparisons by offering data-driven insights and personalized recommendations. Using advanced AI analytics and proprietary intelligence that regular listings can't provide, GRAI evaluates critical factors like median home prices, HOA fees, rental market rates, and gives livability scores across neighborhoods - these scores incorporate hundreds of data points across safety, convenience, and amenities giving you a comprehensive comparison in an instant . For instance, in this 2-bedroom condo search, GRAI helps you quickly contrast Chelsea’s luxury appeal with Downtown Brooklyn’s vibrant affordability or highlight Tremont’s potential for first-time buyers and investors.

Beyond basic metrics, GRAI factors in lifestyle preferences such as access to parks, cultural hubs, school quality, and public transit. Whether you prioritize luxury and proximity to cultural landmarks (like in Chelsea or the Upper East Side) or seek affordability and future growth (as found in Downtown Brooklyn and Tremont), GRAI tailors recommendations to your needs.

Moreover, GRAI identifies potential long-term investment opportunities by analyzing local infrastructure projects, demographic trends, and property appreciation forecasts. It eliminates the guesswork, saving you time and helping you make confident, well-informed real estate decisions.

By combining real-time data with predictive modeling, GRAI ensures that finding the perfect neighborhood isn’t just easier - it’s smarter.

In today's data-driven market, successful real estate decisions require sophisticated analytics and real-time insights. GRAI's AI-powered platform delivers capabilities essential for navigating New York's complex real estate landscape:

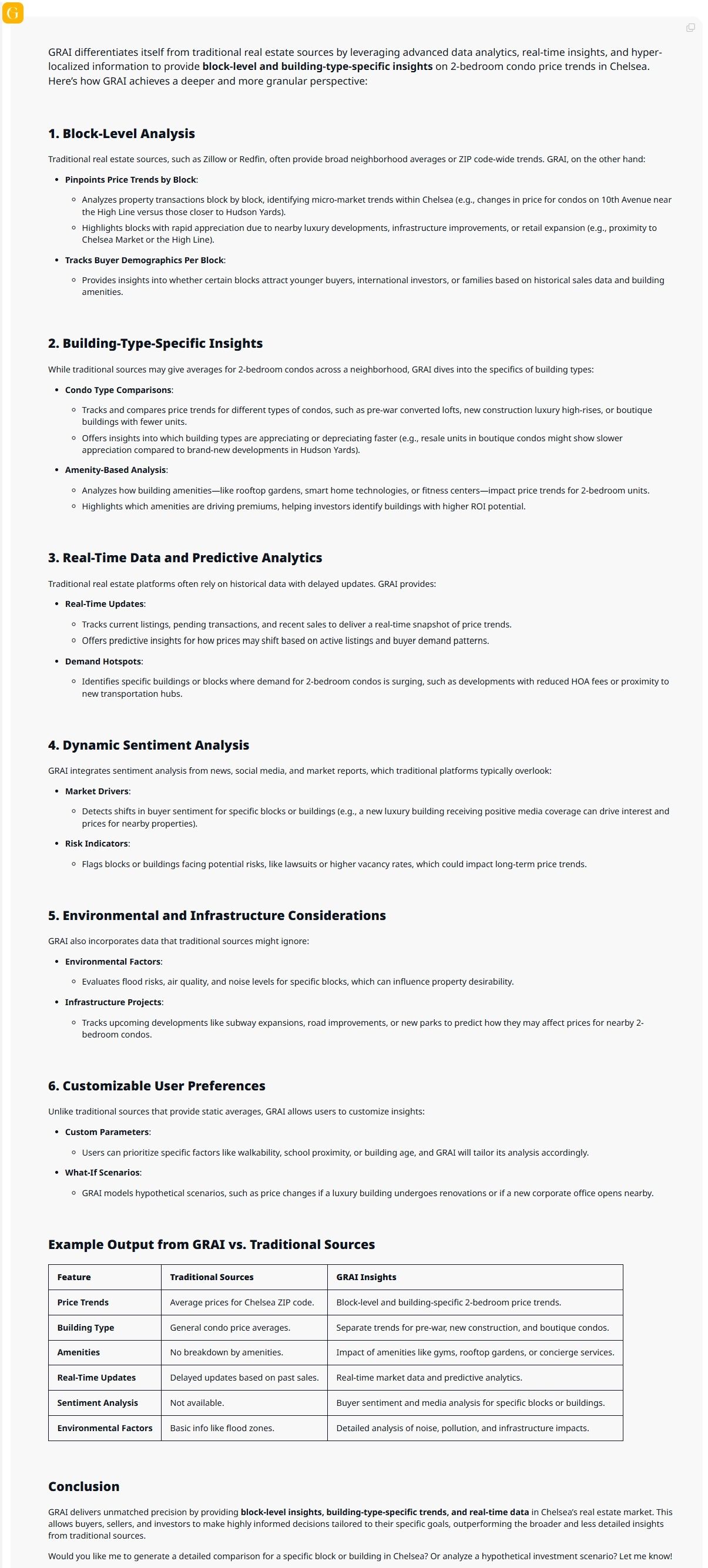

1. Hyper-Local Market Intelligence

GRAI analyzes thousands of micro-market indicators - from building permit filings to neighborhood sentiment scores - to identify opportunities before they appear in traditional market reports.

"When considering a Chelsea 2-bedroom condo, GRAI showed me price trend patterns by specific blocks and even building types. This level of granularity simply wasn't available through traditional sources." - Recent GRAI user

2. Predictive Valuation Modeling

Beyond standard comps, GRAI can predict future valuation based on historical patterns, current market conditions, and proprietary leading indicators:

3. Neighborhood Match Technology

GRAI analyzes lifestyle factors to match buyers with their ideal neighborhood, considering factors like:

4. Investment Risk Assessment

For investors, GRAI provides sophisticated risk analysis tailored to New York's unique market conditions:

Whether you're seeking a Chelsea 2-bedroom with Hudson views, a classic Upper East Side residence, a Brooklyn Heights sanctuary with Manhattan skyline vistas, or an emerging market opportunity in the Bronx, today's New York real estate market demands sophisticated tools and expert analysis.

GRAI's AI-powered platform provides the competitive edge essential for making confident decisions in this dynamic market. By combining hyper-local data, predictive analytics, and personalized insights, GRAI transforms the property search process from overwhelming to empowering.

As New York’s real estate market continues to evolve through 2025 and beyond, staying ahead demands more than conventional market insights - it requires the advanced intelligence that only GRAI delivers with precision

This guide focuses on ZIP codes 10001, 10021, 11201, and 10457, representing diverse opportunities across New York's evolving real estate market. For personalized insights tailored to your specific needs, experience GRAI's AI-powered analytics platform today.

Experience GRAI Now - The Future of Real Estate Intelligence is Here.