Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Shanghai stands as China's undisputed financial powerhouse, a city where futuristic skylines meet centuries-old alleyways. In 2025, this global city continues to defy broader market headwinds. While China’s national housing sector stabilizes, Shanghai’s prime districts are rebounding with precision.

In March 2025, average property prices reached 39,575 RMB per sqm, up from 38,438 RMB in February. This incremental growth - seemingly modest - reflects renewed investor confidence in Tier-1 cities like Shanghai, even as other parts of China face oversupply and declining demand.

But capital alone won’t unlock Shanghai’s complex real estate puzzle. From shifting regulations to micro-market volatility, success in this city demands real-time intelligence. That’s why sophisticated investors are turning to GRAI - the world’s smartest real estate AI platform.

Between 2024 and 2025, Shanghai underwent one of its most decisive transformations in real estate policy, investor sentiment, and housing market dynamics. According to GRAI’s in-depth analysis, this period marked a critical inflection point driven by bold government interventions and evolving buyer behavior.

1. From Policy Paralysis to Stimulus Surge In early 2024, the Shanghai real estate market was still reeling from prolonged stagnation - marked by declining prices and hesitancy among both local and international investors. However, by late 2024, a wave of policy reforms reshaped the landscape:

Real Estate Tax Cuts: Shanghai removed VAT on properties held for over two years and eliminated the classification gap between “ordinary” and “non-ordinary” housing, significantly reducing transaction costs.

Relaxed Purchase Rules: Residency requirements for non-local buyers were slashed from 3 years to just 1 year - opening the gates to a broader investor base.

Lower Down Payments: First-time homebuyers saw down payment requirements fall from 20% to 15%, while second-home buyers benefited from a drop from 30% to 25%, unlocking affordability for the middle class.

These interventions aimed to trigger demand, stimulate liquidity, and revive confidence.

2. Transaction Volumes and Price Stabilization

The introduction of the “Shanghai Seven Policies” catalyzed a sharp rebound:

Transaction Surge: By Q4 2024, transaction volumes in outer-ring areas jumped 28%, with second-hand housing accounting for over 57% of sales - indicating renewed activity in mature neighborhoods.

Price Recovery: After months of price declines, second-hand home prices began stabilizing and showing slight month-on-month increases into 2025, signaling the first signs of sustained recovery.

3. Luxury and High-End Market Momentum

Shanghai’s luxury real estate market exploded in 2024:

Over 60% of China’s new luxury homes priced above ¥30 million were sold in Shanghai alone.

This reflected renewed confidence among high-net-worth individuals and foreign investors - driven largely by favorable tax treatments and clearer investment pathways.

Must Read: How U.S. High-Income Investors Use Real Estate Tax Strategies to Build Wealth Faster

4. 2025 Market Realignment and Urban Focus

By 2025, the focus shifted from policy to structural rebalancing:

Resale Market Dominance: The resale (existing homes) segment began to outperform new construction due to improved affordability and better location advantages in urbanized neighborhoods.

Urban Renewal: The government prioritized redeveloping urban villages and renovating aging housing stock, improving both supply quality and community infrastructure.

5. A Stronger Outlook for 2025 and Beyond

GRAI predicts that Shanghai’s real estate market in 2025 is positioned for cautious but sustained growth, backed by:

Continued government support for affordability and accessibility.

Infrastructure improvements and housing stock modernization.

Growing investor confidence - especially among foreign buyers and Chinese expatriates returning capital to domestic markets.

This pivot from stagnation to revival marks Shanghai as a key city to watch in 2025, with early movers already capitalizing on these shifts. As GRAI’s analysis suggests, the interplay between policy, confidence, and infrastructure will define Shanghai’s investment narrative going forward.

In 2025, Shanghai’s real estate landscape is shaped by a unique mix of policy reforms, infrastructure development, and investor demand. According to GRAI’s latest analysis, four districts stand out as top investment destinations: Huangpu, Pudong, Xuhui, and Jing’an. These neighborhoods combine strong price appreciation potential, high rental demand, and favorable government incentives, making them ideal for both domestic and international investors.

1. Huangpu District - Historic Prestige with Luxury Growth

Luxury Market Leader: Huangpu led Shanghai in luxury home sales in 2024, accounting for over 50% of the city’s total high-end transactions (353 units sold).

Landmark Projects: Key developments include Cuihu Tiandi Liuhe Ting, Zhonghai Shunchang Jiuli, and Fanhai International Residence.

Price Surge Potential: The district recorded an average transaction price of ¥180,955/sq m, with a 15% CAGR over three years - making it a hotspot for high-net-worth buyers.

Prime Location: As Shanghai’s political and cultural core, with landmarks like The Bund and People’s Square, Huangpu offers strong appeal in both the new-build and resale markets.

Urban Renewal: Strategic infrastructure upgrades continue to boost livability and investment confidence.

2. Pudong New Area – Shanghai’s Economic Powerhouse

Commercial Magnetism: Home to Lujiazui, the city’s financial hub, and numerous innovation corridors including the Pilot Free Trade Zone, Pudong remains a focal point for international business.

Luxury Momentum: Pudong ranked second in luxury sales in 2024, with 86 units sold. Prominent developments include Lujiazui Taikuyuan, Jiuli Jingting, Kaixuan Binjiang Park, and Qiantan Lily Garden.

Infrastructure Upgrades: Massive investment in transportation and urban development makes Pudong ideal for long-term capital appreciation.

Rental Stability: With strong demand from expatriates and financial professionals, Pudong ensures consistent high-end rental returns.

3. Xuhui District – Cultural Heritage Meets Modern Connectivity

Sustained Investor Interest: In 2024, 62 luxury homes were sold in Xuhui, led by the Hong Kong Land Kaiyuan project (97% of all sales).

Urban Transformation: Projects like the revitalization of Wukang Mansion highlight Xuhui’s blend of cultural preservation and modernization.

Exceptional Connectivity: The district’s centrality and access to major transit routes enhance its attractiveness for both residents and investors.

Long-Term Potential: Its emphasis on livability and civic infrastructure positions Xuhui as a smart choice for value-driven growth.

4. Jing’an District – A Hub for Young Professionals and Urban Revamp

Ongoing Redevelopment: Major projects like Fangua Long aim to rejuvenate aging areas while maintaining historical integrity.

Business and Lifestyle Center: Jing’an’s mix of premium residential and commercial offerings attracts rising professionals, bolstering rental demand.

Capital Appreciation: As infrastructure improves and cultural districts modernize, property values are expected to climb steadily.

a. Policy Incentives

Relaxed Regulations: Lower down payments and removal of purchase restrictions (e.g., housing classifications) are driving renewed demand.

Tax Benefits: Exemptions on properties held over two years further reduce transaction friction.

Market Confidence: Government stimulus has helped stabilize the property market, encouraging investment.

b. Infrastructure Investment

Big Spender: Shanghai is set to invest ¥240 billion yuan ($32.7 billion) in 2025 across transportation, urban renewal, and social infrastructure.

Connectivity and Quality of Life: These investments increase the livability quotient and value potential in top districts.

c. Rental Demand

d. Price Appreciation

Luxury Market Upside: Huangpu and Pudong show strong luxury price growth, underpinned by limited inventory and premium location advantages.

Redevelopment-Driven Growth: Urban village upgrades in Xuhui and Jing’an are poised to boost medium-to-long-term asset values.

Backed by strong fundamentals, favorable policies, and strategic development, these districts represent the best risk-adjusted investment opportunities in Shanghai for 2025.

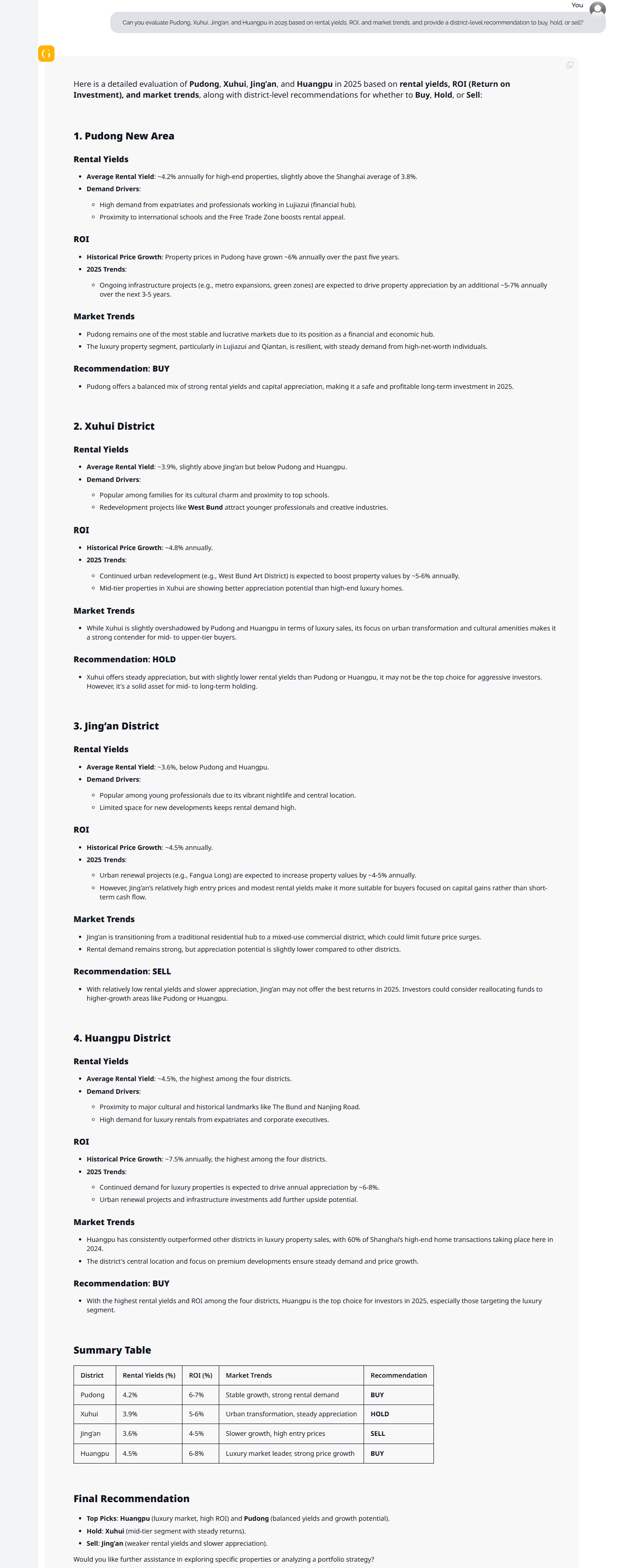

GRAI’s 2025 evaluation of Shanghai’s top-performing districts - Pudong, Xuhui, Jing’an, and Huangpu - highlights significant differences in rental income, capital appreciation, and long-term investment potential. Each district’s performance varies based on factors like urban renewal, infrastructure momentum, luxury market penetration, and tenant demographics.

1. Pudong New Area

Rental Yield: ~4.2% annually

Above the Shanghai average (3.8%)

Supported by strong demand from expatriates and professionals working in Lujiazui and near international schools and the Free Trade Zone.

ROI:

Historical growth: ~6% annually over the last five years

Future projections: 5–7% annual appreciation due to metro expansions, green zones, and ongoing development.

Market Trends:

GRAI Recommendation: BUY

Pudong offers a balanced mix of rental income and capital appreciation, making it a strong, stable, and growth-ready investment zone.

2. Xuhui District

Rental Yield: ~3.9% annually

Attractive to families due to top schools and cultural charm

Mid-tier luxury projects and redevelopments like West Bund Art District attract professionals and creatives.

ROI:

Market Trends:

GRAI Recommendation: HOLD

While Xuhui doesn’t offer the highest yields, it remains a safe mid-to-long-term bet due to its consistent appreciation and lifestyle appeal.

3. Jing’an District

Rental Yield: ~3.6% annually

Demand driven by young professionals and a vibrant nightlife scene

Limited space for new builds supports stable demand

ROI:

Historical growth: ~4.5% annually

Projected growth: 4–5% through projects like Fangua Long redevelopment

Market Trends:

GRAI Recommendation: SELL

Despite strong central appeal, Jing’an’s lower rental yields and slower appreciation make it a weaker investment option in 2025. Investors should consider reallocating funds to higher-growth districts.

4. Huangpu District

Rental Yield: ~4.5% annually - the highest among the four districts

ROI:

Historical growth: ~7.5% annually – highest ROI of all districts

2025 projections: 6–8% appreciation driven by luxury sales and extensive infrastructure upgrades

Market Trends:

Huangpu accounted for 60% of Shanghai’s luxury property sales in 2024

Dominates resale and new-build luxury markets

GRAI Recommendation: BUY

With the highest rental yields and ROI, Huangpu is 2025’s top investment choice, especially for investors focused on luxury real estate and long-term value.

| District | Rental Yields (%) | ROI (%) | Market Trends | Recommendation |

|---|---|---|---|---|

| Pudong | 4.20% | 6–7% | Stable growth, strong rental demand | BUY |

| Xuhui | 3.90% | 5–6% | Urban transformation, steady appreciation | HOLD |

| Jing’an | 3.60% | 4–5% | Slower growth, high entry prices | SELL |

| Huangpu | 4.50% | 6–8% | Luxury market leader, strong appreciation | BUY |

BUY:

Huangpu - For highest ROI, premium luxury appeal, and price momentum

Pudong - For strong yields and long-term economic positioning

HOLD

SELL:

Yes - but with updated compliance frameworks in 2025. Foreign investors can purchase property if they meet:

One-year residency via work permit or dependent visa

Valid Chinese business registration or long-term investment visa

GRAI’s unmatched capabilities to help you with your China real estate investment strategy and decision making:

Monitors regulatory updates

Translates legal documentation into native language summaries

Flags capital repatriation risks and workarounds for offshore investment vehicles

Impact of USD-CNY fluctuations

Policy changes from Beijing and Washington

Foreign direct investment velocity

Investors can simulate ownership timelines, taxation burdens, and exit strategies in less than 30 seconds with GRAI.

The question is no longer should you invest in Shanghai. It’s how.

With GRAI, you can:

Pinpoint micro-market opportunities in seconds

Project risks and rewards before anyone else

Navigate cross-border investment rules in real time

Whether you’re a solo investor in Singapore or a fund manager in Zurich, GRAI gives you superhuman clarity.

Shanghai is moving fast. GRAI moves faster.

Start using GRAI - the world’s smartest real estate AI - today.