Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

Singapore remains the most resilient and globally trusted real estate market heading into 2026.

International investors continue allocating capital to Singapore due to:

Structural supply scarcity

World-class regulatory stability

Low political risk

Strong demand from expatriates and new households

A globally recognized safe-haven economy

Global real estate insights consistently reinforces Singapore’s role as the top Asian gateway market, outperforming major hubs like Hong Kong, Seoul, and even Tokyo in stability and long-term appreciation.

However, Singapore’s 2026 outlook is not uniform. District-level performance varies widely depending on supply pipelines, rental patterns, infrastructure upgrades, and investor sentiment.

These complexities are exactly why GRAI - the world’s smartest real estate AI advisor - has become essential for investors who want to move beyond generic advice and rely on real-time intelligence, predictive analytics, sentiment analysis, and global-to-local data fusion.

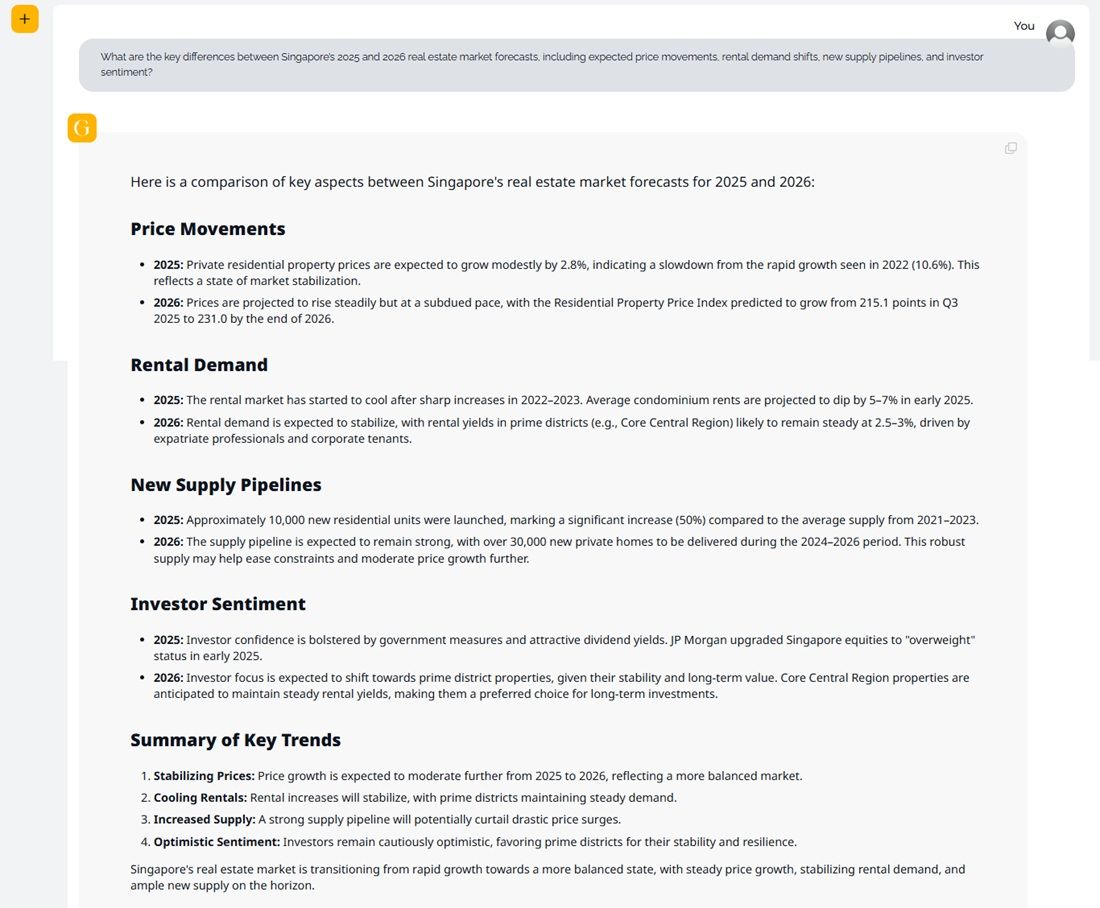

GRAI’s latest evaluation highlights a market that is gradually transitioning from the explosive growth of 2022-2023 toward stabilization, steady demand, and healthier supply dynamics. Here is a detailed, data-backed breakdown of what investors can expect in 2025 and 2026.

2025 Outlook:

Singapore’s private residential prices rose at a moderate 2.8%, marking a noticeable cooling from the sharp 10.6% surge in 2022. This signals a shift toward market normalization, supported by balanced buyer sentiment and better alignment between demand and supply.

2026 Forecast:

GRAI expects prices to continue rising, but at a measured and sustainable pace. The Residential Property Price Index is forecasted to climb from 215.1 in Q3 2025 to around 231.0 by end-2026. This consistent but slower trajectory reflects a maturing cycle driven by stable employment, population growth, and investor confidence.

2025 Outlook:

After two years of rapid escalation, the rental market has begun to cool. Average condominium rents have dipped by 5-7% in early 2025, driven by softened corporate leasing demand and broader market recalibration.

2026 Forecast:

Demand recovers and stabilizes, especially in prime districts (CCR). Projected rental growth of 2.5-3% is expected as expats, corporate tenants, and long-term residents continue to prioritize high-quality locations. This makes 2026 a potentially stronger year for rental-focused investors than 2025.

2025 Supply:

Close to 10,000 new residential units entered the market-a sharp 50% increase compared to the 2021-2023 average. This infusion is helping to rebalance supply-demand tensions created during the pandemic surge.

2026 Supply

Supply momentum remains strong. Over 30,000 private homes are scheduled for delivery between 2024 and 2026, supporting healthier vacancy rates and moderating upward price pressure. This more robust pipeline will play a crucial role in cooling rental inflation and ensuring sustainable capital appreciation.

2025 Sentiment:

Investor confidence is strengthened by government stability and attractive dividend yields. With JP Morgan upgrading Singapore equities to “overweight” in early 2025, broader confidence in the country’s economic trajectory supports sustained property investment.

2026 Sentiment:

Investors will increasingly favor prime district properties, attracted by their stability, resilience, and long-term appreciation potential. These areas remain especially appealing for investors targeting rental consistency and lower vacancy risk.

1. Stabilizing Prices:

Price growth continues but at a moderated pace, signaling a healthier, more predictable market.

2. Cooling Rentals (2025) → Stable Rentals (2026):

Short-term rental dips give way to renewed stability in prime districts.

3. Larger Supply Pipeline:

A strong pipeline of 30,000+ homes ease constraints and prevents drastic price surges.

4. Optimistic but Cautious Investor Sentiment:

Investors remain positive, particularly regarding core central properties, long-term price stability, and Singapore’s economic fundamentals.

What This Means for Investors

Singapore’s real estate market is shifting from aggressive post-pandemic growth to a more sustainable, balanced cycle.

2025 favored strategic buyers looking to capitalize on cooling rents and increased supply.

2026 favors long-term investors seeking stable yields, steady capital appreciation, and prime market resilience.

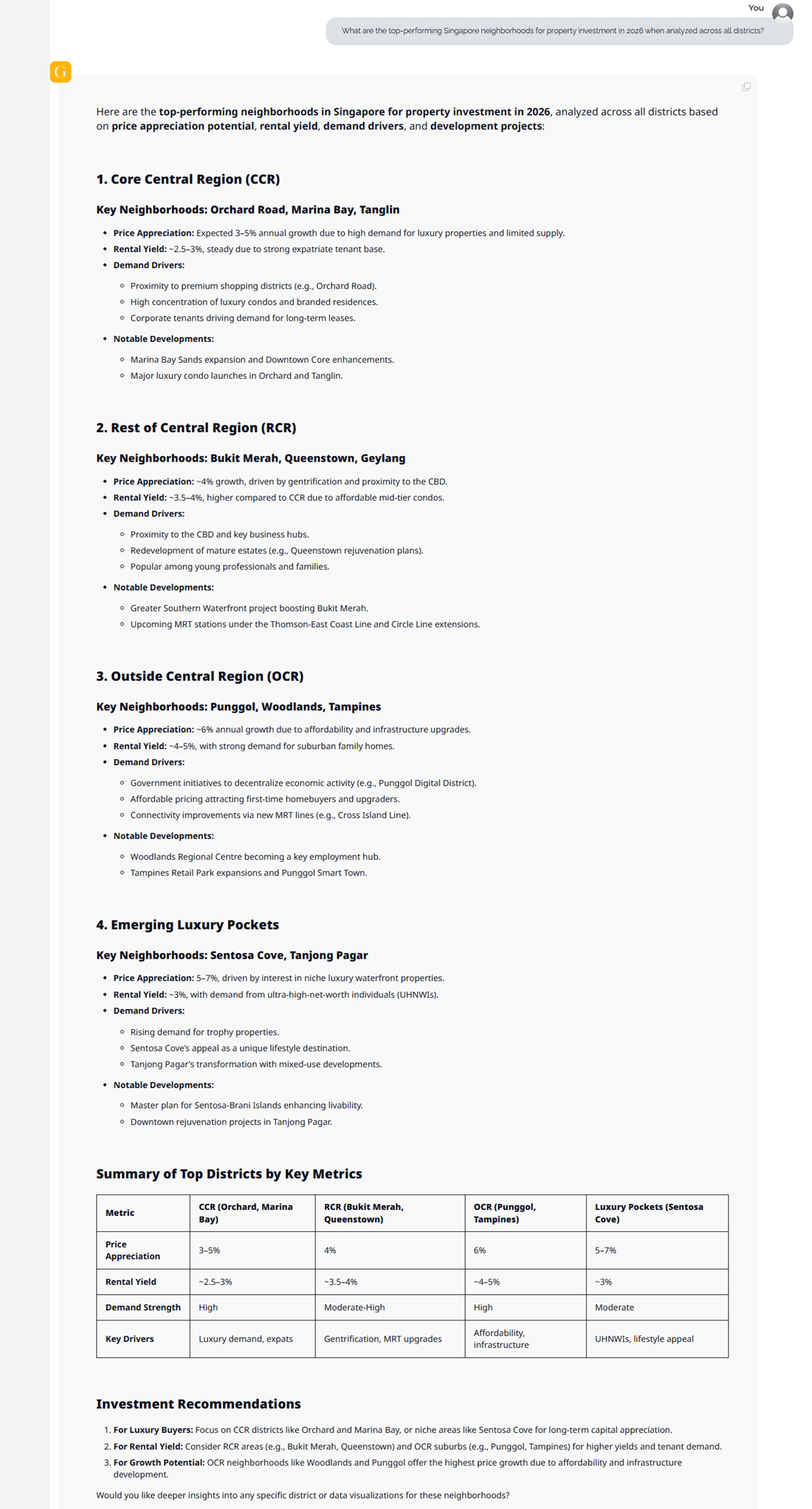

Using price appreciation potential, rental yields, demand strength, and ongoing development pipelines across all three major regions, GRAI identified the most attractive neighborhoods in Singapore’s real estate market in 2026. The results highlight clear leaders across luxury districts, gentrifying mid-tier hubs, and fast-growing suburban corridors.

Top Neighborhoods: Orchard Road, Marina Bay, Tanglin

Why CCR Leads in 2026

The Core Central Region continues to dominate high-value investment performance, supported by strong expat demand, premium amenities, and limited luxury supply.

Expected 3-5% annual growth, driven by sustained luxury demand and tight inventory.

Averaging ~2.5-3%, with consistently strong occupancy from international tenants and corporate long-stays.

Demand Drivers:

• Walking distance to prestigious retail (Orchard Road).

• Clusters of luxury condos and branded residences.

• Corporate demand fueling long-term leasing.

Notable 2026 Developments:

• Marina Bay Sands expansion and Downtown Core improvements.

• Launch of multiple luxury developments in Orchard and Tanglin.

Best For: Luxury investors, foreign buyers, long-term capital appreciation.

Top Neighborhoods: Bukit Merah, Queenstown, Geylang

Why RCR Gains Strong Momentum

These mid-tier districts continue to attract investors due to affordability relative to CCR and proximity to the CBD, with ongoing gentrification boosting long-term value.

- Price Appreciation:

Around ~4% annual growth, supported by rejuvenation programs and proximity to central employment hubs.

- Rental Yield:

~3.5-4%, higher than CCR due to more attractive entry prices.

- Demand Drivers:

• Redesign and rejuvenation (e.g., Queenstown upgrading plans).

• Strong transport connectivity.

• Popular with young professionals and families.

- Notable 2026 Developments:

• Greater Southern Waterfront works lifting Bukit Merah fundamentals.

• New MRT stations under the Thomson-East Coast Line and Circle Line expansions.

Best For: Rental-focused investors seeking strong yields at reasonable price points.

Top Neighborhoods: Punggol, Woodlands, Tampines

Why OCR Is the Growth Engine of 2026

Affordable homes, robust infrastructure, and emerging business hubs make OCR districts primed for the strongest price upside among all regions.

- Price Appreciation:

Projected ~6% annual growth, the highest among the three regions.

- Rental Yield: ~4-5%, driven by families, upgraders, and new suburban employment clusters.

- Demand Drivers:

• Government initiatives (e.g., Punggol Digital District).

• Improvements to suburban connectivity (new MRT lines).

• Attractive prices for first-time buyers.

- Notable 2026 Developments:

• Woodlands Regional Centre emerging as a major employment hub.

• Punggol Smart Town upgrades and Tampines Retail Park enhancements.

Best For: Investors seeking high capital appreciation and strong rental demand with lower entry prices.

Top Neighborhoods: Sentosa Cove, Tanjong Pagar

Why These Micro-Markets Stand Out

Though niche, these pockets deliver high-end appeal and premium appreciation potential driven by lifestyle demand from UHNWIs.

- Price Appreciation:

Strong 5-7% uplift expected, especially in waterfront luxury enclaves.

- Rental Yield:

~3%, supported by ultra-wealthy expatriates and niche demand for trophy assets.

- Demand Drivers:

• Rising demand for waterfront and trophy properties.

• Sentosa Cove’s transformation into a premium lifestyle destination.

• Mixed-use revitalization in Tanjong Pagar.

- Notable 2026 Developments:

• Sentosa-Brani Master Plan enhancing island livability.

• Downtown rejuvenation projects around Tanjong Pagar.

Best For: High-net-worth investors seeking exclusivity and long-term capital appreciation.

| Metric | CCR (Orchard, Marina Bay) | RCR (Bukit Merah, Queenstown) | OCR (Punggol, Tampines) | Luxury Pockets (Sentosa Cove) |

|---|---|---|---|---|

| Price Appreciation | 3-5% | 4% | 6% | 5-7% |

| Rental Yield | ~2.5-3% | ~3.5-4% | ~4-5% | ~3% |

| Demand Strength | High | Moderate–High | High | Moderate |

| Key Drivers | Luxury demand, expats | Gentrification, MRT upgrades | Affordability, infrastructure | UHNWIs, lifestyle appeal |

Want GRAI to score any Singapore district or property for you in real time?

Analyze it instantly → https://internationalreal.estate/chat

1. For Luxury Buyers:

Focus on Orchard, Marina Bay, Tanglin, or niche luxury corridors like Sentosa Cove for premium capital appreciation.

2. For Rental Yield Investors:

RCR districts such as Bukit Merah, Queenstown, Geylang and OCR markets like Punggol or Tampines offer the strongest yields and consistent tenant demand.

3. For Growth-Driven Investors:

OCR neighborhoods-especially Woodlands and Punggol-deliver the highest price growth potential, fueled by new infrastructure, employment hubs, and high owner-occupier demand.

Singapore’s rental market continues to evolve in 2026, shaped by changing tenant demand, tightening regulations, and shifts in investment strategies. GRAI’s analysis provides a detailed comparison of long-term rentals versus short-term rentals, focusing on rental yield, ROI potential, regulatory constraints, operating costs, and overall cash-flow performance.

Long-Term Rentals

Gross Yield: 2.5%-4% annually, depending on property type and location.

Income Profile: Stable monthly income with predictable tenant occupancy.

Short-Term Rentals

Gross Yield: 8%-12% annually, significantly higher due to premium nightly rates.

Income Profile: Irregular income due to seasonal and tourism-driven fluctuations.

Insight: While short-term rentals offer substantially higher headline yields, returns depend heavily on consistent occupancy and seasonal tourism patterns.

Long-Term Rentals

Initial ROI: Moderate-steady yields with slower growth.

Capital Appreciation: Improved property longevity due to reduced wear and tear from longer tenant stays.

Short-Term Rentals

Initial ROI: High, driven by premium pricing for nightly stays.

Capital Appreciation: Potentially impacted by higher wear and tear due to rapid guest turnover.

Insight: Investors focused on long-term asset value preservation often prefer long-term tenants, while ROI-maximizing investors may gravitate towards short-term leasing-if regulations permit.

Long-Term Rentals

Legal Status: Fully compliant under HDB and URA rules.

Ease of Compliance: Straightforward contracts and lease management.

Short-Term Rentals

- Restrictions:

• URA prohibits short-term stays under 3 months (except licensed hotels/serviced apartments).

• Non-compliance can incur penalties up to SGD 200,000.

Insight: In Singapore, regulation-not yield-is the largest barrier for short-term rental investors.

Long-Term Rentals

Management Costs: Low, with 1-2 year leases reducing tenant turnover.

Maintenance: Moderate and spread over longer periods.

Management Costs: High due to constant turnover, cleaning, and platform fees (e.g., Airbnb’s ~3% fee).

Maintenance: High, as properties experience faster depreciation.

Insight: Operating costs dramatically narrow the yield advantage of short-term rentals.

Long-Term Rentals

Stability: Predictable monthly cash flow.

Vacancy Risk: Low, with 1-2 year secure leases.

Short-Term Rentals

Stability: Volatile-peaks during holidays/high-tourism months and sharp declines in off-peak periods.

Vacancy Risk: High, with significant exposure to demand fluctuations.

Insight: Long-term rentals deliver consistent, recession-resistant income. Short-term rentals deliver higher peaks-but also deeper troughs.

Pros:

Reliable income

Lower operating and management costs

Strong legal compliance

Minimal vacancy volatility

Cons:

Lower yields compared to short-term rentals

Slower ROI growth

Best For:

Risk-averse investors seeking steady, predictable cash flow.

Pros:

Highest yield potential

Strong ROI during peak seasons

Premium pricing in tourist hubs (e.g., Orchard, Marina Bay)

Cons:

Strict URA regulations

High management and maintenance requirements

Significant income volatility

Best For:

Investors with properties in tourist-centric zones who are willing to manage high operational intensity and navigate Singapore’s strict compliance environment.

Long-Term Rentals

Deliver stable cash flow, strong compliance, and low management overhead-ideal for most investors in Singapore’s regulated environment.

Short-Term Rentals

Offer superior peak-season profitability but come with strict regulations, higher operating costs, and income volatility-making them suitable only for high-risk, high-management investment strategies.

Singapore remains one of the most transparent and well-regulated real estate markets globally. For international investors, the framework is clear - but financially consequential - making it essential to understand eligibility, costs, and strategic implications before entering the market.

Foreigners are permitted to purchase strata-titled private condominiums without prior approval. These properties form the bulk of international investor activity and are concentrated in the Core Central Region (CCR), city-fringe districts, and well-connected suburban developments.

However, landed residential properties are generally restricted to Singapore citizens. The primary exception is Sentosa Cove, where foreigners may acquire landed homes subject to approval and additional conditions.

Public housing (HDB flats) is not available to foreign buyers.

Foreign buyers purchasing residential property in Singapore are subject to Additional Buyer’s Stamp Duty (ABSD) at a rate of 60%, calculated on the higher of the purchase price or market value.

This significantly increases the total acquisition cost and directly affects:

Entry pricing

Holding period assumptions

Long-term return expectations

Capital allocation versus other international markets

As a result, foreign participation in Singapore market tends to be strategic, long-term, and capital-focused, rather than speculative.

While the regulations themselves are publicly available, their market impact is not static. ABSD influences pricing differently across districts, property types, and market cycles.

For example:

Prime assets may retain capital appeal despite higher entry costs

Certain city-fringe or rental-driven districts may offer stronger long-term balance

Market sentiment among foreign buyers shifts based on global capital flows, not just local policy

This is where contextual intelligence becomes critical.

Rather than interpreting rules in isolation, investors increasingly rely on AI-driven market intelligence to understand how foreign buyer regulations interact with:

Real-time pricing trends

District-level demand shifts

Rental absorption and vacancy patterns

International capital movement across global real estate markets

Platforms such as GRAI help investors frame these regulatory realities within a broader international real estate strategy, allowing them to compare Singapore objectively against other global cities before making capital commitments.

GRAI does not provide legal or tax advice. It provides structured, real-time market intelligence that helps investors ask better questions, evaluate scenarios, and approach decisions with clarity.

Singapore remains accessible, stable, and institutionally strong - but it is not a low-friction market for foreign buyers. Understanding what is allowed is only the starting point. Understanding how those rules shape pricing, demand, and returns over time is where informed investors gain an edge.

| Metric | 2025 | 2026 Forecast | GRAI Interpretation |

|---|---|---|---|

| Private Home Prices | Moderate increase | 2-4% growth | Supply shortages support valuation |

| Rental Index | Stabilizing | Gradual upward trend | High expat demand + low completions |

| Luxury Segment | Resilient | Stable with pockets of strength | Wealth inflow remains strong |

| City-Fringe Prices | Rising | 3-5% appreciation | Connectivity + affordability |

| Suburban Prices | Stable | 2-3% | Stable owner-occupier demand |

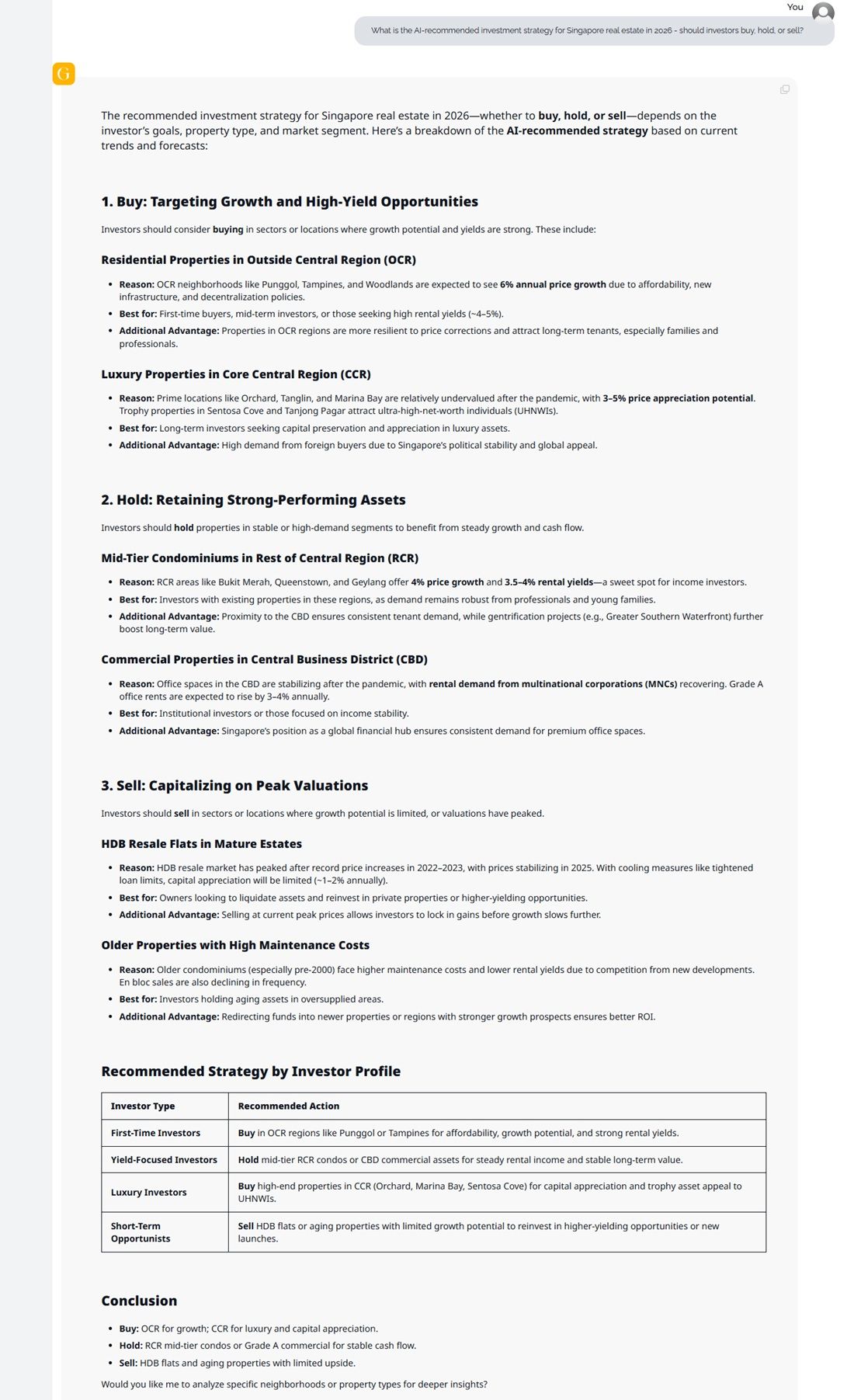

The investment outlook for Singapore’s property market 2026 shows a clear divergence across regions, asset classes, and buyer profiles. GRAI’s analysis indicates that the optimal decision-buy, hold, or sell-depends on growth momentum, rental yield strength, and where each segment sits in the market cycle.

Below is a strategy breakdown powered by GRAI’s forecasts.

Investors should prioritize buying in neighborhoods and asset classes showing strong appreciation potential, resilient demand, and attractive rental yields. GRAI identifies two standout categories:

a. Residential Properties in the Outside Central Region (OCR)

Why Buy:

OCR markets such as Punggol, Tampines, and Woodlands are expected to achieve ~6% annual price growth in 2026, driven by affordability, population decentralization, and major infrastructure upgrades.

Best for:

First-time buyers

Yield-focused investors (rental yields ~4–5%)

Investors seeking resilient long-term family tenant demand

Additional Advantage:

OCR homes historically show higher resistance to price corrections and attract stable occupancy due to family-centric appeal.

b. Luxury Properties in the Core Central Region (CCR)

Why Buy:

Prime districts such as Orchard, Tanglin, and Marina Bay are benefiting from post-pandemic recovery and renewed foreign interest, yielding 3-5% annual appreciation.

Best for:

Long-term investors

Ultra-luxury buyers and global investors

Those seeking capital preservation and trophy assets

Additional Advantage:

Foreign buyer activity and high-net-worth inflows remain strong, reinforcing CCR’s long-term capital appreciation profile.

GRAI suggests holding assets in areas with stable rental demand and predictable appreciation. These segments continue to provide solid returns without significant downside risk.

a. Mid-Tier Condominiums in the Rest of Central Region (RCR)

Why Hold:

Districts like Bukit Merah, Queenstown, and Geylang offer ~4% price growth and 3.5-4% yields, supported by professional tenant demand and ongoing urban rejuvenation.

Best for:

Income investors

Buyers focusing on steady long-term rental performance

Additional Advantage:

Proximity to the CBD ensures persistent rental demand, supported by Singapore’s workforce concentration.

b. Commercial Properties in the Central Business District (CBD)

Why Hold:

Office rental demand is stabilizing post-pandemic, with Grade A rents projected to rise 3-4% annually as multinational corporations expand.

Best for:

Institutional investors

Investors seeking predictable, stable cash flow

Additional Advantage:

Singapore’s global financial hub status continues to support premium office demand.

Investors should consider selling assets in segments where growth has plateaued or where structural disadvantages limit future upside.

a. HDB Resale Flats in Mature Estates

Why Sell:

Prices peaked after the surge from 2022-2023, with 2025 showing stabilization. Regulatory tightening and loan limits mean future appreciation is limited to ~1-2% annually.

Best for:

Additional Advantage:

Selling at or near peak levels allows investors to redeploy capital into stronger-performing segments.

b. Older Properties with High Maintenance Costs

Why Sell:

Older condos (especially pre-2000) face rising maintenance expenses and weaker rental demand due to competition from newer developments.

Best for:

Investors reallocating to higher-growth regions

Those consolidating portfolios for better cash flow

Additional Advantage:

Redirecting capital into newer or infrastructure-backed districts improves overall portfolio ROI.

| Investor Type | GRAI-Recommended Action 2026 |

|---|---|

| First-Time Buyers | Buy in OCR regions like Punggol or Tampines for affordability and growth. |

| Yield-Focused Investors | Hold mid-tier RCR condos or CBD commercial assets for stable rental income. |

| Luxury Investors | Buy high-end CCR properties for capital appreciation and UHNW demand. |

| Short-Term Opportunists | Sell older HDB flats or ageing condos and reinvest into high-growth, higher-yield segments. |

Buy: OCR for growth and yield; CCR for luxury appreciation and capital preservation.

Hold: RCR mid-tier condos and Grade A commercial for stable cash flow and long-term tenant demand.

Sell: Older HDB flats and depreciating assets with limited upside.

Focus on connectivity-driven districts.

Use AI valuations to avoid overpaying. Run your numbers in GRAI to get comprehensive insights.

Prioritize yield-driven units for total returns.

Choose hybrid-work friendly layouts.

Buy before supply tightens further in 2027.

Utilize GRAI’s multi-scenario forecasting before portfolio moves.

Ready to get unbeatable insights for your 2026 personalized Singapore real estate investment guidance?

Start analyzing Singapore property market instantly with GRAI: → https://internationalreal.estate/chat

1. Will Singapore property prices rise in 2026?

Yes, the market signals indicate 2-4% growth, driven by supply shortages and strong household formation.

2. Is buying property in Singapore a good investment in 2026?

Yes-stable rents, strong demand, and long-term appreciation make Singapore one of the safest global markets.

3. Which areas are best to invest in for 2026?

Top districts include D15 (East Coast), D3 (Queenstown), Marina Bay, District 9, and Holland Village.

4. Can foreigners buy property in Singapore?

Foreigners can buy condos and apartments, but landed property is restricted (except Sentosa Cove).

5. What rental yields can investors expect in 2026?

Generally, between 3-4%, with higher yields in suburban and city-fringe locations.

6. How does GRAI help with Singapore property analysis?

GRAI offers AI valuations, district scoring, predictive models, rental forecasting, legal document review, and global real estate insights. Most investors make decisions using delayed reports, scattered property listings, or intuition shaped by outdated information. The Singapore market in 2026 simply moves too fast - and is too complex - for that approach to deliver consistent results.

This is precisely where GRAI becomes irreplaceable, not because it replaces human judgment, but because it supplies the one thing no investor can produce alone: real-time, multi-layered intelligence drawn from thousands of data streams operating simultaneously.

The advantage is subtle at first, but decisive when decisions involve millions.

a) Precision You Cannot Get From Traditional Tools

While most platforms provide static numbers, GRAI runs live AI valuations using current market sentiment, comparable sales, district development activity, and real-time pricing patterns - showing you what a property is truly worth right now, not what it was worth last quarter.

b) District-Level Foresight Before It Hits the Market

GRAI’s Neighborhood Growth Scoring continuously evaluates hundreds of micro-signals: infrastructure catalysts, demographic shifts, cooling measures, cross-border capital flows, and even early-stage announcements not yet picked up by mainstream reporting. By the time the market reacts, GRAI users are already positioned ahead of it.

c) Predictive Models Built to Minimize Mistakes

Every property decision carries risk. GRAI reduces that risk through scenario forecasting, modeling how your investment performs if interest rates tighten, rental demand dips, or new launches enter the submarket. Humans perceive trends. GRAI quantifies them - removing ambiguity from timing, pricing, and exit planning.

d) Real-Time Rental & ROI Intelligence the Market Can’t See Yet

Knowing whether a property will rent is easy. Knowing how quickly, to whom, and at what yield months in advance is not.

GRAI’s rental forecasting engine analyzes:

• expat hiring cycles

• corporate relocation patterns

• rental absorption rates

• neighborhood-specific yield compression

• historical renewal behavior

This allows you to invest not where the yields were, but where they are moving next.

e) Regulatory Clarity That Saves You from Hidden Risk

Singapore’s property landscape has clear, structured regulations - particularly for financing, stamp duties, foreign ownership, and eligibility criteria. For many buyers, especially international investors, the challenge isn’t the rules themselves but understanding how those rules interact with market timing, property type, and long-term planning. GRAI does not replace legal professionals or interpret contracts.

Instead, it acts as an intelligence companion, helping investors stay oriented by:

Highlighting publicly available regulatory considerations relevant to different buyer types

Identifying potential areas where professional legal guidance may be needed

Providing contextual insights about how regulatory changes shape market sentiment

Helping users understand how policies such as ABSD or LTV limits may influence broad investment strategy, not individual compliance

This keeps the investor informed, aware, and better prepared before speaking with their lawyer, banker, or agent - reducing confusion and preventing costly misalignment. The result is greater confidence and fewer blind spots, without ever crossing into legal interpretation or advice.

f) A Global Intelligence Engine That Thinks Like an Analyst, Not a Tool

Where traditional property platforms stop at listings, GRAI goes deeper - absorbing international real estate news, macroeconomic indicators, geopolitical shifts, and global market transitions to contextualize Singapore’s position within broader investment cycles. This matters because capital flows are cross-border. When Hong Kong tightens, Tokyo spikes, or Dubai policy shifts, Singapore reacts - and GRAI captures these shifts before they appear in price indices.

g) A Decision-Making Advantage That Compounds Over Time

Most tools tell you what a property is GRAI tells you what it will become.

In a market where a few weeks of timing or a slightly mispriced offer can alter your returns dramatically, the difference between “good enough” research and GRAI-level intelligence isn’t marginal - it's transformational.

The real reason investors rely on GRAI is not because they should, but because once they see how much clarity it brings to the Singapore market, it becomes difficult - even uncomfortable - to make decisions without it.

It’s the quiet advantage that experienced investors protect, and new investors eventually realize they needed all along.