Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

The Sydney real estate market has always commanded global interest. As one of the most livable cities in the world - boasting a robust economy, world-class education, iconic coastal lifestyle, and resilient infrastructure - Sydney continues to attract local and international buyers.

But 2025 is shaping up to be a transformational year. Regulatory shifts, digital property verification, and sustainability requirements are reshaping buyer behavior. Homeownership affordability continues to challenge first-time buyers, while foreign investors are re-evaluating where and how they place their capital.

Amid this evolving landscape, GRAI - the world’s most advanced real estate AI advisor - steps in as a critical partner for anyone navigating Sydney’s complex property environment. With real-time market intelligence, instant valuations, legal and environmental assessments, and portfolio simulation tools, GRAI is designed to give every investor a strategic edge.

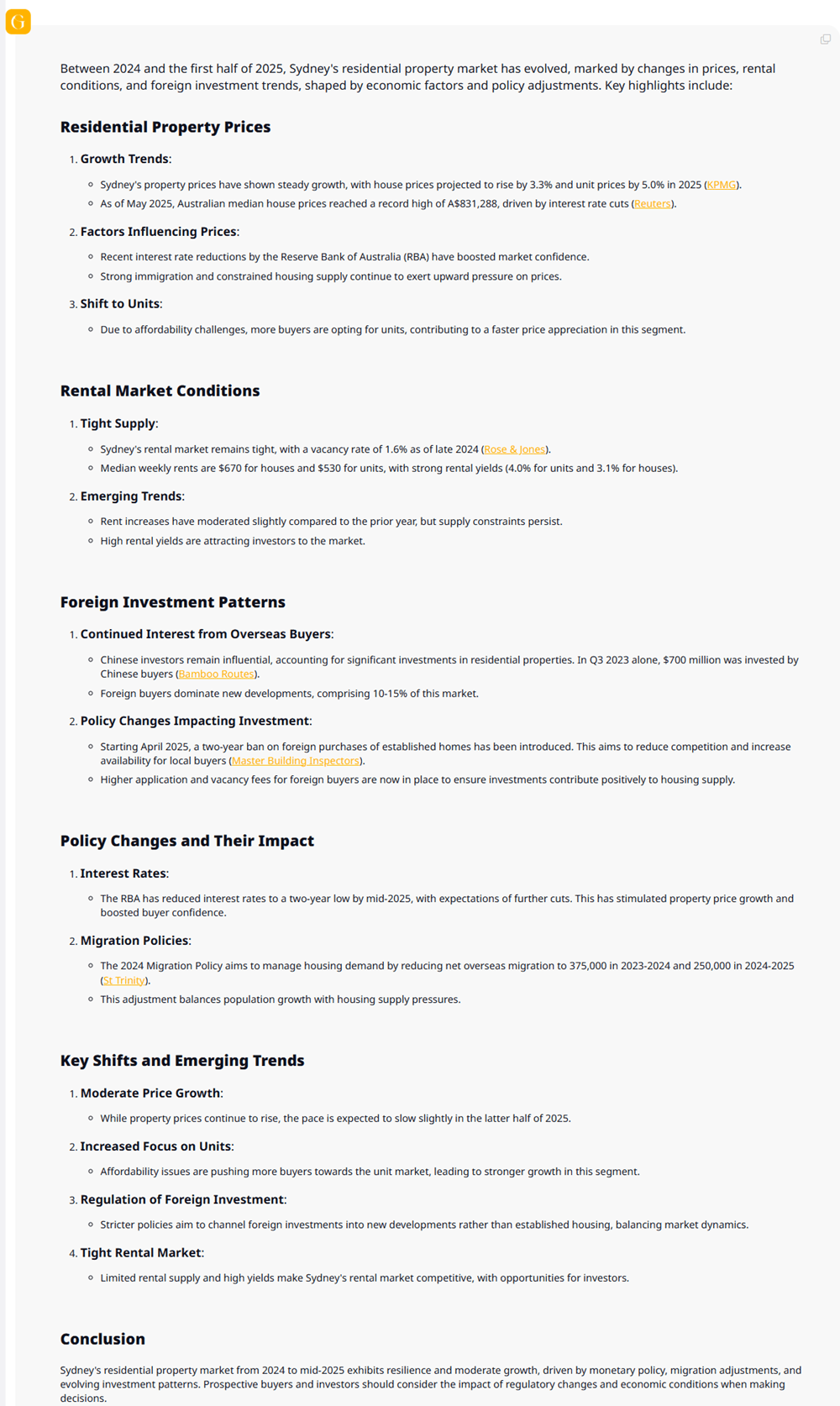

Between 2024 and mid-2025, Sydney’s residential property market has demonstrated resilience amid shifting economic dynamics, foreign investment regulations, and tight housing supply. According to GRAI’s analysis, several key trends are expected to shape the market through the rest of 2025:

1. Residential Property Prices: Moderate but Steady Growth

Sydney’s property prices have continued a growth trajectory. In 2025, house prices are projected to rise by 3.3% and unit prices by 5.0%, supported by reduced interest rates and robust buyer demand. By May 2025, the Australian median house price hit a record high of A$831,288, driven by easing monetary policy and constrained housing supply. Units are showing faster appreciation, as affordability pressures push more buyers toward this segment.

2. Rental Market Remains Tight

Rental conditions remain competitive in Sydney, with a vacancy rate as low as 1.6% by late 2024. Rents continue to climb - weekly medians stand at $670 for houses and $530 for units. High yields, especially for units (4.0%), are attracting property investors, even as the pace of rent increases has slightly moderated compared to 2023.

3. Foreign Investment Patterns Are Evolving

GRAI notes that Chinese investors remain prominent in Sydney’s real estate landscape, accounting for significant residential purchases - $700 million in Q3 2023 alone. However, since April 2025, stricter rules have redirected foreign interest toward new developments, reducing pressure on established housing stock. This shift is designed to prioritize availability for local buyers and alleviate vacancy risks in underutilized assets.

4. Policy and Economic Adjustments

The Reserve Bank of Australia (RBA) has lowered interest rates to a two-year low by mid-2025, bolstering market sentiment and stimulating activity across price tiers. Simultaneously, Australia’s 2024 Migration Policy has tightened overseas migration quotas - targeting 250,000 in 2024–2025 to align population growth with housing infrastructure capabilities.

5. Key Emerging Trends to Watch

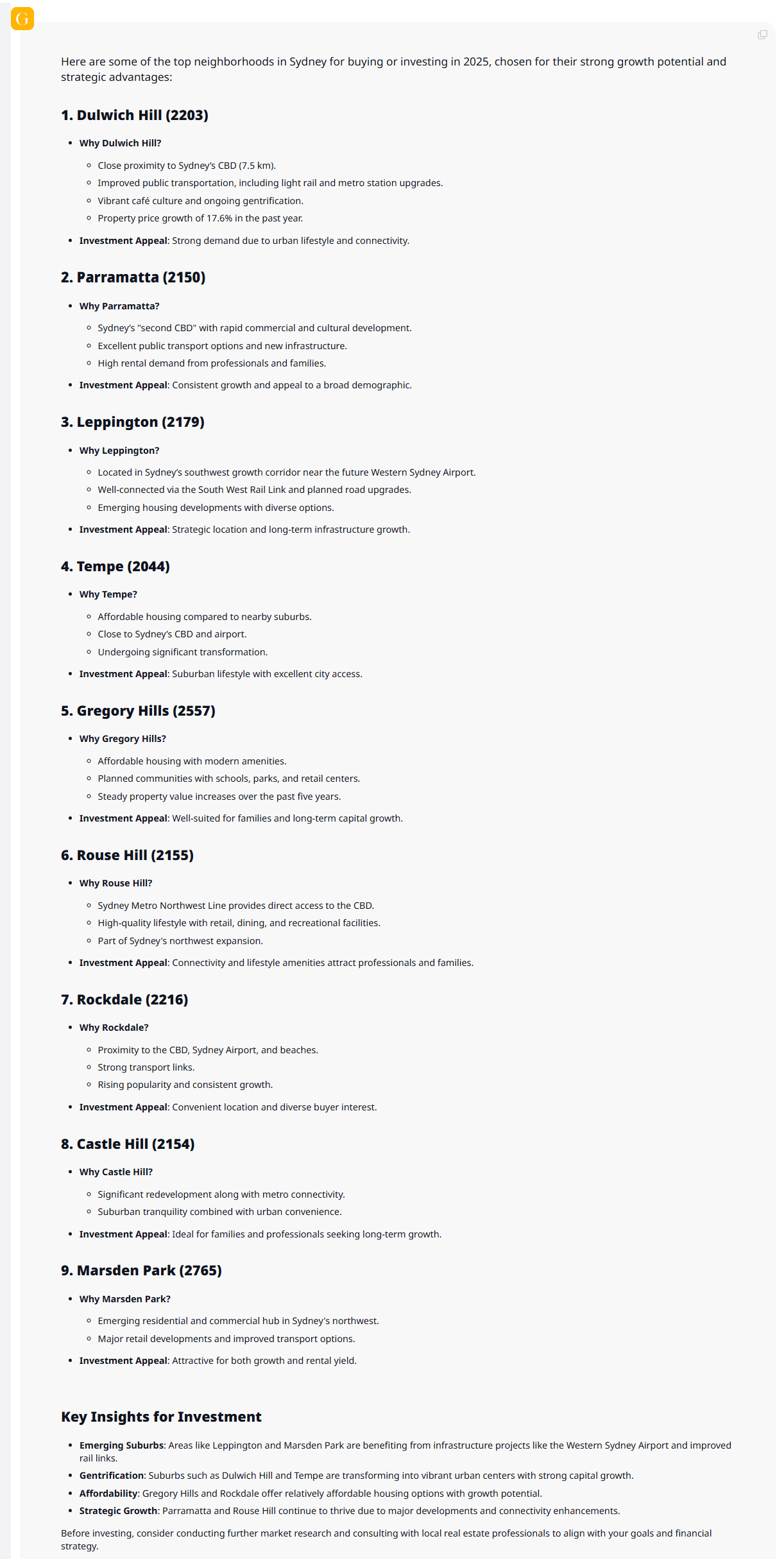

GRAI has identified Sydney’s top suburbs for property investment in 2025 based on infrastructure development, affordability, connectivity, and long-term capital growth potential. These neighborhoods represent strong strategic advantages for investors and homebuyers alike:

1. Dulwich Hill (2203)

GRAI Insight: Strong demand driven by lifestyle appeal and connectivity.

2. Parramatta (2150)

GRAI Insight: Consistent growth and wide demographic appeal make Parramatta a strategic investment hub.

3. Leppington (2179)

GRAI Insight: Long-term growth potential due to future transport and infrastructure projects.

4. Tempe (2044)

More affordable than surrounding suburbs while still close to CBD and airport.

Undergoing rapid urban transformation.

GRAI Insight: Offers a suburban lifestyle with excellent city access - ideal for gentrification-focused investors.

5. Gregory Hills (2557)

Affordable modern homes with schools, parks, and retail nearby.

Consistent property value increases over the past five years.

GRAI Insight: Perfect for family buyers and investors seeking long-term capital growth.

6. Rouse Hill (2155)

GRAI Insight: Attracts professionals and families due to lifestyle amenities and accessibility.

7. Rockdale (2216)

GRAI Insight: A balanced choice for both investors and homeowners due to strong location fundamentals.

8. Castle Hill (2154)

GRAI Insight: Ideal for families and professionals aiming for stability and long-term returns.

9. Marsden Park (2765)

GRAI Insight: High-growth potential for both capital appreciation and rental income.

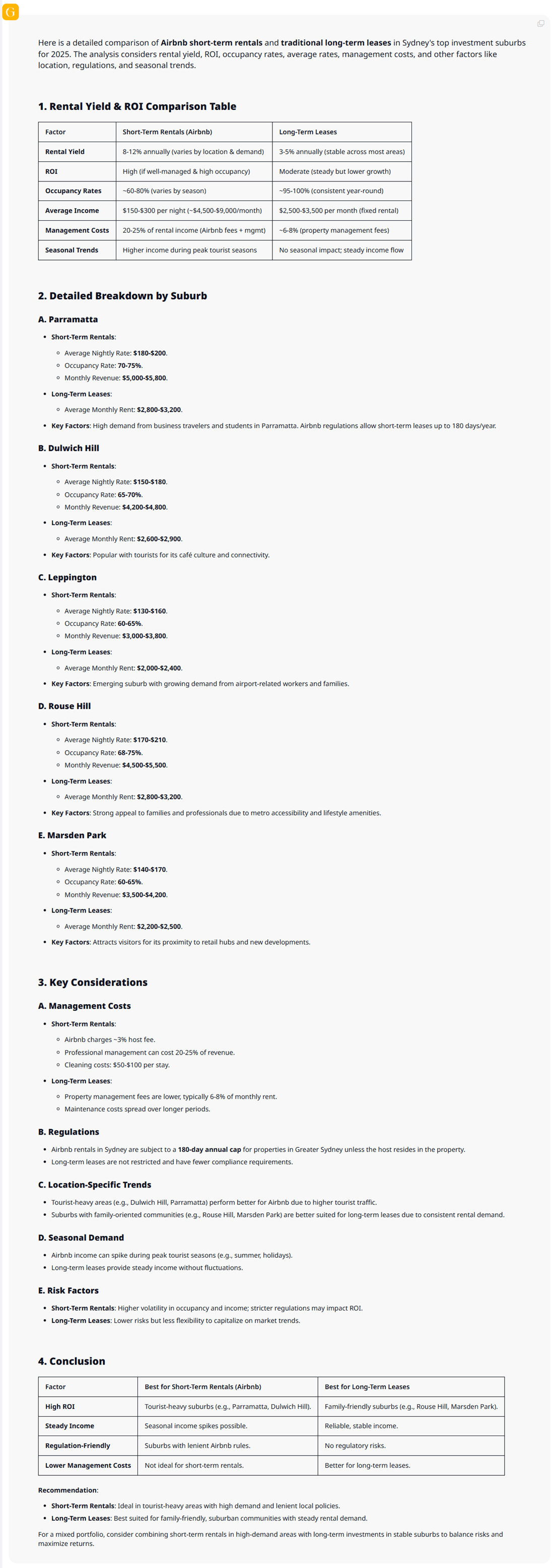

When choosing between Airbnb short-term rentals and traditional long-term leases in Sydney’s top-performing suburbs, it’s essential to weigh factors like rental yield, ROI, occupancy rates, management costs, and local regulations. GRAI’s 2025 analysis compares both investment strategies to help property investors make informed decisions.

1. Rental Yield & ROI Comparison Table

| Factor | Short-Term Rentals (Airbnb) | Long-Term Leases |

|---|---|---|

| Rental Yield | 8–12% annually (location & demand dependent) | 3–5% annually (more stable across suburbs) |

| ROI | High (if well-managed with high occupancy) | Moderate (lower risk, slower growth) |

| Occupancy Rates | ~60–80% (seasonal variation) | ~95–100% (consistent year-round) |

| Average Income | $150–300 per night (~$4,500–$9,000/month) | $2,500–$3,500 per month (fixed) |

| Management Costs | 20–25% of income (Airbnb fees + mgmt) | ~6–8% (property management) |

| Seasonal Trends | High-income peaks in tourist seasons | No seasonal impact; stable monthly income |

2. Suburb-Wise Breakdown: Airbnb vs. Long-Term Leases

A. Parramatta

B. Dulwich Hill

C. Leppington

D. Rouse Hill

E. Marsden Park

3. Key Considerations

A. Management Costs

B. Regulations

C. Location-Specific Trends

Airbnb Favored Areas: Parramatta, Dulwich Hill (high tourist activity).

Long-Term Favored Areas: Rouse Hill, Marsden Park (family-oriented and commuter-friendly).

D. Seasonal Demand

E. Risk Factors

4. Conclusion: Which Strategy Works Best?

| Criteria | Best for Airbnb | Best for Long-Term Leases |

|---|---|---|

| High ROI | Parramatta, Dulwich Hill | Rouse Hill, Marsden Park |

| Stable Income | Seasonal peaks (but less predictable) | Reliable monthly returns |

| Regulation-Friendly | Areas with lenient Airbnb rules | No regulation issues across suburbs |

| Lower Costs | Not cost-effective (high mgmt fees) | Better management cost structure |

GRAI’s Investment Tip:

Airbnb Rentals: Best suited for high-demand, tourist-heavy areas with flexible short-term policies.

Long-Term Leases: Ideal for families and commuters seeking suburban lifestyle and steady rental yield.

Blended Strategy: For portfolio balance, combine short-term rentals in high-income suburbs with long-term leases in growth corridors.

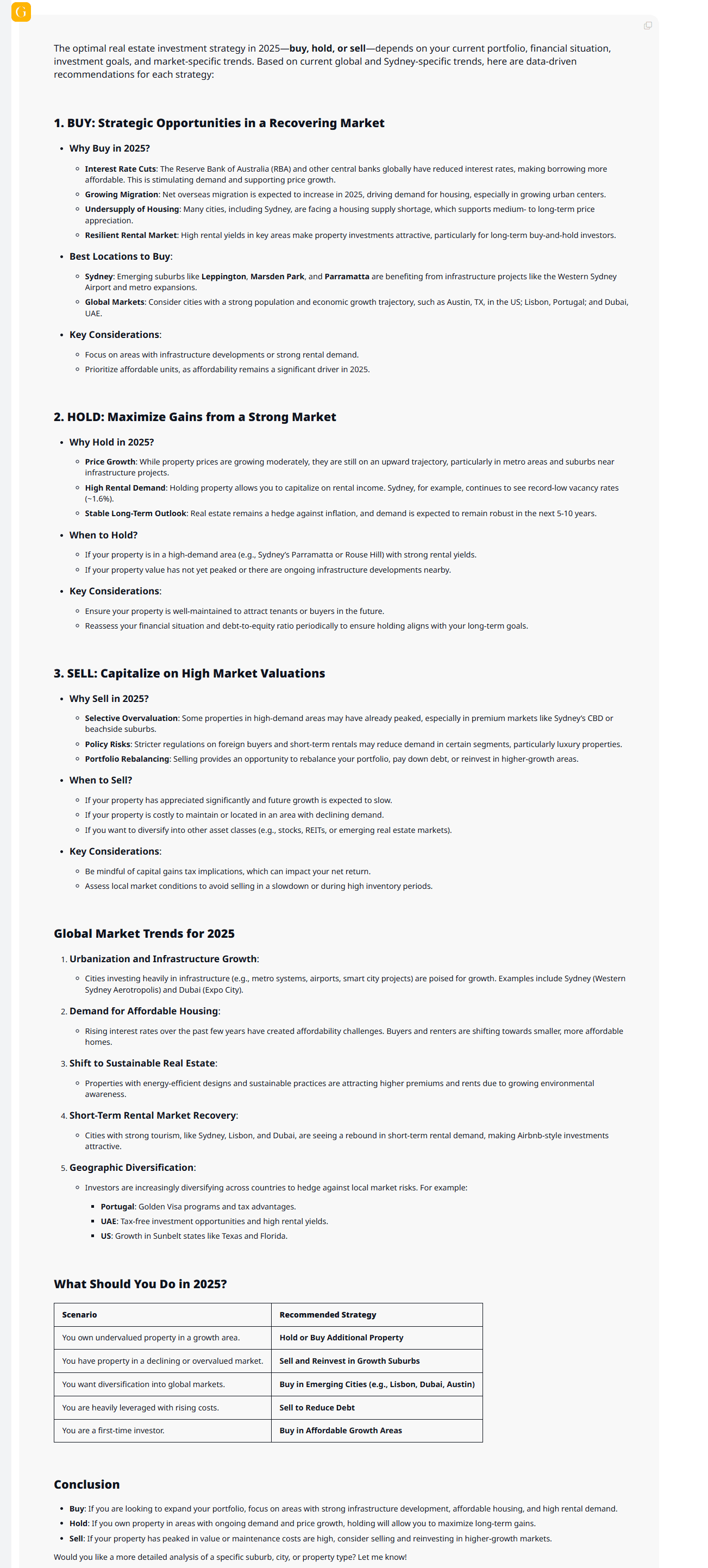

Based on Sydney’s 2025 outlook, GRAI’s AI-generated advisory model offers granular Buy, Hold, or Sell suggestions personalized to each investor’s risk profile and timeline.

1. BUY: Strategic Opportunities in a Recovering Market

Why Buy in 2025?

Best Locations to Buy:

Key Considerations:

2. HOLD: Maximize Gains from a Strong Market

Why Hold in 2025?

When to Hold:

Key Considerations:

3. SELL: Capitalize on High Market Valuations

Why Sell in 2025?

When to Sell:

Key Considerations:

In a high-stakes market like Sydney, every second and every data point matters. GRAI isn’t just another AI assistant - it’s a complete intelligence platform built specifically for real estate professionals and serious investors.

GRAI's Most Impactful Features for Sydney Buyers:

AI-Powered Property Valuation - Accurate, localized, and instant.

Advanced Portfolio Management - Test out “what-if” scenarios for your holdings.

Global & Local Market Insights - Real-time updates on market mood, economic drivers, and neighborhood developments.

Environmental Impact Forecasting - From flood risks to sustainability compliance.

Multilingual Legal Document Review - Analyze contracts from anywhere in the world in any language.

From visualizing your future villa in Palm Beach to planning a renovation in Marrickville, GRAI provides AI-generated cost breakdowns, legal risk flags, and sentiment scoring - so your next move is always your smartest one.

Sydney’s property market remains one of the most lucrative yet competitive investment spaces in the world. With changing regulations, rising construction costs, and a more global buyer pool than ever, relying on gut instinct or outdated trends is no longer enough.

GRAI transforms how you engage with Sydney real estate:

It thinks faster than traditional consultants.

It analyzes more deeply than any manual method.

It operates globally, contextualizing local insights in seconds.

Whether you’re wondering “Can foreigners buy property in Sydney?”, exploring Sydney property prices graphs, or comparing agents, GRAI provides instant answers tailored to your goals.

Subscribe to GRAI today and make your next property decision with unmatched confidence. GRAI isn’t just a tool - it’s your competitive edge in a market that never stops moving.