Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

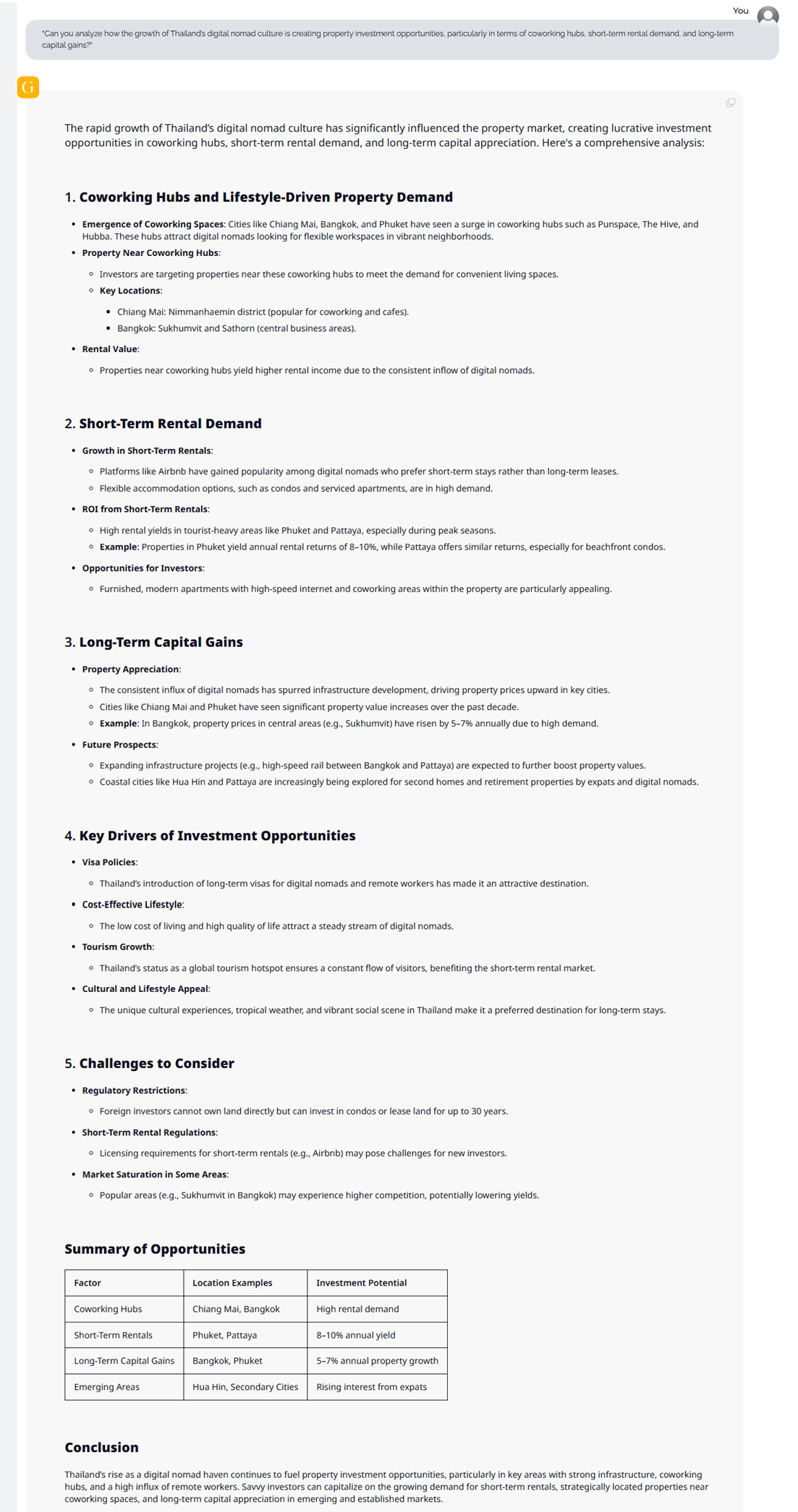

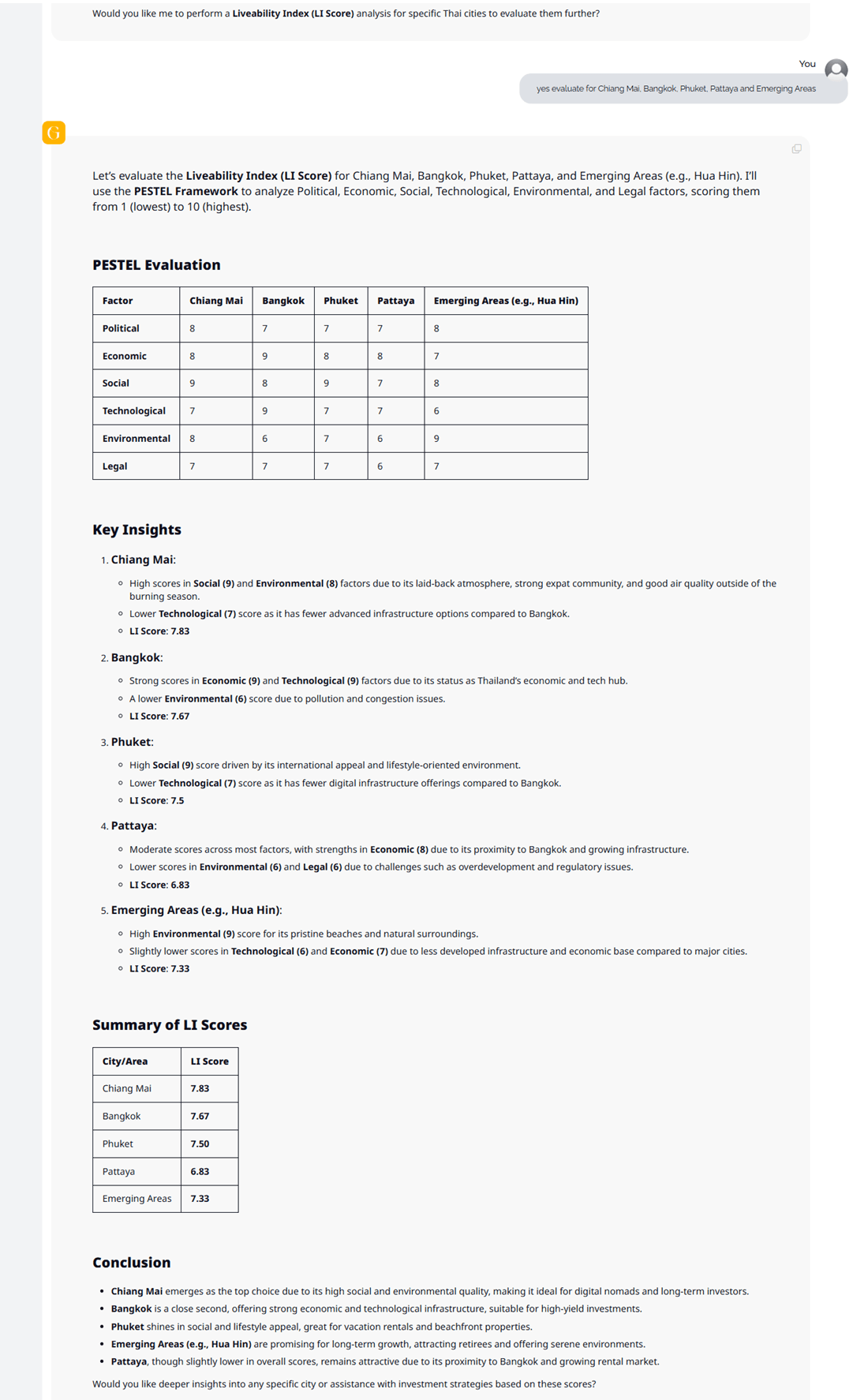

The digital nomad lifestyle has evolved from a fringe movement into a global force, changing how people live, work, and invest. In 2025, Thailand stands as the undisputed capital of this shift. With affordable living, high-speed internet, friendly visa policies, and unbeatable natural beauty, Thailand has become the go-to base for remote professionals.

But this movement is no longer just about renting short-term spaces and working from cafes. Today’s digital nomads are investing. They are transforming real estate markets, shifting the focus from tourism-only economies to remote-first living ecosystems.

This comprehensive guide explores Thailand’s position as a digital nomad haven and explains how you can:

Set up your life as a digital nomad

Tap into real estate investment opportunities

Use GRAI, the Global Real Estate AI advisor, to make smarter, faster, and more profitable decisions

Whether you're a remote worker looking to settle long-term or an investor seeking the next growth opportunity, Thailand - and GRAI - should be at the centre of your strategy.

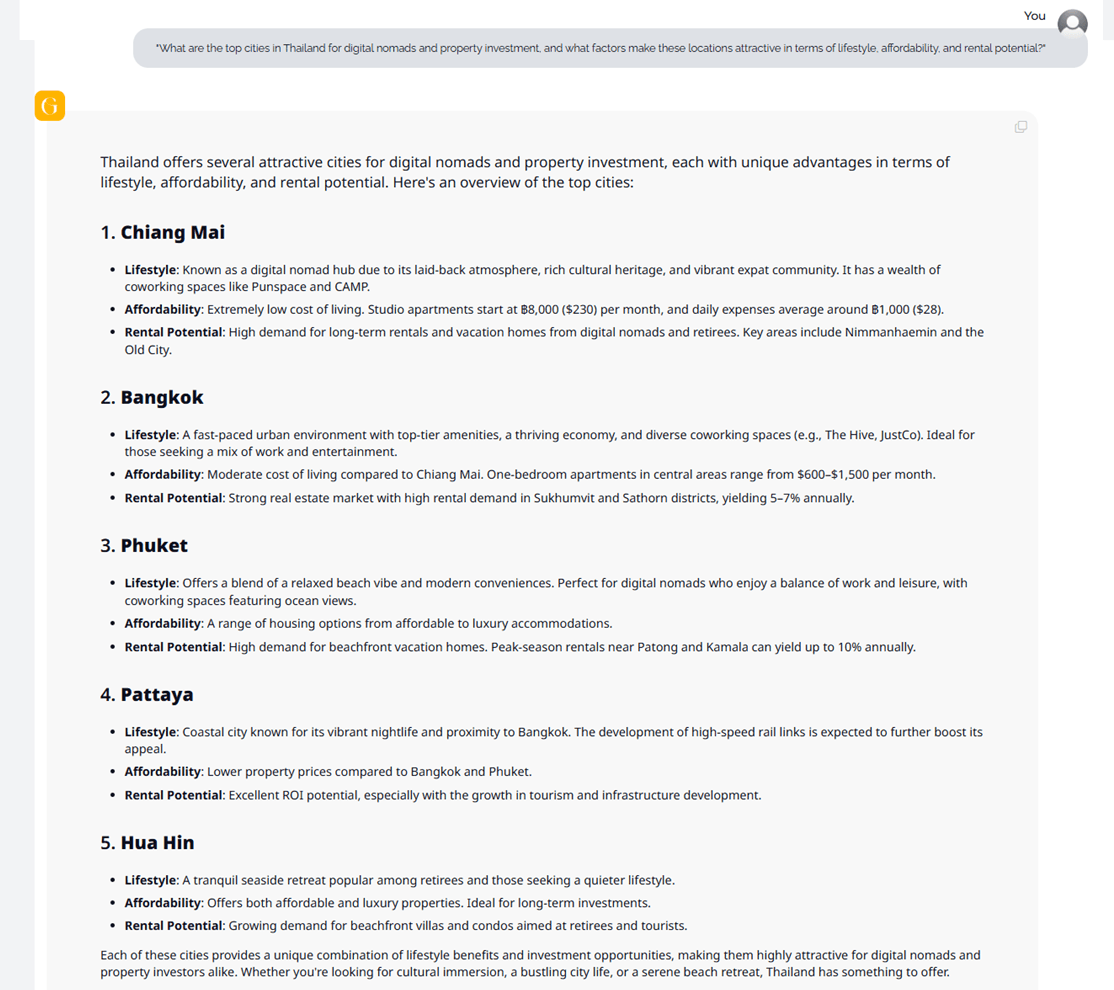

1. Chiang Mai - The Nomad Capital of Asia

Nestled in the mountains of Northern Thailand, Chiang Mai has earned its reputation as a global digital nomad hub. With a cost of living roughly 60% lower than Western cities, it offers tremendous value without sacrificing infrastructure.

Housing: $300–$1,000/month for furnished apartments

Lifestyle: Cafes, coworking spaces (Punspace, Yellow), laid-back pace

GRAI Data Insight: Yield potential above 8% in key areas like Nimman and Santitham

Chiang Mai is particularly appealing for creators, coders, and bootstrapped entrepreneurs. GRAI identifies this city as a "high livability, high-yield" zone - a rare combination for investors.

2. Bangkok - A Metropolis Built for Nomads

Bangkok is more than just Thailand’s capital - it’s a magnet for high-earning digital professionals who want city convenience without Western costs.

Rent: $600–$1,500/month

Hotspots: Thonglor, Ekkamai, Asoke, Ari

Investment Angle: Short-term rentals and serviced condos ideal for monthly nomads

Using GRAI’s Predictive Economic Models, users can identify undervalued districts near BTS/MRT lines, ensuring capital appreciation and high rental occupancy.

3. Phuket & Koh Phangan – Tropical Work-Life Balance

For those prioritizing ocean views and wellness living, Thailand’s islands offer a powerful draw.

Cost: $1,000–$3,000/month

Digital Infrastructure: Expanding rapidly with new coworking spaces

GRAI Highlight: Use Environmental Impact Assessments to screen for flood zones, construction limitations, and climate suitability

Demand is rising for Airbnb-style villas, especially with remote teams now co-locating for "workations." GRAI’s Custom Valuation Tool helps investors compare different layouts, yields, and risk profiles at the click of a button.

Short-Term and Mid-Term Rentals

Digital nomads typically stay 1 to 6 months. Properties optimized for them - fast WiFi, modern kitchens, ergonomic furniture, and flexible leases - can command 30-40% higher rent than tourist-only units.

According to GRAI’s analytics, mid-length rentals in Chiang Mai and Bangkok now achieve:

Occupancy Rates: 85–95%

Gross Yield: 10–14% annually

Serviced Apartments & Co-Living Spaces

These hybrid spaces offer hotel-like services with longer lease flexibility. They appeal to professionals who value both privacy and community.

Startup Cost: $150K–$400K per unit

Expected Return: 12–18% annually in top zones

GRAI's Portfolio Simulation Engine lets you model ROI across a mix of serviced apartments, co-living developments, and traditional condos to help investors balance yield and volatility.

To get started, try asking GRAI:

“What’s the rental yield for a mid-term unit in Nimman?”

“Simulate ROI for a $300K co-living space in Thonglor,”

“Show serviced apartments under $400K.”

Condos for Remote Work Living

One-and two-bedroom condos built within the last decade remain top picks. GRAI’s Valuation Engine factors in:

Comparable listings

Local labor and material costs

Zoning constraints

Developer reputation

This ensures you invest based on real market data, not inflated listing prices or anecdotal trends.

1. Secure the Right Visa

In 2025, Thailand offers several pathways:

Long-Term Resident (LTR) Visa: For professionals earning $80,000+ per year

SMART Visa: For entrepreneurs in tech, medtech, or academia

Elite Visa: Premium access for those ready to invest in long-term lifestyle

Education Visa: A workaround popular among new nomads

GRAI offers localized legal guidance, helping users understand how visa status impacts property rights and financial strategy.

Also Read: Dubai Golden Visa 2025: Costs, Benefits & How to Apply

2. Calculate the True Cost of Living

With GRAI’s cost forecast tool, nomads can compare:

| City | Budget Range | Notes |

|---|---|---|

| Bangkok | $600–$1,500 | More amenities, faster internet |

| Chiang Mai | $300–$1,000 | Affordable but quality living |

| Phuket | $1,000–$3,000 | Lifestyle-driven spending |

3. Choose the Right Location

Instead of relying on blog lists or word-of-mouth, GRAI provides:

Whether you prioritize nightlife, nature, or networking, GRAI recommends areas that match your lifestyle and financial goals.

4. Review Accommodation Contracts Safely

Upload a lease or purchase agreement into GRAI to get:

Contract summaries in plain English

Red flags for any compliance risks or unusual clauses

Multilingual interpretation support

This is especially helpful in a market where foreign property ownership rules can be complex.

5. Simulate Your Investment or Rental Journey

GRAI’s What-If Scenario Engine allows nomads and investors to:

Compare buying vs. renting outcomes over time

Analyze Airbnb income vs. long-term rental profits

Forecast exit value in 3, 5, or 10 years

GRAI isn't just another real estate platform. It's an AI-powered global real estate intelligence system designed for modern investors and nomads who value speed, accuracy, and clarity.

Here’s what you can do with GRAI:

| Feature | Use Case |

|---|---|

| Upload & Analyze Land Images | Evaluate buildability & legal issues instantly |

| Get Instant Property Valuation | Avoid overpaying or missing ROI opportunities |

| Run Predictive Market Analysis | Anticipate demand spikes & neighborhood trends |

| Check Environmental Viability | Avoid flood-prone or high-risk zones |

| Optimize for Lifestyle Fit | Choose areas based on values, not guesses |

With traditional methods, you might spend weeks googling, collating information, calling agents and still be confused as to where to even start. With GRAI, you ask, get informed and decide. Its as simple as that.

Must Read: GRAI Instantly Estimated Home Extension Costs in London

By 2028, GRAI projects Thailand’s digital nomad population will cross 1 million annually. This surge is driven by:

Global companies going permanently remote

Thailand's continued investment in 5G, smart city infrastructure, and high-speed rail

Simplified visa pathways

What does this mean for real estate?

Higher rental demand in Chiang Mai, Bangkok, and emerging hubs like Pai and Hua Hin

Appreciation of well-located condos and serviced apartments

Stronger interest from institutional investors, creating early-mover advantages for individuals

Nomad-friendly infrastructure like coworking spaces, bike lanes, medical tourism centers, and multilingual signage will further boost real estate desirability.

GRAI tracks this data and delivers it before the market reacts. That’s the competitive edge.

Thailand has always been welcoming. But in 2025, it has become strategic. For digital nomads, it’s a place to thrive. For investors, it’s a blueprint for growth. And for both, GRAI is the real estate intelligence engine that powers smart decisions.

Don’t guess. Don’t wait. Don’t follow.

Lead with GRAI. Explore. Analyze. Invest - instantly. Subscribe to GRAI today to stay ahead of trends and take the guesswork out of global real estate decisions.