Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

For decades, property buyers chased location, luxury, and leverage. In the 2020s, they’re chasing something rarer: longevity.

Across continents, “wellness real estate” has evolved from a niche resort concept into a $913 billion global industry.

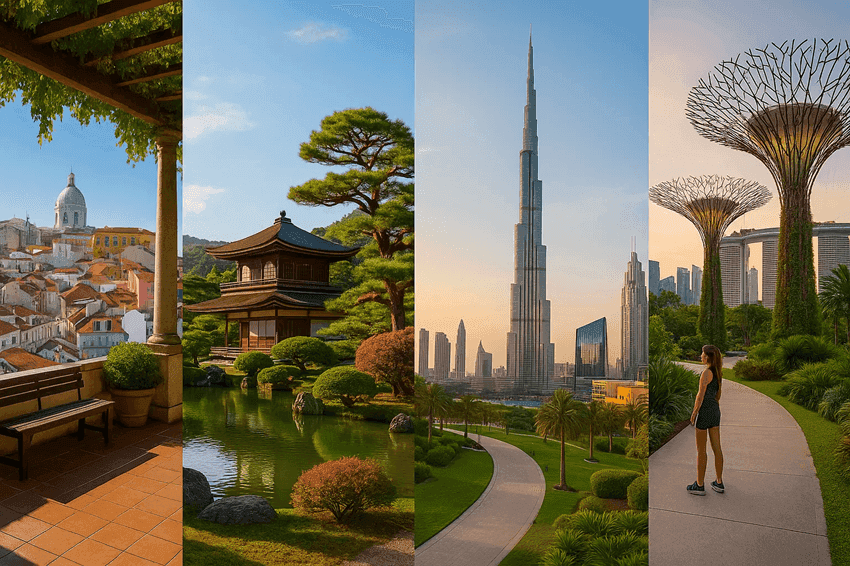

From Dubai’s bio-residences to Portugal’s “Blue-Zone” neighborhoods, investors are betting on a simple thesis: the healthiest square meter wins.

Wellness real estate once meant gyms in basements and yoga decks on rooftops. Now it means biophilic architecture, advanced air-filtration, circadian lighting, community nutrition centers, and on-site medical partnerships.

Between 2019 and 2025, the sector grew at 7% annually, more than twice the global construction average.

Residential projects carrying WELL or Fitwel certification command 4.4%-7.7% rent premiums and 15%-25% higher sale prices.

In other words, wellness has become yield.

Also Read: Real Estate vs Bitcoin vs Gold in 2025: Which Asset Class Deserves Your Capital?

Europe’s pilot for municipal Blue Zones. Neighborhoods integrating walkability, pollution buffers, and sunlight-optimized building codes have seen property appreciation 12%-15% above metro average.

Developers report lower tenant turnover and stronger local retail resilience.

With air-quality regulations and an aging-population focus, Tokyo’s wellness districts now rent for 3%-10% more than standard units.

Long life expectancy is matched by urban calm-noise restrictions, greenery corridors, and convenience-driven planning.

Developers MAG Group and Ellington are marketing “bio-residences” with vitamin-D balconies and circadian lighting.

Sales of wellness-branded properties rose 28% YoY in 2025. Well-being is fast becoming Dubai’s newest luxury currency.

One of the world’s five Blue Zones-areas linked to extreme longevity.

Land values have surged 34% since 2022, driven by remote workers and wellness retreats.

Urban health embedded in national planning.

Proximity to green corridors and sports hubs adds 9%-12% resale premium.

The city’s Healthier SG initiative has made “active design” a property feature, not a policy line.

Health sells-because it compounds.

Longer tenancy: 2.3 years average stay vs 1.6 in conventional rentals.

Lower maintenance issues: 40% fewer complaints due to better ventilation and materials.

Reduced vacancy: Wellness properties experience 20% shorter downtime between tenants.

Institutional adoption: 15%-20% of UHNW investors plan to raise allocation to health-oriented assets by 2026.

When you strip the buzzwords, wellness real estate performs because it aligns three profit centers-time, trust, and tenant loyalty.

Must Read: How Digital Nomads Build Wealth Through Global Real Estate

Three forces are converging:

1. Post-pandemic psychology

Health security outranks commute convenience for 7 of 10 buyers.

2. Climate stress

“Low-tox” regions-Portugal, New Zealand, Thailand-are seeing relocations from polluted or heat-stressed metros.

3. Remote work permanence.

When you can work anywhere, you choose where you feel best. That’s shifting capital from megacities to mid-climate, wellness-certified communities.

Major builders now treat wellness metrics like energy ratings:

Lendlease (Australia) integrates digital health twins to monitor air and daylight exposure.

Emaar (Middle East) ties property pricing to WELL certification levels.

New York’s Hudson Yards is redesigning public spaces to achieve “mental-health zoning” targets.

Urban design is turning into a form of healthcare infrastructure-private, profitable, and data-measurable.

Related: Design Is No Longer Cosmetic: How AI Is Rewriting Real Estate Value Forever

GRAI helps investors and analysts simulate how wellness factors alter property performance across regions:

“Compare ROI of WELL-certified vs conventional condos in Asia and Europe.”

“Forecast rent premium for air-quality-optimized units in major metros.”

“Model long-term appreciation of climate-calm districts vs polluted ones.”

“Identify top cities where life-expectancy gains correlate with price growth.”

Analyze Your Wellness Property ROI with GRAI : https://internationalreal.estate/chat

When health becomes an input variable, GRAI turns sentiment into strategy.

Wellness real estate isn’t a luxury pivot-it’s a survival strategy for the 21st-century city.

Homes, districts, and investors that enhance human resilience will define the next property cycle.

In the past, the mantra was location, location, location.

Now it’s longevity, livability, and light.

Because in tomorrow’s market, the most valuable asset isn’t the square foot you own - it’s how well you live inside it.