Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

In the evolving landscape of global real estate, Tokyo and Singapore stand out as two of the most dynamic and sought-after property markets in Asia. With 2025 shaping up to be a pivotal year for investors worldwide, a common question arises: Where should you invest - Tokyo or Singapore?

From capital appreciation to rental profitability, from economic forecasts to legal and cultural considerations, this article breaks down the most critical investment factors and it does so with the help of GRAI real estate AI advisor. GRAI offers real-time intelligence, legal analysis, environmental risk insights, and much more - empowering global investors to make smarter, faster, and safer decisions.

Whether you're interested in real estate investments, buying rental property, or want to understand Tokyo and Singapore real estate market reports, this is your comprehensive, AI-powered investment guide.

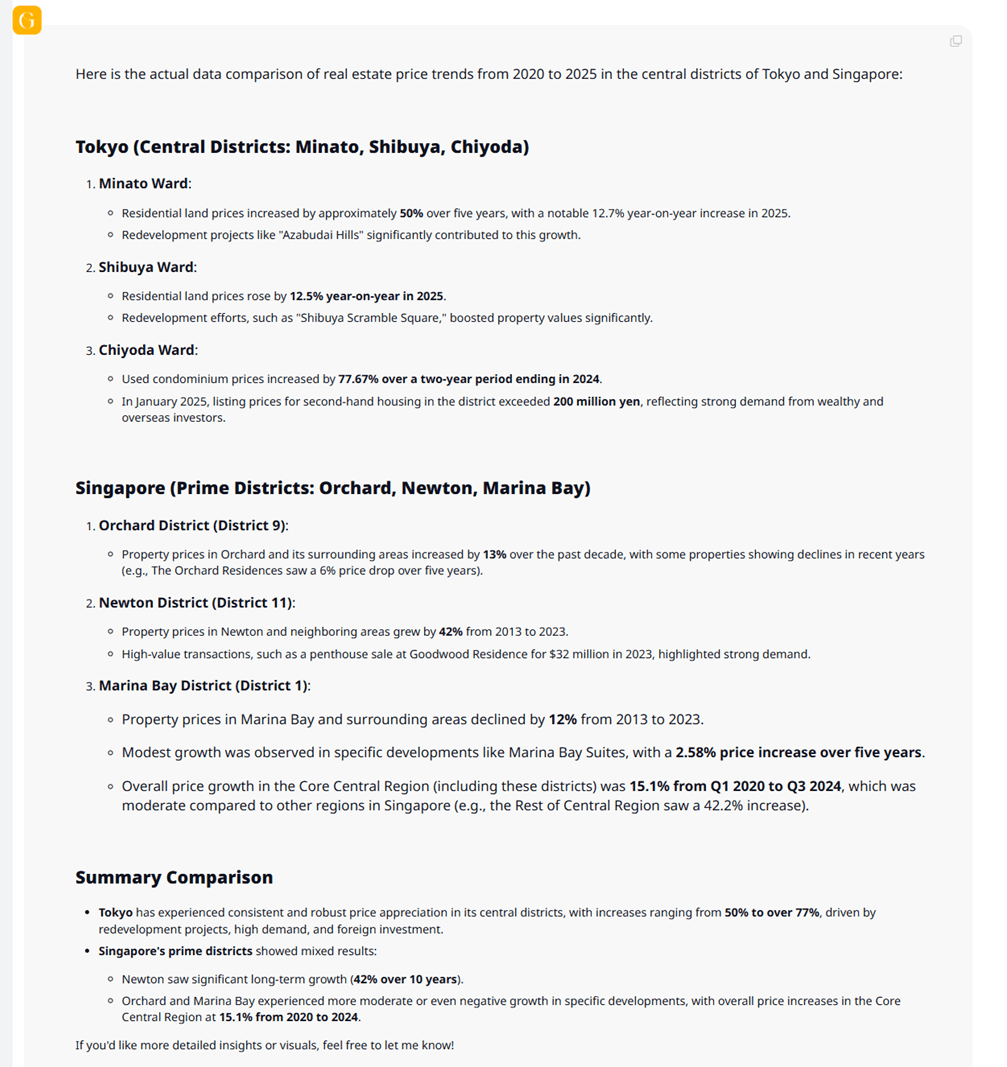

Between 2020 and 2025, Tokyo's central districts - Minato, Shibuya, and Chiyoda - have shown robust and sustained real estate price growth, fueled by a combination of luxury redevelopment projects, high demand from global investors, and infrastructure upgrades.

Minato Ward saw a 50% overall increase in residential land prices over five years, including a notable 12.7% spike in 2025 alone, driven by high-profile projects like Azabudai Hills.

Shibuya Ward registered a 12.5% year-on-year rise in 2025, as redevelopment zones such as Shibuya Scramble Square continued to push up property values.

Chiyoda Ward recorded the most dramatic rise, with condominium prices jumping 77.67% between 2022 and 2024, reflecting the surge in demand from overseas investors. Property listings even surpassed 200 million yen in early 2025 for second-hand housing.

In contrast, Singapore’s prime districts (Orchard, Newton, Marina Bay) showed mixed performance:

Newton District (District 11) emerged as the top performer in Singapore, with a 42% growth from 2013 to 2023, propelled by luxury transactions and sustained investor interest.

Orchard District (District 9) posted a modest 13% gain over the past decade, though some developments like The Orchard Residences saw price dips of 6% over five years.

Marina Bay (District 1) struggled to maintain upward momentum, with an overall 12% decline from 2013 to 2023, though specific projects like Marina Bay Suites saw a 2.58% rise over five years.

According to GRAI’s aggregated data, Singapore’s Core Central Region (which includes these prime areas) experienced an overall price growth of 15.1% from Q1 2020 to Q3 2024 - a modest appreciation compared to Tokyo’s much sharper increases.

GRAI Insight: Decoding Market Momentum

GRAI’s analysis reveals that Tokyo’s central districts outpaced Singapore’s prime areas in five-year price appreciation, driven by redevelopment, investor demand, and global capital inflow. Tokyo showed stronger short-term spikes and long-term growth potential, especially in Chiyoda Ward. While Singapore’s Newton District performed well, areas like Orchard and Marina Bay displayed inconsistent trends. GRAI flags Tokyo as a higher-yield, lower-volatility investment zone for 2025, with precise entry timing and risk signals.

For investors, GRAI enables hyper-local insights, predictive pricing models, and smarter decision-making across both stable and emerging real estate hotspots.

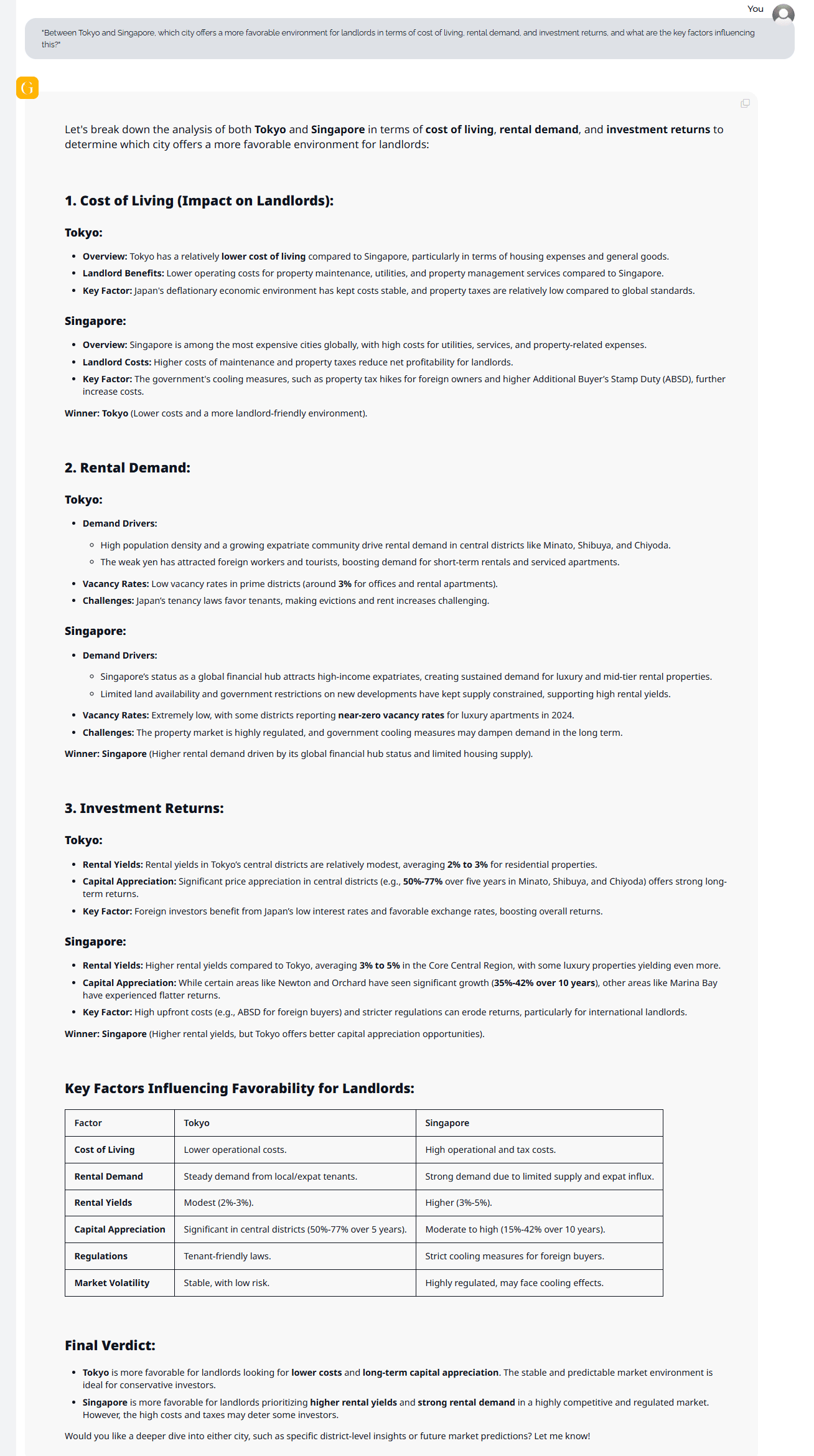

When comparing Tokyo and Singapore from a landlord’s perspective, GRAI’s data-driven analysis evaluates cost of living pressures, rental dynamics, and structural challenges in both markets to determine overall favorability.

1. Cost of Living (Impact on Landlords)

Tokyo:

GRAI highlights that Tokyo offers a lower overall cost of living compared to Singapore, especially in housing-related expenses. This results in reduced operational costs for landlords - covering maintenance, utilities, and property management services. Japan’s deflationary environment has also helped keep property taxes and inflation stable, making Tokyo more landlord-friendly from a cost perspective.

Singapore:

Singapore remains one of the most expensive cities globally, with high operational and tax burdens for landlords. Costs related to property upkeep, foreign buyer stamp duties (ABSD), and tax policy discourage profitability. GRAI notes that these financial pressures can shrink net yields, particularly for foreign investors.

Winner (Cost of Living): Tokyo - Lower costs and more favorable operating conditions.

2. Rental Demand

Tokyo:

GRAI’s insights show that Tokyo has strong local and expat-driven demand in key central districts like Minato, Shibuya, and Chiyoda. Low vacancy rates (~3% in prime locations) suggest stable rental activity. However, strict tenant protection laws and rental increase restrictions pose operational challenges for landlords seeking flexibility.

Singapore:

Singapore’s extremely low vacancy rates and strong inflow of high-income expats create intense demand for both luxury and mid-tier rentals. Limited supply - due to land constraints and government control - has pushed demand up and kept yields strong. GRAI flags this as a major advantage, though it also warns that regulatory constraints could suppress long-term flexibility.

Winner (Rental Demand): Singapore - High-income expat demand and limited housing stock make it more favorable for maximizing occupancy and rent.

GRAI Recommendation:

“Risk-averse investors seeking long-term appreciation and cost efficiency should prioritize Tokyo.”

“Yield-focused investors who can navigate regulation and tolerate volatility may favor Singapore’s Core Central Region.”

GRAI continuously updates market signals - like rental yield heatmaps, regulation alerts, and cost benchmarks - so landlords can optimize property decisions with unmatched precision.

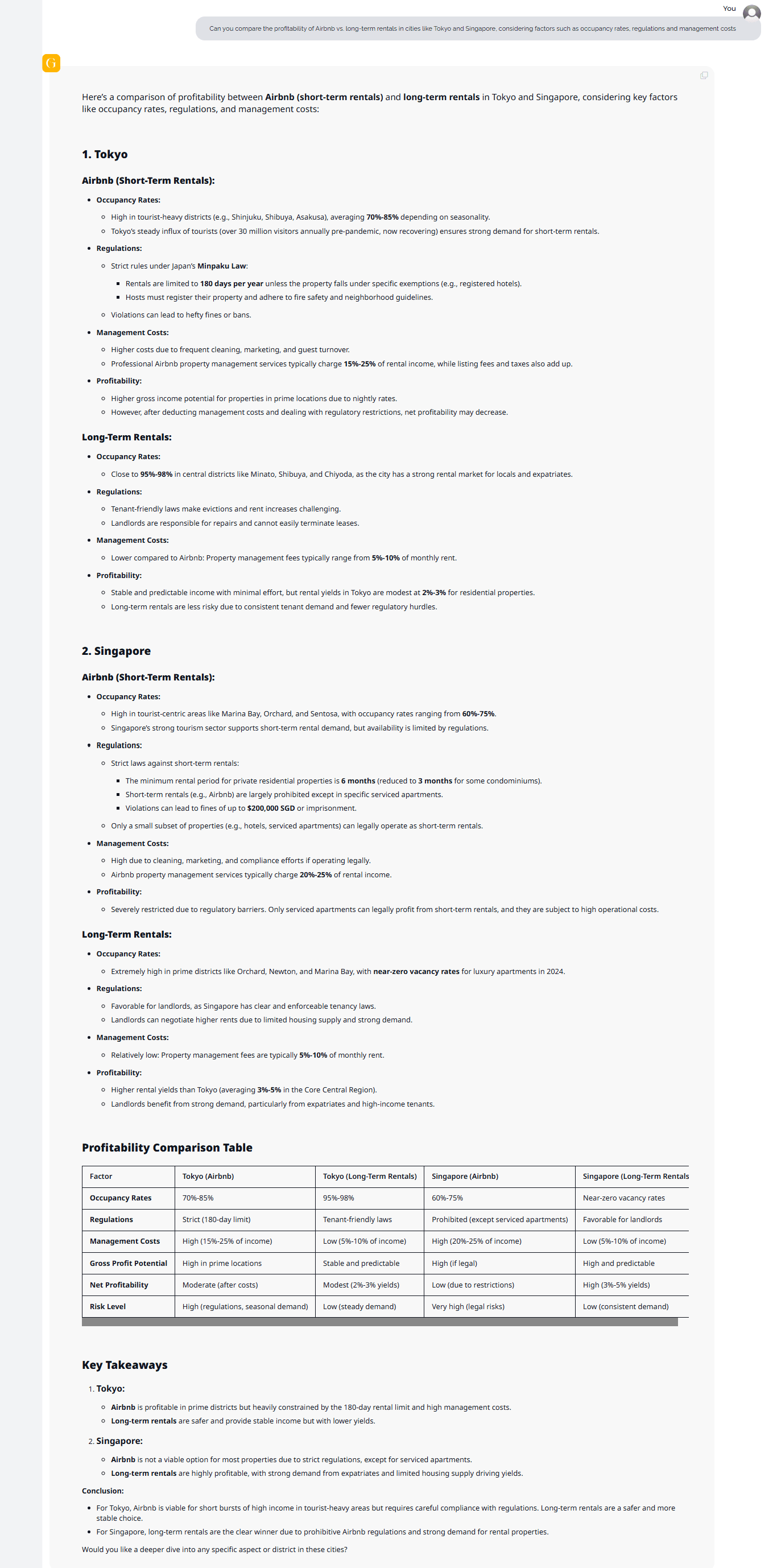

GRAI analyzed profitability across short-term (Airbnb) and long-term rentals in Tokyo and Singapore, factoring in occupancy rates, regulations, management costs, and net yield outcomes. Here’s what the AI-driven analysis reveals:

1. Tokyo

Airbnb (Short-Term Rentals):

GRAI identifies Airbnb as potentially lucrative in tourist-heavy districts like Shinjuku, Shibuya, and Asakusa, where occupancy rates reach 70%–85%. However, Japan’s Minpaku Law imposes a strict 180-day annual rental cap, plus compliance obligations like registration and safety standards.

Professional management fees (15%–25%) and high turnover costs reduce net profits. Despite high nightly rates, regulatory and operational burdens dampen overall returns.

Long-Term Rentals:

With 95%–98% occupancy in central areas, long-term rentals in Tokyo are stable and low-risk. Although yields are modest at 2% - 3%, GRAI highlights tenant-friendly laws and low management costs (5%–10%) as advantages for hands-off investors seeking predictability over peak profits.

GRAI Verdict for Tokyo:

Airbnb is better for high-touch, high-return investors in tourist zones, while long-term rentals offer safety and stability with fewer legal hurdles.

2. Singapore

Airbnb (Short-Term Rentals):

GRAI flags Airbnb as non-viable for most investors in Singapore. Strict regulations prohibit short-term stays under 6 months (3 months for some condos), with fines up to SGD 200,000. Only licensed serviced apartments and hotels can operate legally, and they face high operating costs (20% - 25%).

Despite 60%–75% occupancy rates, the legal risks and limited availability make this model highly unfavorable.

Long-Term Rentals:

Singapore’s prime districts like Orchard and Marina Bay show near-zero vacancy and yields average 3%–5%. Favorable tenancy laws and strong demand from expats make this the preferred route for institutional and individual investors alike, per GRAI’s forecast.

GRAI Verdict for Singapore:

Long-term rentals are the clear winner, offering high demand, predictable returns, and lower legal exposure.

Key Insight:

Tokyo:

• Long-term rentals are safer and provide income with lower fields.

• Airbnb is profitable in prime districts but heavily constrained by the 180-day rental limit.

Singapore:

• Long-term rentals are highly profitable, with strong demand from expatriates and limited housing supply

• Airbnb is not a viable option for most properties due to strict regulations, except for serviced apartments.

Investor Strategy:

Use GRAI to simulate income forecasts based on your preferred model. From nightly rates to monthly lease yields, GRAI calculates profit margins, compliance risks, and market saturation - so you always choose the optimal rental strategy per city and district.

GRAI’s proprietary AI Investment Score evaluates global cities across multiple data sets including:

Here’s how the cities compare:

Tokyo Investment Score: 7.2 / 10

Also Read: Osaka Real Estate 2025: GRAI AI Reveals Top Investment Spots

Singapore Investment Score: 8.9 / 10

GRAI’s Portfolio Management Module suggests Singapore as a top-tier investment opportunity in 2025, especially for investors looking for high liquidity, global appeal, and regulatory clarity.

Modern investors are becoming more environmentally and socially aware - and rightly so. GRAI’s Environmental Impact Assessments compare flood risks, climate projections, and sustainability metrics for both cities:

• Tokyo faces long-term risks from earthquakes and rising sea levels, particularly in low-lying wards.

• Singapore is also vulnerable to climate change but has invested heavily in flood prevention and green infrastructure.

Using AI-driven simulations, GRAI identifies Singapore as more resilient in the face of environmental disruption, especially in newer developments designed with climate adaptation in mind.

Buying Property in Tokyo

Japan permits foreign ownership of land and property, but the process can be opaque without local representation. Contracts are primarily in Japanese, and cultural expectations around property maintenance, tenant relationships, and negotiations can differ sharply from Western norms. GRAI’s Multilingual & Cultural Contextualization capability help investors understand not just what to buy - but how to operate effectively.

Buying Property in Singapore

Singapore is transparent, English-speaking, and boasts one of the most investor-friendly legal environments in Asia. Restrictions do apply - foreigners face higher stamp duties and may not buy landed property without government approval- but overall, the process is streamlined and predictable.

GRAI’s Legal Review Feature simplifies legal due diligence in both markets, flagging risks, summarizing terms, and translating critical clauses instantly.

If you’re focused on high rental income, price appreciation, and a strong legal framework, Singapore clearly outpaces Tokyo in 2025 across most investment metrics. It offers resilience, transparency, and consistent demand - particularly appealing for international investors looking to diversify with minimal friction.

That said, Tokyo remains a viable and attractive market - especially for investors who prioritize legal stability, asset protection, and are seeking undervalued or redevelopment opportunities in fringe districts. With Japan’s growing focus on revitalization and foreign direct investment, niche plays in Tokyo may yield long-term gains for those with a strategic approach.

GRAI bridges this decision-making gap by allowing you to simulate “What-If” scenarios, compare yield curves, predict five-year ROI, and spot risks others can’t see. Its real-time thinking capabilities go beyond static reports or brokerage insights - delivering AI-powered clarity in seconds.

Ready to invest smarter? Subscribe to GRAI today and get instant access to property intelligence for Tokyo, Singapore, and beyond. Whether you’re a beginner or a seasoned investor, GRAI is your key to smarter, faster, and safer international real estate investments.