Ask GRAI Anything

Your Real Estate Questions, Answered Instantly via Chat

Help us make GRAI even better by sharing your feature requests.

For years, China’s real estate market was considered “too big to fail.” By 2020, the sector accounted for 22–30% of China’s GDP and was valued at nearly $52-60 trillion at peak - larger than the U.S. housing market and stock market combined.

But by 2025, the cracks are undeniable. Defaults by giants like Evergrande and Country Garden, millions of unfinished apartments, and a shrinking population have exposed what was once the engine of China’s growth.

And here’s the part many miss: China’s property meltdown isn’t just China’s problem. It’s a global real estate risk.

The “Three Red Lines” Policy

In 2020, Beijing introduced leverage limits for developers: caps on debt-to-asset, debt-to-equity, and cash-to-short-term liabilities ratios. Many firms, already stretched, suddenly lost access to easy credit.

Debt-Driven Growth Model

For two decades, developers relied on pre-sales - selling apartments before construction - to fund new projects. This worked in a rising market, but once confidence cracked, the model collapsed.

Ghost Cities & Unfinished Homes

Millions of buyers had already paid deposits. With projects stalled, trust evaporated. The very asset once seen as a guaranteed savings vehicle became a liability.

Demographic Headwinds

China’s population is now declining. Fewer young households = structurally weaker long-term housing demand. Cultural reliance on real estate as a “store of wealth” has met cold demographic reality.

Local Government Stress

Municipalities depended on land sales for around a third of local budgets at the 2021 peak. As developers stopped buying land, local governments turned to opaque financing vehicles (LGFVs), piling on hidden debt.

Commodity Shock

China produces ~54% of the world’s steel (production share), accounts for >50% of global cement output, and drives >50% of refined copper demand. A construction slowdown:

Depresses iron ore demand, hitting Australia hard.

Lowers copper demand, dragging on Chile and Peru.

Ripples into India’s steel and cement sectors.

Capital Flow Reversal

In the 2010s, Chinese buyers drove luxury real estate in London, Vancouver, Sydney, and San Francisco. Since Beijing tightened outbound flows in 2017, and now with the domestic crisis, this capital has dried up.

Prime London and Sydney apartments see softer demand.

Dubai and Singapore remain attractive, but without Chinese capital the pool is shallower.

Financial Contagion

HSBC, Standard Chartered, and other global banks with developer exposure face rising losses.

U.S. funds holding Chinese high-yield property bonds are already absorbing defaults.

Tighter global credit spreads = tougher financing for CRE everywhere.

Investor Sentiment

Real estate is confidence-driven. When the world’s biggest property market is shaky, global risk perception rises. Cap rates creep higher, valuations compress, and transaction volumes stall.

Japan’s “Lost Decade” (1990s)

Asset bubbles burst → property values stagnated for decades.

Lesson: Real estate downturns in major economies can last far longer than expected.

U.S. Housing Crash (2008)

Highly leveraged lending + speculative demand → systemic collapse.

Lesson: Confidence takes years to rebuild once the foundation cracks.

China isn’t identical - but echoes of both Japan (demographics) and the U.S. (leverage + speculation) are clear.

Dubai Luxury: Fewer Chinese buyers mean more reliance on Gulf and European capital. Prices may hold, but velocity slows.

India: Lower commodity prices = cheaper inputs for infra, but weaker global demand hurts exports.

U.S. CRE: Already under pressure from office vacancies and refinancing. China contagion could tighten credit further.

Europe: London and Paris luxury miss Chinese inflows. Frankfurt banks face indirect stress through exposures.

Scenario 1: Slow Deflation (Base Case)

Prices fall 20–30% over several years.

Developers shrink, local governments adjust slowly.

Painful but contained.

Scenario 2: Hard Landing (Bear Case)

Defaults cascade into banks and LGFVs.

Growth stalls, global commodity and credit markets hit.

Contagion risks rise sharply.

Scenario 3: Policy Rescue (Bull Case)

Beijing steps in more aggressively - direct subsidies, state takeovers, mortgage easing.

Stabilization is possible, but at the cost of higher state balance sheet risk.

1. Avoid Direct Chinese Developer Exposure

Bondholders have already learned this the hard way. Defaults may not be over.

2. Watch Commodities

If you’re exposed to steel, cement, or copper producers, model price downside.

3. Diversify Global Real Estate

With Chinese buyers absent, markets like Dubai and London rely on different pools. This shifts price dynamics.

4. Look for Contrarian Plays

Distressed asset acquisitions in China (if you have appetite + access).

Logistics, data centers, and healthcare globally, which benefit from non-Chinese demand drivers.

Instead of relying on headlines, investors can use GRAI to stress-test real estate portfolios under different China scenarios - from gradual deflation to a severe “hard landing.”

What GRAI does:

Simulate Market Impact: Model how a 20% fall in Chinese housing prices affects Dubai luxury yields, London prime flats, or U.S. office cap rates.

Assess Indirect Effects: Explore how reduced Chinese outbound tourism changes Hong Kong retail NOI or global hospitality occupancy; how weaker trade volumes reshape logistics and industrial demand.

Forecast Capital Flow Shifts: Compare resilience of London, Dubai, and Singapore luxury markets under reduced Chinese high-net-worth investment.

Stress-Test REIT Portfolios: Run sector-by-sector analysis with NOI, cap-rate changes, implied value declines, WAULT (weighted average lease term), and debt refinancing sensitivities.

Board-Ready Outputs: Summarize risks, mitigation strategies (asset sales, refinancing, portfolio hedges), and contrarian opportunities.

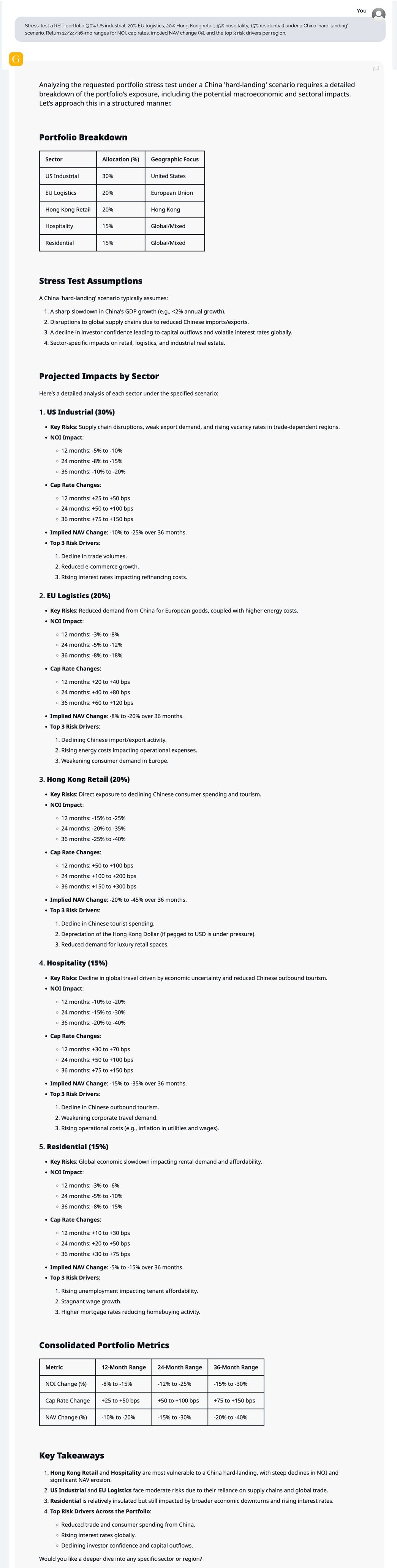

Portfolio mix: 30% U.S. industrial, 20% EU logistics, 20% Hong Kong retail, 15% hospitality, 15% residential.

Assumptions: GDP slows from 5% → 2%; construction activity contracts; capital outflows tighten credit; outbound tourism declines.

| Sector | NOI Impact (36m) | Cap Rate Expansion | Implied Value Change | Key Drivers |

|---|---|---|---|---|

| U.S. Industrial (30%) | −3% to −6% | +25–75 bps | −6% to −15% | Export-linked tenants, modest vacancy drift, refinancing costs |

| EU Logistics (20%) | −3% to −8% | +50–100 bps | −10% to −22% | Trade throughput, tenant expansion delays, euro credit spreads |

| HK Retail (20%) | −12% to −25% | +150–300 bps | −30% to −55% | Mainland visitor decline, luxury sales slowdown, occupancy cost ratios |

| Hospitality (15%) | −8% to −18% | +75–200 bps | −20% to −40% | Chinese outbound travel drop, ADR pressure, debt rollover |

| Residential (15%) | −1% to −4% | +25–75 bps | −5% to −12% | Tenant affordability, unemployment, mortgage resets |

Weighted portfolio NAV impact: −20% to −21% over 36 months.

“Stress test a REIT portfolio (30% U.S. industrial, 20% EU logistics, 20% Hong Kong retail, 15% hospitality, 15% residential) under a China hard-landing scenario. Show NOI, cap-rate, implied value, WAULT, and refinancing risks.”

“Model impact of reduced Chinese outbound travel on Hong Kong retail NOI and global hospitality occupancy.”

“Compare the resilience of Dubai luxury condos vs London prime flats under reduced Chinese capital inflows.”

“Forecast 5-year ROI on a diversified portfolio with and without China hard landing contagion.”

Try it free: https://internationalreal.estate/chat

China’s property meltdown is the slow-motion unraveling of the largest real estate asset class in history. Its effects are already visible in commodities, capital flows, and investor sentiment - and they will ripple across global markets for years.

Investors who treat it as “just a China problem” risk being blindsided. Those who run the models, stress-test their portfolios, and plan ahead will spot opportunities where others see only risk.

With GRAI, you don’t have to guess. You can simulate the future before you invest.